The blockchain trilemma is the key challenge faced by the cryptocurrency industry today: achieving decentralization, security, and scalability all at once. Improving one of the three pillars often weakens another, making it extremely difficult for blockchain networks to strike the perfect balance.

The term ‘blockchain trilemma’ was first coined by Ethereum co-founder Vitalik Buterin in a 2017 blog post and it has since become the main focus of crypto developers. In this article, we explore the problem, explain why it’s such a difficult one to solve, and reveal how developers are trying to solve it.

Key Takeaways

- The blockchain trilemma highlights the challenge of achieving decentralization, security, and scalability simultaneously. Most blockchains can optimize for only two.

- Improving one aspect (like scalability) often weakens another (such as decentralization or security), requiring careful design decisions.

- Solutions like Layer 2 protocols, sharding, and alternative consensus mechanisms aim to address the trilemma, but no perfect solution exists yet.

The Three Pillars of Blockchain Technology

In order to function successfully, achieve mainstream adoption, and accommodate a wide range of applications, blockchain networks need to excel in these three key areas.

1. Security

Security is critical because blockchain users need to be confident that their assets and private information are safe and the rules of the network will be followed. Part of the appeal of blockchain is that it is transparent and tamper-proof. To stay secure, blockchains rely on the following core defenses.

Decentralized ledgers:

Blockchains operate across a global network of computers known as nodes. When a transaction occurs, each node typically keeps a copy. As a result, it is very difficult to tamper with network records. For example, it would be difficult to double-spend currency or fraudulently alter the ownership of an asset because so many participants have a record of the network’s transaction history.

Consensus mechanisms:

When a transaction takes place on the blockchain, participating nodes check the transaction to confirm that it is valid. They must reach consensus in order for transactions to be validated and added to the blockchain. The protocol for reaching consensus is called a consensus mechanism.

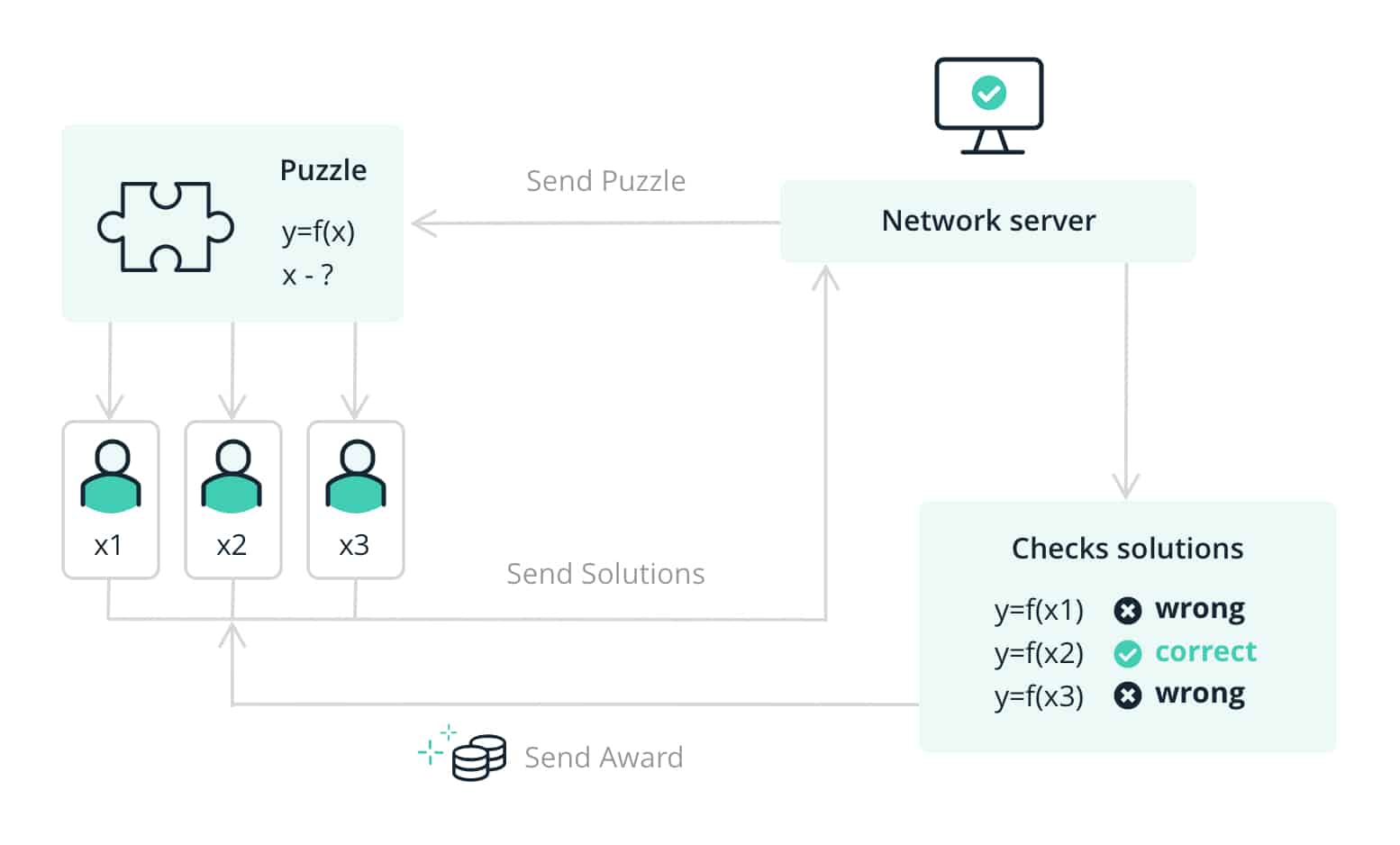

One common consensus mechanism is Proof-of-Work (PoW), which is used by Bitcoin. In this protocol, nodes known as miners use computational power to solve complex mathematical puzzles. Solving these puzzles is hugely resource-intensive.

In order to gain control of the network, an attacker would need to capture more than half the network’s computational power, which becomes harder as the network grows. For example, it would cost an estimated $10 billion dollars to gain control of the Bitcoin network and such an attack would likely make the price of Bitcoin crash anyway. In other words, the PoW protocol makes hijacks of large PoW networks highly unlikely.

Cryptography:

Blockchain users control access to their digital assets with a cryptographic code called a private key. Corresponding public keys act like pseudonyms, which means users can transact without revealing their full identity. This is just one example of how blockchains are secured using cryptography.

2. Scalability

Scalability is the volume of activity that a blockchain can cope with successfully – and its potential to increase that volume. When lots of people are active on the blockchain, it becomes congested, and transactions take longer. Congestion also leads to high transaction fees because demand for space on the network outstrips supply.

Network throughput is a measure of scalability. Bitcoin has a network throughput of 7 TPS meaning it can process 7 transactions per second. Ethereum’s is 30 TPS. By contrast, Visa’s throughput is 65 thousand TPS.

If blockchains cannot scale without becoming slow and expensive, widespread mainstream adoption of the technology is unlikely, and applications that require fast, frequent payments (e.g., blockchain gaming, DEX, NFT drops) become unfeasible.

3. Decentralization

Decentralization is the degree to which a blockchain network is run by an open community made up of a large number of nodes – rather than a central authority or a small number of powerful participants. It’s not just about security. Decentralization is a core principle of blockchain, and many users feel it represents:

- Freedom from censorship.

- Greater control over one’s data and transactions.

- Improved transparency.

- Opportunities for innovation.

- Resilience to operational failures.

Bitcoin, for example, has tens of thousands of nodes, which makes it highly resistant to censorship.

The Blockchain Trilemma Explained

The ideal blockchain would offer high levels of decentralization, security, and scalability. Unfortunately, measures that boost one feature often limit another. Here are some examples of those tradeoffs.

Scalability vs. Decentralization

A network could reduce congestion by increasing the number of transactions per block. However, participants would need more processing power to accommodate larger blocks, so fewer people would be able to participate, which could lead to centralization of control.

Security vs. Decentralization

Similarly, a network could boost security by setting minimum internet speed and bandwidth requirements for validators, but this would exclude some participants, leading to centralization.

Scalability vs. Security

Blockchain developers can make adjustments that lower the block time, i.e., the time between each new block being created. This would boost throughput but also increase the risk of accidental forks, which is when two or more miners find the same block almost simultaneously. Accidental forks can create opportunities for attackers.

Solutions to the Blockchain Trilemma

Despite the tradeoffs that define the blockchain trilemma, it is possible to make improvements in one of the three key areas of blockchain without hindering the others. In fact, many blockchain networks are already taking innovative steps to overcome this conundrum. Solutions fall into two categories. Layer 1 or on-chain solutions change the design of the underlying blockchain. Layer-2 or off-chain solutions are built on top of the blockchain without altering the base layer.

Layer 1 Solutions

Crypto developers are constantly working on ways to improve blockchain technology. There are three major solutions that the industry is focusing on: consensus mechanisms, dynamic block size, and sharding.

1. Switching Consensus Mechanisms

The Proof-of-Work consensus mechanism requires a massive amount of energy and expensive hardware, and it tends to slow down transaction speeds. Networks looking to scale could switch to a different mechanism, such as Proof-of-Stake (PoS), which does not require complex problem-solving and is generally speedier as a result.

Solana, a blockchain launched in 2020, uses a novel consensus mechanism called Proof-of-History, which allows the network to process over 3 thousand TPS. Naturally, there are still tradeoffs in terms of decentralization and security, but they are generally considered less impactful than increasing the network’s block size.

2. Dynamic Block Size

As mentioned above, increasing block size means more transactions can be processed at one time, which increases throughput – but it can limit decentralization. One possible solution is to have a block size that automatically increases during periods of congestion and decreases when demand is lower.

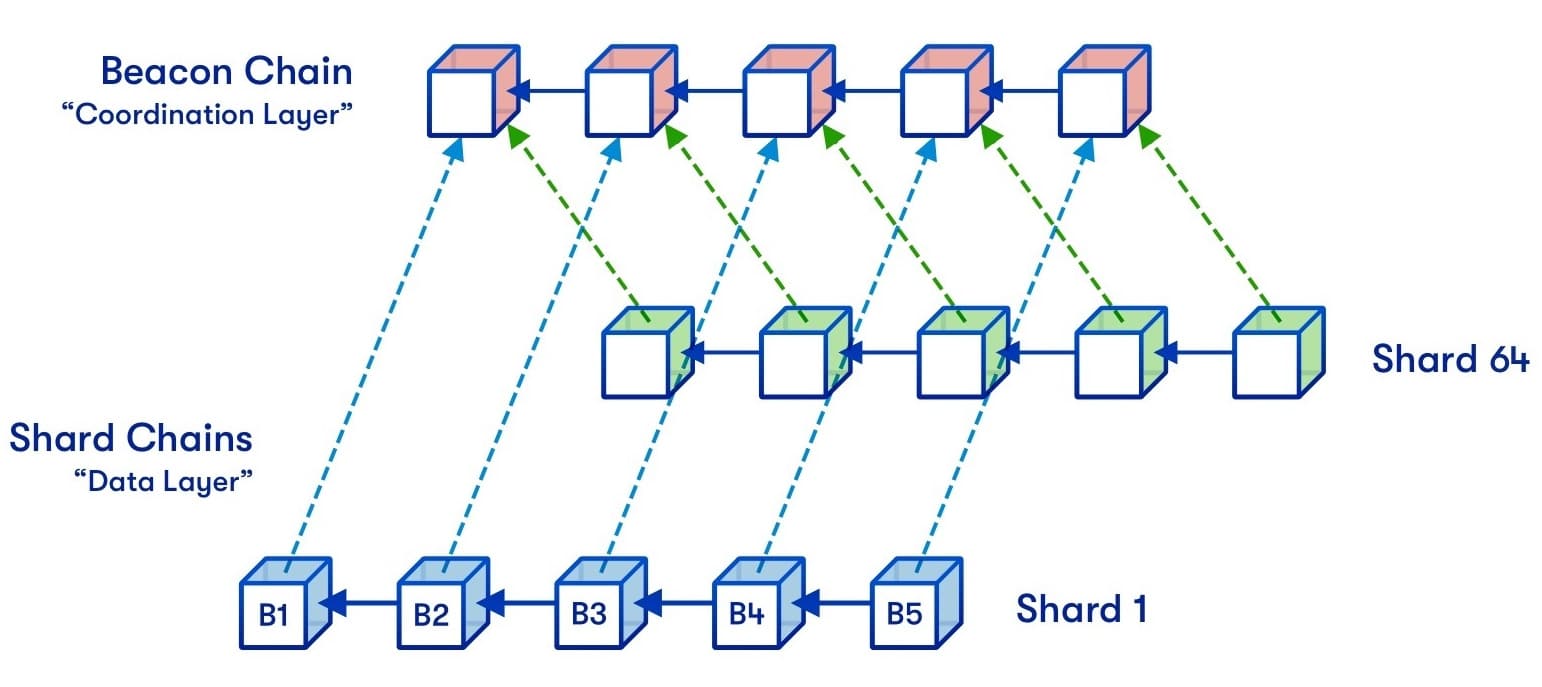

3. Sharding

Sharding boosts scalability by dividing the blockchain into smaller sections or shards. Nodes are assigned to individual shards instead of working on the whole network. It’s a division of labor.

The Zilliqa blockchain has pioneered this technique and Ethereum is working on a more complex implementation of the idea called danksharding.

How are Layer-1 Solutions Implemented?

Minor updates to a blockchain network can be implemented via developers or, when broader agreement is required, via the consensus mechanism. However, when changes impact the underlying protocol, they may require a fork. This is when the blockchain splits or diverges to create two pathways.

Soft forks are “backwards compatible,” meaning changes are compatible with the code they replace. A hard fork, meanwhile, can lead to the creation of a whole new blockchain. Forks can be controversial and cause community divisions – which is one of the downsides of layer-1 solutions.

Layer 2 Solutions

There are countless proposed Layer 2 solutions being worked on by thousands of developers across the crypto industry. Here are five of the most promising right now.

1. Nested Blockchains

A nested blockchain sits atop a main blockchain. The parent chain can delegate some types of work to the child chain. The network maintains its structure while benefitting from the speed of a small chain.

2. Sidechains

A sidechain exists alongside the main chain and is independent. It is connected to the main chain via a “bridge” and has its own native token. They generally tie their security mechanisms to the primary chain, helping to secure the sidechain. Polygon, for example, runs parallel to Ethereum. It offers lower fees and faster transactions – but some argue it is less secure than the main chain.

3. State Channels

State channels act a bit like a prepaid bar tab. They allow two parties to transact without recording each transaction individually on the blockchain. First, a time-limited smart contract is set up. Transactions associated with the contract happen off-chain and are later submitted to the blockchain to be recorded in a batch. This means that the parties pay just one fee and can transact instantly.

4. Plasma

Plasma is the brainchild of Vitalik Buterin. It involves dividing the blockchain into smaller chains that process transactions independently but regularly submit data to the main chain. Plasma chains can facilitate speedy transactions but withdrawals take several days and this system introduces some new security risks. The idea was exciting at first, but it has mostly been set aside by the community in favor of more promising solutions like rollups.

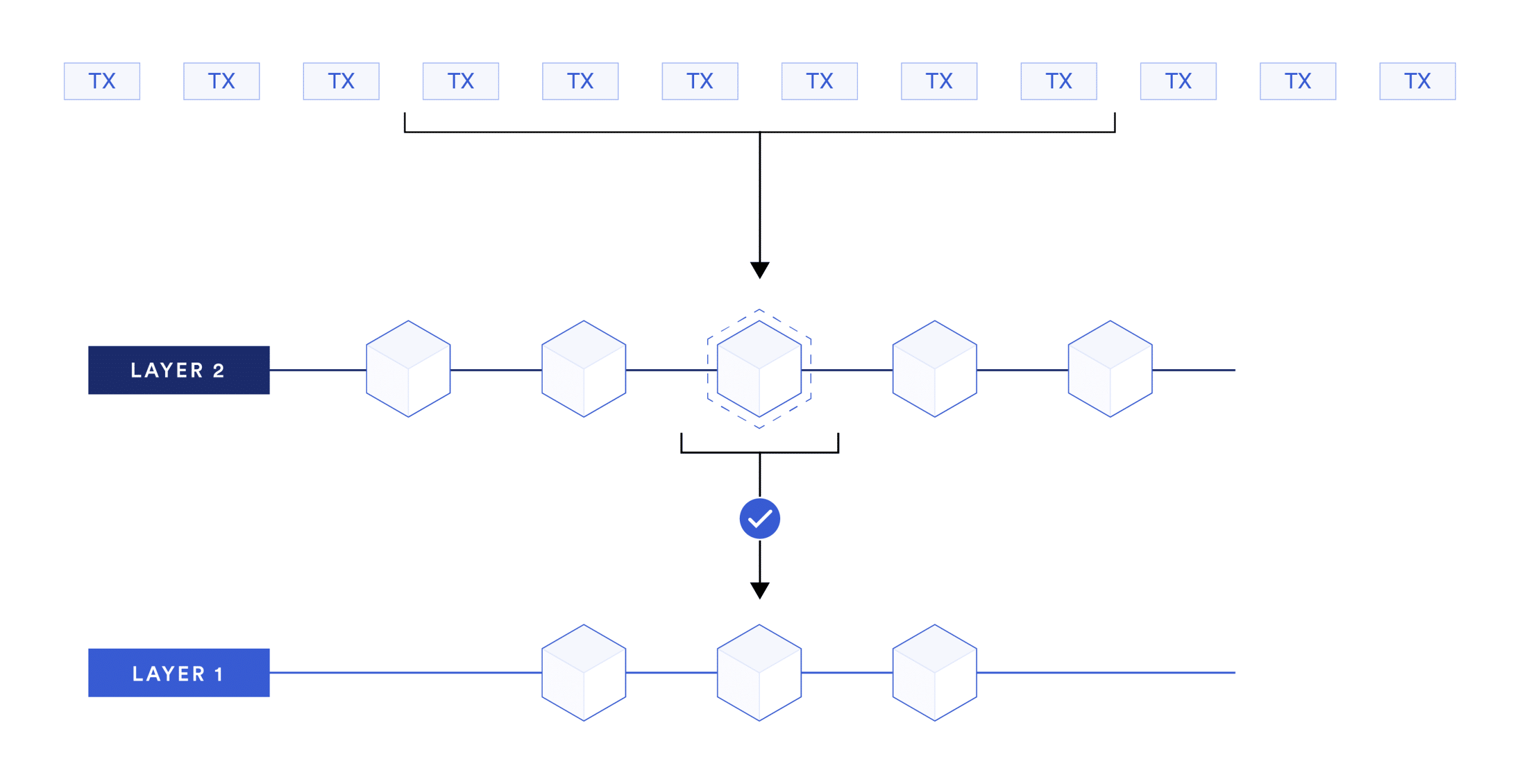

5. Rollups

This technique involves gathering up batches of transactions from the main chain, processing them on a faster parallel chain, and then verifying them back on the main chain. Transaction fees on the main blockchain are only applied once (to the entire batch) rather than to every transaction. Rollups are generally considered one of the best ways to scale blockchains right now.

There are different ways of validating these batches. Optimistic rollups assume that all the transactions in the batch are valid unless a dispute is raised during a specified grace period. zK rollups (short for “zero-knowledge proofs”) meanwhile are validated by a cryptographic proof.

Optimistic rollups are more popular, likely because they are vastly easier to code. Over $15 billion in value was bridged between optimistic rollups and Ethereum in 2024, with Arbitum and Optimism being the most popular solutions.

How Blockchains Are Solving the Trilemma

Legacy blockchains are adopting a combination of layer 1 and layer 2 solutions to boost scalability, and newer blockchains are emerging with novel approaches to all three pillars of blockchain. Here are three real-world examples of blockchains tackling the trilemma.

Ethereum Scalability Solutions

Ethereum’s 2022 shift from PoW to PoS was a turning point for the network. It aimed to set the stage for future scalability upgrades from a technical perspective. Sharding was originally a key part of Ethereum’s roadmap, but rollups have since taken center stage due to their rapid development. Vitalik Buterin spoke about the importance of the switch to PoS and other key upgrades with Forbes if you want to learn more.

One of the most important upcoming upgrades is called danksharding – a proposed solution that would make rollups more affordable. A recent upgrade introduced proto-danksharding, which is the first step towards danksharding. Ethereum also supports state channels, sidechains, and Plasma, among other solutions.

Bitcoin Scalability Solutions

Bitcoin has tens of thousands of nodes and is considered highly decentralized and secure. But transactions are slow and fees are high when the network is busy. Scalability is its most pressing problem to date, but developers are working on multiple potential solutions.

In 2017, the community was divided over the best way to solve this problem. One group favored increasing the block size. The other supported a protocol upgrade called Segregated Witness (SegWit) – a change to Bitcoin’s transaction format that allowed for more transactions in each block. This conflict resulted in a hard fork and the emergence of Bitcoin Cash, which has a significantly increased block size. Meanwhile, Bitcoin adopted SegWit.

Layer-2 solutions are another important solution for Bitcoin’s scalability. Lightning Network, for example, is a layer-2 blockchain that uses payment channels (similar to state channels) to allow pairs of users to transfer funds instantly. It has quickly become one of the most popular ways to send Bitcoin. Sidechains like Rootstock and Liquid Network are also growing in popularity.

Solana’s Security Issues

Solana is one of the fastest blockchains in the world. It’s unique consensus mechanism, Proof-of-History (in tandem with PoS), allows it to process at an extremely high throughput. This is a game-changer for scalability and makes the network attractive for DeFi, NFT, and gaming applications, but the network has suffered centralization and a number of critical security incidents.

To counter this problem, a number of security measures have been introduced, including a bug bounty program that offers rewards for the identification of vulnerabilities and a new third party validator.

The Blockchain Trilemma – Our Verdict

There is almost always a tradeoff between decentralization, security, and scalability. Networks tend to excel at just one or two of these three key goals, but there are some promising solutions that could solve the problem entirely.

Layer-2 solutions are shaping up to be the central solution in the quest for scalability. Rollups and danksharding in particular are extremely promising. They could offer users access to the security of Bitcoin and Ethereum without the congestion and high fees. However, they bring with them technical complexity and the potential for new security risks.

Novel blockchains with innovative infrastructure will likely also excel in areas that rely on speedy transactions, such as DeFi and gaming, but they may have their own tradeoffs to consider.

FAQs

Who coined the term 'blockchain trilemma'?

The term 'blockchain trilemma' was coined by Vitalik Buterin, the co-founder of Ethereum, in a 2017 blog post.

What are the three parts of the blockchain trilemma?

The blockchain trilemma refers to the competing goals of decentralization, security, and scalability.

What is a layer-1 solution?

Layer-1 solutions involve changes to the design of the underlying blockchain.

What is a layer-2 solution?

Layer-2 solutions are built on top of the blockchain without changing its underlying design.

References

- Blockchain Facts – Investopedia

- Buterin Whitepaper on Plasma – Plasma.io

- Danksharding – Ethereum.org

- Scaling Blockchains Lecture – Berkely RDI Center

- Sharding FAQ – Buterin Vitalik

- Scaling – Ethereum.org

- The Security History of Solana – Medium

- Understanding the Challenges of Data Congestion – Forbes

- What Is Solana? – Forbes

- What Is The Blockchain Trilemma? – DBS Financial Planning