Join Our Telegram channel to stay up to date on breaking news coverage

The decentralized finance (DeFi) sector contributes $7.6 billion, accounting for 14.51% of the 24-hour market volume. Notably, stablecoins represent a significant portion, reaching $45.33 billion, constituting 86.56% of the total trading activity within the same period.

8 Best Cheap Crypto to Buy Now Under 1 Dollar

The prominence of stablecoins and the specific contributions of the DeFi sector highlight distinct segments influencing overall market activity. Additionally, Bitcoin’s dominance demonstrates its resilience within this changing landscape.

1. BitTorrent (BTT)

The BitTorrent has recently marked a significant milestone with achieving 200 million users. This coincided with a notable surge in the BTT price, which experienced an 82% increase over the past 48 hours.

A notable observation is the breach of the $0.000001 mark in the BitTorrent price, an occurrence last seen in May 2022. Plus, market sentiment indicates a bullish outlook for BitTorrent. This upward trend is coupled with a Fear & Greed Index reflecting a value of 74 (Greed).

#BTFS technical community has recently launched the BTIP-52 proposal discussion.

The BTIP-52 proposal aims to support encrypted file sharing to enhance data privacy:https://t.co/0JrHsY1HSZ

The proposal is currently in Final status, feel free to join the discussion on Github… pic.twitter.com/chq7y4bLU2

— BitTorrent (@BitTorrent) December 8, 2023

Additionally, the token has consistently traded above its 200-day simple moving average. The coin has also experienced 19 positive trading days out of the last 30, representing 63%.

2. Mina (MINA)

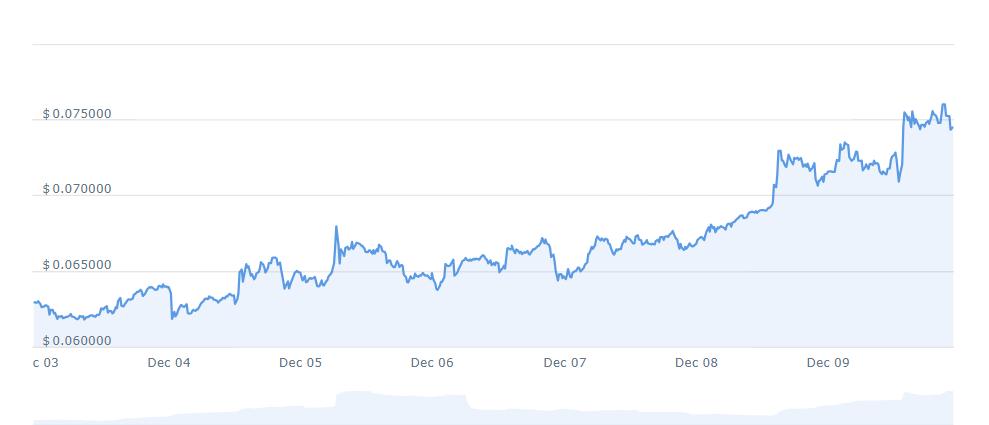

Mina Protocol has shown a 46% price surge in the past year, outperforming over half of the top 100 crypto assets. It’s currently trading above its 200-day moving average. Moreover, the coin has had 18 positive trading days out of the last 30, indicating a favorable trend. Plus, the Mina boasts high liquidity based on its market cap.

Sentiment toward Mina’s price prediction is bullish, with a Greed rating of 74 on the Fear & Greed Index. Hence, this reflects positive investor sentiment and market interest.

Testworld Mission 2.0 Track 3 Update – End of Epoch 3 ✅

In Epoch 2, Network Performance Testing discovered three issues relating to libp2p library, block production, and memory use. The libp2p issue has now been resolved ☑️ Other fixes related to block production and memory use…

— Mina Protocol (httpz) 🪶 (@MinaProtocol) December 1, 2023

Furthermore, by market cap, Mina holds the #38 position in the Layer 1 sector. In addition, price predictions suggest the potential for a maximum of $1.28 for the MINA Coin by the end of 2023. However, this depends on stable market conditions and anticipated bullish trends materializing.

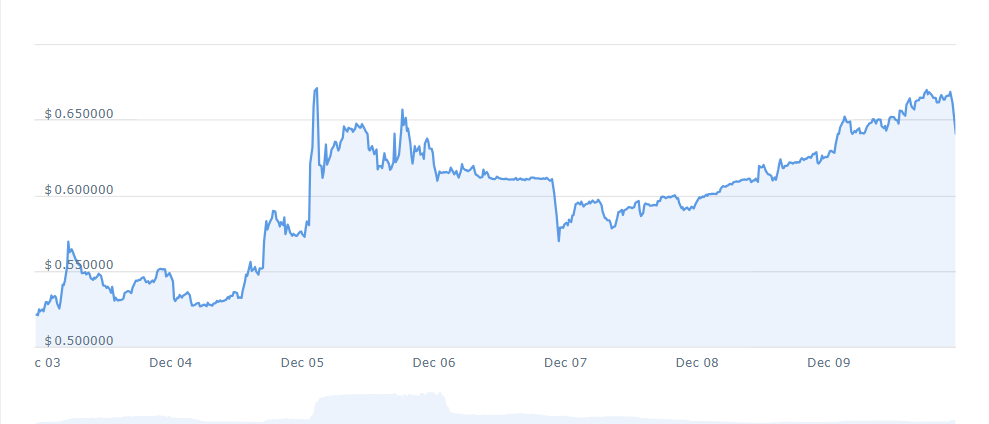

3. Stellar (XLM)

Stellar (XLM) has seen a notable price surge, marking a 57% increase in value over the past year. This growth places it ahead of 59% of the top 100 cryptocurrencies in terms of performance during this period. Additionally, the current trading value of XLM stands above its 200-day simple moving average.

Stellar’s recent trading pattern reflects a positive trend, with 19 out of the last 30 days showing gains. This accounts for 63% of the observed period, indicating favorable market sentiment.

The final Stellar Testnet reset of the year is scheduled for December 18, 2023, at 1700 UTC, which is two weeks from today.

This particular reset is part of the Protocol 20 upgrade process. Read all about it in the upgrade guide 🧠 https://t.co/4JSaUDIgWn

— Stellar (@StellarOrg) December 6, 2023

Furthermore, Stellar exhibits robust traits from a liquidity standpoint owing to its substantial market capitalization. Presently, it holds a high liquidity status based on this metric. Regarding predictions and sentiment analysis, the prevailing sentiment surrounding Stellar is bullish. This outlook aligns with a Fear & Greed Index score of 74, indicating a state of “Greed” among investors and market participants.

4. Blur (BLUR)

The Blur marketplace has recently surged to prominence within the NFT landscape. The coin claims 80% of the total trading volume for non-fungible collectibles. This shift occurred around February, with Blur steadily overtaking OpenSea and dominating the Ethereum-based NFT market.

Analysis of Blur’s current standing reveals a bullish sentiment in price predictions. Moreover, this sentiment is coupled with a Fear & Greed Index reflecting a score of 74, indicating a state of greed among traders.

Furthermore, Blur consistently trades above the 200-day simple moving average. The token has experienced 15 positive trading days within the last 30, contributing to 50% of the observed period. Additionally, its high liquidity is evidenced by its market capitalization.

5. Sui (SUI)

Sui, a prominent decentralized finance (DeFi) protocol, has recently reached another milestone in its growth trajectory. Its bridged USDC has surpassed $100 million, solidifying its position among the top DeFi protocols globally.

This achievement builds upon its earlier milestone of exceeding $175 million in Total Value Locked (TVL). Presently, Sui consistently ranks within the top 25 blockchains for daily transaction volume and within the top 15 by weekly volume.

🎉We're excited to launch the "Frens-Lounge," a token-gated channel for those that own Capys and/or Bullsharks, on the Sui Discord server!

Connect your Sui address to Discord using the "Frens-Verification" channel, and dive into a new vibrant community for our Sui enthusiasts!…

— Sui (@SuiNetwork) December 8, 2023

The network’s growth is primarily attributed to its decentralized ecosystem and independent builders. Notably, seven projects boast over $10 million in TVL, with 11 projects surpassing the $2 million mark.

6. Launchpad XYZ (LPX)

Launchpad XYZ has emerged as a notable platform within the cryptocurrency trading community, aiming to redefine decision-making processes in the era of Web 3.0. Central to its mission is delivering comprehensive data through an advanced dashboard. Therefore, it aims to empower investors to make informed choices when investing in cryptocurrency.

#Blockchain's impact goes beyond finance. 🙏

From supply chain management to voting systems, it offers transparency and efficiency. The potential applications are vast and varied!#LaunchpadXYZ #Crypto #Web3 pic.twitter.com/YhV7USOMhW

— Launchpad.xyz (@launchpadlpx) December 7, 2023

A key distinguishing feature of Launchpad XYZ is its integration of reliable market sentiments. This integration provides users with insights into the investment directions of prominent figures, potentially guiding their decision-making. Moreover, the platform emphasizes user education, encouraging independent trading decisions rather than sole reliance on third-party information.

Launchpad XYZ’s ecosystem uses a native token, LPX, which offers more than exposure to the project’s growth. Notably, users staking a minimum of 10,000 LPX tokens gain access to various premium features. These include reduced trading commissions on the Launchpad XYZ decentralized exchange, among other benefits.

7. aelf (ELF)

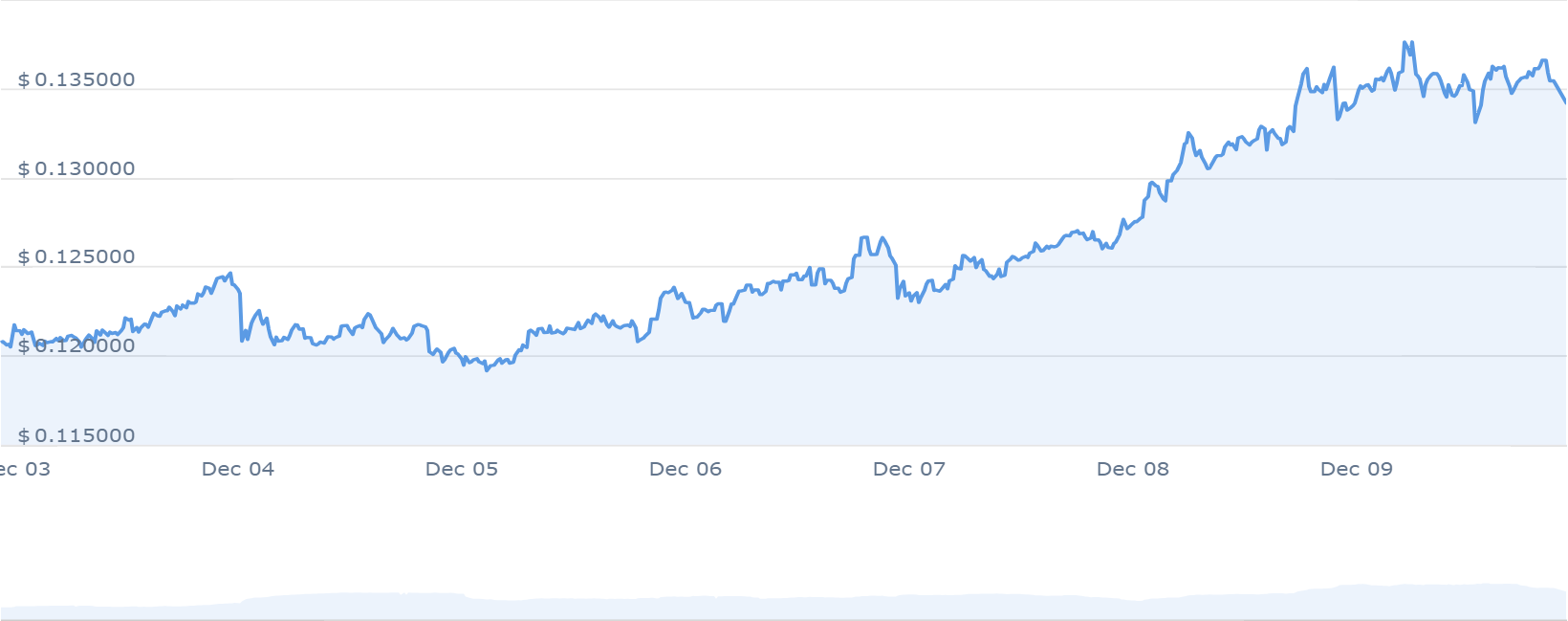

In the past year, aelf has experienced a significant price surge, marking a remarkable 394% increase. This surge has notably outpaced 93% of the top 100 crypto assets within the same timeframe. Also, ELF’s current trading position is above the 200-day simple moving average, indicating a sustained upward trend.

Furthermore, aelf has seen 16 positive trading days out of the last 30, accounting for 53% of its recent trading history. Alongside this positive momentum, sentiment analysis suggests a bullish outlook for aelf’s price prediction. Correspondingly, the Fear & Greed Index registers at 74, indicating a sentiment tilted towards greed in the market.

🏆Hazel, our Head of Investments, was given the opportunity to participate as a panellist at @web3carnival today.

With @brincvc and @TheSandboxGame, they discussed the topic "Game On, Chain On: Leveling Up in Blockchain Gaming" and shared insights on #BlockchainGaming,… pic.twitter.com/yrUs92J0u0

— ælf (@aelfblockchain) December 7, 2023

In terms of supply dynamics, aelf’s circulating supply presently stands at 702.50 million ELF tokens out of a maximum supply of 1 billion ELF. This reflects a yearly supply inflation rate of 34.54%, creating 180.36 million ELF tokens over the past year.

8. WAX (WAXP)

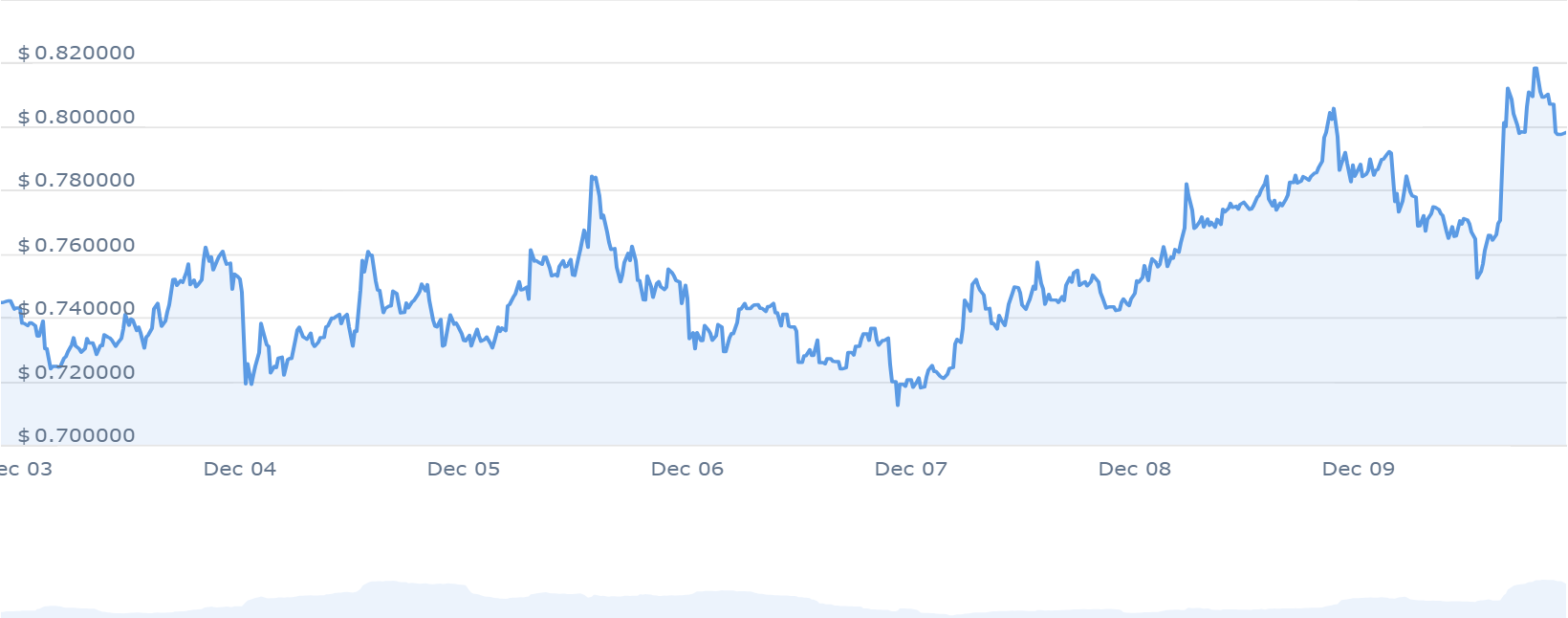

WAXP has undergone a noteworthy 25% price surge over the past year. The current price exceeds the 200-day simple moving average, indicating a sustained upward trend. Recent trading data shows 16 positive trading days within the last month, constituting 53% of the trading period.

It currently hovers near its cycle high, reflecting a strong performance. Additionally, it boasts high liquidity due to its substantial market capitalization.

📢NEW: The Magic of @Disney on WAX!

Get ready for Mickey Mouse, Minnie Mouse, Donald Duck, and other iconic characters, as @OriginalFunko is set to release a new wave of Digital Pop! collectibles on the WAX Blockchain on Dec. 12, exclusively on https://t.co/GacMHBiXpr.

📦What's… pic.twitter.com/lm4GRUSqCc

— WAX (@WAX_io) December 5, 2023

The highest recorded price for WAXP since the last cycle low was $0.076847. Current sentiment analysis leans bullish for price prediction. Meanwhile, the Fear & Greed Index registers 74, indicating a state of greed among market participants.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage