Join Our Telegram channel to stay up to date on breaking news coverage

Cryptocurrencies have faced a major pullback this year. With the highest market cap being reduced to less than a third this year, standing at just over one trillion dollars.

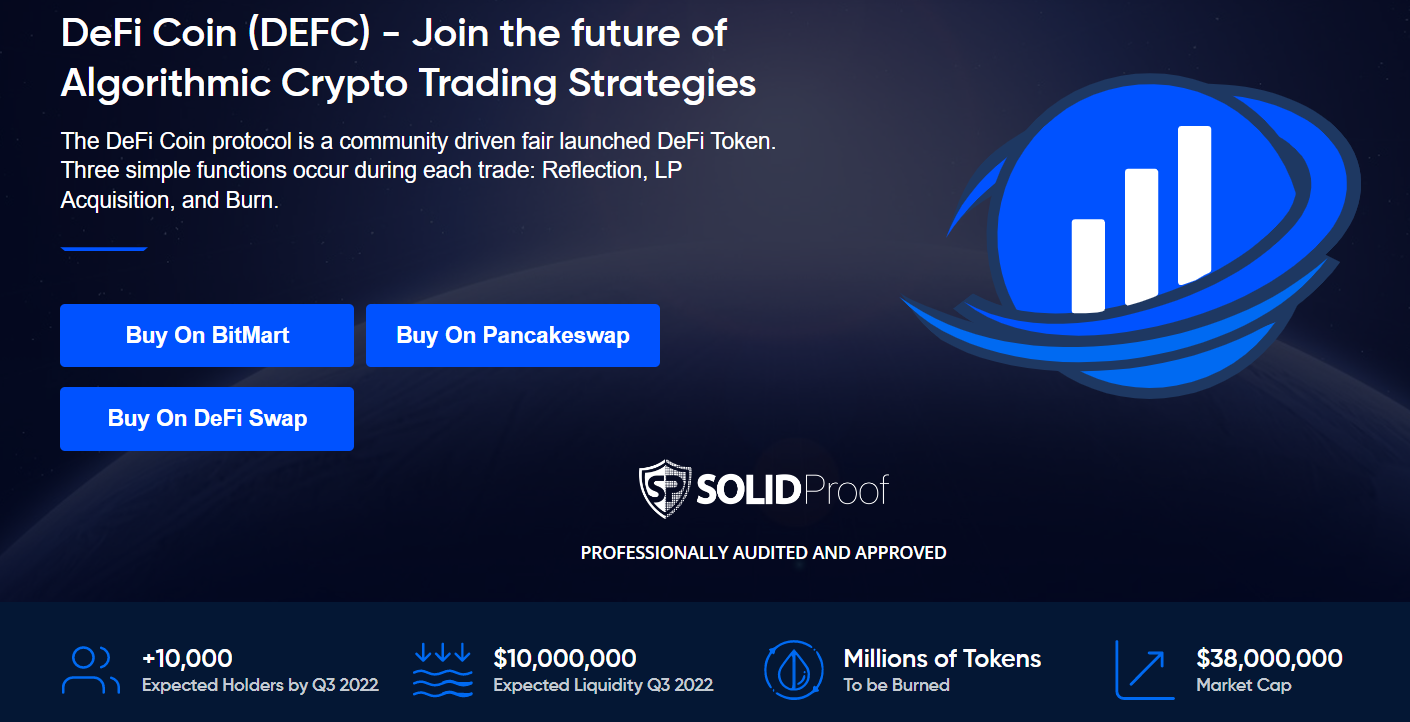

This hasn’t stopped investors from browsing the market for the best cryptocurrencies. And one such token that has managed to grab speculators’ attention is DeFi Coin. This newly minted coin offers investors the potential to make exponential gains, and this was evident a few months after the coin’s launch.

They also make a really good case for diversification, as although your portfolio may include some safe gainers such as Bitcoin and Ethereum, these high market cap coins hardly hold the promise to provide exceptional returns. Having a few low market cap coins gives your portfolio the edge it needs, to outperform everyone in the market and deliver exceptional returns.

But why should you go with DeFi Coin? Well, there is really more than one reason. To start with,

5 Reasons To Invest in DeFi Coin

-

Good Entry Price

While new investors may be looking at the top crypto coins to initiate their investment journeys, these coins have one thing in common and that is a high price entry. This is limiting as not everyone can get a significant quantity of the coin, especially small investors.

Lucky for them, DeFi Coin has a very accessible price, and therefore, allows investors to own a considerable chunk of the cryptocurrency by paying much less than a dollar for a single coin. To give you an example, you could only purchase about 0.06 Eth for $100. Whereas, for the same amount, you can get roughly around 1390 DeFi Coins at $0.072 each.

This presents quite a contrast as for the same price, you’re able to secure a much bigger ownership vs owning something of very little proportion. As a small investor, this can be incredibly lucrative for you in the long run as the price of the coin increases. Pulling the value of your portfolio up with itself.

-

Deflationary Nature

Deflationary crypto coins tend to reduce in supply over time, helping increase the price of the token. Unlike other coins without a cap to the market supply, DeFi Coin dosen’t just keep increasing in supply and prove to be unproductive by limiting the price potential of the token.

With DeFi Coin, half of the tax on each transaction is distributed to investors in the form of rewards and the rest is burned, or wiped out from existence. Meaning, that there will never be more than 100 million DeFi Coins, which remains to be the supply cap of the token.

In addition to the already set-up staking mechanisms, the team also manually burns tokens from time to time. As the project becomes more and more deflationary, and the supply in the market reduces, the price of the token keeps on going higher and higher.

-

Faces Behind The Project

The DeFi coin project is led by industry experts, who are dedicated to making the project a huge success. The team is expected to partner with various other major cryptocurrencies in pooling staking on the DeFi Coin Swap platform.

They also burned all their token holdings at the time of the launch, to convey that the project is not just a “get rich quick” scheme, but a legitimate initiative. And these traits have helped them gain recognition across social media, with more than 20k followers on Twitter. With investors’ confidence, they’re in to make it big in the crypto space.

-

Staking

Crypto tokens that follow a proof-of-stake consensus mechanism allow investors to be delegators and earn interest on their crypto by locking it up for a period of time. Yes, a bunch of cryptos provide staking as an option, but very few come close to the APY DeFi Coin is offering.

As per the official website, if you stake your DeFi coins on the DeFi swap exchange and opt for the 365-day staking plan, you’d be able to receive an APY of 75%.

This option allows investors to earn an additional income, while their investments remain unaffected. So not only will the value of your tokes grow over time, but you will also benefit from the interest accumulated to date. This presents a compelling reason for you to buy DeFi coin over other low market cap coins, offering sub-par staking incentives.

-

Promising Future

The DeFi coin team plans to launch a decentralized exchange on their website and this one is just one of the many ways the team plans to increase the price of their token in the future. In addition to that, they also plan to list the coin on major exchanges, enabling the adoption and helping the coin receive more recognition.

If that’s not enough reason, the team is also planning to release an app, where users will be able to learn about the token and invest in it. For now, the coin is trading at $0.0725 according to coinmarketcap.com with a market cap of $839,945.

Read More

Join Our Telegram channel to stay up to date on breaking news coverage