Join Our Telegram channel to stay up to date on breaking news coverage

Digital assets are seeing a boost in interest as a potential collaboration between the layer-1 blockchain Injective (INJ) and the AI-powered blockchain protocol Fetch.AI (FET) sends bullish signals across the investor community. Analysts see this partnership as a positive development, suggesting it could spark a short-term rally.

Meanwhile, Santiment’s data reveals significant development progress across ten top crypto ecosystems, underscoring their potential for innovation and growth. In light of this, investors are searching for affordable tokens, particularly the best cheap crypto to buy now under 1 dollar.

5 Best Cheap Cryptocurrencies to Buy Under 1 Dollar

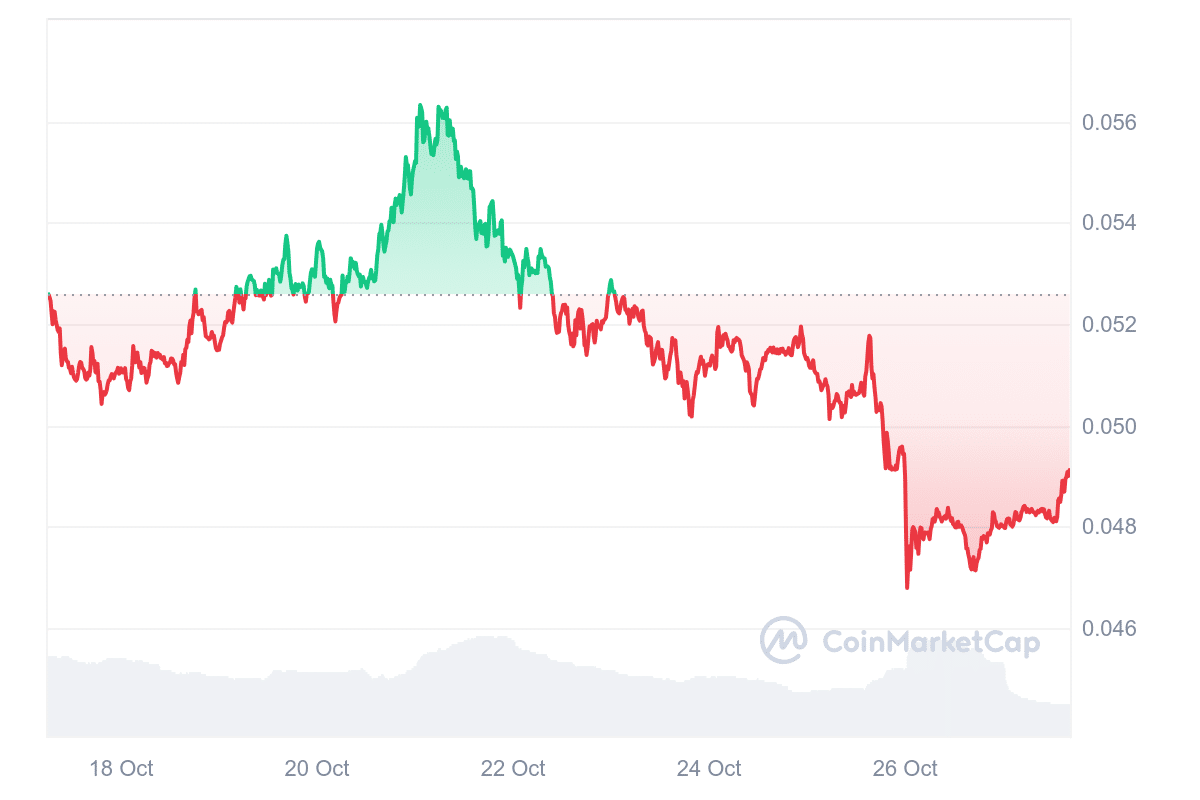

Hedera’s token (HBAR) is currently priced at $0.049684, reflecting a 4.02% increase within the last 24 hours. The Core (CORE) network functions as a Layer 1 blockchain that supports compatibility with Ethereum Virtual Machine (EVM). Notcoin (NOT) is trading at $0.006951, with a 5.26% gain over the same time frame.

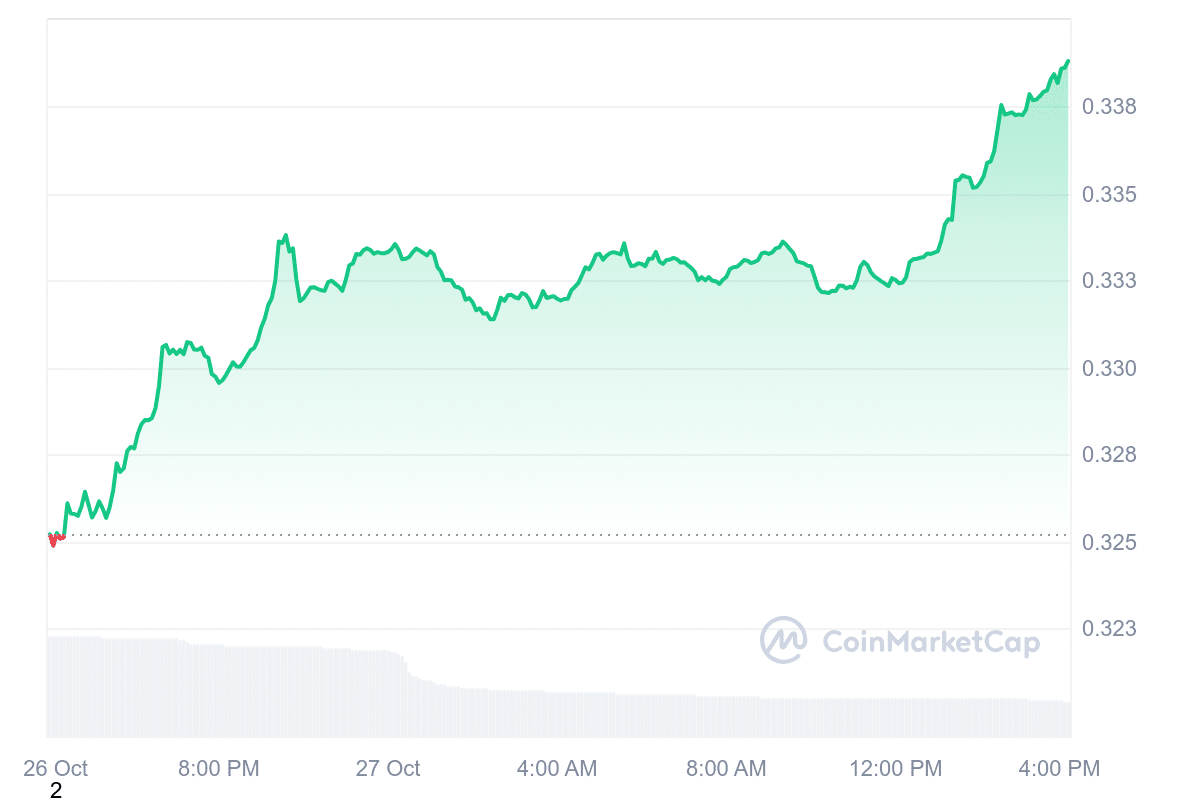

Meanwhile, Pepe Unchained is attracting attention during its presale, combining meme coin popularity with the benefits of a custom Layer 2 blockchain. Cardano (ADA) is trading at $0.341929, showing a 4.58% increase over the past day. Bitcoin is positioned to make another approach toward the $70,000 mark potentially.

1. Hedera (HBAR)

Hedera is emerging as a widely used and sustainable public network tailored for the decentralized economy. It is built with scalability and efficiency in mind, enabling businesses and individuals to create decentralized applications (DApps) with ease.

Two noteworthy applications of Hedera include projects by RedSwan CRE and Diamond Standard. RedSwan CRE leverages Hedera to transform the commercial real estate sector through tokenization. This process allows fractional ownership of assets, making real estate investment more accessible to a wider audience.

Importantly, this innovation broadens investment opportunities, bringing much-needed liquidity to traditionally limited markets. Similarly, Diamond Standard uses Hedera to increase accessibility within the diamond market. By doing so, it enables investors to securely buy, sell, and trade authenticated diamonds through a transparent digital platform.

As of today, Hedera’s token (HBAR) is valued at $0.049684, reflecting a 4.02% increase over the last 24 hours. The price forecast for HBAR suggests possible growth through the end of 2024, though it is within a volatile market context. In October, predictions place HBAR between $0.049356 and $0.079762, with an average value of $0.06302.

With #Hedera, @RedSwanCRE is revolutionizing the world of commercial real estate with #tokenization—democratizing investment opportunities by bringing increased accessibility and previously untapped liquidity to the legacy market. #RWA pic.twitter.com/3b9FlhUwcn

— Hedera (@hedera) October 26, 2024

This represents a 2.02% gain compared to the previous month. According to predictions, this trend may extend into November, where HBAR could potentially reach up to $0.158362. If so, this would yield a projected return of 218.05%, assuming favorable market conditions.

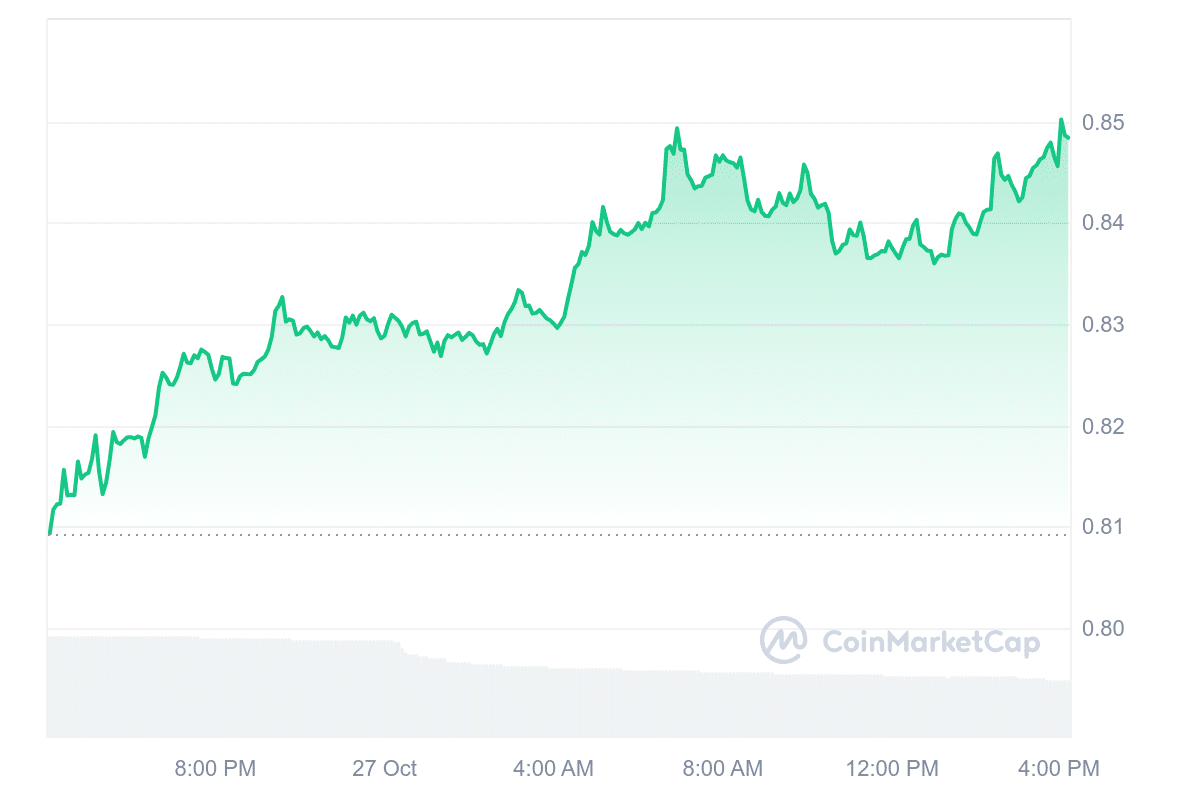

2. Core (CORE)

The Core (CORE) network operates as a Layer 1 blockchain compatible with the Ethereum Virtual Machine (EVM). This compatibility allows it to support Ethereum-based smart contracts and decentralized applications (dApps).

As of today, Core (CORE) is priced at $0.850281. This reflects a 4.17% increase over the past 24 hours. Over the last year, CORE has surged by 102%, outpacing 59% of the top 100 crypto assets. Notably, this includes outperforming major assets like Bitcoin and Ethereum. Currently, CORE is trading above its 200-day simple moving average and is also nearing its cycle high.

Over 300 million transactions have taken place on Core! 🔶🚀

A huge shoutout to all the users and developers who made this incredible milestone a reality. 🧡 pic.twitter.com/KGl0VYDEjf

— Core DAO 🔶 (@Coredao_Org) October 27, 2024

However, market indicators reflect a mixed sentiment for now. While technical signals suggest a bearish outlook, the Fear & Greed Index leans toward “Greed,” scoring a 69. According to present forecasts, CORE’s price may potentially increase by 227.82%, possibly reaching around $2.74 by November 26, 2024.

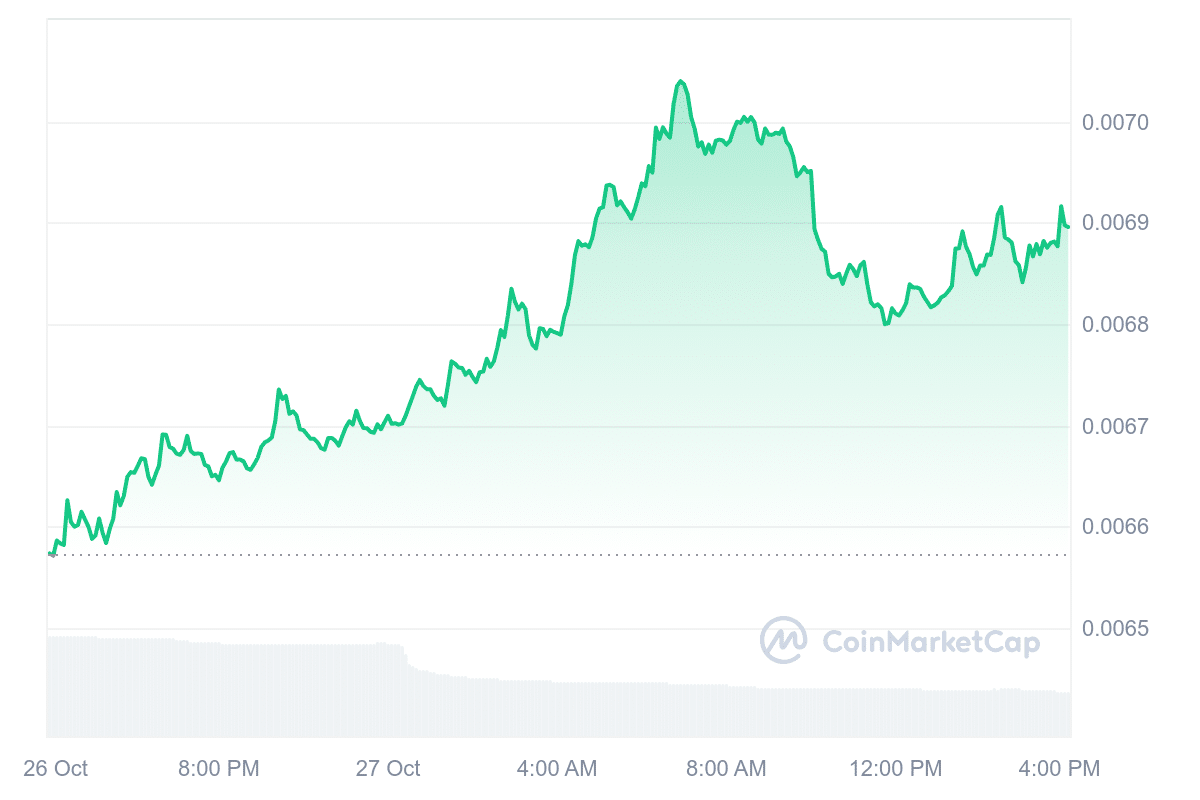

3. Notcoin (NOT)

Notcoin (NOT), currently trading at $0.006951, saw a 5.26% price increase in the last 24 hours. Although this recent gain is positive, the overall sentiment remains bearish. However, the Fear & Greed Index, reflecting a “Greed” reading of 69, signals rising investor interest. This enthusiasm is evident as Notcoin trades close to its cycle high of $0.007056. With significant liquidity relative to its market cap, it does NOT hold strong appeal for active traders.

In October, Notcoin may break away from last month’s downtrend of 25.42%. The projected trading range is between $0.006958 and $0.023665, with an expected average price of $0.014074. This could mark a 51% increase compared to the previous month. For investors, this would mean a potential return of 240.42% if Notcoin reaches the higher end of this range.

decentralized: 95% in hands of the community (2.8m onchain holders)

huge audience ~50m users

weird but massive Telegram apps trend

old crypto-money doesn't understand it

well : )

— Notcoin (@thenotcoin) October 24, 2024

Meanwhile, the price is forecasted to continue rising in November. Predictions suggest a high of $0.027734, with a possible trading range from $0.021538 to $0.032916. If achieved, this increase could offer a 373.50% gain, presenting a significant opportunity for those buying at the current rate.

4. Pepe Unchained (PEPU)

Pepe Unchained is gaining attention in the presale space, combining meme coin appeal with the practicality of a custom Layer 2 blockchain solution. With $22.6 million raised, this project ranks among the highest-grossing presales, currently pricing its tokens at $0.01178. Notably, this price is set to rise as the presale progresses. Pepe Unchained also offers a staking annual percentage yield (APY) of 101%, though this rate will decrease as more investors join the staking pool.

One of Pepe Unchained’s main objectives is to address the high transaction fees often associated with meme coins on the Ethereum network, which can significantly cut into traders’ profits and discourage smaller transactions. To tackle this, Pepe Unchained introduces a Layer 2 blockchain, built on top of Ethereum, intended to increase transaction speed and lower costs. This solution functions like an “express lane,” offering faster and more cost-effective trades while maintaining compatibility with Ethereum.

According to the project’s whitepaper, Pepe Chain is designed to deliver token transfers up to 100 times faster than Ethereum. This Layer 2 network will also include a custom DEX, an instant bridge to Ethereum, and a dedicated block explorer to enhance usability and transparency. Pepe Unchained has also updated its website to provide a hub for its expanding ecosystem, highlighting upcoming blockchain projects and community initiatives.

$22M!!!

Just wait until you see what's cooking 😉 pic.twitter.com/4Wuhy2bfyL

— Pepe Unchained (@pepe_unchained) October 23, 2024

In an effort to encourage development on the Pepe Chain, the team recently introduced a “Pepe Frens with Benefits” grant program. This initiative invites developers to apply for grants to create projects within the Pepe ecosystem, with the applications reviewed by the Pepe Unchained Council. This approach could attract new talent and foster growth, potentially enhancing the platform’s utility once it goes live.

5. Cardano (ADA)

Cardano (ADA) currently trades at $0.341929, marking a 4.58% rise in the past 24 hours. Despite this increase, the overall sentiment remains bearish, while the Fear & Greed Index reflects a “Greed” level of 69. In the past year, ADA’s price has grown by 17%, indicating a moderate yet steady performance over the period.

After experiencing a -15.95 % decline last month, Cardano is expected to stabilize, possibly reversing its recent downtrend in October. Analysts forecast a trading range between $0.312551 and $0.412856, with an average price around $0.348142. This would represent a slight decrease of -14.39% month-over-month. However, this volatility may offer a short-term opportunity for a potential 20.8% return, making it appealing to investors seeking modest gains within the month.

In November, analysts predict a continuation of this trend, with the potential for significant price increases. Cardano’s price range could be between $0.445896 and $0.864925, with an expected high of $0.679506. If this forecast materializes, investors who buy ADA at its current price may see gains of up to 153.07%.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage