Financial privacy expectations are shifting as traditional transactional methods often fail to provide the privacy or freedom that they want. There are limitations, boundaries, and prying eyes everywhere. Cryptocurrencies offer a solution to these concerns, providing a level of privacy and freedom that is often unattainable in the traditional financial world.

The emergence of Bitcoin seemed like the golden goose for these privacy-minded individuals, but many have since realized that the network is far from perfect in this regard. Luckily for them, developers have been working on solutions that function on top of Bitcoin and other cryptos to enhance privacy, making transactions more secure and anonymous while addressing the network’s limitations.

One of the most prominent privacy technologies in the Bitcoin world is CoinJoin, a technique that allows multiple users to combine their transactions into a single, larger one. This effectively obfuscates the transaction history, making it much harder to match transactions with individual users. However, the tech isn’t only used for basic privacy. It’s also popular with criminals looking to launder illicit or sanctioned funds.

This raises important questions: How good is CoinJoin at protecting your privacy? And is it even legal?

People thinking about using CoinJoin need a closer look at the technology – what it is, how it works, and whether it’s a safe option for providing the maximum financial privacy possible.

What Is CoinJoin?

CoinJoin is a privacy-enhancing technique that helps enhance transaction privacy on Bitcoin. Using CoinJoin itself is not inherently illegal in most jurisdictions, though its legality is dependent on the context and nature of the transaction.

A common misconception is that Bitcoin transactions are anonymous and private by nature. It’s true that Bitcoin users don’t get their names revealed, but since it’s a public Bitcoin network, the blockchain is fully transparent, and all recorded details are publicly visible and easily trackable by the government. Most of the time, to swap cryptocurrencies for fiat currencies, you need to go through a registered crypto exchange, which is typically required to verify your identity before transactions.

Bitcoin transactions reveal the amount sent, the sending Bitcoin address, and the receiving Bitcoin address publicly. All data remains publicly available on the blockchain forever.

That’s where CoinJoin offers value, adding a layer of privacy. Here’s how it works:

- It helps conceal user data, such as the receiver’s and sender’s addresses. By obscuring which wallet addresses are used to send specific amounts, CoinJoin ensures that the transaction remains private.

- It merges multiple users’ transactions into one, which helps hide the link addresses between the sender and the receiver, making the transaction difficult to trace.

Naturally, this kind of tech is attractive to criminals, and U.S. regulators have recently cracked down on platforms facilitating CoinJoin transactions. For example, Keonne Rodriguez and William Lonergan Hill were arrested for allegedly operating an unlicensed money-transmitting business, Samourai Wallet, and facilitating over $2 billion in unlawful transactions. This case highlights the tension between financial privacy tools like Samourai’s CoinJoin Mixer and the regulatory efforts to prevent money laundering.

While it’s likely that CoinJoin is still used to conceal illegal funds, the tech also offers several legitimate applications. For example, businesses can use it to pay their suppliers without letting their competitors get a hint about their transaction details.

Here are the top 3 ways CoinJoin can be used for legitimate purposes:

1. Financial Privacy

If you’re using Bitcoin transactions every day, it can expose your spending habits to the public. CoinJoin can help you stay protected from potential scams and theft by making your transactions harder to trace, offering something closer to traditional banking privacy.

2. Activism

Activists, protesters, and journalists can use the CoinJoin protocol to safely transfer funds or coins for their causes. Since the funds or coins cannot be traced or seized as easily by blockchain surveillance or the government, the service is useful for keeping advocacy efforts free from manipulation.

3. Charity

People can use CoinJoin transactions to donate without revealing their identity. This could be a useful way for a donor to give secretly because their information can’t be traced (though it’s far from ideal from a legal perspective).

How Does CoinJoin Work?

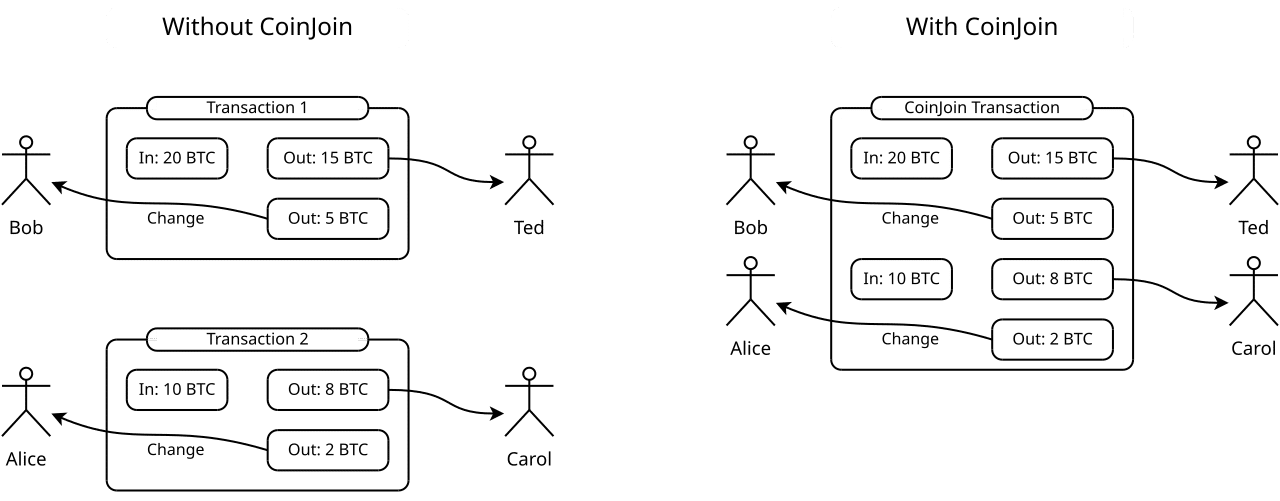

CoinJoin is much simpler than it may seem on the surface. All it is doing is mixing a bunch of Bitcoin transactions together to maintain anonymity. It makes the transaction inputs and standard outputs data unclear, so it’s difficult to tell who sent coins to whom.

For example, five individuals each want to make private Bitcoin transactions to different destinations. CoinJoin combines all of the transactions into a single one, masking the details of the exchange. This makes it much more difficult to trace the amounts of coins sent or received.

To illustrate this from the Bitcoin users’ perspective, we can look at this simple example:

If Bitcoin user A wants to send 0.1 BTC from their wallet to User B, the blockchain records the transaction as A sending 0.1 BTC to B.

Any observer can check a blockchain explorer to find that A paid B 0.1 BTC. Both wallet addresses are still easily trackable even though names and IP addresses are hidden. Because the connection is recorded permanently on the blockchain, it’s now publicly visible. The public Bitcoin network doesn’t require your name or address to complete a transaction, but your wallets can be linked to you through details provided to a crypto exchange or your wallet provider, along with your transaction history.

CoinJoin in Action

To illustrate how CoinJoin provides greater anonymity, let’s look at this example. User A enters into a CoinJoin transaction with 10 other people, each sending 0.1 BTC to different wallets. CoinJoin mixes the transactions so the blockchain shows 10 senders sending crypto coins to 10 receivers. However, it does not reveal who sent funds to whom.

No one can determine whether User A sent crypto to User B or to anyone else among the other receivers. Observers can tell that crypto moved from 10 people to 10 people. All the receivers get paid correctly, but it gets recorded as a single transaction. In some cases, users can repeat multiple rounds of CoinJoin to further obfuscate their transactions.

While CoinJoin transactions significantly increase the privacy surrounding Bitcoin transfers, some misconceptions should still be cleared up to create reasonable expectations and promote proper use.

Common CoinJoin Misconceptions

Like most emerging technologies, there are plenty of misconceptions floating around the crypto world surrounding CoinJoin. Here are three of the most common misunderstandings:

1. CoinJoin Transactions are Completely Anonymous

CoinJoin is not perfect. It cannot provide its users with entirely anonymous transactions, although it still offers more privacy than a regular Bitcoin transaction would. Using advanced techniques like timing analysis, address clustering, behavioral analysis, and others, it’s still possible to trace back to the participants of a CoinJoin transaction.

2. CoinJoin Only Works for Large Transactions

The more participants in a CoinJoin transaction, the stronger the privacy becomes. But that doesn’t mean CoinJoin only works for large transactions. It’s effective for all sorts of transactions, regardless of their size.

3. CoinJoin Doesn’t Offer Much Privacy

On the surface, it may seem like CoinJoin doesn’t make transactions much more private because all of the senders and receivers are still publicly available on the blockchain. However, hiding the connections between the senders and receivers absolutely makes transactions significantly harder to trace.

CoinJoin vs. Crypto Mixers

A crypto mixer is a mixing service that masks the origin or destination of a crypto transaction by mixing multiple transactions from different users. Various types of crypto mixers exist, including centralized services (like Bitcoin Mixer and Anonymixer) and smart contract-based solutions, each with different approaches to providing transaction privacy.

Typically, these mixing services are used with public blockchains like Ethereum and Bitcoin. While mixing tech like CoinJoin is Bitcoin-focused, others offer mixing on other blockchain networks.

CoinJoin vs. TornadoCash

Let’s compare CoinJoin with the infamous crypto mixer TornadoCash. TornadoCash uses smart contracts and zk-SNARKs to make transactions anonymous, as it breaks the on-chain link addresses between the participants. Smart contracts are programs on the blockchain that allow the participants to generate a code called a deposit note using zk-SNARKs (a cryptographic privacy tool that verifies transactions without revealing specific details). This program automatically triggers when someone tries to send or withdraw Ether (ETH).

Let’s say User X deposits 1 ETH into TornadoCash. The smart contract then triggers and gives User X a deposit note. Now, User X can use that note to withdraw the crypto coins or give it to someone else to withdraw. This ensures there’s no traceable link between the participants.

One key difference between CoinJoin and TornadoCash is the amount of tokens you are allowed to mix. TornadoCash allows only identical amounts to be sent, whereas CoinJoin supports mixing varying amounts.

For example, if Users A, B, and C want to transfer funds or coins via TornadoCash, they all need to select exactly the same amount, such as 1, 5, or 10 ETH. On the other hand, with CoinJoin, A, B, and C can mix and send varying amounts.

Here’s a quick rundown of the main differences between CoinJoin and TornadoCash:

| Key Aspects | CoinJoin | Tornado Cash |

| Blockchain Network | Bitcoin | Ethereum |

| User Process | Combines multiple transactions and shows them as a single transaction | Depositor gets a secret note to withdraw funds or coins later |

| Use of Smart Contracts | No | Yes |

| Automated? | Can be automated via wallet software | Automated through smart contracts |

| Mixing Amounts | Variable amounts allowed | Only specific amounts (except through its Nova service) |

| Link Between Participants | Broken | Broken |

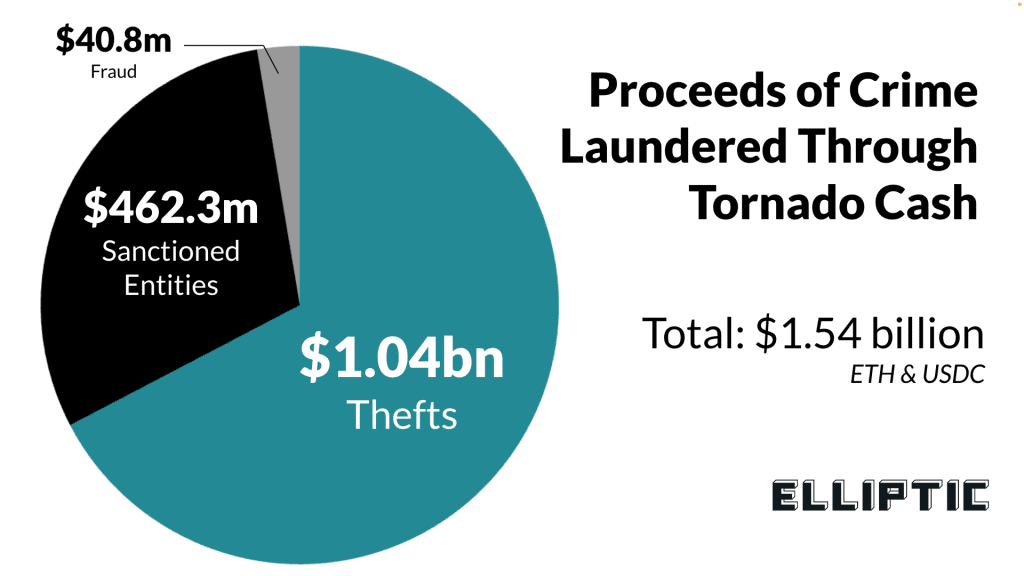

Like CoinJoin, the legality of crypto mixers often depends on the context and nature of the transaction (as well as the jurisdiction). Hiding illegal activities with a mixer is explicitly illegal in the U.S. and most advanced countries. Institutions and exchanges may also refuse to exchange (or even freeze) mixed cryptocurrencies due to their association with criminal activities, making them especially risky to use. This is hardly surprising, as the vast majority of the crypto from mixed services like Tornado Cash seems to have been attained through criminal means such as theft, fraud, or evasion of sanctions.

It’s also vital to note that TornadoCash has been accused of being involved in laundering more than $455 million in the past (and potentially much more). The Lazarus Group – a government-backed hacking group from North Korea – laundered stolen crypto through TornadoCash. As a result, the Biden administration’s Office of Foreign Assets Control (OFAC) sanctioned TornadoCash in August 2022, making it illegal for Americans to use the service. The sanctions were later lifted, but the platform is still stuck in a regulatory grey area.

Is CoinJoin Illegal? What Are the Risks?

Now that you know more about CoinJoin and other crypto mixers, it’s time to fully address the important question of legality. Is CoinJoin illegal? The answer depends on your intentions, actions, and jurisdiction.

CoinJoin transactions are generally legal for most users in the U.S. if you’re only seeking privacy for legal transactions. However, using CoinJoin (or any kind of mixing tech or service) to conceal illegal activity is considered a crime.

Many of the founders and operators of the largest (allegedly) illegal mixing services, including Samourai Wallet and Tornado Cash, have been charged with various crimes relating to money laundering and running unlicensed money-transmitting services. Following the arrests of the Samourai Wallet founders in 2024, CoinJoin implementations in Wasabi Wallet and Whirlpool, both associated with Samourai Wallet, were also shut down due to mounting regulatory pressures and law enforcement actions targeting these tools.

It seems to be essentially impossible to run such a service without violating U.S. law due to its anti-money laundering requirements. Naturally, very few developers are willing to take on the risk. As a result, the future of CoinJoin looks far from certain due to decreasing availability.

Is CoinJoin Safe to Use?

The question remains: is CoinJoin safe to use if users can still access a functioning service? From a privacy standpoint, CoinJoin remains a relatively popular option for anonymity. However, from a legal perspective, it puts users in a troubling grey area. Because legal and illegal transactions can get mixed together in joint transactions, no one can easily tell which ones are legitimate, and you could easily get caught in the crossfire.

While CoinJoin breaks the connection between sender and receiver, making it harder to trace the flow of funds or coins, it’s not foolproof. Advanced tracing tools and techniques can still identify patterns. You could face legal scrutiny or accusations of assisting illegal activity, even if your transactions were entirely legal.

Understanding the Risks of CoinJoin

Shutdowns, criminal charges, and close monitoring are being applied to CoinJoin to try to prevent its misuse for illicit activities like money laundering. However, it’s still available through a variety of decentralized apps. If you’re concerned about the legality of CoinJoin, it’s best to avoid using it (as well as other mixers) entirely or, at the very least, seek legal counsel before doing anything.

Using CoinJoin doesn’t automatically imply involvement in illegal activities, and it can be a valuable tool for privacy-minded individuals. However, it’s important to remember that CoinJoin isn’t foolproof, and the legal and regulatory uncertainties surrounding it make its use risky at best.

FAQs

What's the point of CoinJoin?

The point of CoinJoin is to enhance privacy by mixing multiple Bitcoin transactions into one, making it significantly harder to trace the origins and destinations of the funds.

Is using CoinJoin illegal?

Using CoinJoin is not inherently illegal in most jurisdictions, but using these kinds of technologies or services to hide illicit activities like money laundering is illegal.

Does CoinJoin actually work?

Yes, CoinJoin definitely helps obscure the links between senders and receivers, making it harder to trace transactions. However, it's not perfect, and detailed analysis can still potentially trace transactions.

Is CoinJoin traceable?

CoinJoin can sometimes still be traced through advanced blockchain analysis, though it makes it significantly harder.

What's the difference between CoinJoin and crypto mixers?

CoinJoin is one specific privacy technique that combines multiple transactions into one, whereas crypto mixers are services that pool funds in various ways to obscure transaction histories.

References

- Samourai Wallet founders & CEO arrested, charged – United States Attorney’s Office, SDNY

- Pinpointing and Measuring Wasabi and Samourai CoinJoins in the Bitcoin Ecosystem – ResearchGate

- US drops sanctions on Tornado Cash – Reuters

- Tornado Cash Co-Founders accused of money laundering – FBI

- What Are ZK-Snarks? – Investopedia