A 12% interest savings account would be unheard of holding fiat currency in a bank account – high street banks today pay an average interest rate of 0.05% on balances above a trivial amount, or slightly more if you commit to lock up your money for years in a time deposit, still underperforming inflation.

The success and adoption of Bitcoin and cryptocurrency – the best performing financial asset class of the past decade – has now opened up better opportunities for passive income for the retail investor than a traditional bank.

Crypto savings account platforms allow you to open a crypto wallet with them and earn compound interest on your digital assets. Supported coins include Bitcoin, Ethereum, stablecoins like USDT and USDC (these have the best APY, or annual percentage yield) and more.

Best Crypto Savings Accounts in May 2025

- Aqru – top crypto savings account for high yield

- BlockFi – best crypto savings account in the US

- Crypto.com – top crypto savings account for variety of supported coins

- eToro – most regulated crypto platform with staking

Crypto savings accounts all have different features, incentives, interest rates and supported coins, so the above isn’t necessarily a ranking order or top list – investors may wish to open accounts at several of the best crypto saving platforms in order to not have all their eggs in one basket and diversify their portfolio.

We’ll review the top crypto savings accounts of in terms of factors like high interest, regulation, safety and security, range of supported coins, having an online presence on Reddit, availability in the United States, FDIC insurance, free withdrawals, hidden terms and conditions, and other considerations.

Top Crypto Savings Accounts – Full Reviews

Aqru – top crypto savings account for high yield

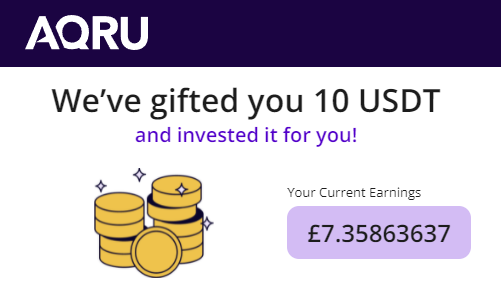

Aqru.io is a relatively new crypto savings account platform founded in 2019 so it is offering many incentives to attract new signups, including a free $10 starting capital immediately credited to you when you open an account, in USDT.

After that there’s also a free $75 when you deposit $500 or more, and a free $75 for every friend you refer to also deposits $500+ and invests it for at least 30 days.

Aqru crypto savings account

Those are larger bonuses than most crypto savings accounts e.g. most users will receive under half that on BlockFi and Crypto.com, although high net-worth depositors can earn more (more on that below).

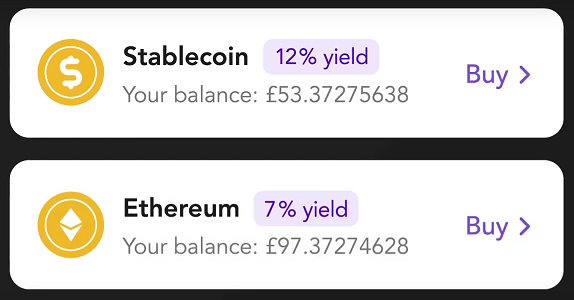

The main benefit of Aqru is that interest rates are flat and apply to all your funds, rather than being tiered (requiring you to deposit a certain amount to earn the highest yield). Whatever amount of BTC or ETH you hold, you earn 7%, whereas you could earn higher on other crypto savings accounts but need to deposit or stake a large amount.

- Bitcoin interest – 7%

- Ethereum interest – 7%

- Stablecoin interest – 12%

To earn a flat 12% interest yearly, you can hold stable coins pegged to the value of the US dollar – Aqru invests your funds in a mixture of Tether (USDT), USD Coin (USDC) and DAI for stability.

Earn interest on crypto paid daily – rather than accrued daily but paid monthly as on some crypto savings accounts. There’s also no term or lockup requirement – it’s a flexible crypto savings account with access to withdraw your funds at any time.

12% interest savings account

The simple format and lack of confusing T&Cs makes Aqru a beginner friendly option to start earning interest on crypto. The team behind Aqru are also public and appear in a tutorial video on the Aqru website explaining how it works. Live chat and email customer support is also available.

Pros

- No hidden tiers or terms

- Get started with free crypto

- Large refer a friend bonus

- Daily interest payouts

- Easy to use

- No withdrawal fees on fiat currency

Cons

- Only BTC, ETH, stablecoins supported so far

- Small Reddit presence

- USA users not accepted

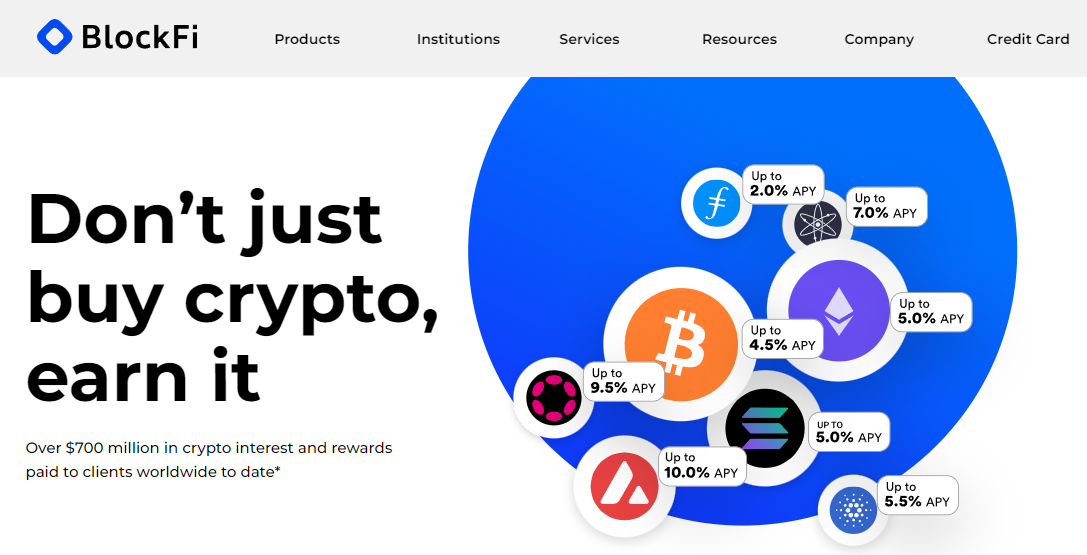

BlockFi – best crypto savings account in the US

BlockFi.com advertises a $250 bonus however there is a requirement to deposit $100,000+ to receive that. A $100-$1499 deposit earns $15, a $1500-$19,999 deposit earns $20, and so on in a tiered system. The refer a friend bonus is $10 for US referrals, and $40 for non-US clients referred.

BlockFi users can receive a credit card with 1.5% cashback on purchases and take out crypto-backed loans at 4.5% APR – using their crypto savings as collateral. BlockFi supports crypto interest on some popular altcoins including Cardano (ADA), Solana (SOL), Litecoin (LTC), Chainlink (LINK), Avalanche (AVAX), Cosmos (ATOM) and more.

Founded in 2017, BlockFi built a good reputation paying crypto interest to about one million registered users over several years, and managing $10 billion in assets, until coming under the attention of Gary Gensler and a Securities and Exchange commission (SEC) crackdown in February 2022.

BlockFi interest account – top crypto savings account in U.S.

According to Reuters BlockFi paid a settlement with the SEC without admitting or denying the charges that it failed to comply with regulatory state registration rules, or register with the SEC.

- Bitcoin interest – 4.5%

- Ethereum interest – 5%

- Stablecoin interest – 9%

BlockFi will continue operating – a good sign for crypto savings accounts in general. Visit the BlockFi website for the latest information. It recently received a Connecticut license so is now available in CT state, but not yet in New York. All other US states are accepted. The BlockFi Reddit r/BlockFi has tens of thousands of subscribers.

BlockFi has personalized options for high net-worth investors, and various other investment platforms for accredited and institutional investors, such as the BlockFi Bitcoin Trust and equipment-backed loans for mining businesses.

Pros

- Was not shutdown after SEC crackdown

- Proven track record of crypto interest payments

- Credit card, crypto and USD loans

- One free withdrawal per month

Cons

- Not available in NY state

Crypto.com – top crypto savings account for supported coins

Crypto.com attracts attention with its slick platform, metal VISA debit card and advertising campaigns which feature Matt Damon and crypto interest rates of up to 14.5% on Polkadot, 14% on stablecoins, 8.5% on BTC and ETH – in total you can earn interest on 50 crypto assets.

In terms of potential ROI it is the best crypto savings account on the market however there are complicated requirements, including the need to buy, own and stake $40,000 or more of the exchange’s native token CRO (similar to BNB on Binance) in order to earn the highest crypto interest rates.

Earn crypto interest

It’s also necessary to commit to a three-month lockup period. The interest rates are significantly lower for users that don’t do these – for example only 1.5% Bitcoin interest if you don’t stake CRO and with a flexible term, 3.5% on Ethereum and 6% on stablecoins.

So the drawbacks are that if the value of CRO, or the crypto asset you are holding crash (unless it’s a stablecoin) during the lockup term you may not earn money. The DOT price is in a downtrend vs its 2022 open.

- Bitcoin interest – 1.5 to 8.5%

- Ethereum interest – 3.5 to 8.5%

- Stablecoin interest – 6 to 12%

- Other crypto interest – 0.5 – 14.5%

View the full list of 50 supported coins and calculate the minimum and maximum rewards on the Crypto.com site – click Crypto Earn in the website menu.

One advantage is that you can take out crypto loans, borrowing up to 50% of your crypto collateral with no credit check required, paying back on your own schedule with no late fees. The APR is 8% p.a. when you stake $40k+ of CRO or 12% without CRO staking.

When creating an account via a referral link such as the one on this site you receive a $25 signup bonus. Once you’ve opened an account you can also earn $25 via their refer a friend bonus.

Pros

- 50 supported cryptos

- Visa card with up to 8% cashback

- Also a crypto exchange

- Crypto credit – borrow up to 50%

- DeFi (decentralized finance) wallet

Cons

- Need to stake CRO for high interest rates

- 1 – 3 month lockup periods

- Hong Kong, Switzerland, Malta users not eligible for crypto interest

eToro – most regulated crypto platform with staking

eToro.com isn’t technically a crypto savings account as it doesn’t pay crypto interest however you can earn an APY by staking Ethereum, Cardano or Tron, paid in the crypto asset you stake, so it’s similar.

When you stake crypto you are paid a dividend for allowing your tokens to be used to validate transactions on a blockchain network, whereas with crypto savings accounts you are paid because the platform lends out crypto to institutional and retail borrowers – like banks lend out fiat to a third party to earn revenue.

Earn APY on Ethereum

The Ethereum APY depends on how much you invest (up to 6.25%) and is subject to a lockup period – up until the launch of ETH 2.0. ADA and TRX yield are more complicated and depend on the number of tokens in the staking pool. Users posting on eToro – it’s a social trading platform where all investors have a profile they can make posts to – have reported 2 – 5% APY. Payments are made once a month based on daily snapshots of your token balance.

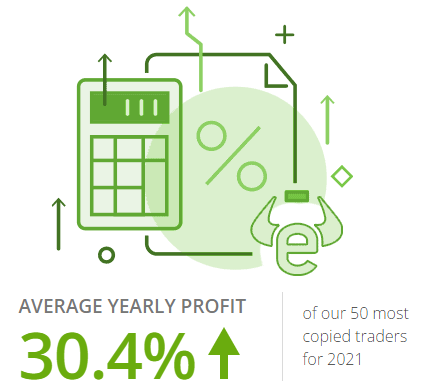

Bitcoin can’t be staked, so Bitcoin interest can’t be earned on eToro. You can copytrade on the platform though, picking an experienced professional trader and copying their trades, fully automated with no management fees. The top copied traders returned investors an ROI of 30.4% in 2021, and 83.7% in 2020, outperforming the best crypto savings accounts.

- Bitcoin interest – n/a

- Ethereum interest – 5 to 6.25%

- Stablecoin interest – n/a

Alongside copytrading and copyportfolios (smart portfolios where you copy a portfolio allocation of altcoins) the main appeal of eToro is it is highly regulated, by the Financial Conduct Authority and other international agencies. For US residents, your cash holdings are FDIC insured for up to $250,000, and any US stocks held – it’s also a stockbroker – are covered by SIPC insurance.

Crypto holdings are not covered by the FDIC or SIPC deposit insurance, however eToro has been operating since 2007 – predating crypto – with no regulatory issues in America, Europe, Australia and most countries globally, and hasn’t been hacked in its history. You can sell cryptocurrency for cash on the platform.

eToro also have a 4* rated mobile app for Android and iOS, based on thousands of user reviews on the Google Play store and Apple store, and a crypto wallet – the eToro Money wallet which comes with a crypto debit card.

There is no welcome bonus however there is a $50 refer a friend bonus and you can earn an income by becoming a trader that others copytrade – through their popular investor programme. Read more on our eToro review.

Update 2025 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Pros

- Available in USA and worldwide

- FCA, ASIC, CySEC regulated

- Also a crypto platform – buy, sell, trade, copytrade

- FDIC-insured custodial account for cash

- Founded in 2007

- Other cash income opportunities

- Minimum deposit only $10

Cons

- Locked Ethereum staking (ETH 2.0)

- No Bitcoin interest

- Only ETH, ADA, TRX staking supported

Risks of Crypto Savings Accounts – Latest News in 2025

Forbes has alleged that hundreds of whistleblowers have filed claims of fraud and wrongdoing in the cryptocurrency industry, although it’s unclear how many of those were related to cryptocurrency savings accounts.

The SEC has said that BlockFi interest accounts are securities under US laws, and that BlockFi misrepresented the level of risk in its crypto lending activity. However accusations of crypto projects being securities are common in the cryptocurrency markets, seen by crypto enthusiasts as a politically biased attack on emerging blockchain technology by the financial system.

BlockFi has also neither confirmed nor denied the allegations. Axios.com has said that if there were a run on assets, BlockFi ‘couldn’t necessarily keep paying interest or return customer’s money‘, and crypto savings accounts are more like risky high-yield bonds. BlockFi has stated they put remediation actions in place and are ‘leading the creation of a new regulatory landscape for crypto.’

Interest in these high yield platforms shows no sign of slowing down however – Altcoinbuzz.io reports that 24% of US citizens today hold crypto, a sign that ‘consumer needs aren’t being met by banks‘.

The Aqru crypto savings platform

Owning crypto is particularly common among millennials. The College Investor is the first Google result for ‘top crypto savings accounts’, a personal finance and investing blog for a millennial audience.

Fool.com has called Bitcoin and cryptocurrency collateral ‘the future of banking‘ and ran a story of a couple that converted 100% of their net worth into crypto and were able to operate and pay all their bills, finding a way to not rely on the traditional banking infrastructure.

Is earning interest on crypto safe? Only time will tell, but increasingly retail investors are turning to it, rather than earn a pittance with regular savings accounts, and companies like BlockFi are backed by industry-leading investors including Morgan Creek Capital Management, Coinbase Ventures, Valar Ventures, Galaxy Digital, Susquehanna Government Products and Winklevoss Capital.

The Winkelvoss twins Tyler and Cameron managed to get rich by investing in Bitcoin and are now billionaires. They famously told CNBC their prediction that Bitcoin will reach $500,000 based on it overtaking Gold’s marketcap.

Do exercise caution if you see high APY quotes of 1000% or similar however as some ponzi schemes and scams have made false promises of a very high APY in order to lure investors into a ‘rug pull’ scam.

Top Crypto Savings Accounts – the Verdict

Using cryptocurrency savings accounts you can earn interest faster than traditional savings accounts, the risk/reward debatably worth it given the average household loses hundreds of dollars a year from their savings due to inflation, which spiked to record levels in 2022.

With the crypto markets in a correction and Bitcoin around its 21 weekly EMA, it’s a good time to invest and ‘buy the dip’. As well as putting your coins in cold storage to appreciate in value as a long-term investment, you can also compound your holdings by earning crypto interest – but which of the crypto savings account providers are best for you and your investing strategy?

If you’re outside the US, and investing under $40,000, Aqru would be the top crypto savings account on our list, offering a lucrative 7% Bitcoin and Ethereum interest, or works as a 12% interest savings account if you hold stablecoins. Although it is a relatively-new crypto interest platform, with a small Aqru Reddit r/Aqru. Its current Trustpilot rating is 4.6/5 based on 21 Aqru reviews.

If you’re based in the United States on that budget and Aqru isn’t yet available, BlockFi would make sense as the best option if you want to earn Bitcoin interest, or take out a crypto loan.

Crypto.com is better suited to high net-worth investors who are not risk-averse, as its highest interest rates require investing over $40,000 and staking CRO. BlockFi does also have specialized options for wealthy investors.

eToro passive income potential by copytrading

eToro is best suited to risk-averse investors who don’t mind locking up their Ethereum for staking, as it’s FCA regulated and in operation for the longest time, complying with SEC regulations.

However the value of Ethereum could dump, as is common in crypto markets. Arguably the lowest risk option is to earn interest on stablecoins, for which Aqru pays out 12% interest, as they don’t lose value being pegged to the value of USD.

eToro has the advantage of being a crypto platform where you can buy the crypto you wish to earn interest on, with the option to day trade or copytrade as other sources of income and passive income. It is our top recommended crypto exchange, featured in the Economic Times as the best platform of 2022.

Investors interested in crypto passive income may wish to open accounts on several of the top crypto saving account platforms to split up their funds and hedge risk against crypto market downturns. Set up two factor authentication on each account for security.

We’ve also recently reviewed Nexo another of the best crypto savings accounts on the market.

FAQs

How to earn interest on crypto?

Open a crypto savings account at one of the top platforms reviewed in this guide, verify your identity with ID documents to fulfill KYC (know-your-customer) requirements, then deposit crypto. Interest is earned automatically with no other user input required, just like a bank savings account.

What is the top crypto savings account platform?

That depends on your needs, country of residence, and what crypto you want to earn interest on - our experts found Aqru to be well-suited to all crypto investors outside the United States.

How to earn compound interest on crypto?

If you leave your crypto holdings in your crypto savings account, the interested accrued will be compounded, as with a traditional bank account, only with a higher interest rate and compound growth rate.

What is the best high yield crypto savings account?

In percentage terms, Crypto.com offer up to 14.5% interest however only on DOT and if you stake the required amount of CRO over three months at a time. Aqru offer a competitive 12% on stable coins.

What is the best crypto savings account Reddit users prefer?

Based on number of subreddit subscribers, the BlockFi app is very popular, perhaps due to being available in the USA. Other popular crypto interest accounts are the company Celsius network, the Gemini Earn program on Gemini exchange, Anchor Protocol, Binance Earn on Binance exchange, the ByFi centre on Bybit, and Coinbase Earn on Coinbase. Crypto.com has the largest Crypto Reddit sub on our top list, although that may be because it is also an exchange with spot and derivatives trading and an NFT marketplace.