Join Our Telegram channel to stay up to date on breaking news coverage

Given the ongoing struggle of the biggest cryptocurrency, investors should consider cheaper investment options. This strategic choice can yield significant returns in the future, especially when major cryptocurrencies experience a resurgence. Additionally, altcoins, including the cheap ones, can embark on a bullish streak.

Bitcoin (BTC) held above the $26,000 mark despite the recent equity market downturns and a U.S. dollar upward surge. The cryptocurrency was trading at around $26,500 on Friday afternoon.

This signified a modest 0.3% increase for the week. In contrast, the S&P 500 and Nasdaq Composite Index saw significant 2.7% and 3.2% declines, respectively. Notably, BTC’s resilience in the face of stock market turbulence is attributed to its lack of correlation with the Dollar Index (DXY), which reached zero correlation.

6 Best Cheap Crypto to Buy Now Under 1 Dollar in September 2023

Affordable altcoins are prone to volatility, which aligns with the cryptocurrency market’s overall nature. Stability is mainly found in stablecoins, while most other cryptocurrencies exhibit price fluctuations. Acquiring digital assets at a low cost can offer investors a less risky position.

We’ve curated a list of cryptocurrencies under 1 Dollar, presenting an opportunity for investors to explore these options for low-risk investments.

1. Bitget Token (BGB)

Bitget Token (BGB) is the native utility token for Bitget, a centralized cryptocurrency exchange (CEX). It serves as a means of facilitating various activities within the Bitget ecosystem.

BGB offers a range of utility features, such as staking, social trading, profit sharing, and discounts on trading fees. Moreover, BGB holders can access Bitget’s launchpad and launchpool services.

Bitget underscores its commitment to low-cost transactions by leveraging a decentralized blockchain network, eliminating intermediary costs.

What is the best #crypto to buy today? 🤩

— Bitget (@bitgetglobal) September 22, 2023

Emphasizing scalability, Bitget assures users that the platform can effectively manage increased transaction volumes as it expands. BGB holders can also benefit from reduced trading fees of up to 20% and exclusive promotional opportunities.

BGB tokens are built on the Ethereum blockchain in compliance with the ERC-20 standard, ensuring the tokens can be securely stored in any Ethereum-compatible wallet.

2. The Graph (GRT)

The Graph serves as a protocol for blockchain data indexing, primarily Ethereum. Its founders, Yaniv Tal, Jannis Pohlmann, and Brandon Ramirez, initiated this project to address the challenge of efficiently accessing.

Similarly, it aimed to fix the challenge of processing data within decentralized applications (DApps) on blockchain networks. The protocol indexes transaction and event data from DApps onto the blockchain. This data is then meticulously scanned and organized by a Graph Node.

Are you building a dapp & want to feed yield aggregator data from Yearn V2 to your frontend?

You can build your own subgraph or get started now by using @messaricrypto’s standardized @yearnfi V2 subgraph.

Here’s what you need to know 🔽

🔎 What’s a subgraph? 🔍

Subgraphs are… pic.twitter.com/UV16QuiL2N

— The Graph (@graphprotocol) September 22, 2023

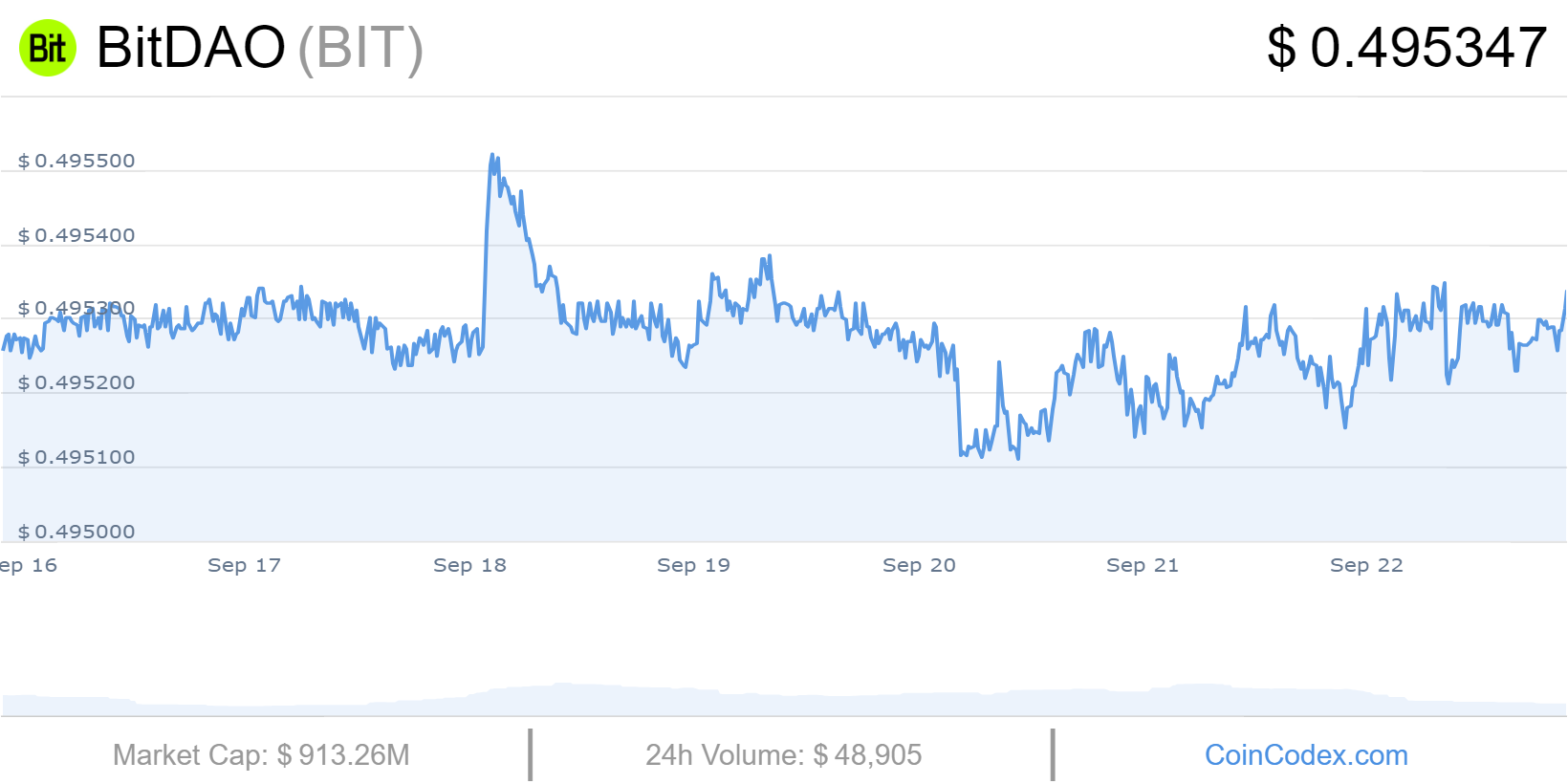

3. BitDAO (BIT)

BitDAO operates as a decentralized autonomous organization (DAO) with a clear objective to establish a global decentralized token economy that promotes inclusivity.

Governed by BIT token holders, BitDAO concentrates its efforts on DeFi and employs a democratic decision-making process through proposals and voting by token holders. A fundamental aspect of BitDAO’s strategy is the attraction of developer talent through token swaps and collaborative development endeavors.

These token swaps fortify the BitDAO treasury with tokens from prominent crypto projects. The organization’s commitment extends to projects encompassing DeFi, DAOs, NFTs, and gaming, offering vital support in research, development, liquidity provision, and funding.

BitDAO closely adheres to the standard DAO model within the crypto sphere, where token holders collectively administer the platform. Members are rewarded with BIT tokens to incentivize contributions to BitDAO’s growth.

Importantly, BitDAO functions as a collective effort devoid of central authority, with active member participation in project development. BitDAO’s roadmap emphasizes strategic collaboration through token swaps with established and emerging projects, focusing on spot and derivatives decentralized exchanges (DEXes).

4. Nexo (NEXO)

Nexo is dedicated to enhancing the value and utility of digital assets. Their comprehensive product suite caters to various retail and institutional clients. Likewise, they offer advanced trading solutions, liquidity aggregation, and tax-efficient asset-backed credit lines.

The NEXO Token, an Ethereum-based ERC-20 token, offers holders access to Nexo’s Loyalty Program, delivering preferential borrowing rates and cash-back incentives. Nexo’s journey began in 2018 as an over-collateralized lending platform but has since evolved into a comprehensive crypto management suite.

Noteworthy offerings include Instant Crypto Credit Lines, which enable users to secure loans in 40+ fiat currencies or stablecoins by collateralizing digital assets. Furthermore, Nexo’s Earn Interest product provides flexible yields, daily payouts, and a zero-fee policy on deposits, withdrawals, and top-ups.

Users can also optimize their returns by swapping assets. Nexo Pro, a trading platform, offers access to 400+ market pairs and supports spot and futures trading, including leverage options.

On your marks, get set… It's question 2 from the Recurring Buys Quiz!

For 250 $NEXO:

What's that one guilty pleasure purchase you just couldn’t resist? pic.twitter.com/6u1pCHEBix

— Nexo (@Nexo) September 22, 2023

Nexo Prime functions as a proprietary prime brokerage for institutional clients, offering a comprehensive set of tools for trading, borrowing, lending, and secure asset storage.

5. Terra Classic (LUNC)

Terra Classic is a blockchain network that differentiates itself from traditional fiat-backed stablecoins like USDT and USDC by relying on algorithmic stablecoins. Instead of holding fiat or liquid assets, Terra Classic employs smart contracts to control stablecoin values.

Terra Classic facilitates fast, cost-effective transactions and boasts a range of decentralized applications. Equally, the Anchor Protocol allows users to earn a 20% APY on USTC deposits.

6. Meme Kombat (MK)

Meme Kombat has launched a new crypto presale, generating notable interest within the cryptocurrency community. This project goes beyond a simple token for trading; it encourages token holders to stake their assets on the Meme Kombat platform and participate in betting on battles for potential rewards.

Meme Kombat aims to harness the capabilities of blockchain technology to merge betting, memes, and gaming, capitalizing on these emerging trends to create a distinctive project. The $MK token is currently available at $1.667, offering a promising annual percentage yield (APY) of 112%.

The gaming aspect of Meme Kombat will commence with the launch of Season 1 immediately following the presale. Season 1 will introduce 11 meme characters, allowing players to bet on their chosen contenders in a range of battles.

The token distribution strategy is clear: 50% is allocated to the presale, and 30% is designated for staking and battle rewards. Also, 10% is reserved for pairing with a decentralized exchange liquidity pool, and 10% is set aside for community rewards.

With a relatively modest fundraising goal of $10 million, Meme Kombat presents an intriguing opportunity for investors to explore. It’s worth watching this project as it continues to evolve.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage