As the market rebounds in 2025, staking is gaining renewed attention from investors looking to grow their holdings without actively trading. But which is the best crypto platform for staking?

Our top pick for the best crypto staking platform for most users is Binance, which offers a broad selection of supported coins, flexible terms, and competitive rewards. Coinbase stands out as the best choice for beginners, with an easy interface and automatic staking on popular assets like Ethereum and Solana. For those who prefer a non-custodial, self-custody approach, Best Wallet offers seamless staking while keeping you in control of your keys.

Also worth considering are OKX, which appeals to more advanced users with its range of staking and DeFi options, and Nexo, which blends staking-like yields with borrowing and exchange features. In this guide, we cover the best crypto staking platforms and the best coins to stake in 2025.

Best Crypto Staking Platforms 2025

| Platform | Custody Type | Ease of Use | Staking Variety | Yield Range (Est.) | Best For |

|---|---|---|---|---|---|

| Binance | Custodial | Moderate | Very wide (50+ assets) | 2% – 20%+ | High-yield, variety seekers |

| Coinbase | Custodial | Very Easy | Limited (ETH, SOL, etc.) | 3% – 6% | Beginners and U.S.-based users |

| Best Wallet | Non-Custodial | Easy–Moderate | Depends on integrations | Variable | Self-custody stakers, DeFi users |

| OKX | Custodial | Moderate | Wide, includes DeFi tools | 2% – 20%+ | Advanced users and DeFi explorers |

| Nexo | Custodial | Easy | Moderate (30+ assets) | 4% – 12% | Earning yield across multiple services |

| Kraken | Custodial | Easy | Limited (ETH, DOT, ATOM) | 4% – 12% | Security-focused, U.S./EU users |

| MEXC | Custodial | Moderate | Moderate (15–30 assets) | 3% – 10% | Promo staking and passive earners |

| Bybit | Custodial | Easy | Moderate (Earn products) | 3% – 15% | Short-term staking, passive income |

| BingX | Custodial | Easy | Limited | 3% – 8% | Newer users, basic earn products |

| KuCoin | Custodial | Moderate | Wide, flexible & locked | 2% – 18% | Broad access with low lock-in risk |

On this Page:

Top Crypto Staking Platforms 2025

Let’s take a look at some of the most popular staking platforms and discuss their characteristics.

1. Binance

Binance is the world’s leading cryptocurrency exchange, with billions in assets traded daily. It offers exposure to some of the largest crypto assets, such as Bitcoin, Ethereum, and several others. It also provides crypto staking services.

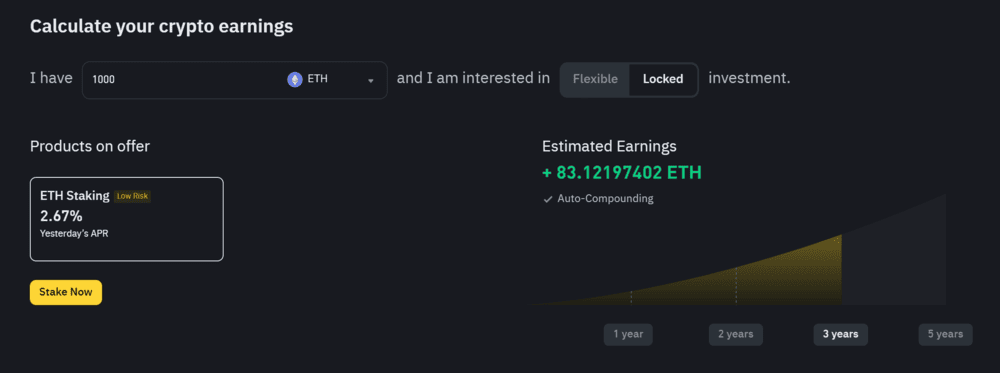

Using its ‘Binance Earn’ crypto staking service, Binance allows you to earn interest on the staking coins you have in your wallet. The service has three staking options, namely locked staking, DeFi staking, and ETH staking.

Locked staking allows you to hold your coins for a pre-fixed period, usually between a week and three months. The funds are stored in your wallet, and you can withdraw them whenever you want, although at a cost.

Binance’s DeFi staking is focused on DeFi projects. Although they are considered the best coins to stake in terms of generating higher yields than locked staking, they are inherently riskier. ETH staking is the third option. ETH staking allows you to earn staking rewards by supporting the Ethereum network from your Binance wallet.

Binance doesn’t charge staking fees when you use Binance Earn. You can stake 69 assets on the exchange, as well as five flexible DeFi staking assets. These include Filecoin (FIL), Shiba Inu (SHIB), AOL, Kusama (KSM), and the Binance Coin (BNB).

Your staking reward on Binance will vary based on the asset staked, the amount of staking coins, and the lock-up period.

2. Coinbase

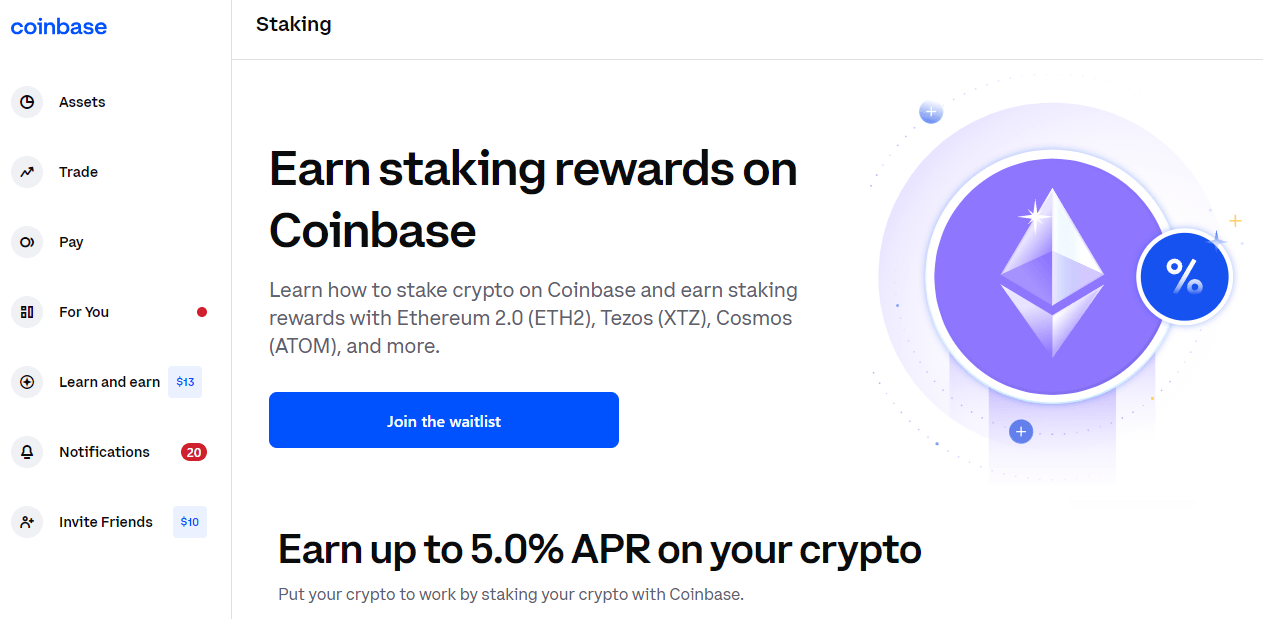

Coinbase is a leading US-based exchange that emerged in 2021. The crypto platform provides crypto trading and staking services across different PoS pools.

To enjoy Coinbase’s staking service, users must verify their identity with a valid TIN and reside in a location where staking is allowed.

Coinbase allows users to stake on the following assets: DAI, USDC, Cosmos (ATOM), Tezos (XTZ), Algorand (ALGO), and Ethereum with an APR of 4.1%. Coinbase launched the pool for ETH staking in April 2021.

Unlike Binance, Coinbase’s pool options for staking are limited. Coinbase charges a commission for staking tokens on behalf of its users.

Additionally, because Coinbase is US-based, US users are taxed on staking rewards as long as they are above $600, as provided by the 1099-MISC tax policy.

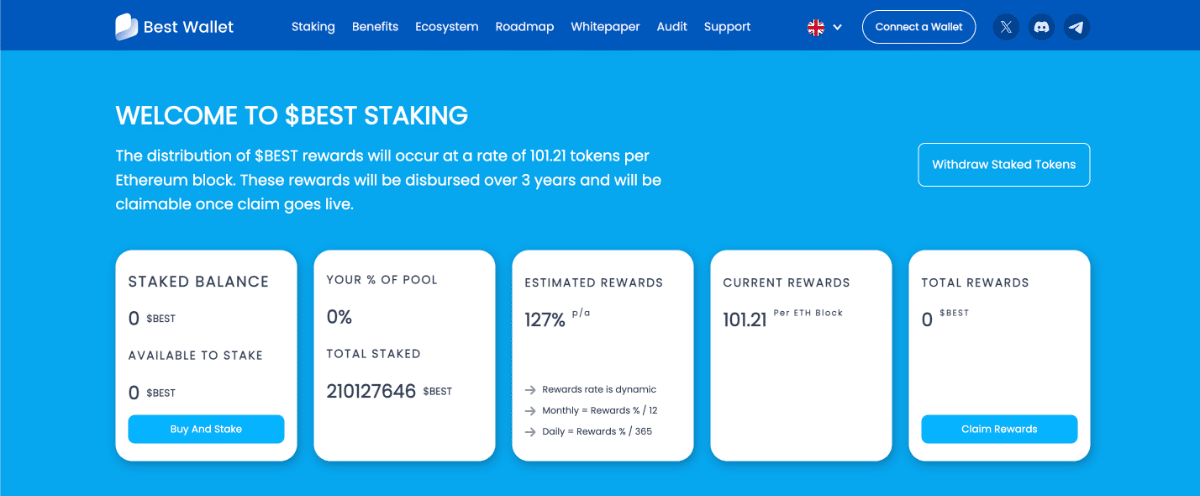

3. Best Wallet

Best Wallet is a non-custodial, multichain wallet that is available as iOS and Android apps. It distinguishes itself with an extensive and rapidly growing user base, with hundreds of thousands of downloads across app stores. The wallet supports 60+ blockchains, making it versatile for crypto staking.

What makes Best Wallet stand out is its integrated staking aggregator that allows users to earn passive income through multiple supported cryptocurrencies. The wallet doesn’t charge fees for storing or receiving cryptocurrencies, though users pay standard network fees for transfers.

Security is a major priority, with features like 2FA, biometric verification, and third-party insurance through Fireblocks. As a non-custodial wallet, users maintain complete control over their private keys.

Best Wallet’s interface is designed to be intuitive for beginners while offering advanced features for experienced users. It also includes portfolio tracking capabilities to help users monitor their investments effectively. The platform supports staking across multiple networks with competitive APYs depending on the asset.

4. OKX

OKX is an innovative exchange offering financial services that has grown to become one of the leading exchanges in terms of trading volume. The platform serves millions of users in over 100 countries and provides a comprehensive suite of services including spot, margin, futures trading, DeFi, lending, and mining services.

For staking enthusiasts, OKX offers a variety of staking options through its “Earn” platform. Users can stake numerous cryptocurrencies, including popular assets like ETH, DOT, SOL, and many others. The platform typically offers competitive APYs ranging from 2% to over 10%, depending on the asset and staking conditions.

OKX’s staking service is user-friendly with a simple interface that makes it easy to deposit funds and start earning rewards. The platform provides flexible and fixed-term staking options, allowing users to choose between liquidity and higher returns. Additionally, OKX regularly updates its staking offerings to include new and promising tokens, giving users diverse opportunities to earn passive income.

OKX prioritizes security, with robust measures in place to protect users’ assets. The exchange employs a comprehensive risk management system and maintains insurance funds to mitigate potential losses.

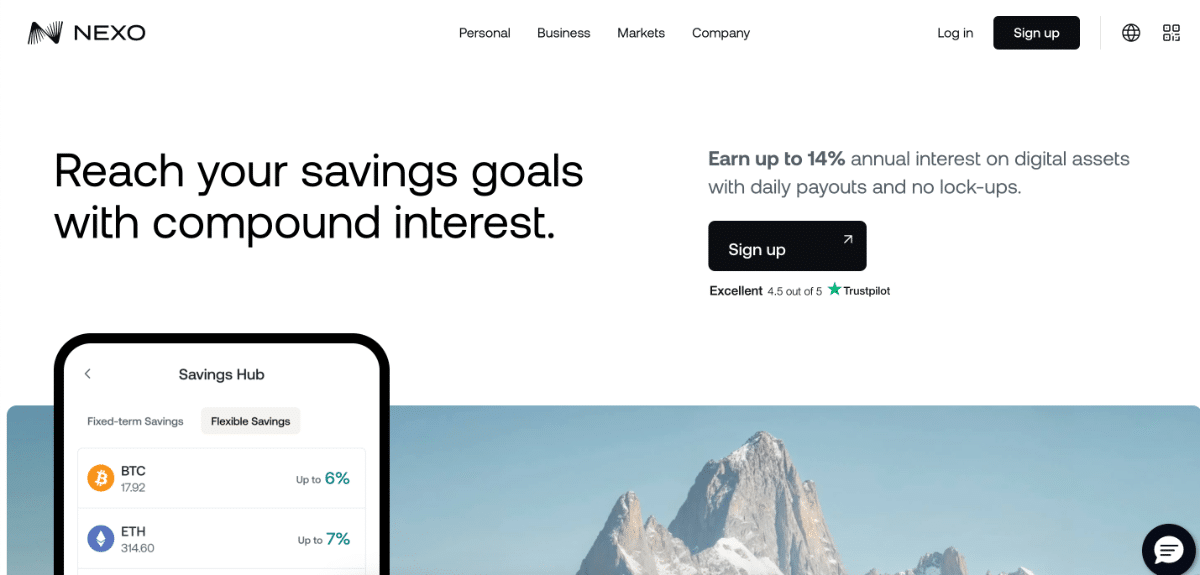

5. Nexo

Nexo is a premier digital assets wealth platform designed to help clients grow, manage, and preserve their crypto holdings. Since 2018, Nexo has provided services to forward-thinking clients in over 150 jurisdictions, managing over $11 billion in assets and processing over $320 billion in transactions.

Nexo offers two main staking options: Flexible Savings and Fixed-term Savings. With Flexible Savings, users earn daily interest on their digital assets at competitive rates while retaining access to their funds at any time. Fixed-term Savings, on the other hand, offer higher interest rates over a set period.

One of Nexo’s standout features is its Exchange service, which allows users to efficiently exchange crypto, stablecoins, and fiat currencies across 1,500 trading pairs. Users can also receive up to 0.5% crypto cashback for certain swaps and set orders at specific prices for greater trading control.

For those interested in leveraging their crypto holdings, Nexo offers crypto-backed loans with interest rates starting from 2.9% annually, allowing users to borrow funds without selling their digital assets. Repayments can be made on the user’s schedule using a variety of assets.

Security is paramount at Nexo, with clients’ assets held in multi-signature cold storage wallets managed by trusted custodial partners including Ledger Vault and Fireblocks.

6. Kraken

Kraken is among the oldest and largest cryptocurrency exchanges in the U.S. and globally, founded in 2011 and formally launching trading operations in 2013. Kraken offers a wide range of services, making it a one-stop shop for crypto trading and staking. The platform supports over 290 cryptocurrencies and more than 780 cryptocurrency trading pairs. Kraken’s staking service allows users to earn rewards by staking various cryptocurrencies, making it an attractive option for investors looking to generate passive income.

The exchange emphasizes security, though like other exchanges, it has encountered difficulties complying with laws and regulations. In February 2023, Kraken settled with the SEC for $30 million over allegations that its staking program constituted an unregistered security offering. As a result, Kraken ceased offering staking services to U.S. clients, though these services remain available to eligible customers in other regions.

Despite regulatory challenges, Kraken continues to be a popular choice for crypto staking due to its established reputation, security measures, and range of available assets. The platform offers competitive staking rewards, though specific rates vary depending on the cryptocurrency being staked.

Best Hardware Wallets For Staking

Staking through this means is known as cold staking. Investors who prefer this medium have to keep their PoS tokens staked in one address. Otherwise, moving them out of that address will cause them to lose their staking rewards.

Hardware wallets are recognized for their security since they are not connected to the Internet. Still, to access them, you would need a private key known to only the wallet’s owners. Many hardware wallets support staking.

1. Ledger

This is a leading wallet in the crypto industry in terms of security. Ledger wallets come in several models, including the Nano S Plus, Nano X, and the newer Ledger Stax. Staking is supported directly through the Ledger Live app, which offers a streamlined experience for staking various cryptocurrencies.

Ledger now supports the staking of many more coins than in previous years, including Ethereum (ETH), Polkadot (DOT), Cardano (ADA), Cosmos (ATOM), Solana (SOL), Tezos (XTZ), Algorand (ALGO), and Tron (TRX). The staking interface in Ledger Live has been significantly improved, offering users detailed information about rewards, unbonding periods, and validator statistics.

One significant advantage of staking through Ledger is the enhanced security provided by keeping your private keys offline in the hardware device, protecting them from online threats while still earning staking rewards.

2. Trezor

Trezor is one of the oldest hardware wallet brands and continues to support staking for various cryptocurrencies through its Trezor Suite interface and third-party integrations. The newest models, including the Trezor Model T and Trezor Safe 3, provide expanded staking capabilities.

Trezor now supports native staking for Ethereum, Cardano, Tezos, and several other proof-of-stake cryptocurrencies. For coins not directly supported in Trezor Suite, users can connect their Trezor to compatible third-party software wallets that offer staking features.

The main advantage of staking with Trezor is combining the security benefits of cold storage with the ability to earn passive income, all while maintaining complete control of your private keys.

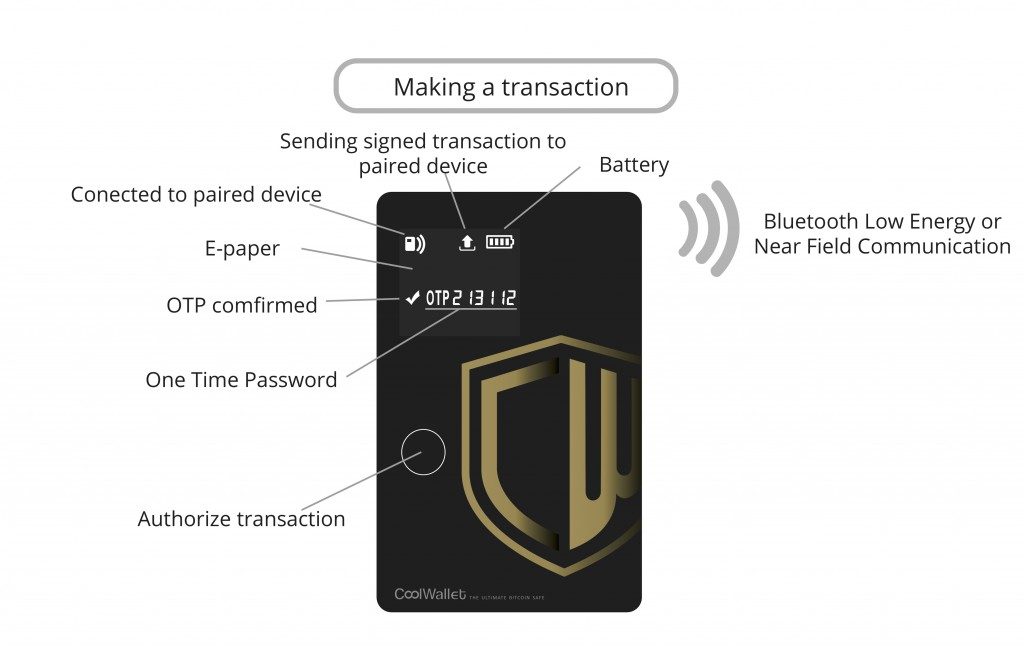

3. CoolWallet

CoolWallet has evolved its offerings with newer models that include enhanced staking capabilities. Their latest wallets feature Bluetooth connectivity and allow users to stake various cryptocurrencies directly through the CoolWallet app.

The wallet now supports staking for a wider range of assets, including Ethereum, Cardano, Polkadot, and several others. Their in-app X-Savings feature has expanded to support more stablecoins beyond USDT, including USDC and DAI.

CoolWallet’s combination of portability (credit-card-sized hardware wallet) and wireless connectivity makes it convenient for users who want to manage their staking activities on the go while maintaining hardware wallet security.

Best Coins to Stake

Currently, there are thousands of staking pools distributed across various platforms. DeFi enthusiasts look out for pools with either high annual percentage returns (APR) or annual percentage yields (APY). Additionally, they try to stake assets with good fundamentals and room to grow in market valuation.

Below is a list of some of the best coins to stake and the crypto staking rewards they can yield.

1.Solaxy

Solaxy is a cutting-edge layer 2 project build on top of Solana with the goal of solving the network’s congestion issues through rollups and off-chain processing. Solana is far from the slowest major crypto network, but traffic spikes during periods of congestion still increases fees and slows down transactions.

The project’s mainnet isn’t live yet, but it has already launched a full testnet with cross-chain swapping. Coming up next is its very own decentralized exchange (DEX) and cross-chain bridge. The team is aiming to build an entire ecosystem of apps on top of Solana to benefit from the network’s miniscule fees and nearly-instant transactions.

Solaxy is powered by its native token $SOLX, which will be used to pay for transaction fees, governance, and more. $SOLX is nearing its presale goal with over $44 million raised so far. Users can already stake their $SOLX tokens to earn passive income. $SOLX staking rewards are higher than most projects, with 25% of the entire token’s supply allocated to rewarding early supporters.

2. Snorter Bot

Snorter Bot is a massively hyped Solana-based trading bot project that combines the virality and hype of meme coins with powerful utility. The bot is built into Telegram, allowing users to access advanced trading features including fast sniping, honeypot detection, stop-loss orders, limit orders, copy trading, and more, all in a Telegram window.

The project’s native token, $SNORT, is still in its presale phase, but it has already raised over $500,000. When it officially launches, it will be available on both Solana and Ethereum. Presale investors can already stake their tokens to earn up to 642% APY. If that wasn’t enough, the project has allocated 20% of the token’s supply to reward the community with airdrops and other promotions and giveaways.

3. Ethereum ($ETH)

Ethereum Price Chart

(ETH)Ethereum (ETH)

Ethereum (ETH) remains the second-largest cryptocurrency by market capitalization behind Bitcoin and the most prominent altcoin in the digital currency ecosystem. Since completing “The Merge” in September 2022, Ethereum has fully transitioned from an energy-intensive Proof-of-Work model to a more sustainable Proof-of-Stake consensus mechanism, making ETH a premier stakeable asset.

Approximately 28.13% of all available ETH is now staked, representing 34 million ETH tokens with a staking market cap of around $60.3 billion. This massive pool of staked assets shows us investors’ strong confidence in Ethereum’s long-term viability and the appeal of earning passive income through staking.

While retail stakers on their platform are estimated to receive an estimated reward rate of about 2.04% APY, other staking options can yield higher returns. The Ethereum staking pool available through the ETH LaunchPad offers yields averaging around 4.1% APY, depending on the total amount of ETH staked network-wide. These rewards fluctuate based on network participation, as more ETH gets staked, the relative rewards decrease per validator.

The entry requirement for validators is 32 ETH, which represents a significant investment. However, staking pools and liquid staking derivatives like Lido’s stETH or Rocket Pool’s rETH allow investors to participate with much smaller amounts while maintaining some liquidity.

Unlike Ethereum, Bitcoin continues to operate on the original Proof-of-Work consensus mechanism, which means BTC cannot be directly staked. Instead, Bitcoin miners secure the network using specialized hardware and electricity. However, investors seeking yield on their Bitcoin holdings can stake wrapped Bitcoin (WBTC), an ERC-20 version of Bitcoin that runs on the Ethereum blockchain, through various DeFi protocols such as Aave and Compound, typically earning between 0.5-3% APY depending on market conditions.

4. Cardano ($ADA)

Cardano Price Chart

(ADA)Cardano (ADA)

Cardano (ADA) stands strong in the proof-of-stake ecosystem, with its native token designed specifically for staking functionality. Approximately 59.99% of all circulating ADA tokens are actively staked, representing 21.2 billion tokens with a staking market cap of $15.3 billion. This high participation rate highlights strong community commitment to the network’s security and governance.

While Coinbase reports a conservative estimated reward rate of 1.68% APY for their platform, staking directly through native Cardano wallets like Daedalus or Yoroi can yield higher returns, with an average network-wide return of approximately 3.5-4.6%, depending on the stake pool selected. These rewards are distributed every five days at the end of each epoch, providing regular passive income to ADA holders.

Cardano’s staking process is notably user-friendly compared to other proof-of-stake blockchains. There is no minimum staking requirement, allowing even small investors to participate, and staked ADA remains liquid—tokens aren’t locked and can be spent at any time without a waiting period. However, only the ADA that remains in your wallet at each epoch snapshot will earn staking rewards.

The network’s design balances decentralization with efficiency through its delegation mechanism. While users could run their own stake pools, most choose to delegate their ADA to professional stake pool operators. The protocol has built-in safeguards against pool centralization, with diminishing returns for pools that grow too large, encouraging a more distributed validator network.

Cardano has expanded its utility beyond simple transactions since implementing smart contract functionality through the Alonzo hard fork. Smart contracts require ADA for transaction fees and as collateral in specific DeFi applications, creating additional demand for the token. This expanded utility enhances the value proposition for stakers, as their rewards potentially gain value both from accumulating additional tokens and from the increased utility of ADA within the Cardano ecosystem.

5. Bitcoin Hyper

Bitcoin Hyper is one of the most exciting layer 2 projects in the crypto market and is set to bring full DeFi functionality as well as low fees and lightning-fast transactions to Bitcoin. It sets itself apart with its custom implementation of the Solana Virtual Machine (SVM), which is what powers its DeFi capabilities and scalability.

The project wants to combine the incredible functionality of DeFi from Ethereum and Solana, such as lending, borrowing, and yield farming, with Bitcoin’s unmatched security and immutability. The network will be powered by its native token, $HYPER. The community seems to love the project, as it is about to reach its presale goal of over $600,000. Presale buyers can stake their tokens immediately to start earning rewards. Over 44 million $HYPER has already been staked, likely because the platform offers up to 1184% APY.

6. Polkadot ($DOT)

Polkadot Price Chart

(DOT)Polkadot (DOT)

Polkadot (DOT) has emerged as one of the highest-yielding major cryptocurrencies for staking, offering an impressive average annual yield of 9.91%. As the backbone of a “layer 0” blockchain ecosystem, Polkadot was created to address the interoperability limitations that plague many other blockchain networks, allowing different blockchains to communicate and share information securely.

Currently, 54.38% of all DOT tokens are actively staked on the network, representing over 854 million tokens with a staking market cap of approximately $3.7 billion. This substantial participation rate demonstrates strong investor confidence in Polkadot’s technological model and future potential.

Polkadot’s staking mechanism, known as Nominated Proof of Stake (NPoS), differs from standard PoS systems in several important ways. Rather than requiring users to run validator nodes directly, you can participate as a “nominator” by selecting up to 16 validators to back with your DOT tokens. When these validators perform their duties correctly, you’ll share in the rewards proportionally to your stake. This approach makes staking more accessible while maintaining network security.

For those looking to maximize DOT staking rewards, it’s worth considering the following factors:

- The 28-day unbonding period locks your tokens when you decide to unstake, during which time you won’t earn rewards but still can’t access your DOT

- You’ll need a minimum of approximately 120-160 DOT to receive rewards as a nominator due to the network’s minimum active nomination requirement

- Validator selection significantly impacts your returns—choosing validators with lower commission rates and consistent performance will optimize your earnings

When staking directly through the Polkadot.js wallet or Ledger hardware wallet, you retain full control of your DOT while earning some of the highest yields available in crypto staking. This combination of impressive returns and Polkadot’s vision for a multi-chain future continues to attract both long-term investors and those seeking substantial passive income from their cryptocurrency holdings.

4. Solana ($SOL)

Solana Price Chart

(SOL)Solana (SOL)

Solana (SOL) has established itself as one of the most compelling cryptocurrencies for staking in 2025, offering an attractive 5.83% APY. It maintains its position as a leading “Ethereum alternative.” With nearly 65% of all SOL tokens currently staked, representing 336.3 million tokens with a staking market cap of approximately $52.1 billion. The network enjoys strong security and high participation from token holders.

What makes Solana particularly appealing for stakers is its unique approach to blockchain scaling. Unlike many competitors, Solana’s Proof-of-History (PoH) consensus mechanism works alongside its Proof-of-Stake system, enabling the network to process transactions at speeds exceeding 50,000 per second with minimal fees. This technical advantage has attracted substantial developer activity, creating a thriving ecosystem that enhances SOL’s utility and value proposition.

When you stake SOL, you’re not just earning passive income—you’re also supporting one of the fastest-growing blockchain ecosystems in the market. The network has seen its staking rewards trending upward, with an 8.05% increase in APY over the past month, suggesting improving economics for stakers as the platform continues to mature.

For those interested in staking SOL, you have several options to consider:

- Non-custodial wallets like Phantom, Solflare, and Sollet provide the most direct staking experience, allowing you to select validators personally while maintaining control of your private keys

- Liquid staking solutions such as Marinade Finance and Lido for Solana issue tokenized representations of staked SOL (mSOL or stSOL), enabling you to maintain liquidity while earning staking rewards

- Hardware wallet integration with Ledger devices offers enhanced security for those staking larger amounts

The unbonding period for Solana is much shorter than many competing networks at just 2-3 days, providing greater flexibility when you need to access your funds. However, be aware that while Solana has shown impressive technical capabilities, the network has experienced occasional outages in the past—a risk factor to consider when determining your allocation to SOL staking.

5. BNB Chain ($BNB)

BNB Price Chart

(BNB)BNB (BNB)

BNB (formerly Binance Coin) has evolved from a simple exchange token into one of the cryptocurrency market’s heavyweights, currently maintaining a market cap of approximately $85.6 billion. While only about 20.79% of BNB is staked, significantly lower than many other major proof-of-stake cryptocurrencies, this still represents 29.3 million tokens with a staking market cap of nearly $17.8 billion.

What makes BNB particularly interesting as a staking option is its dual utility. Beyond earning the current 3.83% APY through staking, BNB provides significant advantages within the Binance ecosystem. When you hold BNB, you’ll benefit from:

- Trading fee discounts of up to 25% on the Binance exchange

- Priority access to new token launches through Binance Launchpad

- Reduced fees when using BNB to pay for transactions on BNB Chain

- Eligibility for Binance Earn products with enhanced rates

The staking mechanism for BNB differs from many competitors as it uses a Delegated Proof of Stake system with only 21 active validators. While this raises some centralization concerns, it enables the network to process transactions more efficiently and maintain consistently low fees. If you’re considering staking BNB, you have several options:

Staking directly on Binance Exchange offers simplicity and variable lockup periods, with higher APYs for longer commitments. BNB Vault on Binance combines multiple yield strategies to optimize returns. DeFi protocols like PancakeSwap and Venus allow you to stake BNB while maintaining more control over your assets. Third-party staking platforms such as Trust Wallet provide a middle ground between security and ease of use.

It’s worth noting that BNB’s staking rewards have seen substantial volatility in recent months, with a dramatic 97.97% decrease in yield.

6. Cosmos ($ATOM)

Cosmos Hub Price Chart

(ATOM)Cosmos Hub (ATOM)

Cosmos (ATOM) delivers one of the highest staking yields among established cryptocurrencies, currently offering an impressive 14.31% APY according to recent data. This remarkably high return rate exists in part due to the token’s essential role in securing the broader Cosmos ecosystem, often called the “Internet of Blockchains.” Unlike single-blockchain networks, Cosmos provides the infrastructure for different blockchains to communicate with each other while maintaining their independence.

The Cosmos Hub, secured by staked ATOM tokens, is the central connecting point in this interoperable network. When you stake ATOM, you’re not just earning passive income—you’re helping secure a critical infrastructure that supports dozens of major blockchain projects built using the Cosmos SDK, including Binance Chain, Crypto.org Chain, and Osmosis. This utility drives real demand for the token beyond speculation.

Currently, 57.57% of all ATOM tokens are staked, representing 225 million tokens worth approximately $1 billion. This high participation rate demonstrates strong confidence in the network’s security model and future potential. The staking ratio has remained relatively stable despite market fluctuations, indicating a committed long-term holder base.

For those considering staking ATOM, it’s worth understanding the specific mechanics involved. When you stake tokens, you’ll need to select a validator from the active set. Your selection matters significantly—validators charge different commission rates (typically 1-10%) and have varying uptime records that can affect your rewards. Poor validator performance can also lead to “slashing,” where a portion of staked tokens is lost if the validator misbehaves or fails to maintain proper operation.

One important consideration when staking ATOM is the 21-day unbonding period. During this time after initiating an unstake, your tokens are neither earning rewards nor available for transfer or trading. This extended lockup period helps secure the network, but requires careful planning if you might need quick access to your funds. Some investors prefer to stagger their ATOM stakes so that not all tokens are locked in the same unbonding cycle.

7. Algorand ($ALGO)

Algorand Price Chart

(ALGO)Algorand (ALGO)

Algorand (ALGO) offers stakers an attractive 7.58% APY through its innovative Pure Proof-of-Stake (PPoS) consensus mechanism, designed to overcome the blockchain trilemma that has plagued many earlier networks. Founded by Turing Award-winning MIT professor Silvio Micali, Algorand’s technical architecture enables it to process over 6,000 transactions per second with near-instant finality and minimal fees, all while maintaining high security and decentralization.

What makes Algorand’s staking model unique is its two-tiered approach to rewards. The network has evolved beyond simple protocol staking to include a governance component that increases potential returns. When you stake ALGO, you can participate in quarterly governance periods by committing your tokens for three months and voting on key protocol decisions. This governance participation rewards engaged stakeholders more generously than passive holders, motivating active involvement in the network’s future direction.

Current data shows that only 12.53% of all ALGO tokens are being staked, representing 1.1 billion tokens with a staking market cap of approximately $246.7 million. This relatively low participation rate compared to other major proof-of-stake cryptocurrencies presents an opportunity for new stakers to enter with potentially higher returns, as rewards are distributed among fewer participants. The yield rate has also been trending upward, showing a 28.13% increase.

For those interested in staking ALGO, the process is notably user-friendly. Unlike many competing networks, Algorand doesn’t require tokens to be locked up or delegated to validators. Instead, you can participate in governance by simply holding ALGO in a compatible wallet and committing to maintaining your balance throughout the governance period. Popular wallet options include the official Algorand Wallet, Pera Wallet, and MyAlgo Wallet, all of which support governance participation directly through their interfaces.

One significant advantage of Algorand’s staking model is the absence of slashing penalties. While many proof-of-stake networks can confiscate a portion of your staked assets if your validator misbehaves, Algorand’s approach means your principal is never at risk beyond normal market volatility. The only penalty for governance participants is forfeiting rewards if you withdraw committed tokens before the end of the governance period.

Staking Stablecoins

Stablecoins are considered by more conservative investors to be the best coins to stake as they are less volatile, meaning they are not subject to sudden market fluctuations, unlike other crypto assets. One reason for this is that they are pegged to fiat currencies which give them adequate backing provided there is a reserve.

Your principal is more guaranteed, and the returns are more predictable. Below are some stablecoins you could stake, as well as platforms that enable stablecoin staking and yield rates:

- USDC – issued by Circle and is pegged to fiat dollars on a 1:1 basis. Binance offers 3.49%, Coinbase 0.15% and OKX 3.23%.

- BUSD – issued by leading crypto exchange Binance. Users earn 3.59% annually for staking BUSD on Binance.

- DAI – another stablecoin pegged to the US dollar and issued by the decentralized protocol and autonomous organization MakerDAO. DAI has a circulating supply of 6.4 billion. However, the token’s supply is not known.

The disadvantage of staking stablecoins is, of course, that they don’t rise in value; they remain stable. When you buy Ethereum and stake it, you can earn income in two ways: from the rise in the price of ETH and from crypto passive income.

How to Stake Crypto – Quick Guide

- Choose an exchange that offers staking.

- Create and verify a free account.

- Deposit funds via bank transfer, PayPal, debit card, or other payment methods.

- Buy coins such as Ethereum, Cardano, or Tron.

- Select staking services via the exchange.

- Receive the staking rewards that are distributed automatically each month.

How to Stake Crypto – Best Methods

There are several ways how to stake crypto assets – DeFi staking, using staking-as-a-service platforms, staking on an exchange, and even on hardware wallets.

DeFi Staking

Decentralized finance advocates for users being in control of their funds, eliminating the role of a third party or an intermediary. This is the concept behind DeFi staking, such that users act as validators and help secure the network just like miners do on PoW-enabled blockchains.

More often than not, running a node as a validator often comes with steep requirements. For instance, the minimum stake of 32 ETH required to run a node on ETH is relatively high. Alternatively, you can opt for pools on decentralized exchanges such as PancakeSwap or Uniswap.

In most cases, there is no minimum stake stipulated in these pools. This creates an opportunity for free entry and exit such that users can stake and unstake at any time.

In DeFi staking, you can earn passive income on your tokens via two means, namely liquidity mining and yield farming. With liquidity mining, stakers provide liquidity on a pool and are rewarded with transaction fees spent by other pool users.

Tokens are often paired with liquidity pools (LPs). For example, you could have a pool with Binance Coin (BNB) and Axie Infinity Shards (AXS) paired together. Users who prefer to stake in this pool have to use equal amounts of BNB and AXS tokens.

Staking-as-a-Service Platforms

Staking-as-a-Service platforms are focused on providing crypto staking. Using these platforms, you are delegating your assets while they maintain a node as a validator on your behalf. Delegating your assets to them is not handing over custody – you are still in control of your assets and allowed to ‘undelegate’ them whenever you wish.

While they run the nodes and handle other technicalities involved, they charge commissions on your rewards. This is like their reward for the service rendered. Staking with SaaS platforms is also known as soft staking.

Several platforms offer staking services and they do so across different pools. Only a few have been able to resonate with staking enthusiasts.

Staking on Exchanges

Many leading crypto exchanges make things simple for their customers and offer automatic staking rewards on their platforms. There’s no need to set up your a node or purchase any special equipment.

Rewards are automatically paid out to users monthly, with the platform reserving a small percentage of yields as the fee for operational costs and other incurred costs. Users should note that staking via exchange is not available in all countries.

How to Stake Crypto – Step-by-Step

Let’s break down the staking steps in detail:

Step 1 – Create an Account

The first step to staking crypto is to find a preferred crypto exchange. There are different platforms, and each has its own strengths and weaknesses, unique features, and fees – find one that you’re comfortable holding your funds.

Most are available as free mobile apps on iOS or Android, or via their websites. Create an account with basic information and then verify that account. This will involve confirming an email address and phone number, and providing a photo ID such as a passport or driver’s license. Some platforms also require proof of address and may ask customers to complete a questionnaire.

As mentioned, staking services are unavailable on major crypto exchanges in some countries.

Step 2 – Buy Staking Coins

Once an account has been created, search for the cryptocurrency you wish to stake using the search bar available on most platforms. Then, purchase the token.

Different exchanges have different minimum purchase amounts and fees, but most will allow users to buy major cryptos such as ETH, ADA, and SOL, with fiat currency. Follow the instructions on-screen to complete the transaction.

Keep in mind that the coins you purchase should be supported for staking on your chosen platform. Most major exchanges clearly indicate which cryptocurrencies are available for staking, along with their respective reward rates.

Step 3 – Stake Your Coins

Navigate to the app’s staking section—on Binance, for example, this is called ‘Earn’. Find the token you wish to stake and select the relevant staking product.

Binance allows users to stake tokens for a set period of 30, 60, 90, or 120 days. The rewards percentage increases the longer a token is locked. Users select the locking period and the amount to stake.

On other platforms like Coinbase or Kraken, the staking process may be slightly different, but the general concept remains the same – you’ll need to navigate to their staking or earn section, select your asset, and follow the instructions to commit your tokens to staking.

Note that you can redeem tokens early if you decide to sell a token, but all potential rewards will be lost, and some platforms may charge early redemption fees.

Step 4 – Receive Crypto Staking Rewards

Crypto exchanges will automatically distribute staking rewards, although the timescale for rewards varies. Some platforms distribute rewards daily, while others may pay out weekly or monthly.

The rewards will not automatically be added to the staking pool, but there is nothing to stop users from manually adding rewards to create compounding interest. Some platforms do offer auto-compounding options that reinvest your rewards automatically.

You can typically track your staking rewards through the platform’s dashboard or earnings reports. This allows you to monitor your passive income and decide whether to continue staking a particular asset or possibly stake additional tokens.

Is Staking Crypto Safe?

While crypto staking may hold many benefits for those who engage in it, some risks must be considered as well. Let’s discuss them below:

Possible Exploits or Hacks

Security breaches represent one of the most serious risks to staked assets, particularly on centralized platforms. Over the last few years, several major incidents have demonstrated this vulnerability, with Huobi exchange losing more than $100 million to hackers in November 2023.

Non-custodial staking options, where you maintain control of your private keys, can significantly reduce the risk of losing funds in a centralized platform hack. Hardware wallets that support staking, such as Ledger or Trezor, provide an additional security layer by keeping your private keys offline while still allowing you to participate in staking activities.

Unstaking Limitations and Lock-up Periods

Most staking protocols implement mandatory lock-up periods during which you cannot access your staked assets. These periods vary widely between cryptocurrencies, from a few hours to several weeks or months. For example, Ethereum requires a minimum waiting period before unstaked tokens become available, while Cardano has a shorter unstaking cycle.

During this unstaking period, you remain exposed to market volatility without the ability to sell. As the reference material notes, “The balance you stake will be unavailable to sell or send until you unstake it,” and the process completion time isn’t guaranteed. This illiquidity can be particularly problematic during market downturns, when you might want to exit positions quickly but cannot.

Liquid staking derivatives (LSDs) like stETH for Ethereum have emerged as a solution to this problem, allowing you to maintain some liquidity while continuing to earn staking rewards. However, these derivatives come with their own risks, including potential depegging from their underlying assets.

Protocol Penalties and Slashing Risks

Many proof-of-stake networks implement “slashing” penalties for validators who violate protocol rules, either intentionally or through technical errors. These penalties can result in the partial or complete loss of staked assets.

While slashing is relatively rare, the consequences can be severe. Common causes of slashing include:

- Double-signing (validating conflicting blocks)

- Extended validator downtime

- Malicious network behavior

- Technical failures in validator setup or maintenance

When staking through third-party providers, it’s crucial to understand their slashing protection policies. Some providers commit to reimbursing slashing penalties resulting from their mistakes, but not those caused by external factors like protocol bugs or network-wide attacks.

Value Fluctuation and Impermanent Loss

Cryptocurrency volatility poses a significant risk to stakers. When the value of your staked asset decreases during the lock-up period, you experience what’s sometimes called impermanent loss, though unlike in liquidity pools, this loss becomes permanent if you’re forced to sell at lower prices.

During the market downturn of late 2023, many investors who had locked their assets in longer-term staking contracts watched helplessly as their staked assets lost significant value while being unable to sell. To mitigate this risk, consider diversifying your staked assets across different cryptocurrencies and staggering your staking positions to avoid having all your assets locked for the same period.

Validator and Third-Party Risks

When delegating your assets to a validator or staking service, you inherently trust their technical competence and ethical behavior.

Different staking options carry different risks:

- Crypto exchanges may offer convenient staking but present centralized security risks

- DeFi platforms introduce smart contract vulnerabilities and less regulatory protection

- Staking pools depend heavily on the reliability of pool operators

- Running your own validator node requires technical expertise and constant maintenance

To minimize third-party risk, thoroughly research validator performance metrics before delegating, including their historical uptime, commission rates, and community reputation. Distributing your stake across multiple validators can also help reduce your exposure to any single point of failure.

Reward Variability and Inflation Risks

Staking rewards are not guaranteed and can fluctuate significantly based on network conditions, validator performance, and protocol changes. As more participants stake their assets, individual rewards typically decrease. Additionally, some cryptocurrencies with high inflation rates may dilute the value of your staking rewards over time.

What is the Future of Crypto Staking?

Staking has become a lucrative venture for investors wanting to earn crypto passive income as an alternative to day trading or choosing to sell cryptocurrency and realize profits. It provides a way to hedge against downside risk and compound gains.

The rise of liquid staking derivatives (LSDs) continues to transform staking, allowing users to maintain liquidity while still earning staking rewards. Protocols like Lido and Rocket Pool have seen tremendous growth, with these liquid staking tokens increasingly being integrated into DeFi applications.

Regulatory clarity has improved in many jurisdictions, though challenges remain. The SEC’s actions against exchanges offering staking services have prompted many platforms to revamp their offerings with clearer terms and disclosures. Several countries have now established frameworks that recognize staking as a legitimate investment activity, providing more certainty for participants.

Institutional involvement in staking has significantly increased, with major financial institutions now offering staking services to their clients. This mainstream adoption has brought greater liquidity and stability to the staking ecosystem.

The environmental benefits of crypto staking continue to be a strong selling point as sustainability concerns remain at the forefront of technological adoption. The energy efficiency of PoS compared to PoW has made staking more attractive to environmentally conscious investors and organizations.

Cross-chain staking solutions are emerging, allowing users to stake assets across multiple blockchains from a single interface. This interoperability is making staking more accessible and efficient for the average user.

Security measures have improved following several high-profile exploits in previous years. Auditing standards for staking protocols have become more rigorous, and insurance products designed explicitly for staking risks are now available.

As the crypto market continues to mature, staking is increasingly viewed as an essential component of a diversified crypto investment strategy. If you are looking to enter the space, established exchanges and staking platforms like Binance, Coinbase, Best Wallet, OKX, Nexo, and Kraken offer secure, user-friendly options to start earning passive income through staking.

Also read our guide to the top crypto saving accounts, another way to earn crypto passive income.

FAQs

What does staking mean in crypto?

Crypto staking involves locking up your cryptocurrency assets for an extended period of time to unlock rewards or earn interest on your coins. Crypto staking rewards come in the form of more coins, making staking one of the simplest ways to earn crypto passive income.

What is the best crypto staking platform?

We recommend Binance or Coinbase as two globally popular and secure crypto exchanges that offer staking services.

Any risks in crypto staking?

There can be risk attached to staking coins that are relatively new to the cryptocurrency markets and may end up as failed projects - earning crypto staking rewards on a token that crashes and doesn't recover won't be profitable long term. This is unlikely to happen with crypto majors such as ETH and ADA, although the price can vary wildly during a locked staking period.

Is crypto passive income a safe investment?

The cryptocurrency markets have outperformed all other financial assets over the last decade, including Gold, and bank savings accounts. The crypto marketcap still has room to grow, currently at around a quarter of the size of Gold. Staking coins in order to earn more of that coin is safer than attempting to daytrade the volatile swings in the market.