Join Our Telegram channel to stay up to date on breaking news coverage

The cryptocurrency market has slid down a little after another record-breaking day yesterday. After topping $3 trillion, its total cap has slid back down to $2.9 trillion, according to CoinMarketCap. Most major coins have fallen along with the market, with bitcoin (BTC) and ethereum (ETH) slipping by around 2% each. However, there still are a few coins doing well today, while many of the big cryptocurrencies are likely to bounce back as we near the ned of the year. As such, we’ve put together a list of the 5 next cryptocurrency to explode. This covers coins with good short and long-term potential.

5 Next Cryptocurrency to Explode

1. Loopring (LRC)

LRC has already exploded after the past couple of days, but there’s a good chance its rally could continue for a couple more. At $3.27, it’s up by 55% in the last 24 hours, and by 128% in the past week. It’s also 749% up in the past month.

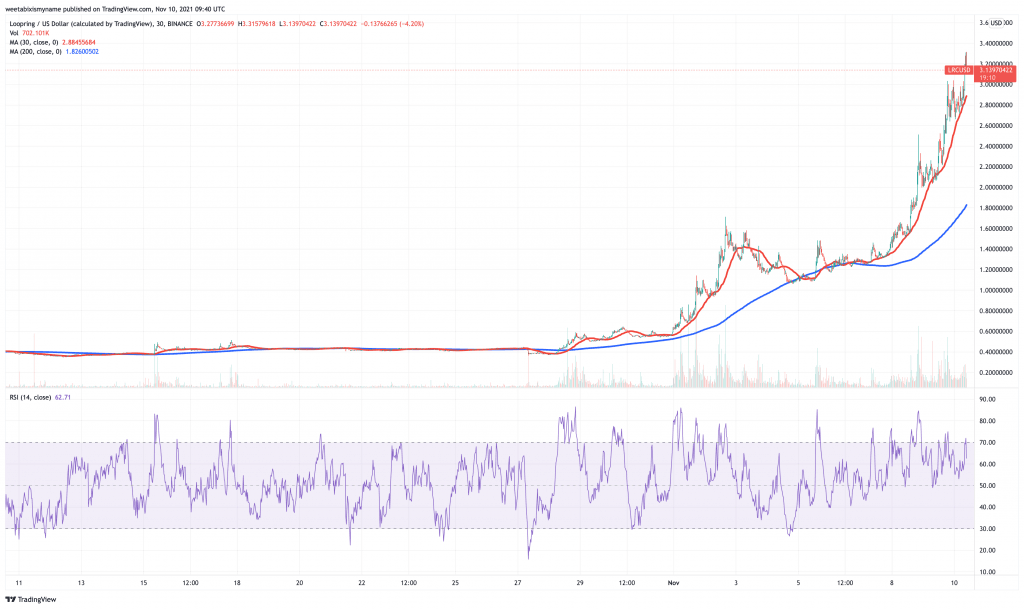

LRC’s relative strength index (in purple above) has shown a real ratcheting up of momentum over the past few days. It now stands at just above 70, which is verging on overbought. That said, it was also 70 yesterday, before LRC hit yet another all-time high.

Loopring is a layer-two scaling solution for Ethereum. It uses zero-knowledge rollups to help decrease transaction fees and increase transaction capacity, and is used with a variety of decentralised exchanges. It has gained traction more or less in proportion to Ethereum fees rising.

1/85th the cost, same great Ethereum taste

L2 swaps hit different pic.twitter.com/BQoWh09OWR

— Adam Browman (@A_Browman) November 8, 2021

And with Ethereum fees likely to remain high at least until its transition to proof-of-stake next year, expect demand for LRC to remain fairly high. This is why, after already rallying this week, it’s still one of our 5 next cryptocurrency to explode.

2. Bitcoin (BTC)

BTC may be down today, but it would be foolish to think another rally isn’t somewhere around the corner. At $66,800, it’s down by 2% in the past 24 hours, and by 2.5% compared to the all-time high of $68,641 it set a day ago now. It’s also 5% up in the past week, and by 22% up in the past month.

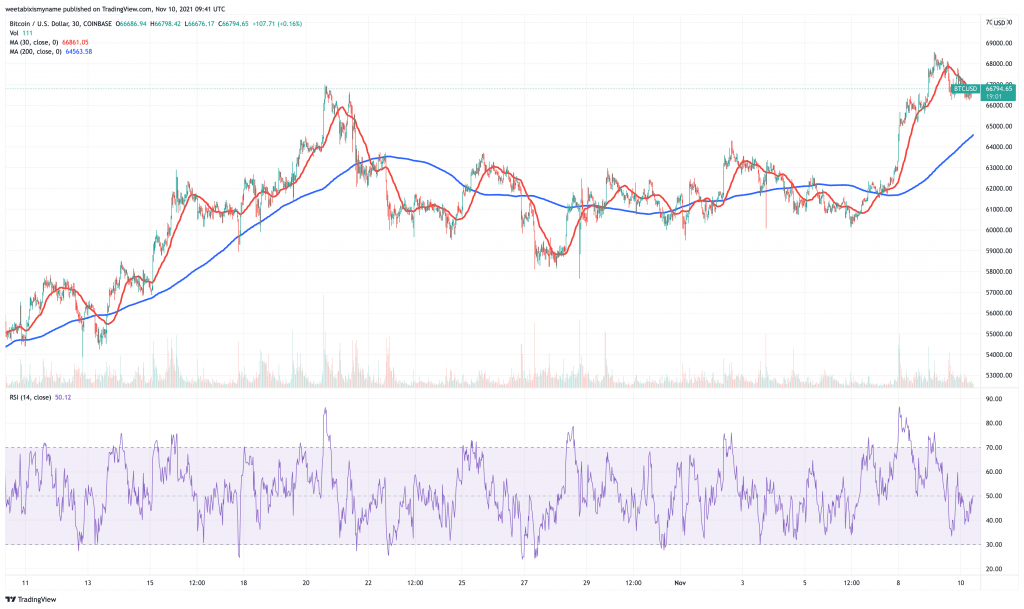

BTC’s technical indicators show that it has cooled off, at least for now. Its 30-day moving average (in red above) is beginning to gravitate towards its 200-day average (in blue). Meanwhile, its RSI is at a very moderate 50. This shows there’s room to enter the bitcoin market before the next big surge.

And yes, bitcoin is very well-positioned to surge again soon. Last month, the SEC gave the green light to the ProShares Bitcoin ETF, while more Bitcoin ETFs are also likely to follow. For instance, Grayscale Investments recently applying to turn its bitcoin fund into a spot-based ETF.

And when you add rising inflation into the mix, bitcoin really could take off towards the end of the year. This is what a range of analysts are predicting: Alex Krüger recently forecast a price of between $75,000 and $85,000, while analysts at Kraken suggested $96,000 in a new report.

Likewise, the stock-to-flow model suggests a price of around $100,000 by the start of 2022. This is probably a best-case scenario, but the model has been impressively accurate so far this year.

Like clockwork pic.twitter.com/SBjFgdmAyy

— PlanB (@100trillionUSD) November 2, 2021

3. Ethereum (ETH)

ETH is also down by 2% today, at $4,733. This is 2.7% off its latest ATH of $4,857, which it also set yesterday. At the same time, the current price represents an increase of 3% in the past day and 38% in the past month.

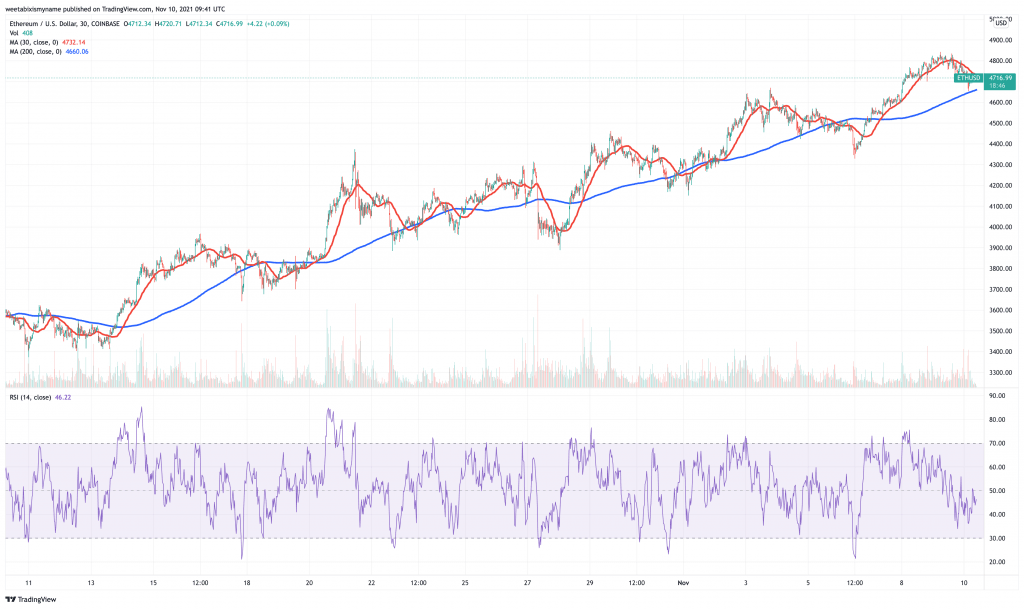

ETH is another cryptocurrency that is cooling off right now, but most likely before another rally. Its RSI is firmly in moderate territory, being neither overbought nor oversold.

At the same time, Ethereum continues to witness impressive growth. Its total value locked in has reached a new high of $182.64 billion. This means it accounts for around two thirds of the total DeFi market.

Ethereum’s traffic will undoubtedly continue pushing up demand for ETH, which is taken in fees. At the same time, changes this year to the platform’s tokenomics makes it even likelier that ETH will rise strongly.

Specifically, the London hard fork (completed in August) means that Ethereum burns a portion of its fees. As a result ,its issuance has recently become negative. And with supply declining over time, increases in demand will have an outsized positive effect on its price.

$ETH price breaking new highs while a record amount of 16.9k ETH was burnt in the past 24 hours

This also brings ETH's issuance to a record low of -1.1% pic.twitter.com/UrG0g0urlO

— Lucas (@LucasOutumuro) October 29, 2021

More and more ETH holders are also sending the coin to Ethereum 2.0’s staking contract, which now holds over eight million ETH. This figure is only going to increase over time, particularly as the transition to proof-of-stake draws closer (expected some time in early 2022).

$ETH continues to hit new all-time highs.

A supply squeeze seems more probable since:

– The staking contract hit 8.2m ETH

– +8m ETH locked in #DeFi

– Since October 1st, more than 860k ETH left centralized exchanges, decreasing the supply available.https://t.co/s9gSaI5JGF pic.twitter.com/EtPQwUAm9h— IntoTheBlock (@intotheblock) November 8, 2021

Taken together, this kind of growth indicates why ETH is one of our 5 next cryptocurrency to explode.

4. Cardano (ADA)

ADA is down by 1.6% in the past 24 hours, to $2.24. That said, it’s up by 14% in the past week and by 5% in the past fortnight.

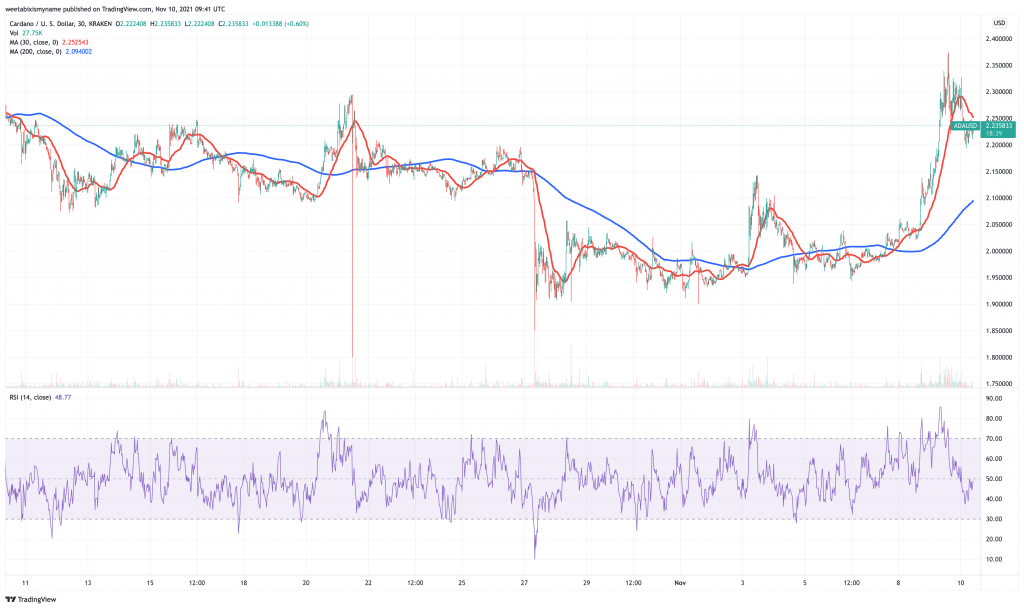

ADA has come back to life again after a period of relative stagnation. Its 30-day average has broken free from its 200-day average, indicating a new, longer term level.

ADA’s renewed good fortunes can be pinned on recent Cardano developments. On November 5, Input Output Hong Kong introduced the beta version of the Plutus Application Backend (PAB), which is a suite of tools enabling developers to create and test dapps. In other words, this release will facilitate the rolling out of dapps and services on Cardano, thereby increasing demand for ADA.

This marks a significant milestone in the #DeFi journey on Cardano, simplifying on-chain #smartcontracts integration and smoothing the route to #dApp deployment. $ADA #Cardano 2/4

— Input Output (@InputOutputHK) November 5, 2021

Combined with September’s rolling out of smart contract capabilities, this development suggests that Cardano is on the cusp of becoming a fully functional blockchain. And once it does become such a chain, ADA could indeed explode.

5. Avalanche (AVAX)

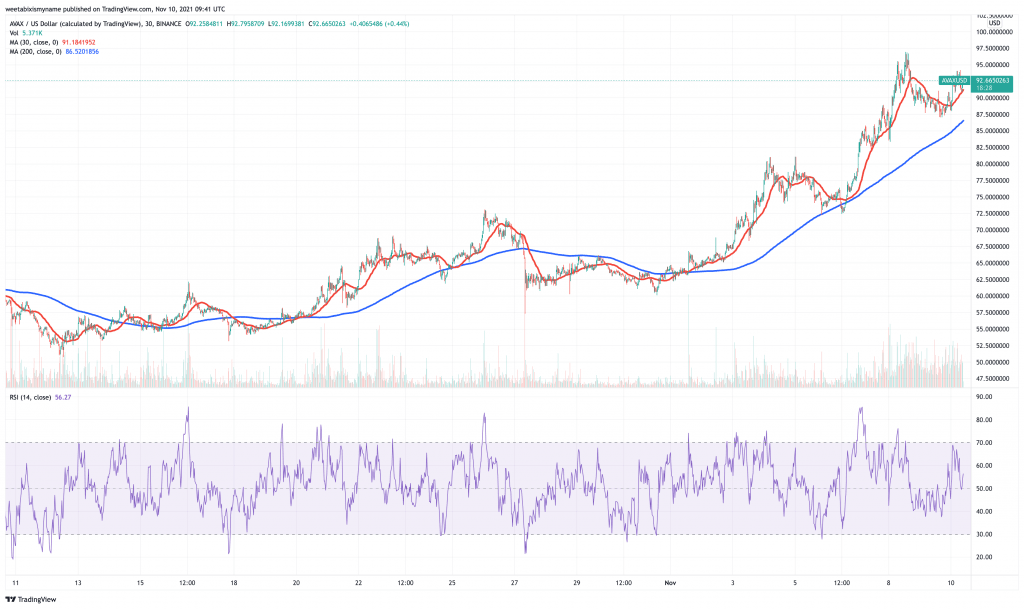

AVAX is up by 3% in the past 24 hours, at $92.89. This may be 3.7% down compared to the all-time high of $96.46 it set two days ago, but it’s also 37% up in the past week. Not only that, but the altcoin is 64% up in the last 30 days.

AVAX’s 30-day average continues to rise above its 200-day, indicating that its rally is continuing. Similarly, its RSI has returned to a position where it can begin rising up again.

Looking at the bigger picture, AVAX is one of the most exciting altcoins on the market right now. Its native platform, Avalanche, has been experiencing some very encouraging growth in recent weeks. Most notably, its total value locked in now stands at $10.37 billion. This is up from a mere $1 billion in the middle of August.

As with Solana (SOL), AVAX could also shoot up the ranks to become one of the top-five cryptocurrencies by market cap. Indeed, it recently launched a $200 million fund dedicated to boosting development of the Avalanche ecosystem, so it’s probably only a matter of time.

The Avalanche Foundation has launched Blizzard, a $200M+ fund dedicated to accelerating development, growth, and innovation across the #Avalanche ecosystem.

Check out the full details below ⬇️https://t.co/AR25D8E2lL

— Avalanche 🔺 (@avax) November 1, 2021

Capital at risk

Read more:

Join Our Telegram channel to stay up to date on breaking news coverage