Join Our Telegram channel to stay up to date on breaking news coverage

The Spark Pool Chinese mining pool has been making headlines within the Ethereum community for the past few days. Two transactions within this mining pool had left the Ethereum community stunned, as almost 20,000 ETH was paid in transaction fees, worth about $5.2 million. The most worrisome part is the fact that the transaction itself was worth less than $90,00, 350 ETH. The other transaction was worth even less than that, standing at just 0.55 ETH, or $133.

An Suspected Partially Successful Hack

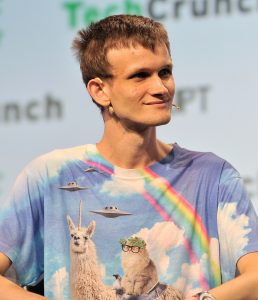

From a glance, a crypto community simply figured that the sender of the fund had mixed up the fields in regard to the value of transfer as opposed to the fees. However, Vitalik Buterin, the Co-Founder of Ethereum, stood with PeckShield, a blockchain analytics firm based in China, suggested a whole other option. They indicated that a crypto exchange, one they’ve refrained from disclosing, was being held to ransom by a group of hackers. According to these two, these hackers had managed to gain access to the exchange’s wallets.

So the million-dollar txfees *may* actually be blackmail.

The theory: hackers captured partial access to exchange key; they can't withdraw but can send no-effect txs with any gasprice. So they threaten to "burn" all funds via txfees unless compensated.https://t.co/kEDFGp4gsQ

— vitalik.eth (@VitalikButerin) June 12, 2020

It’s thought that these criminals manage to obtain partial permissions in the exchange, such as server management or what have you. However, this undisclosed exchange used multi-signature verification when it came to its private keys, which helped protect against theft due to the multiple private keys needed to sign each outgoing transaction. Because of this, the hackers were incapable of sending the crypto holdings to their own wallets.

Scorched Earth Tactics

However, the hackers seemed to be capable of getting an edge regardless, leveraging the permissions they had to blackmail the exchange into sending their funds. They did so through burning the exchange’s assets by way of paying incredibly high transaction fees.

Buterin went further, explaining that similar events could occur within “Scorched Earth” games. This included scorched-earth vaults, rather the “Moeser-Eyal-Sirer” vaults. These include scenarios within staked funding, as well, where hackers could slash these funds, but not outright steal it.

Everything Probable, But Nothing Concrete

The story itself is still unconfirmed, with the theory of human error losing credence by the hour since there were two transactions. It’s hard to make a mistake that costs you so much money twice in a row, after all. It should be further noted that the transactions themselves, paying only a handful of Ether for a massive gas price, belong to a crypto whale, as well. The wallet of the shipper stood at more than 21,000 ETH left within the address, which is worth more than $5 million. This is the case after $5.2 million in ETH transaction fees was paid out already.

Read more:

Join Our Telegram channel to stay up to date on breaking news coverage