ERC-20 is the most widely used token standard on Ethereum. It provides a simple, consistent set of rules that developers can use to mint and manage fungible tokens – digital assets that each hold the same value and utility.

The ERC-20 standard has become a foundational building block for decentralized finance (DeFi) and countless other blockchain projects built on Ethereum. Without such a standard, the exponential growth of new crypto tokens, wallets, and exchanges would likely have been much more complex and difficult to use.

In this guide, we will detail what ERC-20 means, how it works, why it’s so important, and how it compares with other top Ethereum token standards like ERC-721 and ERC-1155.

What Does ERC-20 Mean?

ERC-20 is a technical standard (or token standard) that defines how fungible tokens function in the Ethereum ecosystem, outlining a set of rules for transferring tokens, checking balances, and approving spending. This standard acts like a “rulebook” for developers, helping them create tokens that are compatible with the rest of the Ethereum ecosystem, such as crypto wallets, decentralized applications (dApps), and exchanges. Standardization has played a huge role in fueling the explosion of DeFi projects and other blockchain innovations built on Ethereum.

It’s important to note that ERC-20 is specific to fungible tokens. This simply means that each token is interchangeable with any other token of the same kind, similar to fiat currencies. For example, one ETH is always interchangeable with any other ETH.

What Is An ERC?

The “ERC” in ERC-20 (and every other Ethereum token standard) stands for Ethereum Request for Comment. ERCs are proposals that suggest some kind of technical improvements or standards for how things should function on the Ethereum network. Because Ethereum is an open-source, decentralized platform with no central authority, the ERC system allows developers to submit ideas to be reviewed and further refined by the broader Ethereum community.

An ERC is created through the following process:

- A developer writes a proposal.

- The community reviews and refines the proposals.

- If approved, the proposal becomes an official Ethereum standard.

The number “20” in ERC-20 simply identifies this specific proposal. Other major ERCs include ERC-721, the most popular token standard for non-fungible tokens (NFTs), and ERC 1155, a multi-token standard used in many blockchain games that allows both fungible and non-fungible tokens in one contract.

The History of ERC-20

Before ERC-20, each new blockchain-based token had its own custom code, making it difficult for wallets, exchanges, and decentralized applications (dApps) to support them.

ERC-20 was proposed by an Ethereum developer called Fabian Vogelstellar on November 19, 2015. The idea was to create a standard so that all tokens follow the same set of rules, ensuring compatibility across the Ethereum ecosystem. He posted the proposal on GitHub, a platform where developers store and share code. Vogelstellar explained why this process is so important in driving innovation in an interview at Devcon3 if you want to hear more.

The proposal was recognized in late 2017 and formalized in Ethereum Improvement Proposal 20 (EIP-20), which was written by Vogelsteller and Vitalik Buterin, a cofounder of Ethereum, and can be viewed here.

ERC-20 came to the forefront during the 2017/18 initial coin offering (ICO) boom. An ICO is similar to an initial public offering (IPO) but for a new cryptocurrency instead of a stock. Most tokens launched during this period were on the Ethereum network, and ERC-20 became the industry standard. There are now more than 350 thousand ERC-20 assets.

How ERC-20 Tokens Work

ERC-20 tokens serve a wide range of purposes on the Ethereum network. They can represent digital currencies, voting power in governance systems, or even tokenized versions of real-world assets such as real estate or gold. These tokens are powered by smart contracts, which are self-executing lines of code stored on the Ethereum blockchain. These contracts automatically perform specific functions, such as processing transactions, when certain predetermined conditions are met.

When a developer creates an ERC-20 token, they write a smart contract that defines the token’s name, symbol, supply, and how transactions should work. The contract must implement standard ERC-20 functions. For example, balanceOf() allows the user to check their balance while transfer() instructs the contract to send tokens from one wallet to another. Normally, this would require a strong understanding of coding and Solidity, the coding language used on Ethereum, but today, there are platforms that can help you create tokens much more easily.

This standardization has fueled the rapid growth of DeFi by enabling developers to build interoperable wallets, decentralized exchanges, lending apps, and other DeFi platforms without the need for custom coding. As a result, users can easily trade, lend, stake or borrow tokens across the Ethereum ecosystem.

10 of the Most Popular ERC-20 Tokens

There are hundreds of thousands of ERC-20 assets, but some have gained far more traction than others. Here are ten of the most popular and valuable ERC-20 tokens.

1. Tether (USDT)

Tether is the largest stablecoin in the world by market cap and is pegged to the U.S. dollar. A stablecoin is a token that tracks the value of another asset, like gold or a fiat currency. It offers the advantages of a cryptocurrency without the volatility. Tether is backed by an equivalent reserve of U.S. dollars and (mostly) stable assets like U.S. Treasury bills. However, this was not always the case.

Tether was investigated by the New York Attorney General’s office and fined in 2021 after falsely claiming that every token was backed 1:1 by cash reserves. In reality, its reserves were mostly made up of commercial paper, a kind of short-term, unsecured corporate debt, and other non-cash assets. You can now check Tether’s reserves on its transparency page.

2. USDC (USDC)

USDC is the second largest stablecoin in the world, with its value pegged to the U.S. dollar. It is backed by crypto exchange Coinbase and Circle, a blockchain-focused fintech company. While it was originally created on Ethereum, USDC is also available on various other blockchains. Like Tether, USDC reports its reserves on its transparency page.

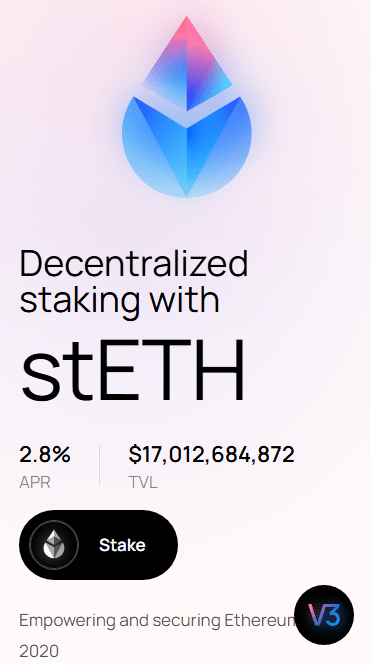

3. Lido Staked Ether (stETH)

stETH is a token you get when you stake Ethereum through a service called Lido, the top liquid staking service on the network. Staking involves pledging your ETH to help secure and operate the blockchain network in exchange for rewards (more ETH). Normally, staked ETH is locked up and unusable, but with liquid staking tokens like stETH, you receive a tradable token that represents your staked ETH. This way, you can use your stETH on various DeFi platforms while still earning your staking rewards.

4. Chainlink (LINK)

Chainlink is a decentralized oracle network built on Ethereum and other blockchains, connecting the blockchain to real-world, off-chain data like asset prices or sports results. It uses multiple independent data providers (or oracles) to reliably access and verify this data. For example, if you wanted to take out a loan using ETH as collateral, Chainlink could pull up the current market price of ETH and share it with a DeFi app to determine how much ETH you need to lock up.

Chainlink is one of the first and most prominent oracle networks in the world. It was launched in 2017 by a company called SmartContract. It uses its native token, LINK, to pay oracles for providing accurate and reliable data.

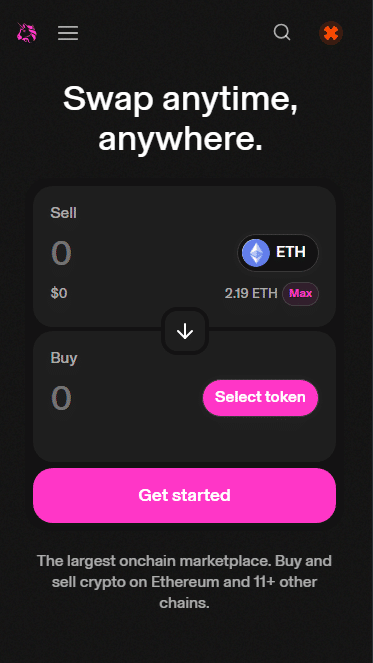

5. Uniswap (UNI)

Uniswap was one of the first major DeFi apps on Ethereum, and it quickly became the largest decentralized exchange (DEX) on the chain. It allows users to trade crypto without a middleman in just a few clicks. Uniswap’s native token, UNI, is a governance token that gives its holders voting rights to help direct its future. Anyone who holds UNI can vote on key proposals like protocol upgrades and updated fee structures. Uniswap is also known for popularizing the “airdrop” method of distributing tokens after it distributed 400 UNI tokens to early users in 2020.

Uniswap recently launched its own blockchain, Unichain, though it is still operating on Ethereum and other popular networks as well.

6. Shiba Inu (SHIB)

Shiba Inu is a meme-inspired ERC-20 token that gained massive popularity as an alternative to Dogecoin (DOGE). Unlike DOGE (which runs on its own chain), SHIB is Ethereum-based, which allows for a much wider range of potential use cases.

The token was created in 2020 by an anonymous developer under the pseudonym Ryoshi. It began with an enormous total supply – one quadrillion tokens – and has evolved from a meme into a full ecosystem with its own decentralized exchange, staking protocol, and other DeFi functionality. Like DOGE, SHIB benefited from the 2020 memecoin craze and the 2021 GameStop saga.

7. Wrapped Bitcoin (WBTC)

Wrapped Bitcoin allows Bitcoin holders to interact with Ethereum’s DeFi platforms. Bitcoin and Wrapped Bitcoin have equal value, and each WBTC is backed by 1:1 Bitcoin held in reserve. By converting real Bitcoin into Wrapped Bitcoin, users can gain access to the massive ecosystem of DeFi platforms on Ethereum.

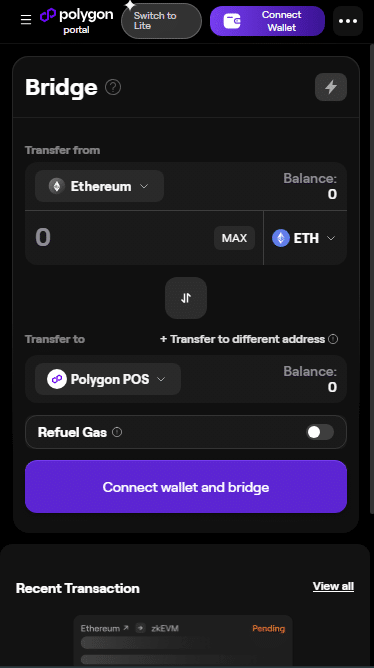

8. Polygon (MATIC)

Polygon is a separate blockchain designed to operate alongside Ethereum as a “layer two” network, helping to improve transaction speed and lower costs. Ethereum users can “bridge” crypto onto Polygon with its official bridge to engage with crypto apps there.

Because Polygon is so similar to Ethereum, developers can easily alter their Ethereum platforms to support Polygon, providing a cheaper and faster alternative. Polygon’s native cryptocurrency is MATIC and it’s an ERC-20 token.

9. Wrapped Ether (wETH)

Ether, the native token of Ethereum, doesn’t follow the ERC-20 standard which means it isn’t compatible with some dApps. For example, you have to use wETH and not ETH to bid on NFTs on OpenSea. Wrapped Ether solves this problem by tokenizing Ether into an ERC-20-compliant token at a 1:1 ratio.

You can exchange your Ether for Wrapped Ether to make it easier to trade, lend, and engage with DeFi protocols that require ERC-20 tokens. Wrapped Ether is also popular on layer 2 networks like Polygon to avoid fees and delays on Ethereum.

10. Dai (DAI)

Like Tether and USDC, DAI is a decentralized stablecoin that is pegged to the U.S. dollar. However, it is not backed by fiat currency. Instead, it is backed by crypto collateral (mainly Ether), which operates using an autonomous smart contract system called The Maker Protocol. DAI is heavily over-collateralized to help ensure that fluctuations in the value of its collateral don’t depeg the stablecoin.

Dai was created by the Maker Foundation, which was founded as an open-source project in 2014. It is now controlled by the decentralized autonomous organization MakerDAO.

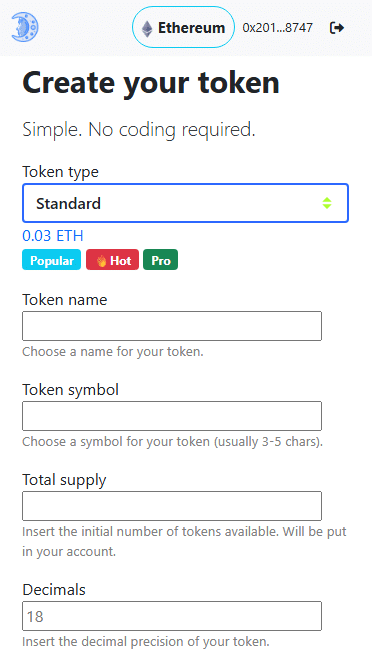

How to Create an ERC-20 Token Without Any Coding

To create an ERC-20 token from scratch, you need a deep understanding of Ethereum’s coding language, Solidity. You also need to be able to deploy that code on the Ethereum blockchain, and understand gas fees, wallets, and security best practices. Fortunately, several browser-based platforms now allow you to create ERC-20 tokens without coding. These include Moon Deploy, Coin Factory, and CreateMyToken.

Here are the key steps in the token-making process.

Step 1: Choose a Platform

Crypto token creator tools are not regulated, and there are plenty of scams in this space. Do some research (e.g., search the tool on social media, look for user reviews, and check GitHub or the founders’ LinkedIn profile) and make sure the site is set up securely (e.g., uses HTTPS, not just HTTP). A legitimate site will never ask you to share your private key or make unrealistic promises. If it sounds too good to be true, it probably is.

Step 2: Create and Connect Your Wallet

If you don’t already have one, you’ll need to create an Ethereum wallet. The token creator platform will ask you to connect your wallet in order to proceed. You’ll need to have some Ethereum in your wallet to get started.

Step 3: Name Your Token and Enter Key Details

When prompted, use the simple interface to enter key details like your token’s name, symbol, and total supply. You may be able to use a template or select generic answers for some of the parameters required.

Step 4: Pay a Fee

Gas fees are essentially transaction fees on the Ethereum network. They are paid in ETH and used to remunerate validators who keep the network running. At the time of writing, Moon Deploy charges 0.03 ETH in gas fees when you create a token. This equates to less than US$50. More complex tokens will likely cost significantly more.

Step 5: Create

Hit “Create.” Confirm your new token. Then, add it to your wallet. If you are using MetaMask, you can check out its support page for a step-by-step guide.

Other Popular Ethereum Token Standards

ERC-20 is the most widely used standard that governs fungible tokens on the Ethereum network, but there are several other ERC standards that enable different functionalities. Here are three of the most notable standards:

ERC-721

ERC-721 is the main standard for non-fungible tokens (NFTs). While fungible tokens are interchangeable (like a dollar or a Bitcoin), non-fungible tokens are one-of-a-kind and have a unique value (like artwork or sports memorabilia). They can serve as proof of ownership for digital assets like music, art, collectibles, in-game items, and even tokenized real-world assets. If you know anything about NFTs, you have probably heard of the Bored Ape Yacht Club NFT collection. These colorful pictures of apes in various garb have sold for millions of dollars apiece.

ERC-721 ensures that NFT smart contracts have metadata that indicates their unique identity and maintains a record of ownership. Naturally, it also allows users to manage and transfer their NFTs. ERC-721 is a widely adopted standard and platforms like OpenSea make it extremely easy to create your own ERC-721 tokens without any coding knowledge required.

ERC-1155

ERC-1155 is a multi-token standard that supports both fungible and non-fungible tokens within a single smart contract. The flexibility of this token standard allows developers to include an unlimited number of assets in a single contract and transfer them in just one transaction.

According to Ethereum.org, ERC-1155 also “improves the functionality of both the ERC-20 and ERC-721 standards, making it more efficient and correcting obvious implementation errors.” ERC-1155 tokens are especially popular in blockchain-based games where some assets are fungible (like common weapons) while others are non-fungible (such as avatars or digital land).

ERC-777

ERC-777 improves on ERC-20 by including more advanced features for token transfers. For example, ERC-20 requires users to manually approve token spending. ERC-77 simplifies this step with a function called “hooks” that lets smart contracts react automatically to incoming tokens. For example, a decentralized exchange using ERC-777 tokens can instantly execute a trade when tokens are received without needing prior approval (which is impossible with ERC-20).

It’s important to note that ERC-777 is backward-compatible with ERC-20, meaning that it can work with most existing Ethereum wallets, platforms, and tools, making it a flexible option for developers building in the DeFi space.

The Future of ERC-20 Tokens

Ethereum is at a pivotal moment in its history and it is facing a number of major challenges. The Financial Times argued that Ethereum is having a “midlife crisis” as it faces stiff competition from newer, faster networks like Solana. Uniswap – one of the biggest drivers of activity on Ethereum – has launched its own blockchain (Unichain), raising concerns that other high-volume projects will follow.

Unichain is about to cross $4B in volume on the Uniswap Protocol

Pink chain is on the move ✨

— Uniswap Labs 🦄 (@Uniswap) April 28, 2025

In addition, the Ethereum Foundation is split over arguments about the network’s long-term direction. Meanwhile, the whole crypto industry is struggling as it faces an extraordinarily volatile economic and regulatory environment.

Nevertheless, Ethereum still shows strong signs of resilience. Activity on layer-2 networks – such as Arbitrum and Optimism – have reached an all-time high, helping to scale Ethereum and reduce network congestion on the main chain. Growing institutional interest in Ethereum, with institutions like Fidelity investing over $25 million in Ethereum, is another major positive sign.

In May 2025, Ethereum will undergo an upgrade known as Pectra, which aims to make the network more efficient and easier to use. The upgrade will include improvements to the staking process and introduce “smart wallets” that behave more like apps. The next planned major upgrade, Fusaka, is expected later in 2025 to continue to build on these improvements.

If Ethereum can reestablish itself as an industry leader and survive the competition and other market challenges, it may power the next wave of innovation in crypto and beyond. If it fails to reduce transaction costs and network congestion, it may fall behind its faster competitors like Solana for good.

ERC-20 Tokens Are Here to Stay

ERC-20 has established itself as the go-to standard for building cryptocurrencies on Ethereum. The standardization that it provides ensures vital compatibility across wallets, apps, and exchanges throughout the network. ERC-20 has undeniably paved the way for an explosion of new tokens (e.g. Tether, Shiba Inu, and USDC) and DeFi applications with a broad range of use cases.

However, Ethereum faces challenging market conditions and has underperformed compared to other blockchains in recent years. Network updates in 2025 could help to reestablish the network as the industry leading programmable blockchain and this essential standard isn’t going away anytime soon.

FAQs

What does ERC-20 mean?

ERC-20 stands for Ethereum Request for Comment 20, a technical standard that defines how fungible tokens should work on the Ethereum network to ensure compatibility across the entire ecosystem of wallets, exchanges, and dApps.

Is USDT an ERC-20 token?

Yes, USDT is available as an ERC-20 token on Ethereum, though it is also issued on other blockchains like Solana and Tron.

Are ERC-20 tokens safe?

ERC-20 tokens are no more or less safe than any other kind of token. Most are generally safe to use, but their security depends on the smart contracts behind them and how users store them.

Where can you buy ERC-20 tokens?

You can buy ERC-20 tokens on most centralized crypto exchanges like Coinbase or Binance, as well as decentralized exchanges like Uniswap.

Is ETH an ERC-20 token?

No, ETH is Ethereum's native token and doesn't follow the ERC-20 standard. However, Wrapped Ethereum (wETH) is a popular ERC-20 version of the token.