Join Our Telegram channel to stay up to date on breaking news coverage

Heading into July, the crypto market appears to be commencing a bear run. Save for a few small-cap coins, asset prices have slid once more as pressure from the traditional economy continues to build and weigh on them. However, the decentralised finance (DeFi) space continues to show promise, especially for investors with the long game in mind.

In this article, we’ll examine the best DeFi crypto coins and the factors that could cause them to see price surges in the near future.

1. DeFi Coin (DEFC)

The top coin on our list of the best DeFi crypto coins is DEFC – the native coin for the DeFi Swap trading and exchange ecosystem.

DeFi Swap, launched in 2021, is a decentralised exchange (DEX) that enables seamless coin trading. The DEX enables trading without a third party, offering low fees and almost instant transaction finality. With investors looking to support the DeFi Swap ecosystem, many of them trooped to buy DeFi Coin – the exchange’s native token.

DeFi Swap, launched in 2021, is a decentralised exchange (DEX) that enables seamless coin trading. The DEX enables trading without a third party, offering low fees and almost instant transaction finality. With investors looking to support the DeFi Swap ecosystem, many of them trooped to buy DeFi Coin – the exchange’s native token.

At press time, DEFC trades at $0.14 per token. The crypto asset is riding an impressive 16.6% jump in the past week.

We selected DEFC as the overall best DeFi coin because of the many benefits that the digital asset offers. Whenever DEFC is sold, DeFi Swap takes a 10% fee. This fee incentivises investors to hold the coin, and we believe this should push its price forward over time and reduce its supply.

DeFi Swap’s developers are also looking to list DEFC on other centralised exchanges. We believe that this will lead to more growth for DEFC as it gets exposed to a broader investor pool.

2. Uniswap (UNI)

Another impressive option for investors looking for the best DeFi crypto coins is UNI. The digital asset operates as the platform token for Uniswap – one of the largest DEXs in the market right now.

Currently, UNI trades at $4.92. The digital asset is up by 3.795 in the past week, with UNI still showing strong fundamentals to hold its price gain.

As a DeFi giant, UNI will be sure to see gains when the market flips bullish. Also, Uniswap continues to grow. After crossing $1 trillion in trades in May, Uniswap Labs – the exchange’s developers – purchased Genie, a non-fungible token (NFT) marketplace and aggregator built on Ethereum.

2/ Over the past three years, The Protocol has

🛹 Onboarded millions of users to the world of DeFi

💸 Introduced fair and permissionless trading

🚰 Lowered the barrier to liquidity provision pic.twitter.com/mT2ZzjMTav— Uniswap Labs 🦄 (@Uniswap) May 24, 2022

The Genie acquisition signals a broader push into NFTs by Uniswap, and we expect the platform to make a strong presence in the space soon.

3. Chainlink (LINK)

Chainlink has seamlessly transcended different sub-genres of the crypto space. The decentralised oracle is responsible for providing off-chain data to blockchain smart contracts, helping them to work seamlessly and support their protocols.

While the market’s forces have weighed on it, there are still several reasons to buy Chainlink. The first reason is the oracle’s recent expansion to the Polkadot blockchain with a custom parachain called Efinity.

LINK also got a massive boost earlier this week when it was listed on the popular retail trading platform Robinhood.

LINK is now on Robinhood @chainlink #CryptoListing https://t.co/0aTjVAOhMy

— Robinhood (@RobinhoodApp) June 28, 2022

The listing will grant LINK even more exposure, with a price gain expected in the short term at the very least.

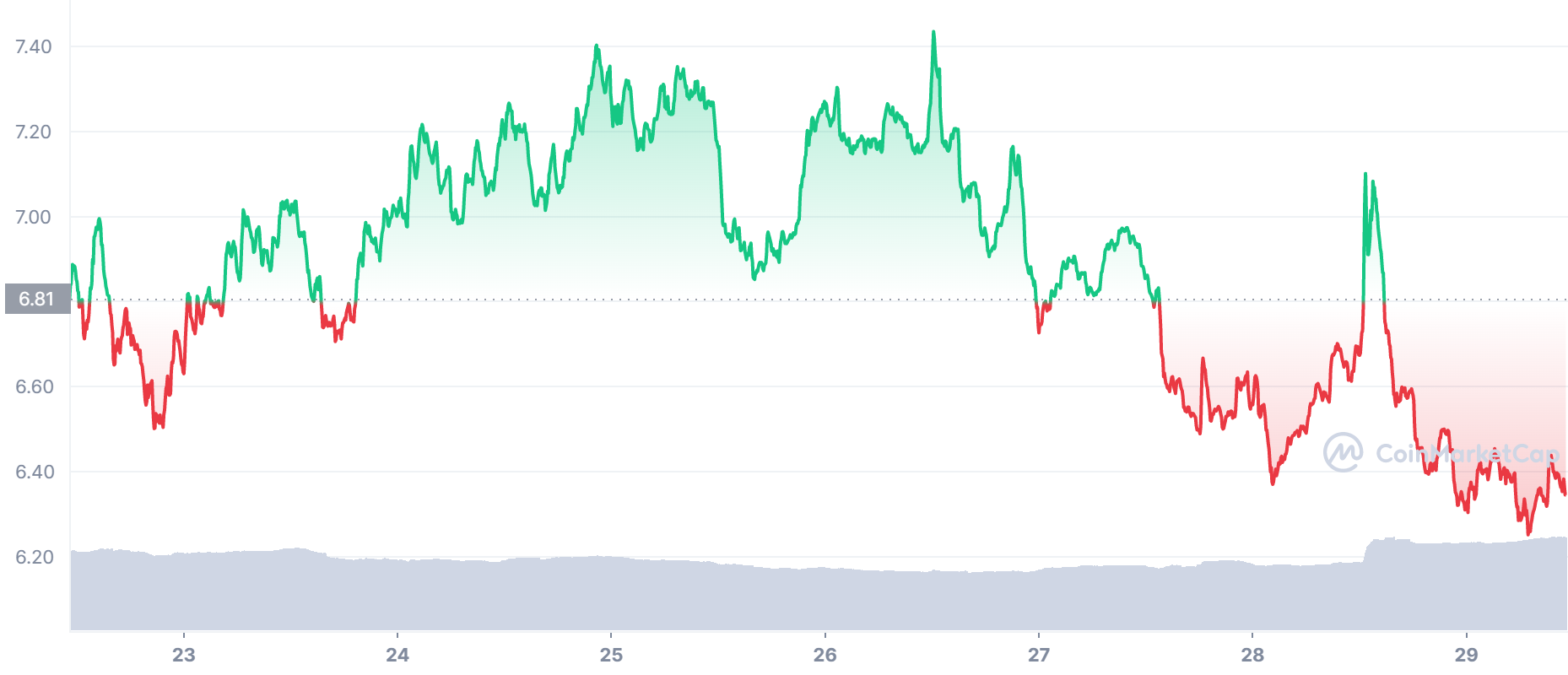

4. THORChain (RUNE)

Next on our list of the best DeFi crypto coins is RUNE. The digital asset is the native token for THORChain – a decentralised liquidity protocol that allows users to enjoy seamless asset trading.

RUNE powers the entire network, and it is used as a pairing token that accompanies every asset in THORChain’s liquidity pools. Thus, RUNE is the second token deposited in the liquidity pool. Investors can also buy the digital asset to pay for fees and governance.

RUNE currently trades at $1.92. The crypto asset is up by 6.07% in the past week, holding on to its gains quite well.

For now, RUNE appears to be benefiting from the launch of THORChain’s mainnet. Prior to this, THORChain had operated on the Ethereum and Binance Chain networks. By launching its own blockchain, the protocol is looking to become a standalone service and grow even more.

5. Maker (MKR)

The final coin on our list of the best DeFi crypto coins is MKR – the native token for Maker. The lending protocol has grown to become the DeFi market’s leading service. The platform is operated by MakerDAO – the same decentralised autonomous organization (DAO) that operates the DAI stablecoin.

As the leading DeFi protocol, investors can buy Maker and earn gains when the market flips bullish. At the same time, the MakerDAO is currently voting on a proposal to invest 500 million DAI in US treasuries and bonds.

The Maker Governance votes to determine how to allocate 500 million DAI between different investment strategies.

This allocation poll is a result of the passage of MIP65: Monetalis Clydesdale: Liquid Bond Strategy & Execution.

A recap on how it would work.

🧵

— Maker (@MakerDAO) June 27, 2022

The proposal signals MakerDAO’s push into the traditional economy – especially amid the current market conditions.

Read More:

Join Our Telegram channel to stay up to date on breaking news coverage