EOS Price Chart

The EOS price can fluctuate by several percentage points in any 24 hour time period, and has volatile bull and bear cycles on longer timeframes. Use the chart buttons to zoom out and compare the EOS price in the last week, month or year. Also select from the dropdown options to change the currency to US Dollars, UK Pounds or Euros.

[ccpw id=”432638″]EOS is an interesting smart contract platform that’s innovative and controversial in about equal portion. What you think of EOS will depend largely upon what sort of crypto politics you subscribe to. But whether the EOS blockchain is a scam or a revolution, the EOS coin has value and is widely traded throughout the world. We’ll make some EOS price chart predictions after we take a closer look at what makes this project tick.

EOS was launched in 2017 by none other than Dan Larimer and co. Larimer was known at the time as the creator and ex-head of both Bitshares and Steem – two high quality crypto ecosystems in their own right, though both were abandoned by Larimer before they reached true maturity. EOS has a year-long ICO, during which time it raised more than $4 billion. Yes, that’s right, “billion”.

EOS’s ICO haul was conspicuously large for an esoteric tech startup with no working product, but that didn’t stop from investors and developers from signing on with rabid enthusiasm. EOS started sprouting new Dapps and smart contracts in no time, and remains a hotbed for blockchain development to this day. EOS has been labeled the “Ethereum Killer” since day one, and in fact some of its develop base did self-poach from Ethereum.

However, many believe that all is not rosy with EOS. Far more centralized than Ethereum (in order to achieve scalability on the cheap), EOS block creators look very much like an oligopoly. Able to vote themselves into power to stay (1 EOS = 1 vote), even malicious block producers can stay in power without the community being able to respond.

Furthermore, EOS core development has slowed to a crawl. Where there once were dozens of Github commits per day, the rise has now stagnated.

As of 2024, EOS has redesigned the commit details page to attract more developers, offering new features such as comment counts, floating comments, keyboard navigation, quick view switching, filtering by file extension, and filtering out hidden diffs. Although the number of responses to these developments has increased, many remain indifferent or negative about the changes.

Third party development remains committed, but people who accuse Larimer of abandoning a third crypto project aren’t making up such an accusation out of thin air.

So we’re left with a confusing platform and cryptocurrency with EOS. Can EOS thrive as-is if core development ceases? Are malicious block producers a fatal flaw? Is the project’s scalability a fair payoff for sacrificing decentralization? We can’t answer these questions with any finality, but they do fill us with a certain skepticism that will inform our resulting EOS value predictions.

Why EOS Prices Rise and Fall

EOS prices rise and fall on the back of market hype. At times in its history, the coin was the darling of the crypto investment world and any expert would have recommended to buy EOS. The project was marketed like the second coming of Christ and investors the world over fell over themselves to get a piece of the action by purchasing and storing the currency in EOS wallet until its price would rise.

When the crypto markets crashed, so did EOS. It wasn’t powerful enough on its own to beat out the downward pressure of a plummeting Bitcoin. And yet, it continued to perform well compared to other projects, quickly hurtling toward the cryptocurrency market top 10. Even today, EOS’s true believers hold the coin steady at the #5 position on Coin Market Cap.

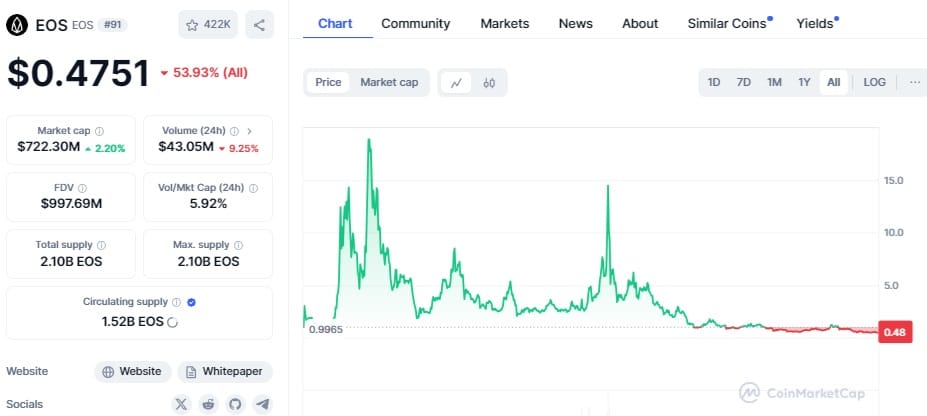

But this is more wishful thinking than anything else, as its performance since the bull market of 2021 has fallen short of expectations. Candles have mostly been red, and the drop has been so drastic that most wise crypto investors have started to believe that this project has been completely abandoned. This is one of the reasons attributed to the token’s decline, which now seems to be on the verge of dropping out of the top 100 spots in terms of market capitalization. As of 2024, EOS is a sub billion crypto and ranks #91.

Criticisms of EOS are easy to find, and have already been described here in short. So why are EOS prices so buoyant? Well, EOS is and always was a hype beast. The project has spent no small portion of its $4 billion bankroll in spreading the word of EOS far and wide. EOS’s community is, consequently, fairly enormous. Even amidst the yearlong crypto price drought through which so many of us have suffered, the EOS community remains large and robust.

Bitcoin is still king. When BTC prices fall, so do all other altcoin prices. When Bitcoin prices rise, money enters the space, and investors spread out into the most popular alts. EOS may be a media juggernaut, but it is not yet immune to these market realities. Because of the fundamental problems with EOS we’ve already described, we don’t expect EOS price live to shoot to the moon anytime soon, at least on its own power, but if the bulls return, you can bet that EOS prices will follow suit.

So that’s our take on EOS for the very short term. But how have EOS prices been affected by past market forces? And how will our EOS predictions scale for this blockchain project when considering distant future performance? To find out, just keep reading.

EOS Historical Prices

Because of EOS’s yearlong ICO, EOS coins trickled onto the market gradually. Investors during this period weren’t likely to invest much more or less than they’d pay at ICO, and EOS coin price stayed around $1 for its first few months on the market, July through November 2017.

Then all hell broke loose. EOS was one of the best performers in the crypto price run that peaked in January 2018, when EOS coins hit almost $20. EOS prices collapsed along with everything else in the months to follow, but EOS prices did something almost no other crypto coin did during the epic bear market crash: they recovered more than 100%.

That’s right, while all of the other crypto mainstays were still tumbling bruised and bloody down the crypto price cliffs in late April 2018, EOS was hitting new all-time highs of over $21. These EOS worth increases coincided with the release of the EOS mainnet and the release of the real EOS coins. Up until then, EOS traders had been trading EOS coin placeholders. They had the same value and nominal function as the mainnet EOS coins, but would have to be traded for the real thing. That’s what happened in late spring 2018.

After reaching its all-time high in the summer of 2018, EOS started a free fall, bottoming at $1.9 before bouncing back to $8. This push-and-pull action persisted throughout 2019, as a bullish wick formed around the $5.3 level before the decline resumed.

Bitcoin’s surge past its 2021 all-time high lifted all crypto assets, including EOS. However, the utility token fell short of reclaiming its all-time high and began correcting as soon as it rose to $15. Then, the bear market of 2022 occurred, and the price action started to indicate that the community had lost complete faith in the project.

Even though the token has experienced minor growth spurts since then, its price action has now started to resemble that of a meme coin. In 2024, the token has barely managed to cross the low resistance level of $0.5.

EOS Future Price Predictions

So what does the future of EOS hold? Well, we’ve made it no secret that we’re skeptical of EOS on many levels. Anything could happen, but we think that it’s most likely that EOS prices won’t ever reach past heights again. Even if they do, our EOS prediction is that EOS price success would be only a temporary situation.

EOS Prices in 2024

Bitcoin experienced major bullish momentum in 2024, pushing it past its previous highs and reaching a new all-time high of $74k. As mentioned, the entire cryptocurrency market was expected to be swept up in the crypto fever during this time. However, little action was seen within the EOS ecosystem.

The token, which had already shown signs of decline before 2021, managed to break past its $1 resistance briefly, but that didn’t last long. It didn’t take much for the community to come to its senses, leading to a further drop in EOS’s price.

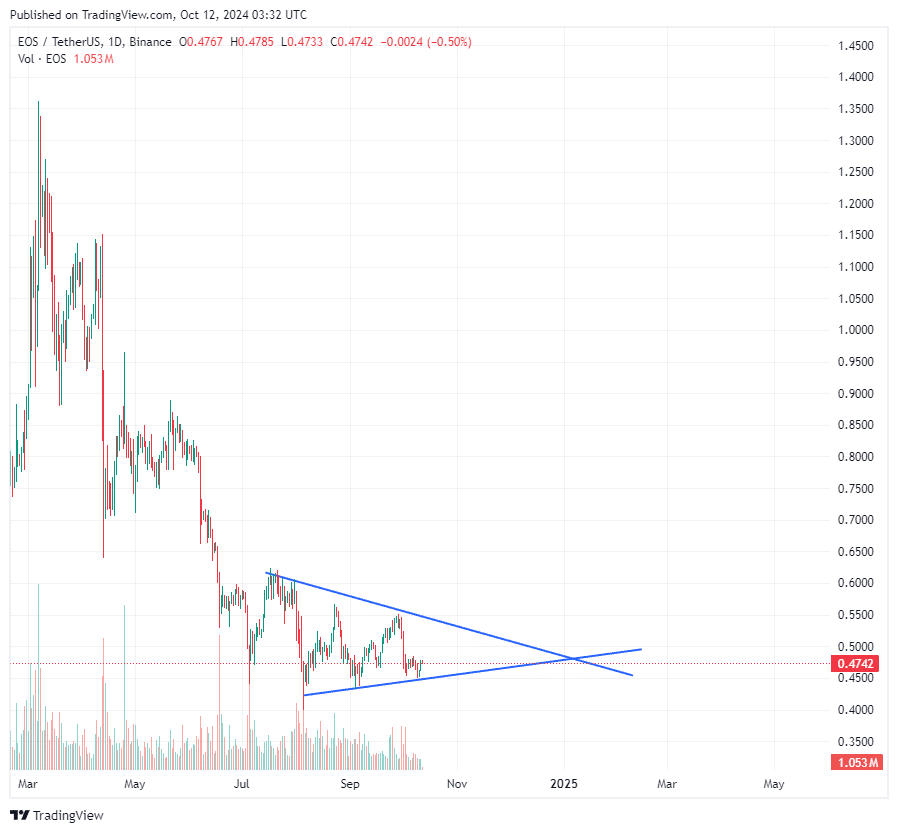

However, when we zoom in on the recent price action, we can see an asymmetrical pattern forming, which could indicate a potential price reversal is on the horizon.

Furthermore, the EOS Network Foundation recently tweeted that EOS’s Total Value Locked (TVL) has reached an all-time high.

Nothing new here…

The #EOS TVL has reached yet another all-time high.

Previous ATH: 263.03M $EOS

New ATH: 272.16M $EOS pic.twitter.com/64ompukHUI— Vaulta (prev. EOS) (@Vaulta_) October 5, 2024

However, the chart is in terms of EOS, not USD, as one user has rightfully pointed out. Using EOS on the DefiLlama chart is seen as a beauty metric and not of significant value.

Therefore, it can be said that the EOS Foundation is upselling a token that has already started to show signs of diminishing. With that in mind, while a trend reversal is possible, it is also clear that it may not last long. Based on these factors, it is likely that by the end of 2024, the EOS price will continue to trend downward to reach:

$0.2 per EOS coin.

EOS Prices in 2025

Many anticipate 2025 to be a bullish year for Bitcoin, and with that, the rise of other cryptocurrencies is almost seen as an imminent occurrence. However, as the price trends suggest, it is becoming increasingly likely that EOS will further diminish in value.

While the EOS Foundation is working hard, most of the engagement it receives on its X account has been minimal. Furthermore, the tone of these interactions doesn’t come across as entirely genuine. Despite this, EOS is forming partnerships that could be beneficial for its long-term growth.

But here’s the kicker: these partnerships aren’t making headlines, and only a few people are aware of them on social media. It seems that only new crypto start-ups are emerging to leverage EOS technologies. Therefore, unless something drastic happens within the EOS ecosystem, we don’t expect the EOS price to experience any major increase in 2025.

Additionally, EOS is currently trading at its all-time lows, which means that even if it experiences a surge, it likely won’t be as drastic as the 2021 bull run. At best, EOS could rise from $0.2 to $0.35 before correcting back to…

$0.1 per EOS coin.

EOS Prices 2030 and Beyond

There likely won’t be much action for EOS in 2030. Additionally, with few “stans” for EOS lately and the bullish community sentiment on CoinMarketCap largely driven by a handful of loyalists, EOS may completely disappear from the market.

By 2030, six years will have passed, which is like a century in the blockchain space, given the rapid developments. Whatever the EOS network offers, other projects may emerge to provide superior alternatives. EOS can no longer claim to be an “Ethereum Killer”—it is more likely that other emerging projects will overshadow it. Currently, Cardano stands as its top competitor, with a market capitalization surpassing $12 billion.

Although Cardano has mirrored EOS’s price action in some ways, it has begun to get back on track. Considering these factors, along with the declining interest in EOS, it is safe to predict that by 2030, the EOS price will drop close to…

$0 per EOS coin.

So there you have it. We’ve looked at all the evidence we can find, and we think EOS isn’t going to last for the long haul. In our opinion, EOS succeeded in its early days because of marketing and investor FOMO, not because of the virtue or durability of the tech. EOS could prove us wrong, but it will take a renewed commitment from Dan and the other core developers. Meanwhile, the platform will have to find a solution for malicious block producer oligarchs, and any of a dozen more potentially fatal EOS miscalculations.

We don’t have any reason to hate EOS specifically. If it was an ethically run piece of software gold, we’d support it just like it’s most ardent admirers. But this just doesn’t seem to be the case from where we’re sitting. If you’re on the fence about whether or not to invest in EOS, please do your own research and make your own decision.

It is Time to Look at Better Alternatives, Like Meme Coins

People still holding out hope that EOS will somehow get back on track should recognize that the token’s appeal among the wider crypto circles has significantly waned. Only a select few Web3 crypto enthusiasts talk about it, and even those tend not to have many positive things to say about the project.

Additionally, the price trends show no indication that EOS will increase drastically anytime soon. Therefore, those still holding EOS may want to consider a failsafe strategy by diversifying into meme coins currently available in presale.

Meme coins have gained massive popularity since the meme coin mania of 2023. When Pepe unlocked the potential of meme coins, numerous investors, even those seeking long-term gains, flocked toward these assets in hopes of achieving parabolic profits. That said, the focus on utility-focused cryptos hasn’t been lost on them. As a result, investors have begun to seek out projects that blend virality with utility in a balanced manner.

One of the biggest projects to catch the community’s attention is Memebet Token. Memebet Token is a hybrid of a meme coin and a crypto gambling platform. It offers the viral potential of meme coins while delivering utility that could attract both degen and long-term investors.

Memebet Casino is not designed to be a typical crypto gambling site. While it will offer the usual perks of a standard casino—such as slots, roulette, table games, live games, and sports betting—the key difference is that only meme coins can be used to place bets.

Any top meme coin, such as Pepe, Muro, Dogecoin, Dogewithhat, and more, can be used to play on the casino. These volatile assets align well with the uncertain and volatile nature of the games on Memebet Casino.

Additionally, the casino will be active on Telegram, offering players the benefit of no-KYC requirements. Planned airdrops and exclusive holder benefits for those who stake $MEMEBET are also expected to maintain strong engagement on social media, potentially helping the project consolidate a significant presence in the cryptocurrency market.

With a straightforward utility that is easy to understand and memes that resonate with internet culture, Memebet Token could be considered a better alternative to EOS.