Join Our Telegram channel to stay up to date on breaking news coverage

Gain insights into seven affordable cryptocurrencies valued below $1, exploring their unique features and potential for value appreciation in the crypto world as of November 23.

In the latest 24-hour period, the global crypto market capitalization is $1.41 trillion, marking a 2.02% increase. Notably, the total market volume in this timeframe has reached $52.64 billion, indicating a decline of 26.03%.

7 Best Cheap Crypto to Buy Now Under 1 Dollar

The decentralized finance (DeFi) sector constitutes $5.16 billion in volume, equivalent to 9.80% of the total crypto market volume for the day. Concurrently, stablecoins contribute significantly, accounting for $46.42 billion in volume. This represents 88.20% of the total market volume within the same timeframe.

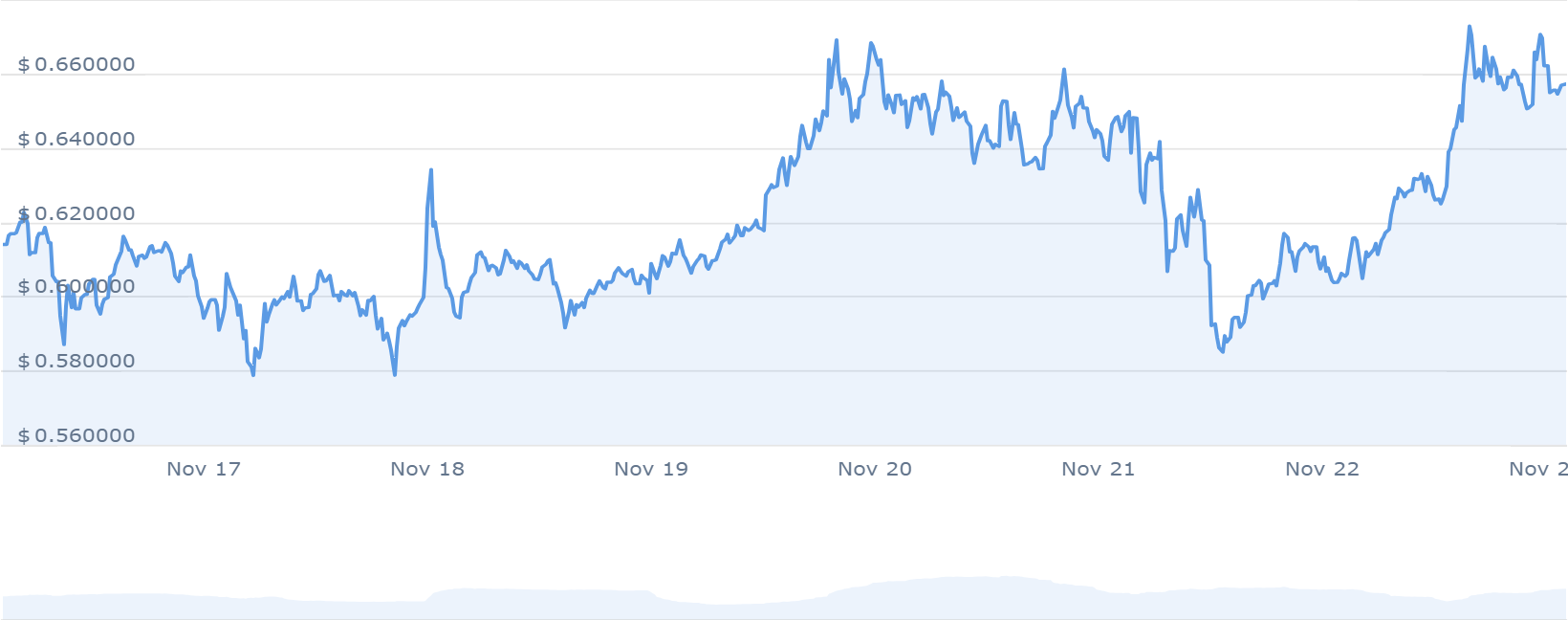

1. Mina (MINA)

The Mina Protocol has seen a significant 22% price increase over the past year, outperforming 56% of the top 100 crypto assets. Currently, it’s trading above the 200-day simple moving average. Plus, it has shown positive movement for 16 out of the last 30 days, accounting for 53% of the observed period.

Regarding supply dynamics, the circulating supply of Mina Protocol is at 1.01 billion MINA out of a maximum supply of 824.10 million MINA. Over the last year, an inflation rate of 35.30% resulted in the creation of 262.58 million MINA. Within the Layer 1 sector, it holds the #38 position based on market cap rankings.

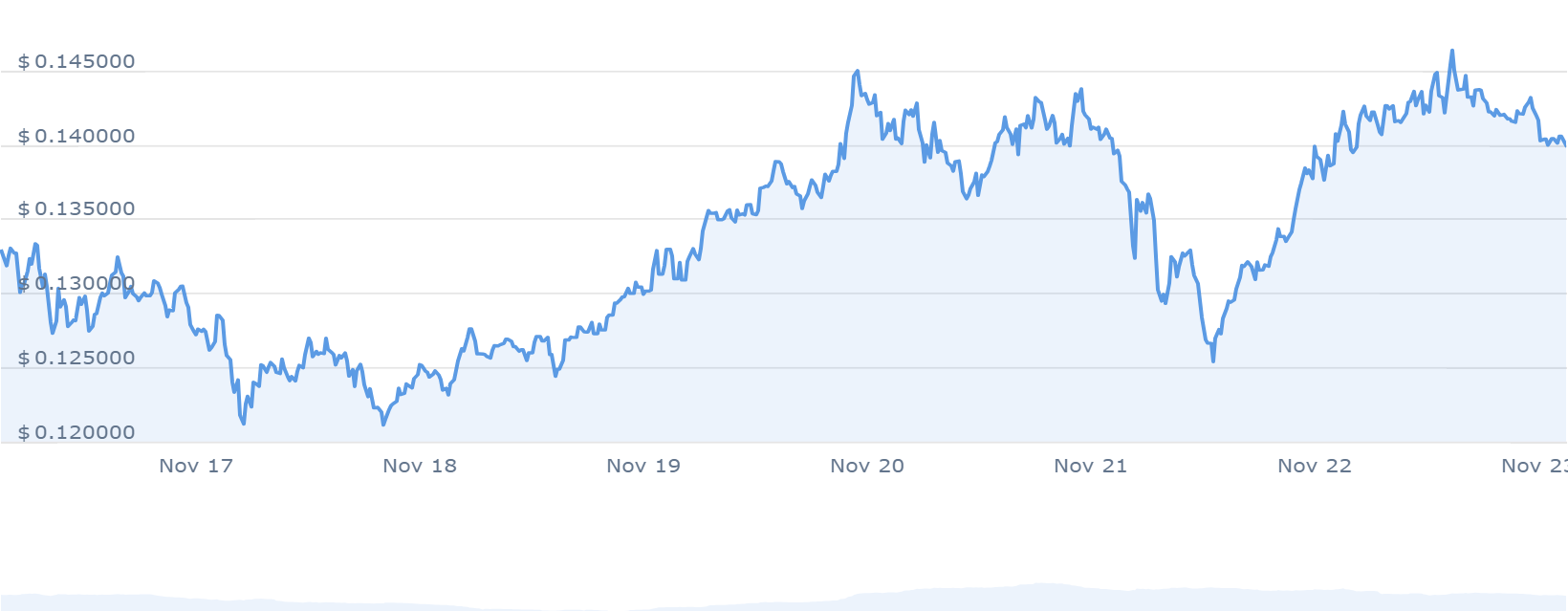

2. The Graph (GRT)

The convergence of AI and blockchain technology has sparked a significant shift in the cryptocurrency landscape. This has given rise to influential AI blockchain projects. The Graph (GRT) token stands out amidst this movement, with notable growth in its valuation.

Over the past year, The Graph has surged by 146%, outpacing 85% of the top 100 crypto assets. It has consistently traded above its 200-day simple moving average and maintained a positive trend. Plus, 19 out of the last 30 days reflected gains, constituting 63% of the period.

🌟 Congratulations to all the hackers who joined the @ETHIstanbul hackathon by @ETHGlobal! The Graph Foundation awarded bounties to builders who used subgraphs or Substreams to build bold new dapps for web3.

Here are the winners 🔽

Best New Subgraph:

🥇 zkmap: Built a…

— The Graph (@graphprotocol) November 22, 2023

Market sentiment toward The Graph appears bullish, aligned with a Fear & Greed Index of 66 (Greed). It also boasts a circulating supply of 9.31 billion GRT out of a maximum supply of 10.06 billion GRT. Likewise, the token has seen a 34.98% yearly supply inflation rate, creating 2.41 billion GRT in the past year.

3. Centrifuge (CFG)

Centrifuge has shown significant performance changes within the cryptocurrency market in the past year. Its price surged by 154%, surpassing 87% of the top 100 crypto assets, including Bitcoin and Ethereum. The project has consistently traded above the 200-day simple moving average, indicating sustained market interest.

Centrifuge’s performance has been positive compared to its initial token sale price. Over the last 30 days, it has seen gains on 20 days, marking a 67% positive trend. Trading on KuCoin has contributed to a 24-hour trading volume of $1.60M, forming a market cap of $199.63M and a dominance of 0.01%.

Token standards like ERC20, ERC721, and ERC4626 have helped build decentralized finance.

In this blog post from Centrifuge CTO @offerijns: How can we evolve these standards to suit real-world assets? And how is Centrifuge helping to make this possible?https://t.co/Ebif97K0wj

— Centrifuge (@centrifuge) November 22, 2023

Furthermore, the sentiment around Centrifuge’s price prediction remains bullish, reflected in a Fear & Greed Index reading 66 (Greed). With a circulating supply of 360.26M CFG, the yearly supply inflation rate sits at 3.94%, with 13.65M CFG created last year.

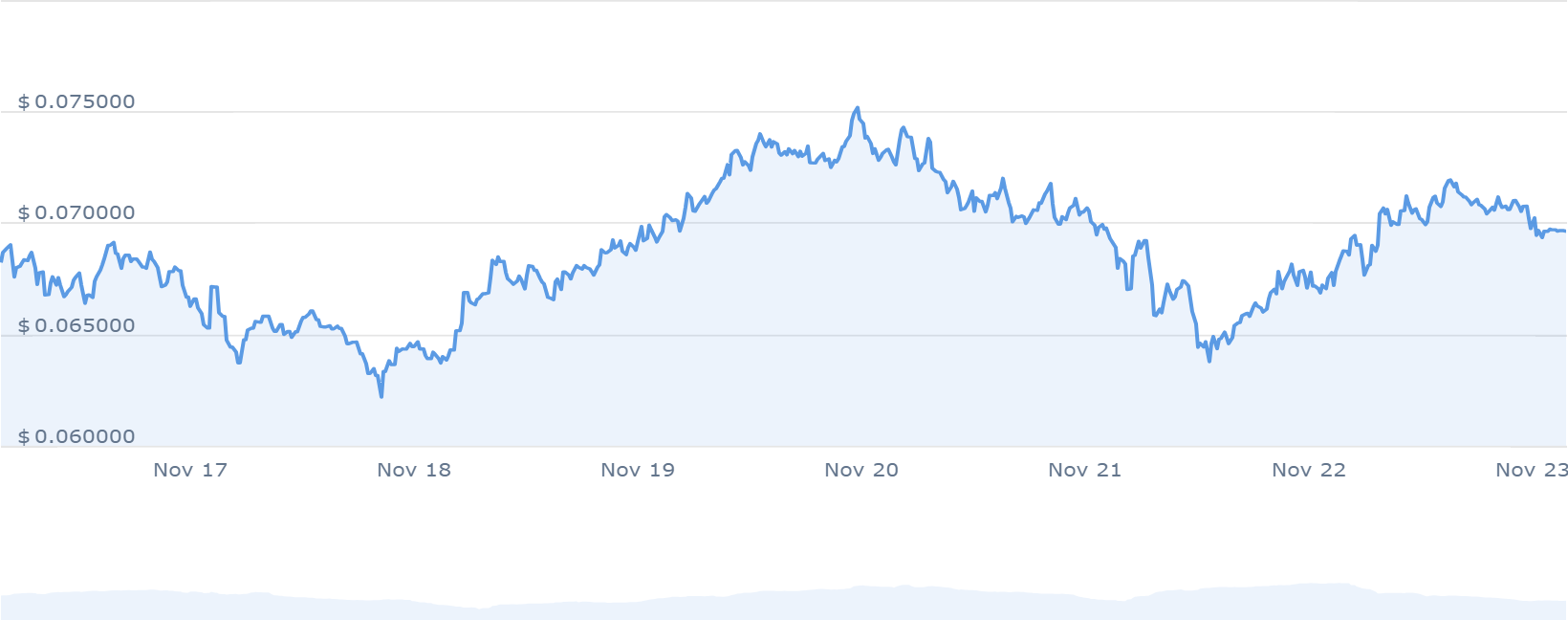

4. Oasis Network (ROSE)

The Oasis Network, currently trading at $0.069653, exhibits notable trading trends and performance metrics. The coin maintains a position above its 200-day simple moving average, indicating sustained market stability over the mid-term. Within the last 30 days, it experienced 19 days of positive growth, amounting to a 63% upward trend in this period.

Over the last year, the price of Oasis Network has surged by 52%, indicating considerable growth and potential investment returns for stakeholders. The current sentiment analysis on Oasis Network’s price prediction leans towards a bullish outlook. In contrast, the Fear & Greed Index registers at 66, indicating a moderately greedy market sentiment.

This month @CoinSender launched its token distribution and management platform to the public — after a successful incubation period with support from an Oasis grant

This marks a new era in asset management with simplicity and flexibility at its core

Let's dive into it: 🧵 pic.twitter.com/CbyftVD2dC

— Oasis (@OasisProtocol) November 22, 2023

Regarding supply dynamics, the circulating supply stands at 6.54 billion ROSE out of a maximum supply of 10 billion. The network has witnessed an annual supply inflation rate of 30.13%, creating 1.51 billion ROSE in the past year. As for its market standing, Oasis Network holds the #15 position in the Proof-of-Stake Coins sector and ranks #5 in the AI Crypto sector.

5. Bitcoin Minetrix (BTCMTX)

Bitcoin Minetrix introduces a novel cloud mining model, inviting retail investors to participate in Bitcoin mining starting from a minimum $10 investment. The platform utilizes a stake-to-mine token, $BTCMTX, which users stake to earn mining credits. Initial interest has been notable, with $4,292,615 generated, as reported on their official status update.

#BitcoinMinetrix bringing essential news!

Over $4,200,000 raised! 🔥 pic.twitter.com/QWHKasvilZ

— Bitcoinminetrix (@bitcoinminetrix) November 21, 2023

The project aims to provide an alternative to conventional cloud mining services, potential scams, and high hardware expenses-related concerns. Bitcoin Minetrix’s fundamental concept involves users staking BTCMTX tokens to obtain cloud mining credits. As such, it intends to decentralize control and offer token holders a more secure and transparent mining experience.

The staking pool has seen significant participation, with over 400,000 BTCMTX tokens currently locked in staking. The project claims an annual percentage yield (APY) of 103,225%, based on the current participation and staking levels.

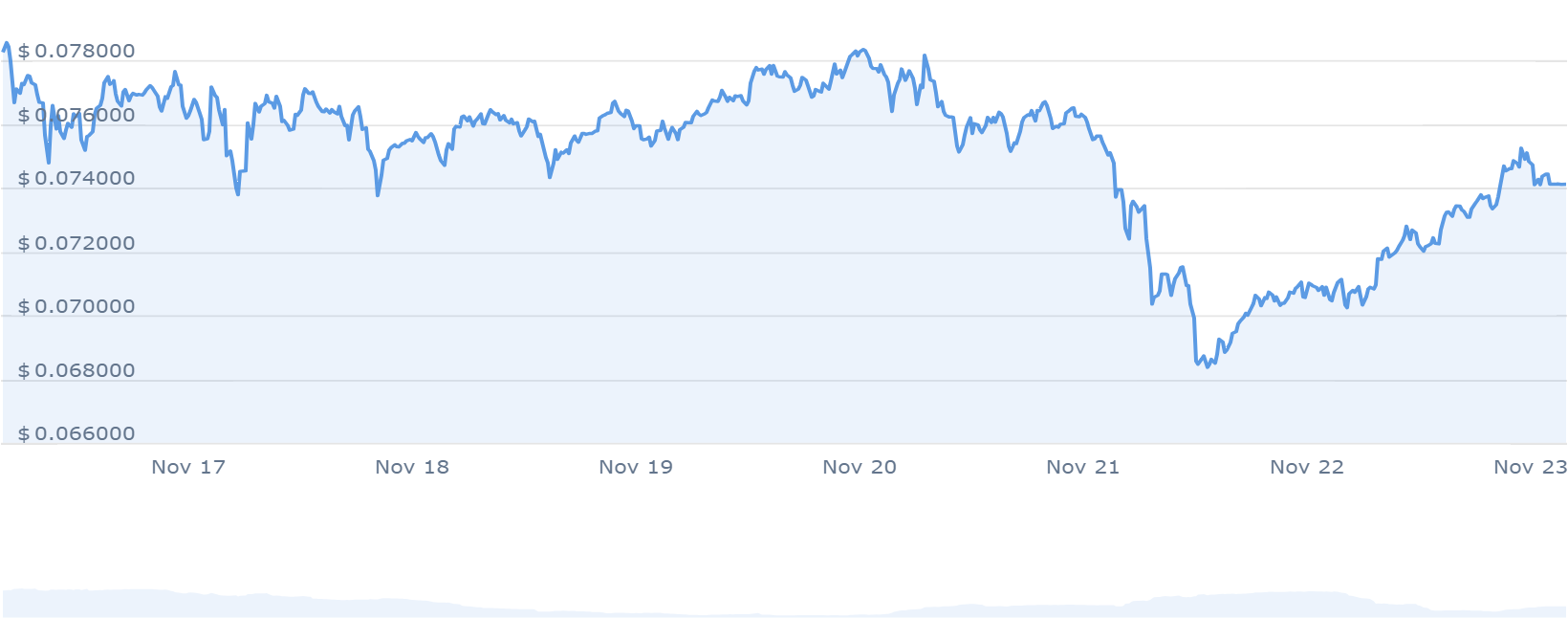

6. Chiliz (CHZ)

Chiliz (CHZ) recently completed integrating its 2.0 mainnet into Binance, enabling users to deposit and withdraw CHZ and Fan Tokens across different networks. This development aims to simplify the experience, especially for those engaging with Fan Tokens linked to popular teams.

Binance’s commitment to user-friendly crypto services is evident as it expands deposit and withdrawal options within its ecosystem. Consequently, CHZ has shown a positive trend, with 16 out of the last 30 days reflecting a 53% increase. This has bolstered its appeal due to high liquidity and availability on Binance.

Notably, CHZ hit its all-time high at $0.889434 in March 2021 and its lowest at $0.003960 in September 2019. Post its peak, the lowest recorded was $0.053888, while the highest reached $0.086156.

Binance has completed Chiliz Chain integration and swap 🌶️✅

Deposits and withdrawals on @Binance for the Chiliz (CHZ) token and Fan Tokens are now available on Chiliz Chain, The Sports Blockchain_ ⚽️#ChilizChain ⚡️ $CHZhttps://t.co/UTAw9kFqPS

— Chiliz ($CHZ) – The Sports Blockchain ⚽🏆 (@Chiliz) November 23, 2023

Moreover, sentiment regarding CHZ indicates a neutral price prediction for CHZ, while the Fear & Greed Index stands at 66 (Greed). Ranking #6 in the NFT Tokens sector by market cap, Chiliz’s integration with Binance marks a significant stride. As such, it offers users greater accessibility and functionality within the crypto landscape.

7. Cardano (ADA)

Cardano displays robust performance, hinting at a potential breakthrough above the $0.40 mark due to increased staking rewards and heightened transactional activities. ADA’s price remains resilient at the $0.35 support level, supported by an adoption rate surpassing 30%. This level of adoption has been consistently achieved eight times within the last three months. Hence, this indicates a rising interest in the Cardano network.

ADA’s price range fluctuates between $0.253 and $0.318. Its 10-day moving average is $0.373, while its 100-day moving average is $0.282. Key support levels are at $0.150 and $0.214, while resistance levels are at $0.343 and $0.408.

Furthermore, the network’s staking valuation has reached historic highs, driven by increased staked ADA coins. This surge in staking activity signals a bullish cycle of increased ADA staking and reduced market supply.

The Cardano Foundation is unwavering in its commitment to furthering the goals of CIP-1694 and steering #Cardano towards a fully decentralized on-chain governance system. Explore the specifics of our involvement in the Cardano ballot. #CIP1694

🧵(1/7) pic.twitter.com/HMKajPaXcX— Cardano Foundation (@Cardano_CF) November 20, 2023

If this trend continues, ADA might experience an upward movement toward $0.40, potentially breaching this resistance. However, a decline below $0.30 could challenge this positive trend. The $0.33 support level might offset a major bearish reversal.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage