Join Our Telegram channel to stay up to date on breaking news coverage

These are the best affordable tokens to invest in for October 2023, all priced under $1. They offer potential opportunities for budget-friendly crypto investments.

The decentralized finance (DeFi) sector currently represents $3.42 billion in 24-hour volume, constituting approximately 10.07% of the total cryptocurrency market volume. This data underscores the prominence of DeFi projects within the broader cryptocurrency ecosystem.

Furthermore, stablecoins, digital assets pegged to traditional fiat currencies, significantly contribute to the market’s trading volume. Stablecoins account for $30.79 billion, equivalent to 90.66% of the total cryptocurrency market’s 24-hour trading volume. This highlights the utility and popularity of stablecoins for various use cases, including trading and transferring value.

7 Best Cheap Crypto to Buy Now Under 1 Dollar

These data points provide a snapshot of the current state of the cryptocurrency market, including the role of DeFi and stablecoins. Investors and enthusiasts may find this information valuable for tracking market trends and making informed decisions within the cryptocurrency space.

1. Fantom (FTM)

The Fantom Foundation recently unveiled improvements and enhancements to its blockchain network. This upgrade aims to enhance network performance and accessibility notably.

Moreover, Sonic’s upgrade aims to reduce database storage requirements by approximately 90%. This reduction can lead to more efficient resource utilization and a more streamlined blockchain infrastructure. Also, the collateral requirements for stakers will be lowered to 50,000 FTM tokens, potentially encouraging greater participation in the network.

4/

The unity of reduced operational costs and lowered validator staking requirements (now just 50,000 $FTM) has made it more accessible than ever to participate in securing the network!

As always, #Fantom plays a pivotal role in making blockchain tech more accessible.

— Fantom Foundation (@FantomFDN) October 27, 2023

This compatibility is significant news for developers, allowing migration of existing Ethereum-based applications to the Fantom network. Fantom’s price is anticipated to reach an average price of $0.97 by 2023. However, a major bearish trend in the crypto market could see the price drop to $0.84

2. EOS (EOS)

EOS, currently trading at $0.6001, has seen a modest increase of 2.25% in its price today. Over the past two months, EOS has rallied, with its price remaining within a 15% range. The market for EOS is characterized by a persistent struggle between bulls and bears, with neither side exerting clear dominance.

Notably, EOS recently rebounded from the lower boundary of the accumulation range and appears to be moving towards testing the resistance levels. From a technical standpoint, EOS has surpassed the 50-day Exponential Moving Average, although it remains within its current trading range.

Any potential momentum in the price is contingent on a breakout from this range. At present, the price is confined to $0.51 (support) and $0.59 (resistance). Analyzing trading volume, EOS has seen $116.37 million in trading volume, representing a 7.67% intraday increase.

Join @brandonlovejoy in a conversation with @UplandMe, @adoptwombat & @FACINGSofficial 🎙️

Learn how in-game assets & play-to-earn mechanisms can be leveraged to drive value back to a project's community 🎮

🔔 Set a Reminder 👇https://t.co/rqMdCelFee pic.twitter.com/tI6iaJ6QCE

— EOS Network Foundation (@EOSNetworkFDN) October 27, 2023

Examining the Moving Average Convergence Divergence (MACD) lines, there is a notable optimistic crossover. In addition, the histogram bars consistently form above the mean line, signaling a short-term resurgence of bullish sentiment.

3. Terra Classic (LUNC)

Luna Classic (LUNC) has garnered attention within the cryptocurrency market due to its strong community support. Similarly, it has collaborated with the Terra Alliance, a consortium of businesses and platforms advocating adopting LUNC as a payment method.

The project displayed substantial growth in its initial phases, reaching an all-time high (ATH) of $119.18 for Terra Coin in April 2022. Thus attracting a significant investor interest.

Furthermore, Luna Classic has experienced price fluctuations, with the potential for further growth. According to price prediction, the average price of LUNC in 2023 is anticipated to be around $0.00028.

In a bearish scenario, the minimum price may hover around $0.000095. However, if the upward momentum continues, Luna Classic could reach a maximum price of $0.00054 in 2023.

1/ Proposal 4790, which outlines plans to strengthen the Terra economy by leveraging TFL’s resources and expertise, has passed with overwhelming community support.

In the coming weeks, TFL will begin to execute the items outlined in the proposal 🧵👇

— Terra 🌍 Powered by LUNA 🌕 (@terra_money) October 25, 2023

Furthermore, there are expectations of a bullish trend in 2023 that may contribute to appreciating Luna Classic’s price. It’s essential to remember that cryptocurrency markets are highly volatile and subject to various factors, and actual price movements may differ from predictions.

4. Tezos (XTZ)

Tezos (XTZ) has attracted attention in the cryptocurrency market due to its significant growth since its inception. The project’s focus on real-world applications and ongoing initiatives make it a subject of interest.

One of Tezos’ notable features is its commitment to participation and community governance, aligning with the principles of Web3. The platform’s development community and governance mechanisms have contributed to its growing popularity. Likewise, scalability is a factor that may influence Tezos’ future price performance.

Furthermore, XTZ’s maximum price projection stands at $2.97. In contrast, the average trading price is estimated to stabilize around $2.16, assuming market conditions align with expectations. In a bearish market scenario, the minimum price for Tezos could decline to $1.83.

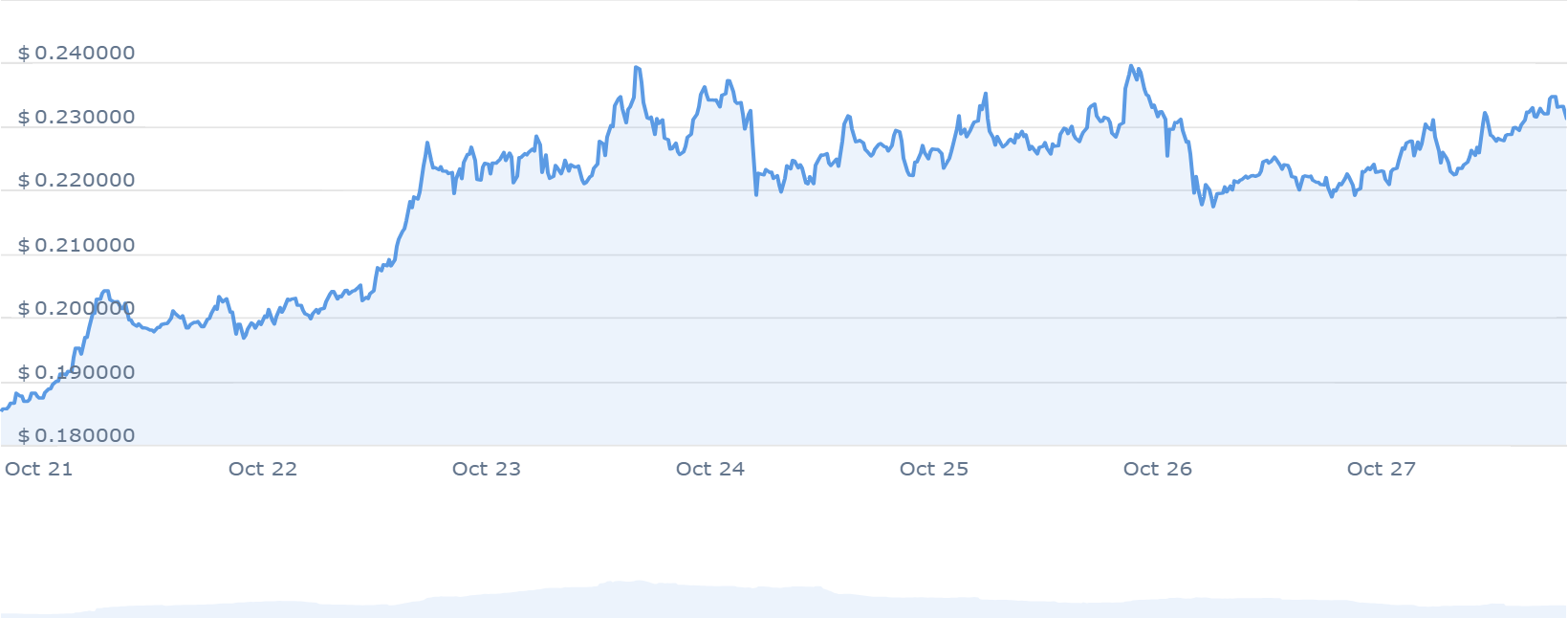

5. Stacks (STX)

Stacks has garnered attention within the crypto market due to its notable performance in 2021, delivering favorable returns to early investors. Offering a unique roadmap, Stacks has received positive feedback from investors, potentially establishing it as a long-term contender. Furthermore, the platform aims to facilitate DeFi, NFTs, and a range of other applications on the Bitcoin network.

The platform holds promise for reaching new heights, particularly if it continues introducing new features and functionalities. As such, the STX token is anticipated to gain more recognition and traction within the DeFi space as it expands its user base.

Moreover, analysis suggests that STX Coin’s prices may experience an upswing soon. By year’s end, the STX Coin could achieve a maximum price level of $1.89, contingent on favorable conditions in the crypto market. In a more conservative scenario, the average price of the STX Coin by 2023 may hover around $1.38.

Hundreds of developers via hackathons and the sBTC Incentivized Testnet Program have started using sBTC 🧡

The use cases are endless 🟧

Read more on all developer resources 👇 (1/2) pic.twitter.com/u3eosY6HyV

— stacks.btc (@Stacks) October 27, 2023

However, in the event of a bearish performance in the crypto market, the minimum price level for the STX Coin could decline to $0.91 by 2023. Nonetheless, projections are made with the expectation of a bullish rally in 2023. Thus leading to a significant increase in the value of the Stacks Token during the second half of the year.

6. yPredict (YPRED)

The yPredict presale has achieved a substantial funding milestone, amassing over $4.5 million from a diverse group of global investors. This signifies a robust interest in the project’s goals. In this public presale, yPredict aims to make 80% of its total token supply available, totaling 100 million YPRED tokens, for potential buyers.

🌟 Calling all inquisitive minds and trading aficionados! 🚀🔮 Prepare to embark on an illuminating journey into the realm of predictive analytics and trading with the upcoming Ask Me Anything (AMA) event hosted by the visionary team at https://t.co/O3DpDau9AR. 📝📊

Unleash your… pic.twitter.com/hmkhNoRTsQ

— yPredict.ai (@yPredict_ai) October 24, 2023

Moreover, YPRED token holders can benefit from various incentives, including competitive staking rewards of up to 45% per quarter. Similarly, users can gain significant discounts on yPredict’s AI tools and lifelong free access to the platform’s price predictions.

The current phase of the presale, which is the seventh, offers YPRED tokens for $0.1 per token. Therefore, interested investors should act promptly to secure tokens at this favorable rate.

Once the presale reaches the $4.58 million funding milestone, the price of YPRED tokens will increase to $0.11. Subsequently, upon listing on cryptocurrency exchanges later in the year, the token will be priced at $0.12. As such, early participants in the presale could realize a 20% gain when the token is listed on exchanges.

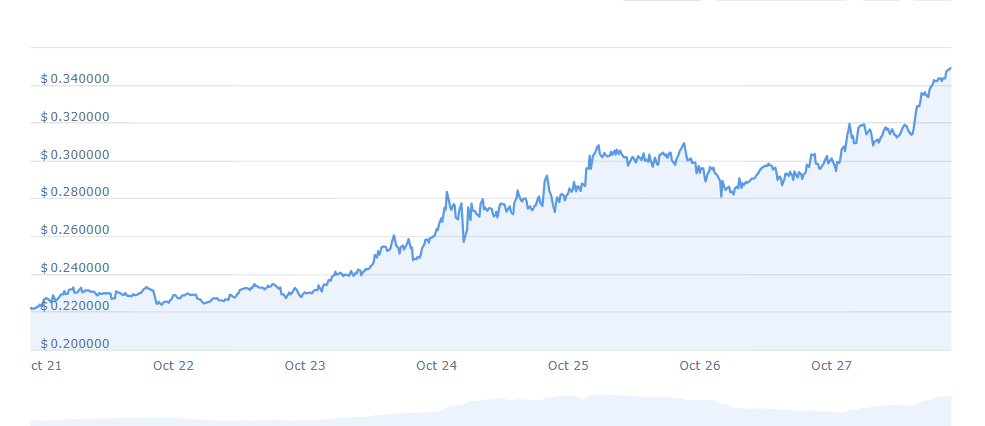

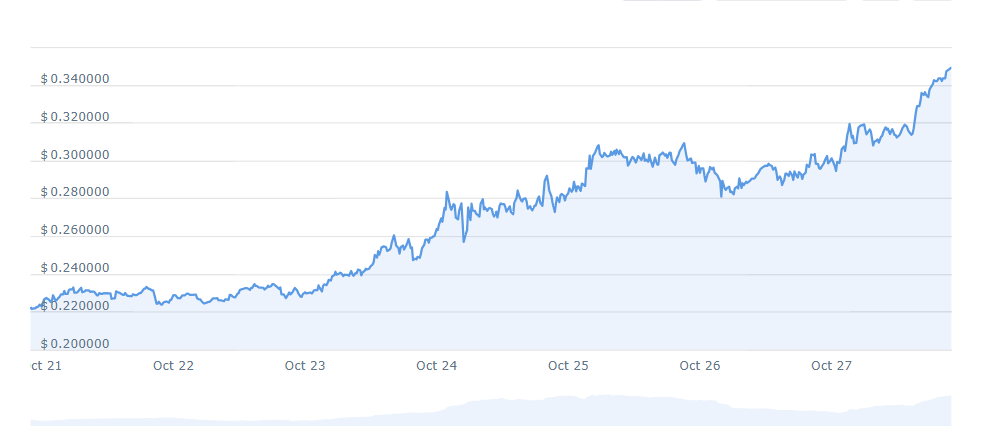

7. Fetch.ai (FET)

Fetch.ai (FET) is a blockchain platform integrating artificial intelligence to optimize everyday tasks. Its core concept revolves around digital twins, automated entities capable of conducting negotiations and executing tasks on behalf of users. This versatile platform encompasses various applications, including taking advantage of disparities in cryptocurrency exchange rates.

The native token of the Fetch.ai ecosystem is $FET, the gateway to accessing services and participating in platform governance. Users can achieve this through a staking mechanism, offering token holders the opportunity to earn from an adaptable annual interest rate set at 10%.

Fetch.ai is often regarded as a noteworthy cryptocurrency for potential investment due to its promising outlook. Based on price predictions, it is anticipated that the maximum price of Fetch.ai will stabilize around $0.74 as the cryptocurrency market recovers its value.

The price prediction for the FET coin indicates an average price of $0.65 by 2023. However, in the event of a significant bearish trend in the crypto market, the minimum expected price value by 2023 is projected to be $0.56.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage