Join Our Telegram channel to stay up to date on breaking news coverage

Ripple’s token, XRP, reached $2.5 early Monday, surpassing BNB and Solana to claim the third spot among cryptocurrencies on CoinMarketCap. This price surge comes amid growing market optimism, fueled by governments and institutions’ increasing adoption of digital assets.

As a result, many cryptocurrency analysts are revising their Bitcoin price forecasts, with most now predicting a range between $225,000 and $250,000 per BTC by 2025. Some experts suggest that the anticipated return of Donald Trump to office as U.S. Meanwhile, the altcoin market’s current positive trend has prompted investors to search for affordable tokens, particularly the best cheap crypto to buy now under 1 dollar.

6 Best Cheap Crypto to Buy Now Under 1 Dollar

XDC Network, priced at $0.0671, has seen a 12.11% increase in the past 24 hours, indicating growing interest in its ecosystem. Polygon, a prominent Ethereum scaling and infrastructure platform, has partnered strategically with the Worldwide Stablecoin Payment Network (WSPN). The Arbitrum Foundation has introduced the Trailblazer AI Grant, a $1 million initiative to drive AI innovation on its Ethereum layer-2 scaling network.

FreeDum Fighters (DUM), a new crypto project, has raised over $700,000 in its presale, which will conclude in a week. The Curve DAO Token (CRV) has demonstrated positive performance recently. KLAY is trading at $0.2836, with a market cap of $1.04 billion. Coinbase’s policy chief anticipates quick approval of crypto legislation following Trump’s victory.

1. XDC Network (XDC)

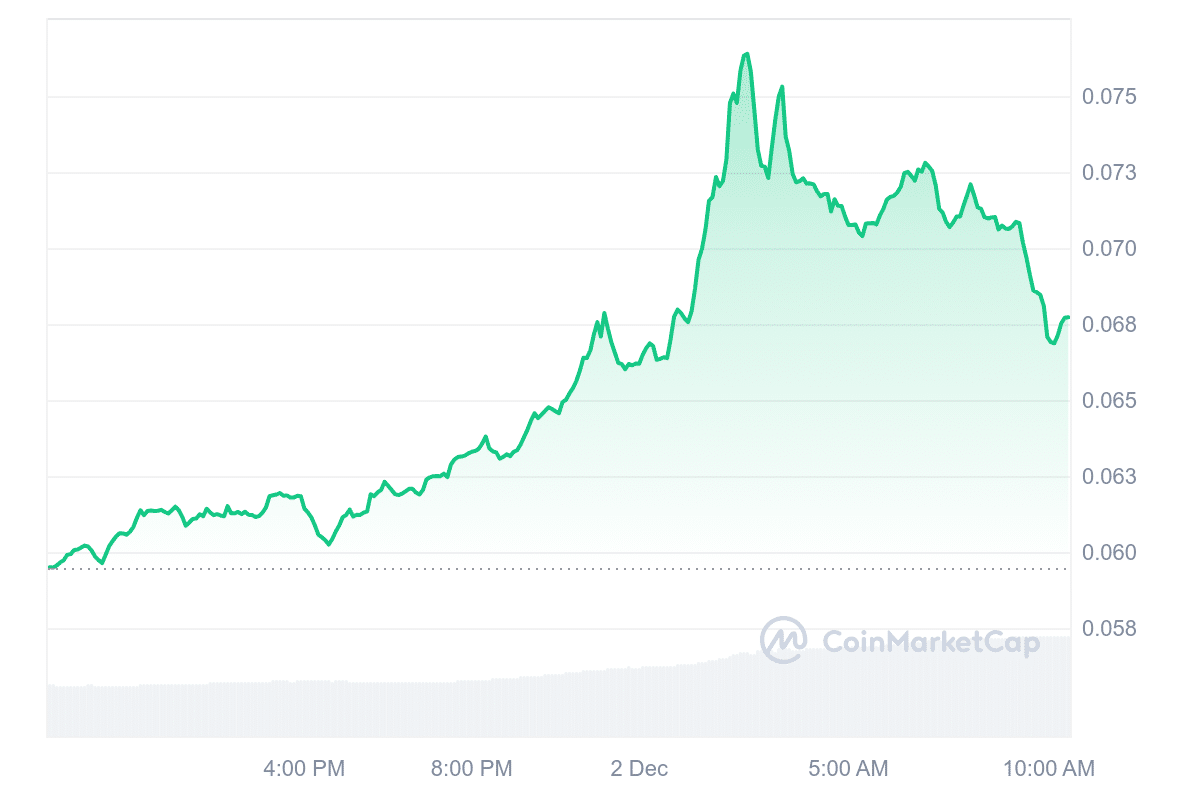

XDC Network, currently priced at $0.0671, has gained 12.11% in the past day, reflecting growing interest in its ecosystem. The network is pivotal in blockchain innovation, focusing on real-world assets (RWA) and trade finance. These sectors are forecasted to grow significantly, with RWAs projected to reach $5–16 trillion by 2030 and trade finance estimated at $87.81 billion by 2031.

The XDC Network distinguishes itself by building a robust ecosystem of decentralized applications (dApps) that aim to transform how businesses interact in global markets. Its partnerships and achievements demonstrate consistent progress in driving Web3 adoption. With a clear focus on scalability and industry needs, XDC is positioned to address critical challenges. Its recent price movement suggests growing confidence in its ability to deliver real-world solutions in blockchain technology.

🌊aelf Ventures Weekly News Highlight: 29 November 2024💡

1️⃣Silicon Valley VCs Take Center Stage in Trump’s Transition and Policy Planning@elonmusk's influence on @realDonaldTrump's transition team is bringing Silicon Valley heavyweights to the forefront of federal… pic.twitter.com/Xw9FRkuUJ6

— aelf (@aelfblockchain) November 29, 2024

2. Polygon (MATIC)

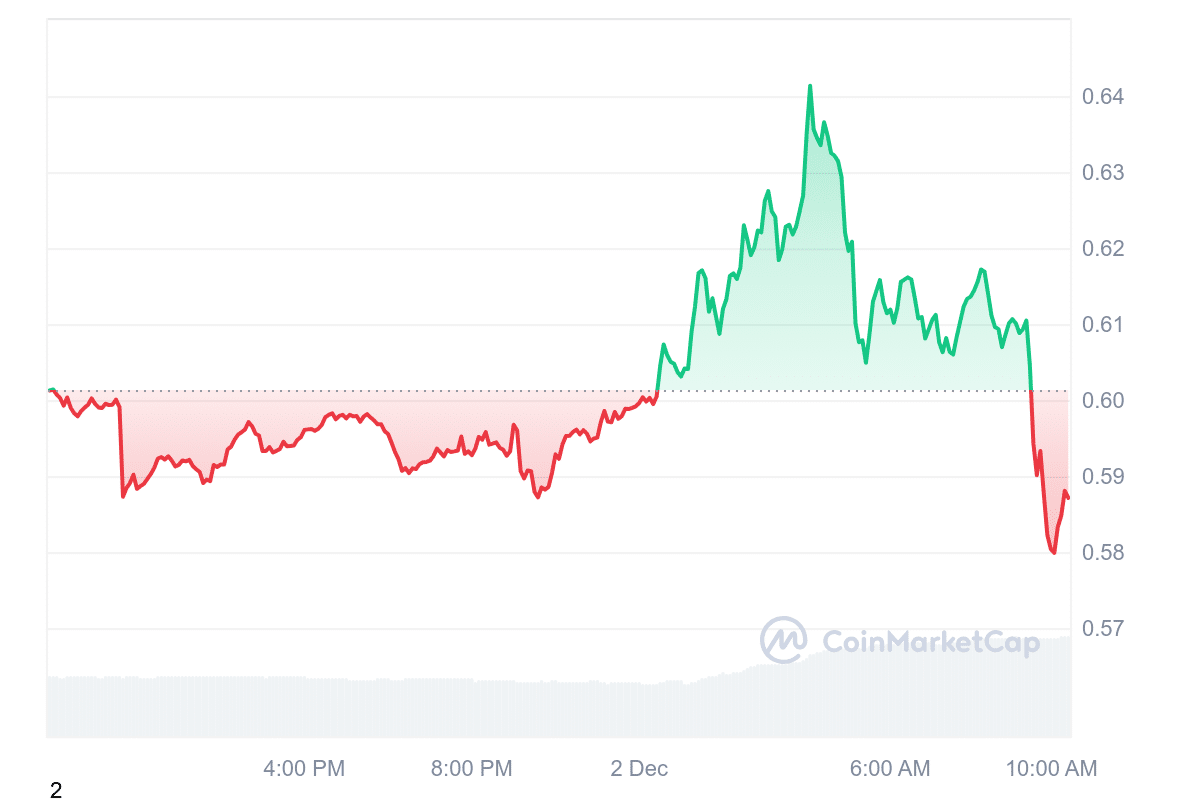

Polygon, a leading Ethereum scaling and infrastructure platform, has partnered strategically with the Worldwide Stablecoin Payment Network (WSPN). WSPN is a global organization specializing in Distributed Ledger Technology (DLT) and focusing on improving payment systems.

The collaboration aims to increase the adoption of WSPN’s primary stablecoin, WUSD. This fiat-backed coin maintains a 1:1 peg to the U.S. dollar. By integrating with Polygon, WUSD could benefit from enhanced scalability and accessibility within the blockchain ecosystem.

Is Agglayer just a bridge? Does the Agglayer validate chain states? Will the Agglayer need additional interoperability solutions?

We're clearing up all your @Agglayer misconceptions here 🔽https://t.co/LMoqU3TzwC

— Polygon (※,※) (@0xPolygon) November 27, 2024

Polygon’s metrics reflect its strong market position. The token, MATIC, is trading at $0.5888, with a 24-hour volume of $25.67 million and a market cap of $1.32 billion. It has shown positive trends, including trading above its 200-day simple moving average and recording 17 “green days” (closing prices higher than opening) in the last 30 days, indicating a bullish sentiment. Moreover, the Fear & Greed Index reflects “Extreme Greed” at 80, underscoring high market confidence.

3. Arbitrum (ARB)

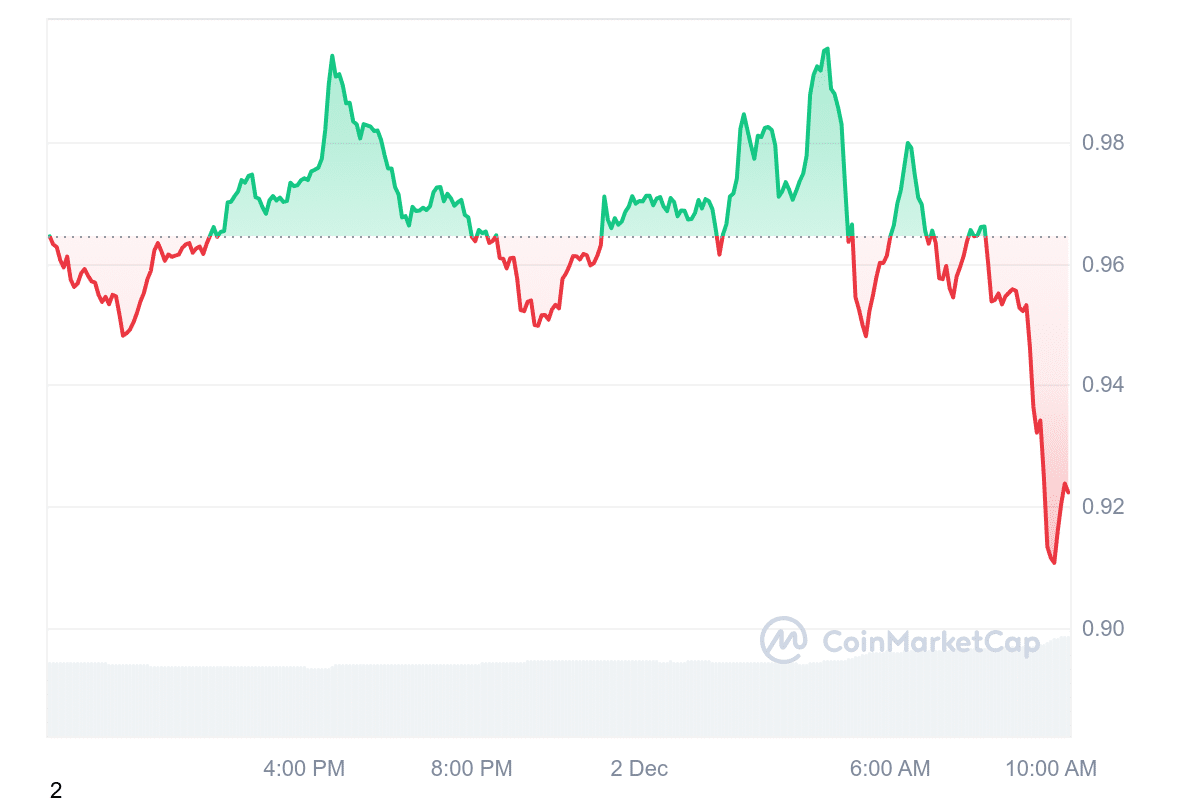

The Arbitrum Foundation has launched the Trailblazer AI Grant, a $1 million initiative to foster artificial intelligence innovation on its Ethereum layer-2 scaling network. Announced on 27 November, the program offers $10,000 grants to teams developing live AI agents integrated with the Arbitrum ecosystem.

The foundation expects the program to accelerate AI adoption and strengthen Arbitrum’s position in the blockchain and AI sectors. It hopes to bring diverse applications to the network by encouraging synergy between AI and blockchain technologies.

Arbitrum’s ecosystem continues to gain traction, with ARB tokens trading at $0.9247 and outperforming its 200-day simple moving average. With 60% of the last 30 days in “green,” market activity reflects strong liquidity and a positive outlook, indicating growing interest in the platform’s offerings.

4. FreeDum Fighters (DUM)

FreeDum Fighters (DUM) is a new crypto project that has raised over $700,000 in its presale, which is set to end in a week. With Bitcoin nearing $100,000 and discussions about regulatory changes, the crypto market is experiencing strong momentum. FreeDum Fighters, currently priced at 0.000113, capitalizes on this trend by offering a political-themed token that has attracted investors’ attention.

The project’s standout feature is its dual-pool staking system, which allows users to earn rewards by staking in two pools: MAGATRON for the right and Kamacop 9000 for the left. MAGATRON offers 240% annual returns, while Kamacop provides 377%. Users can stake in both pools for more flexibility, supporting both political sides.

Congrats $DUM fam!

We reached $700k raised 🥳 pic.twitter.com/8UqHJega8L

— FreeDum Fighters (@Freedum_Fighter) December 2, 2024

FreeDum Fighters also hosts weekly political debates, during which participants can earn DUM tokens as rewards. The debate system adds an engaging element to the platform, and 10% of the total token supply is reserved for debate winners.

The project has gained a following, with over 2,300 members on Telegram, and has received praise from crypto influencers. Rating crypto platforms have also highlighted FreeDum Fighters’ strong tokenomics and community-driven approach. As the presale concludes, FreeDum Fighters looks set to bring a unique twist to the PolitiFi space.

Visit FreeDum Fighters Presale

5. Curve DAO Token (CRV)

Curve Finance, a prominent decentralized exchange (DEX) for stablecoin trading, continues solidifying its role as the primary platform for deUSD and other stablecoins. This position is expected to grow further, especially with the upcoming entry of institutional funds. BlackRock’s $533 million BUIDL fund, alongside other tokenized institutional assets through Securitize, will soon leverage Elixir’s deUSD protocol for DeFi access.

This partnership creates significant potential, with up to $1 billion in real-world assets (RWAs) now able to mint deUSD, a yield-bearing synthetic dollar. Curve Finance already handles the majority of deUSD trading and liquidity, with $64 million (approximately 60% of total liquidity) in its pools.

Curve enables @BlackRock (BUIDL) to enter DeFi. Thanks to @elixir for making it happenhttps://t.co/SqETddHpNa

— Curve Finance (@CurveFinance) November 29, 2024

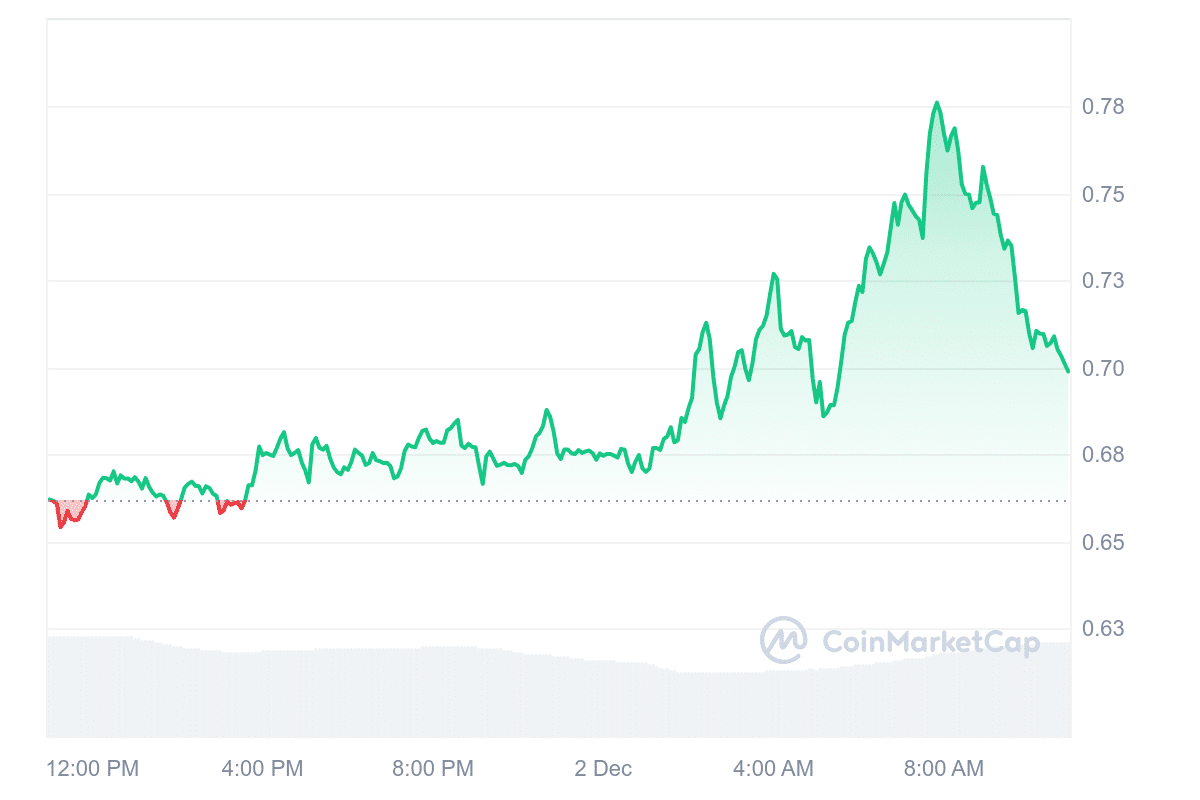

The Curve DAO Token (CRV) has recently shown positive performance. It is currently ranked #111, with a market cap of $869.84 million, reflecting a 5.41% increase. Over the past year, its price has risen by 15%, trading above its 200-day simple moving average (SMA) of $0.351. The token is priced at $0.6989, 95.73% above its 200-day SMA.

The market sentiment for CRV is currently bullish, with the Fear & Greed Index showing a value of 80 (Extreme Greed). The token has seen 20 out of 30 days in the green in the past month, indicating a strong upward trend. Given its market cap, CRV also benefits from high liquidity, which contributes to its stability.

6. Klaytn (KLAY)

Klaytn (KLAY) is a Layer 1 public blockchain designed to support a variety of Web 3.0 applications. Launched in June 2019, it emphasizes low transaction latency, enterprise-grade reliability, and a developer-friendly environment. These features make it well-suited for use cases in decentralized finance (DeFi), real-world assets, entertainment, gaming, and central bank digital currencies (CBDCs). It was part of the Bank of Korea’s CBDC pilot project.

As a globally competitive blockchain ecosystem developed in South Korea, Klaytn has facilitated over 1 billion transactions. These transactions span more than 300 decentralized applications (dApps), reflecting its capacity to support diverse projects.

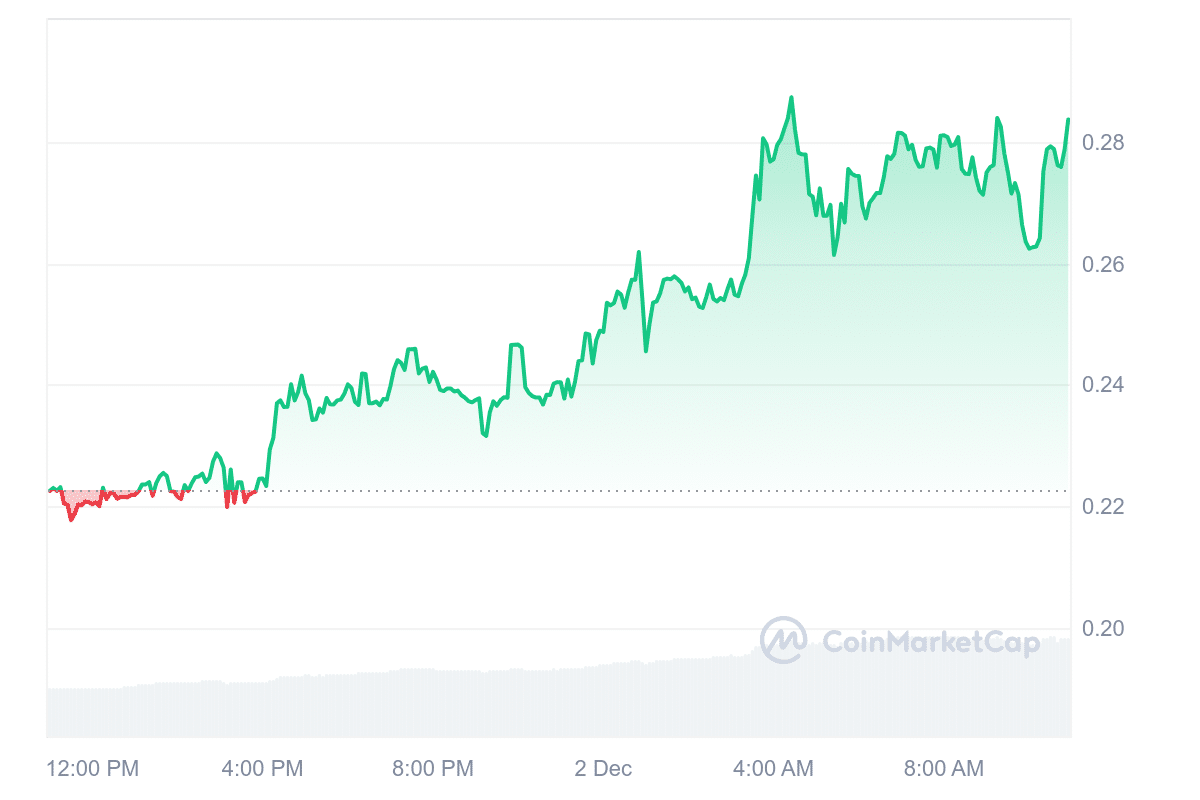

KLAY is currently priced at 0.2836 and has a market capitalization of 1.04 billion. Over the past 24 hours, its trading volume increased by 105.19% to 822,120. The asset has experienced a 48% price increase in the last year. It also trades 91.19% above its 200-day simple moving average (SMA), which is 0.1541.

Price movements over the past month show that KLAY had 19 green days or 63% of the time. This consistent upward trend is reflected in a bullish price sentiment. The Fear & Greed Index is 80, indicating “Extreme Greed.”

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage