Join Our Telegram channel to stay up to date on breaking news coverage

The month is in full swing, and crypto investors have already started looking for high-return cryptocurrencies. With coin prices showing mixed performances, everyone needs to be more cautious about where they put their money. In this roundup, we highlight the right selection of high-return cryptocurrencies for investors to look into as they build diversified portfolios.

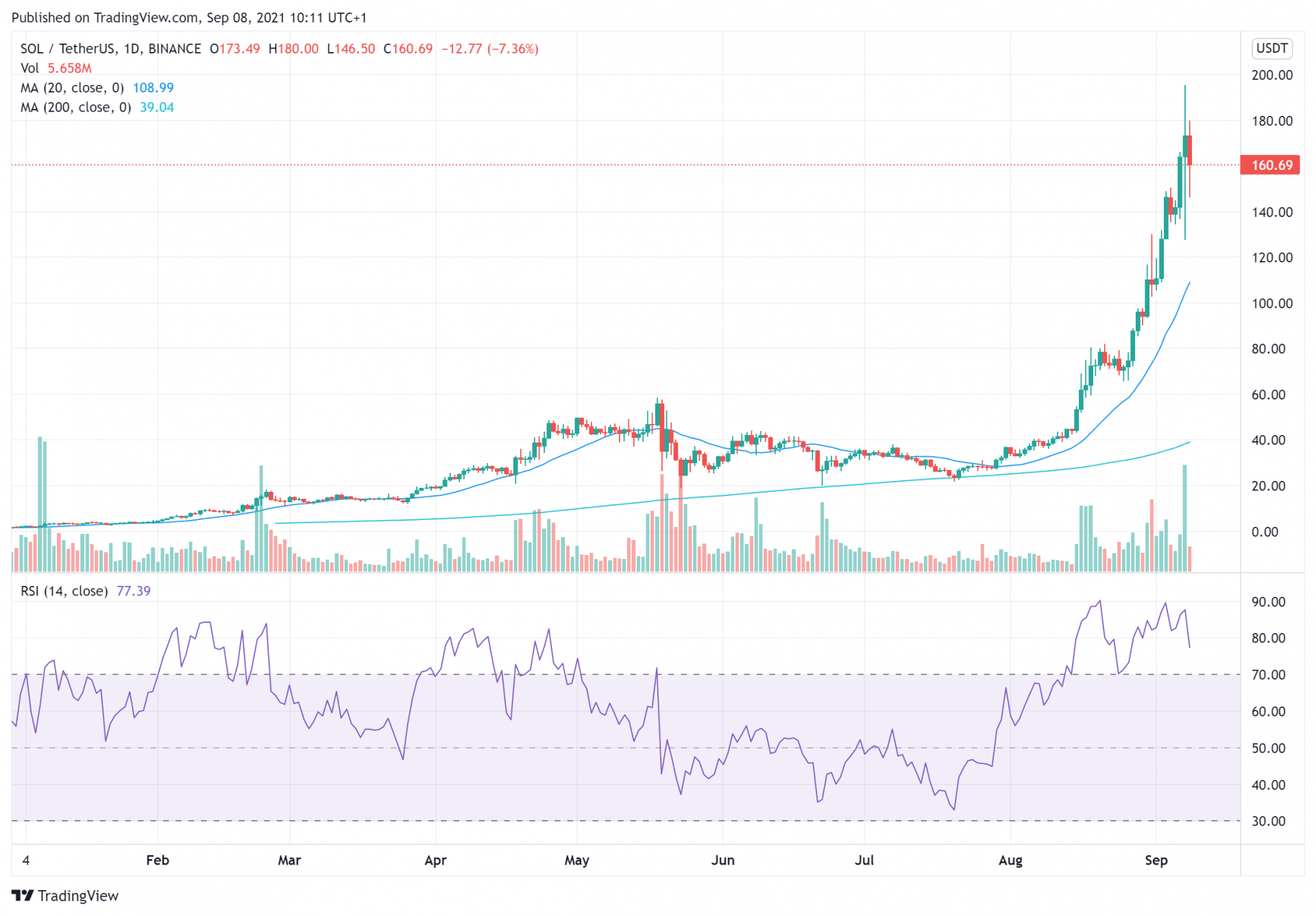

1. Solana (SOL)

Solana kicks off our list of the best high-return cryptocurrencies for this week. The coin has been on a significant surge in the past week, posting outsized returns for investors who were lucky enough to get in early.

Over the past week, SOL perform better than other large-cap coins – including Bitcoin. Data from CoiNShares shows that the asset led altcoins in terms of institutional inflows, with SOL-based investment products seeing a healthy $13.2 million injection – a 388% increase over the previous week.

SOL also got a huge boost following the launch of a marketplace for non-fungible tokens (NFTs) on the Solana blockchain. The marketplace is an offshoot of FTX – the popular decentralized exchange and derivatives trading platform that operates on Solana.

SOL currently trades at $160.04 – down 11.49% in the past day and up 42.50% in the past week. The asset is still well above its 20-day moving average (MA) of $109.75 and 200-day MA of $39.16. The coin’s relative strength index (RSI) stands at 77.33, and it’s been dropping. So, this is a good time to buy in and enjoy gains once the market rally kicks in again.

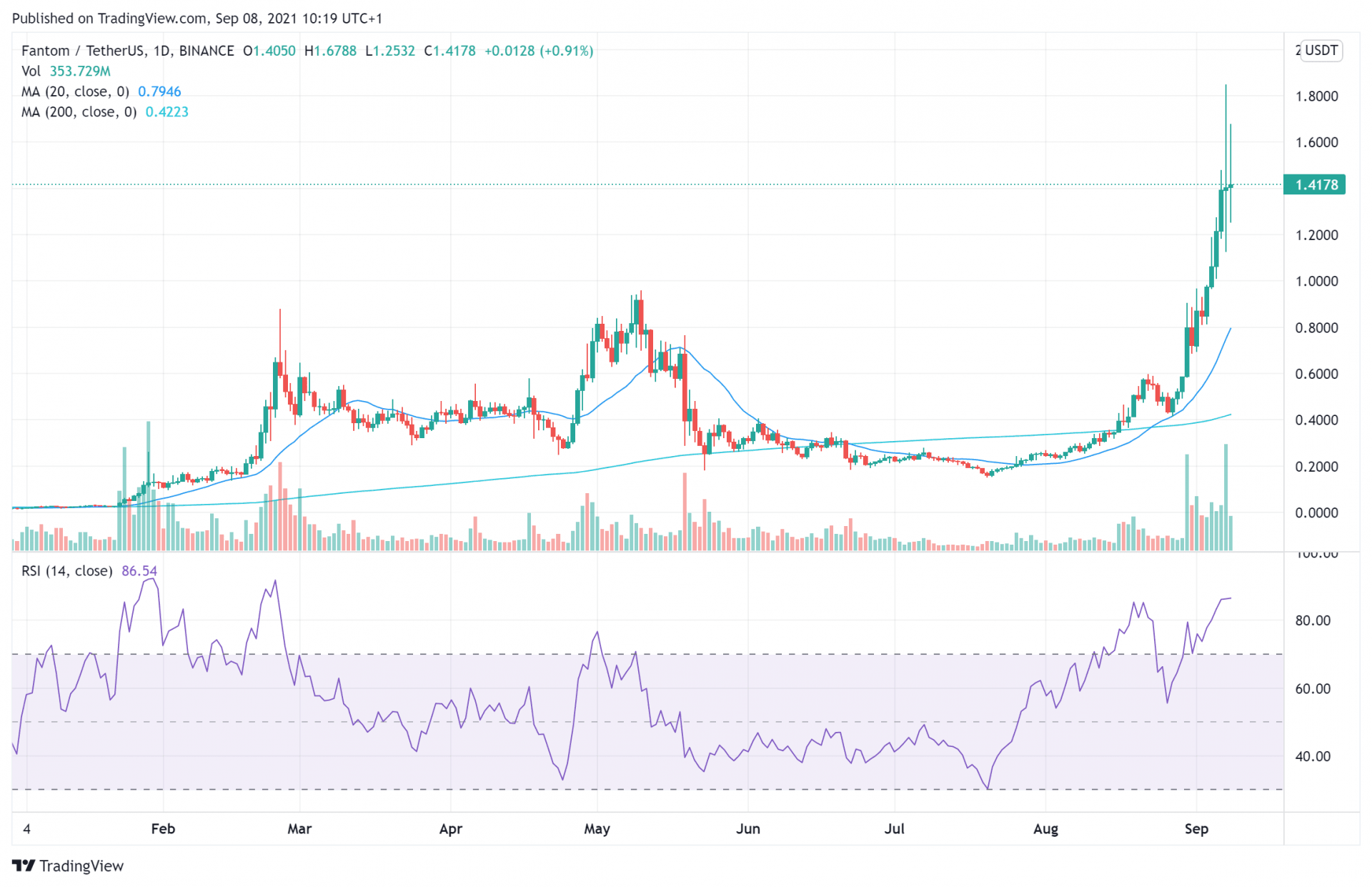

2. Fantom (FTM)

The native token for Fantom – an advanced blockchain platform that allows developers to build decentralized applications (dApps). The coin has also shown significant gains in the past week, offering better performance than many of the conventional high-return cryptocurrencies.

FTM’s momentum is coming as the developers look to broaden its adoption – as well as that of Fantom itself. Last week, the Fantom Foundation announced a 370 million FTM incentive program. Under the initiative, developers who launch on the Fantom network will be eligible to apply for rewards of between 1milliona and 5 million FTM. Rewards will be based on the protocols’ total volume locked.

Social media engagement for FTM has also surged, with data showing that the coin saw an almost 96% engagement increase. All of these have helped to prop up the FTM price quite well.

FTM currently trades at $1.41 – down 14.11% in the past day and up 87.44% in the past week. The past week has helped FTM, with the asset trading well over its 20-day and 200-day MAs of $0.79 and $0.42 respectively.

Its RSI is still pretty overbought at 86.79. Considering that FTM recently set an all-time high at $1.85 investors are confident that it will be able to test those highs again once the correction is over.

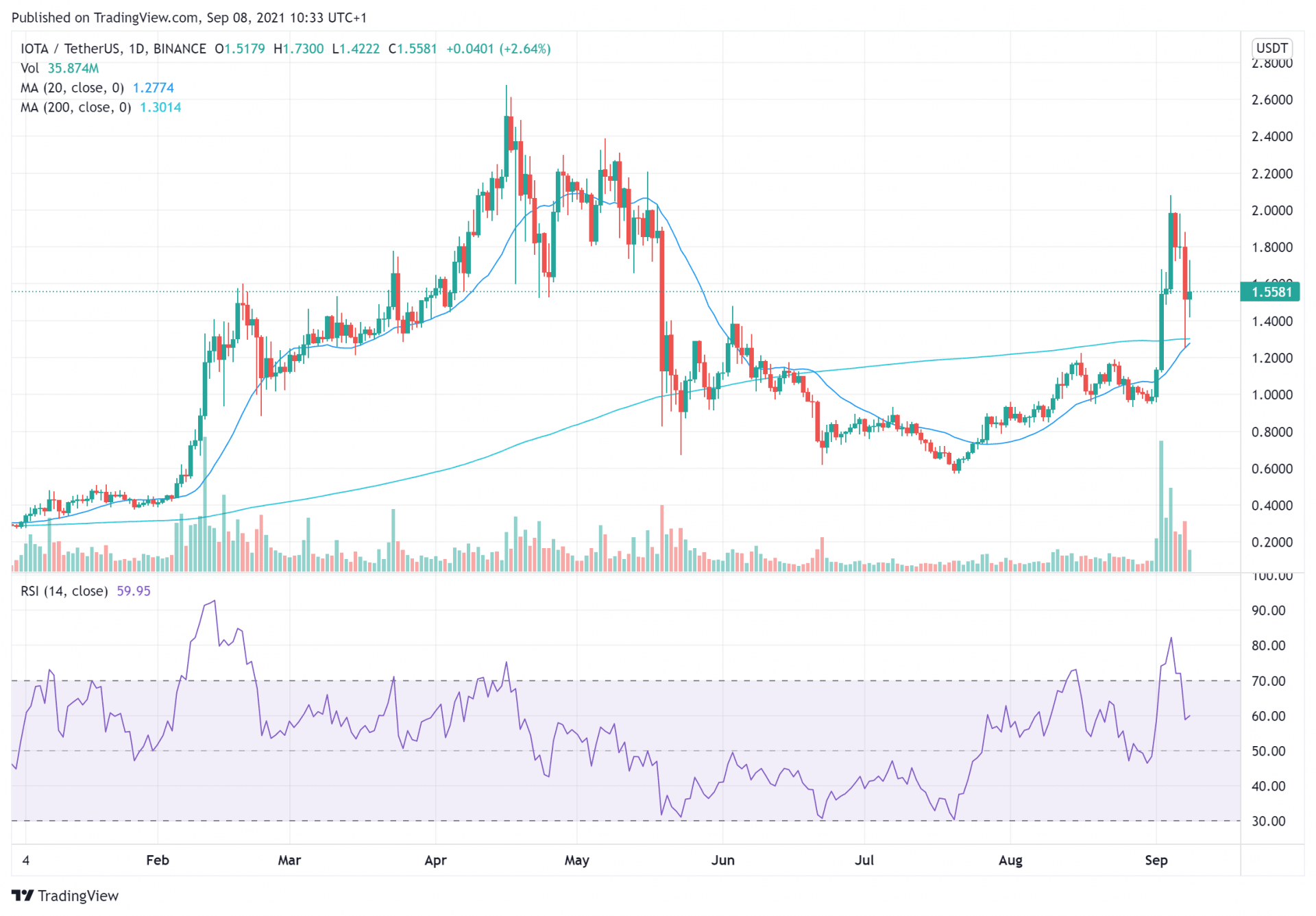

3. IOTA (MIOTA)

MIOTA is the native token for IOTA – an open-source blockchain protocol that looks to power the Internet of Things. The blockchain looks to become the standard mode for transaction processing across devices, and MIOTA is its native transaction engine.

MIOTA has shown significant gains over the past week as well, earning a spot on our list of high-return cryptocurrencies. The gains seem to have come from recent upgrades to the IOTA blockchain. Recently, the blockchain integrate its Hornet upgrade, which restored auto-peering and integrated a plugin with the Hornet node.

This week, the European Commission’s blockchain initiative also selected seven projects to participate in the early stages of an EU-wide blockchain platform. IOTA was one of the selected parties, and it was chosen to especially docs on improving cross-border relations between governments, citizens, and businesses.

All of these have pushed MIOTA pretty high. The asset currently trades at $1.56 – down 7.4% in the past day, but up by 53.44% in the past week. With a 20-day and 200-day MA of $1.26 and $1.29 respectively, MIOTA looks safe for now. But, its dropping RSI -which currently stands at 59.77 – shows that investors are selling off in the interim.

You can keep an eye on it as the market recorrects.

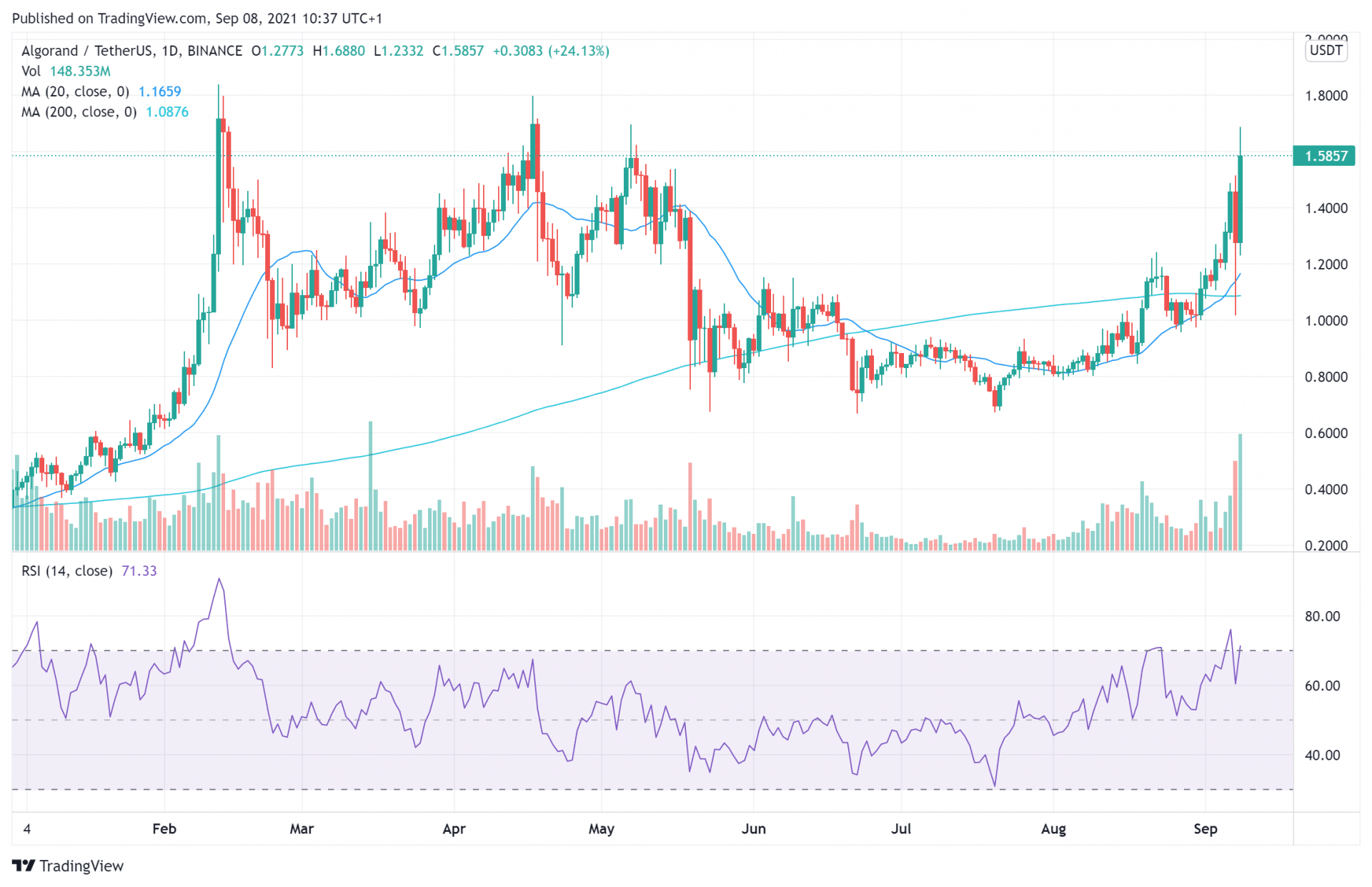

4. Algorand (ALGO)

ALGO is the native token for Algorand – a blockchain platform that looks to knock Ethereum off its porch. Like many new-generation blockchain platforms, Algorand aims to solve the blockchain trilemma – achieving speed, scalability, and security.

While most of the broader crypto market is looking pretty bleak, ALGO has bucked against the trend. The asset is trading at $1.58 – up 13.9% in the past day and 38.89% in the past week. Given that the asset’s all-time high stands at $1.86, ALGO is in a healthy position to test those highs once more. The coin is technically sound, with a 20-day MA of $1.16 and a 20-day MA of $1.08. The coin’s RSI also stands at 71.59 – underbought for a cryptocurrency.

The price surge appears to be related to developments in El Salvador. Earlier this week, Latin American crypto exchange Bitso announced that it would assist in launching a state-supported Bitcoin wallet in El Salvador. The initiative will be conducted along with several other companies, including Algorand.

The El Salvador project remains highly controversial, but success with it could spur Algorand – and push ALGO further into the rank of high-return cryptocurrencies.

5. Quant (QNT)

Last – but definitely not the least – on our ranking of high-return cryptocurrencies is QNT – a project that supports blockchain interoperability. Quant offers tools to help develop infrastructures that enable enterprise-level dApps.

Using QNT, developers can access Quant’s OverLedger DLT Gateway – the tool responsible for interoperability with blockchains and which allows developers to build multi-chain apps.

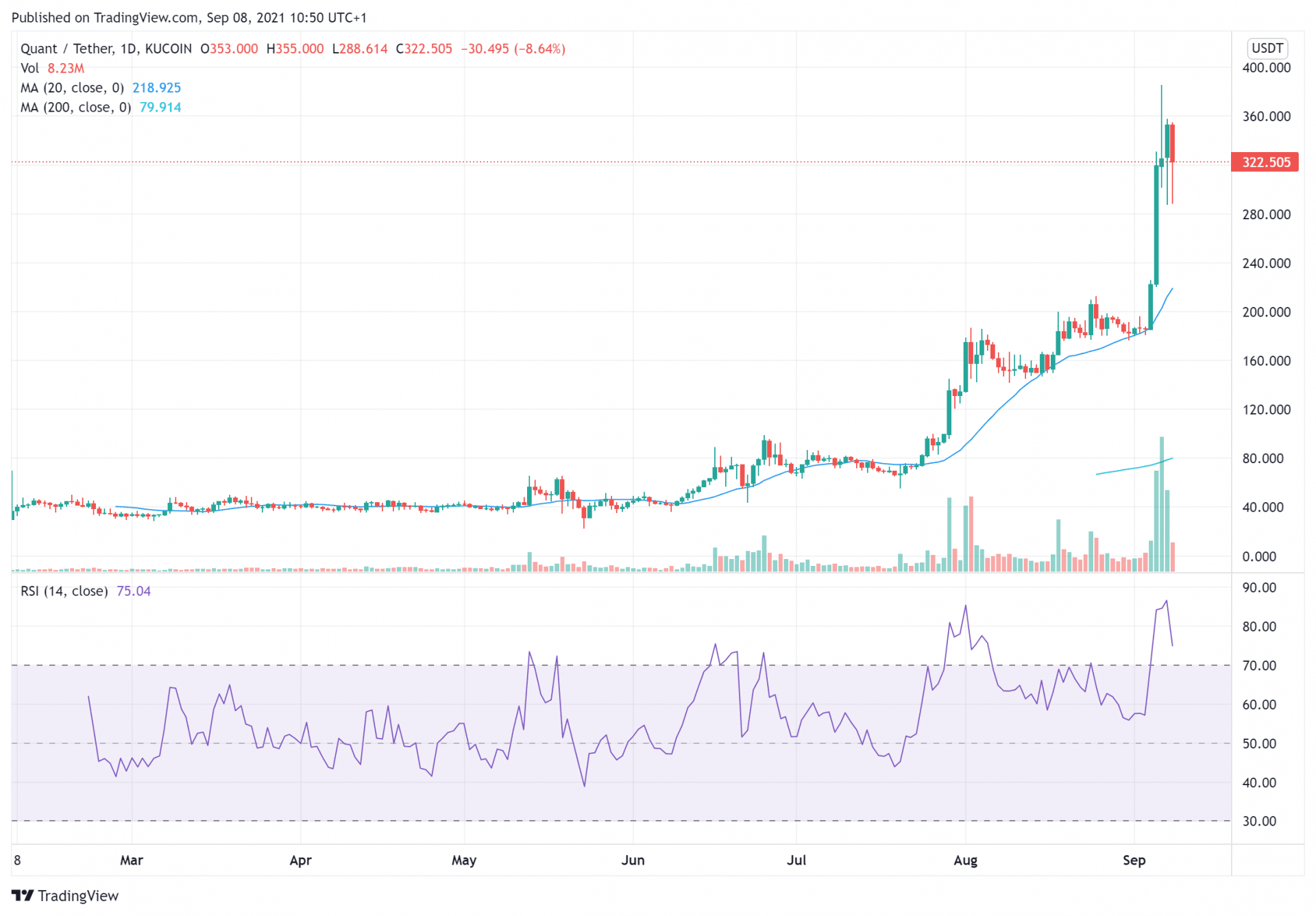

Like ALGO, QNT has so far bucked against the bullish trend in the market. The asset’s price stands at $320.06 – up 3.7% in the last 24 hours and 73.22 in the past week. The asset’s price also set a new all-time high of $383.79 earlier this week, and investors seem confident about retesting the highs.

QNT holds well above its 20-day and 200-day MAs of $218.10 and $79.05. Its RSI is also 74.95 – a healthy point to buy, especially since it’s dropping.

The price jump is primarily due to the release of OverLedger 2.0.5 – Quant’s business gateway, which offers universal interoperability. With this upgrade, users will be able to connect any system to any blockchain.

Quant has also joined blockchains like Polkadot and Kusama to launch developer initiatives, with the establishment of its Quant Developer Program to help attract new builders into its ecosystem. Lastly, the past month has seen QNT listed on major exchanges Binance and Coinbase. This should boost its appeal and credibility even more.

Read more:

Join Our Telegram channel to stay up to date on breaking news coverage