Segregated Witness or SegWit was a major upgrade to the existing Bitcoin protocol. It was introduced in 2017 to solve some long-standing issues in the network. Mainly, it helped fix problems with transaction malleability and network congestion by increasing the capacity of each block.

As a soft fork, SegWit made the Bitcoin network faster and more efficient. It also laid the groundwork for layer 2 solutions like the Lightning Network. Bitcoin’s Lightning Network combines payments into one final transaction, further reducing fees. The upgrade took place in the midst of the “block size wars,” where the crypto community fought about the tradeoffs between scalability and decentralization.

SegWit was a big deal when it was enacted, and it has had a major impact on the future and trajectory of Bitcoin and other cryptocurrencies.

Key Takeaways

- Segregated Witness (SegWit) separates signature data from transaction data, allowing more transactions per block.

- Making transactions more space-efficient often leads to lower fees for users.

- SegWit was a necessary upgrade to support technologies like the Lightning Network, allowing faster and cheaper off-chain Bitcoin transactions.

What is SegWit? SegWit Upgrade Explained

To understand SegWit, we need to rewind a bit.

Back in 2013, the average Bitcoin block size was just 125 kilobytes. This was fine in the early days when Bitcoin didn’t have so many users. However, the network was growing incredibly fast. By 2015-2016, Bitcoin was extremely popular, which is why it started facing growing pains. Many people were using the network, but it could only handle a limited number of transactions per block. This translated to slow transactions and high fees as users battled to have their transactions processed first. By May 2015, blocks had grown to about 425 KB on average, which is a 240% increase.

The network kept getting busier. Estimations showed that blocks were hitting the 1 MB limit about four times per day on average. Approximately 3% of valid transactions on the Bitcoin network were facing confirmation delays due to network capacity issues. This wasn’t just a technical footnote. It was becoming a major deal in the Bitcoin community.

By 2015, more blocks were getting close to full, which meant even longer waiting times and higher transaction fees. People were getting worried. Bitcoin was created to be a fast, low-cost way to send money. However, with the delays and rising fees, it was starting to feel more like a clogged highway than a global, decentralized payments system.

This led to the infamous block size wars.

Some members of the community wanted to simply increase the block size. This would let more transactions fit into each block, reducing congestion and fees. However, others warned that this would centralize the network. Bigger blocks immediately meant more storage and bandwidth, which would mean that fewer people would be able to run full crypto nodes.

Segregated Witness (SegWit) was introduced by developer Peter Wuille. It offered a compromise. The new upgrade didn’t raise the block size directly. Instead, it optimized how data was stored on the network.

By separating (or “segregating”) the signature data, also known as the “witness data,” from the rest of the transaction, SegWit made room for more transactions. It didn’t have to change the block size limit in a traditional sense, but it helped relieve the congestion on the Bitcoin blockchain.

The Block Size War Explained: The Road to SegWit

The core issue in the block size war was Bitcoin’s block size limit. As Bitcoin’s popularity grew, the limitation in transactions led to network congestion, slower transaction times, and higher fees. The community then split into two camps:

- Big blockers who advocated for increasing the block size to allow more transactions per block.

- Small blockers who emphasized maintaining the 1MB block size to preserve decentralization.

Some of the key proposals in the so-called war included:

- Bitcoin XT: Proposed by Mike Hearn and Gavin Andresen in 2015, this initiative aimed to increase the block size to 8 MB. The idea had initial support but didn’t gain consensus and was eventually abandoned.

- Bitcoin Classic: Launched in 2016, this initiative suggested a more modest increase to 2 MB. Still, it lacked sufficient support from the community. Note that this Bitcoin Classic (ARAW) or BXC chain is not related to the 2016 Bitcoin Classic fork.

- New York Agreement (SegWit2x): In May 2017, over 50 companies and miners agreed to implement SegWit, which was followed by a 2MB block size increase. However, the proposal faced backlash from the community, which viewed this as a corporate takeover. This plan was eventually shelved as well.

- Bitcoin Cash: Those who were dissatisfied with the outcome of SegWit created Bitcoin Cash in August 2017, implementing an 8MB block size to allow for more transactions per block.

In response to the New York Agreement, a grassroots movement led by users initiated BIP148. This idea signaled support for SegWit activation without miner consensus. The pressure led to the successful SegWit activation on August 24, 2017.

How Does SegWit Work?

To understand SegWit, you need to understand how Bitcoin transactions work. Each Bitcoin transaction has two main parts:

- The data that says who is sending how much crypto to whom.

- The signature data that proves the sender has the right to spend the crypto.

Before SegWit, both types of data were stored together in Bitcoin transactions. This caused two problems.

First, it used up space. Transaction signatures can take up more than half the size of a transaction. This alone significantly limited how many transactions could fit in each block.

Second, it left the Bitcoin network vulnerable to transaction malleability. This bug allowed someone to slightly change the signature data without affecting the actual transaction. This might sound harmless at first, but it actually made it much harder to build advanced tools like payment channels and smart contracts on top of the Bitcoin blockchain.

SegWit fixed this by separating the witness data (the signature or witness data) from the rest of the transaction. The signature still gets recorded in each transaction, but it isn’t counted when the block size is being measured.

Think of this as putting the receipts in a separate folder. The transaction will still work, but it will take up less room in the main ledger.

The result was impressive. SegWit transactions were faster and came at a lower cost, and all of it was achieved without raising the block size limit in the traditional sense.

Legacy vs. SegWit vs. Native SegWit

In 2017, the SegWit upgrade introduced two new Bitcoin script types:

- Pay-to-Witness-Pubkey-Hash (P2WPKH)

- Pay-to-Witness-Script-Hash (P2WSH)

These formats moved signature data to a new Witness field, reducing transaction malleability and lowering fees.

Before SegWit, Bitcoin used legacy script types like P2PKH and P2SH. P2WPKH is the SegWit version of P2PKH, while P2WSH mirrors P2SH, often used for multisig transactions.

To ease the transition, developers also introduced wrapped SegWit formats, namely P2SH-P2WPKH and P2SH-P2WSH. This allows older wallets to send to SegWit addresses by embedding them in legacy-compatible scripts.

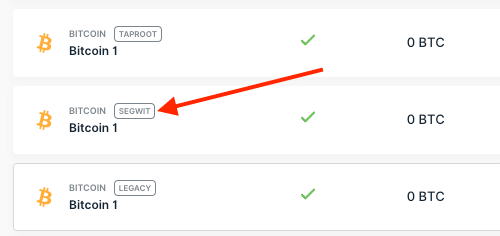

Today, we have three different Bitcoin addresses on the market: legacy, SegWit, and native SegWit. Let’s see how these differ.

| Feature | Legacy (P2PKH / P2SH) | Wrapped SegWit (P2SH-P2WPKH/P2SH-P2WSH) | Native SegWit (P2WPKH/P2WSH) |

| Address prefix | 1 for P2PKH, 3 for P2SH | 3 | bc1 |

| Script type | Legacy | SegWit inside Legacy wrapper | Full SegWit |

| Compatibility | Universal | High (legacy-compatible) | Limited (needs newer wallets) |

| Transaction fees | High | Lower than legacy | Lowest |

| Typical use cases | Standard, Multisig | Transition phase to SegWit | Optimized for modern use |

The Impact of SegWit

SegWit had a major impact on the Bitcoin network.

First, it helped with scalability. By freeing up space in each block, more transactions could be processed. This helped reduce transaction fees and wait times, especially when the network was busy.

It also fixed transaction malleability. With this problem out of the way, developers were able to build second-layer protocols. The famous Lightning Network protocol allows for faster and cheaper off-chain transactions.

The idea of SegWit quickly spread to other blockchain networks as well. Litecoin even adopted it before it was rolled out on Bitcoin. SegWit’s initial success on Litecoin helped validate the idea, building enough confidence in the community to finally implement it in Bitcoin.

Of course, adoption didn’t happen overnight. At first, many crypto wallets and services were slow to support SegWit. Some exchanges waited months or even years to opt for this upgrade. Over time, though, the usage of the upgrade has grown steadily.

As of 2025, over 80% of Bitcoin transactions utilize the SegWit format.

Pros and Cons of SegWit

SegWit brought major changes to Bitcoin and how it processed transaction data. It helped solve some of the network’s biggest problems, but it wasn’t without controversy. To really understand its impact on the blockchain, it helps to look at both sides of the upgrade.

| Pros | Cons |

|---|---|

| SegWit allowed more transactions to be processed per block, making the blockchain much more efficient. | SegWit split the community – some thought it was too conservative, while others argued that the meager effective block size increase was already too much. |

| The drop in transaction congestion led to lower fees and faster transactions, especially during peak times. | Even after it was activated, many wallets and exchanges were slow to switch to SegWit addresses and benefits took years to fully kick in. |

| SegWit made it easier to build tools on top of the Bitcoin blockchain. | The SegWit debate eventually led to the creation of Bitcoin Cash, a Bitcoin hard fork with larger blocks, splitting the community further. |

| SegWit was a successful example of a soft fork, paving the way for other vital upgrades implemented through soft forks and discouraging hard forks. | SegWit helped scale as a transitional upgrade, but further scaling solutions are still needed. |

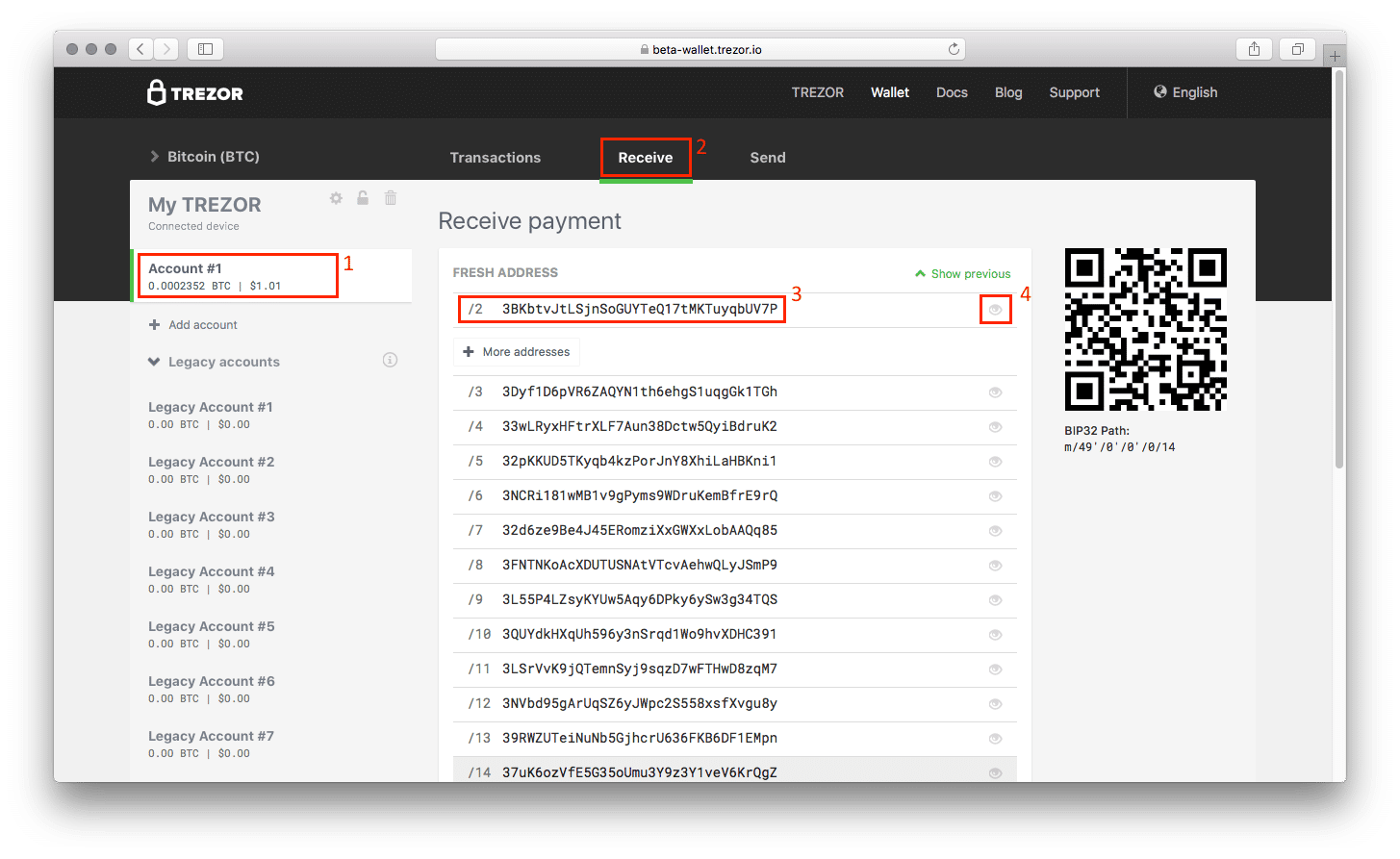

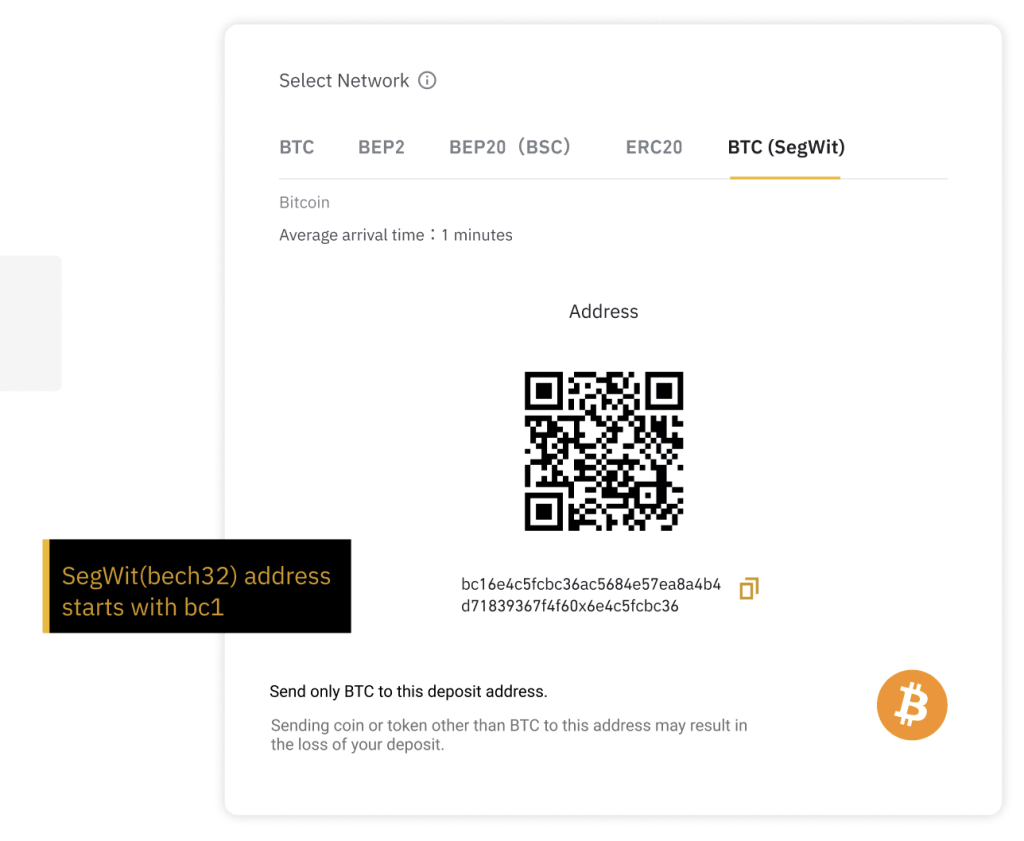

How to Use SegWit Today

Using SegWit is very simple, as long as your Bitcoin wallet supports it. The easiest way is to choose a wallet that creates SegWit addresses by default. The SegWit address starts with bc1 (native SegWit or bech32) or sometimes 3 (P2SH compatibility).

Most major wallets, including Ledger, Trezor, Electrum, as well as popular mobile apps like BlueWallet and Munn, support SegWit.

Here is what you should do:

- Check your wallet settings: Look for address type options. Choose the SegWit or bech32 format.

- Send from a SegWit address: To reduce the transaction size and maybe even the fee, send from a SegWit address.

- Receive with your SegWit address: Share the address when someone wants to pay you. They’ll benefit from lower fees, too.

Bitcoin remains backward-compatible, which means that you can still receive BTC in non-SegWit transactions.

Conclusion

SegWit was one of Bitcoin’s most important upgrades. It helped the Bitcoin network scale, lowered fees, and unlocked many new possibilities. It also revealed the power of soft forks, allowing for major upgrades without splitting the community in half.

However, it didn’t come easily. The arguments around SegWit were some of the biggest arguments in the history of Bitcoin. They led to countless hard forks, endless drama, and deep divisions in the community. Some of these fights continue to this day, and a non-insignificant portion of the Bitcoin community has left for other projects like Bitcoin Cash or Bitcoin SV.

Even now, SegWit isn’t perfect. Much more needs to be done to effectively scale Bitcoin as adoption continues to skyrocket. However, it was a necessary step forward, setting the stage for faster and cheaper Bitcoin transactions in the long run.

FAQs

Is SegWit still relevant in 2025?

Yes. Most of the transactions on the network are now SegWit transactions. This is a core part of Bitcoin and helped make upgrades like Taproot possible.

Does SegWit increase Bitcoin's block size?

Not directly. By moving signature data out of the block weight calculation, it allows more transactions to fit, so it effectively increased the network's capacity.

Is SegWit better than Bitcoin Cash's approach?

This depends on your priorities. SegWit focused on long-term scalability using second layers. Bitcoin Cash chose larger block. The debate on which is better still continues.

Can I use SegWit addresses?

Yes. Most modern wallets support native SegWit addresses (they start with bc1 or 3). They are cheaper to use and more efficient.