Bitcoin Hyper is a cutting-edge Bitcoin Layer-2 solution launched in early May 2025 alongside the release of its whitepaper. It aims to combine Bitcoin’s security and decentralization with Solana’s cheap, lightning-fast transactions and endless utility.

The project touts major claims, including a custom implementation of Solana’s Virtual Machine for speed and a roadmap toward community-led governance. This all sounds amazing, but with so many crypto projects turning out to be scams, it is important to examine this new idea carefully.

What Is Bitcoin Hyper?

The main goal of Bitcoin Hyper is to solve the greatest problems facing Bitcoin today: scalability and utility. Users don’t want to pay a few dollars for every single transaction, especially when it takes so long to process them.

Bitcoin Hyper emerged in early May 2025, which coincides with the release of its white paper. The white paper lays out the vision: a Bitcoin Layer-2 built on Solana’s VM, using advanced zero-knowledge proofs and retaining full-grade Bitcoin security. It details the Canonical Bridge, staking models, tokenomics, and rollout strategy from presale to DAO governance.

How Bitcoin Hyper Works

Bitcoin Hyper claims that it will process transactions in about 2 seconds, thanks to a globally distributed network with nodes in Singapore, London, Frankfurt, California, Nevada, and Florida.

Ideally, its advanced cryptographic mechanisms should help reduce both the transaction fees and the waiting times. The idea is to make small-value Bitcoin transactions more practical than before and even cost-efficient for everyday use.

While its initial focus is on Bitcoin payments, Bitcoin Hyper states that its mission is to carry forward Bitcoin’s community ethos and integrate deeply into the systems of merchants. This hints at a future functionality, such as DeFi applications, all secured by the already proven Bitcoin model.

“Our core mission is to carry on the “world community” aspect of the original Bitcoin project. To that end, we are actively integrating Bitcoin Hyper into the existing merchant processing networks for a true native and seamless solution,” said Bitcoin Hyper Community Member Mike Estrada.

A More Technical Overview of Bitcoin Hyper

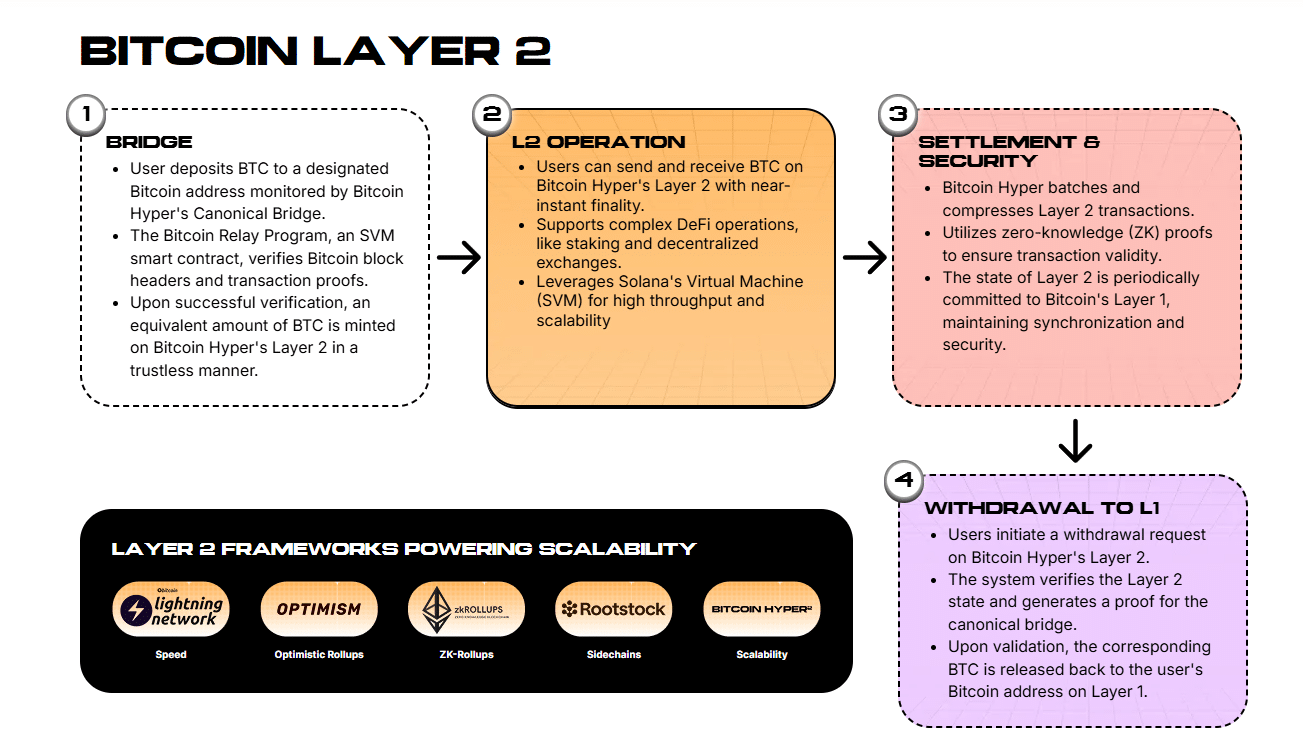

Bitcoin Hyper is a Layer 2 protocol designed to improve Bitcoin by leveraging Solana’s Virtual Machine (SVM) for speed, scalability, and programmability. Its core infrastructure includes:

- Canonical Bridge + Bitcoin Relay: Users lock BTC in a monitored Bitcoin address. A bridge then verifies using relay proofs before it mints an equal amount on the new network.

- Layer 2 Settlement System: The transactions occur in the SVM-powered environment. Batches are compressed using ZK proofs and are regularly committed (anchored) back to Bitcoin for security.

- Withdrawal Process: Users can redeem wrapped BTC by proving their Layer-2 balance to the bridge, which triggers a release of the original BTC.

- Proof-of-Stake + Energy Efficiency: The protocol runs on PoS, which reduces power use significantly compared to Bitcoin’s PoW.

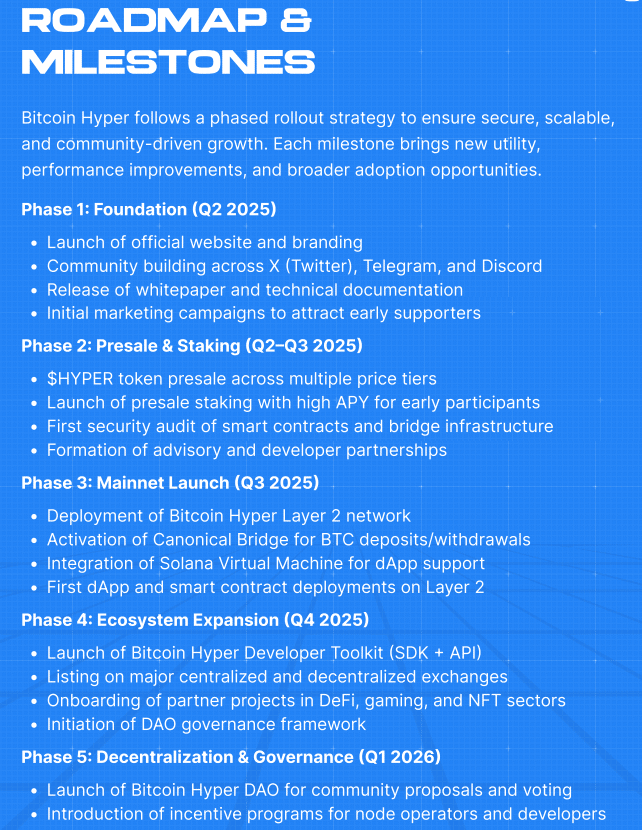

According to the white paper, the roadmap stages for Bitcoin Hyper include:

- Phase 1 (May-August 2025): Presale, staking launch, technical documentation, and audits.

- Q3 2025: Mainnet deployment, bridge launch, inception of smart contracts, and merchant integrations.

- Late 2025 – Q1 2026: SDK release, exchange listings, DAO formation, developer partnerships and grants, and DeFi apps deployment.

Presale and Token Sale Mechanics

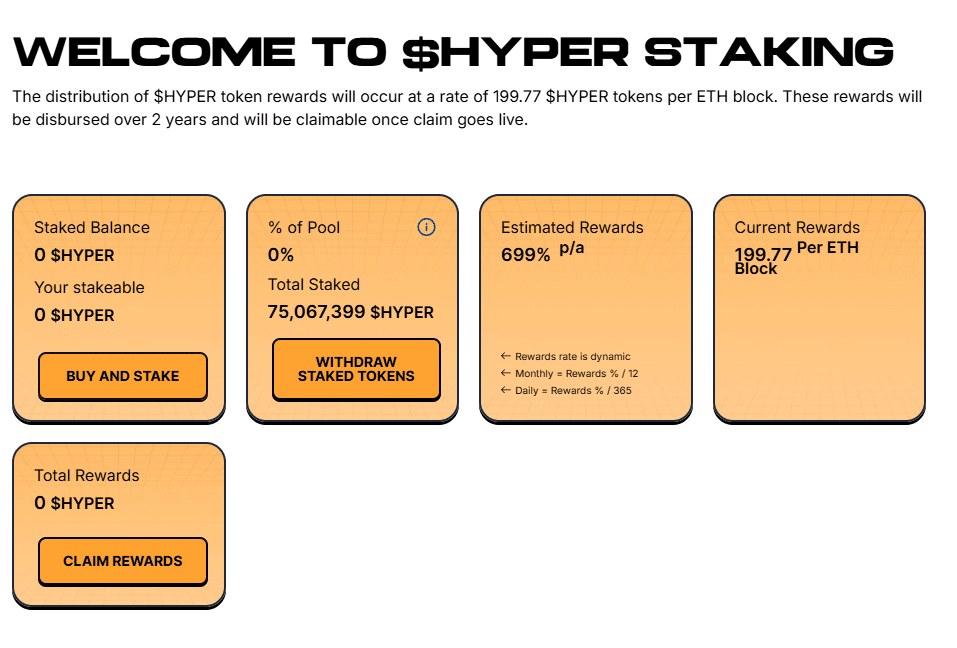

The Bitcoin Hyper network will be powered by its native token, $HYPER. It will be used to pay for transactions, earn premium features, earn staking rewards, and vote in governance decisions. It is currently in its presale phase, but investors can already stake their $HYPER and start earning rewards immediately. The total supply is capped at 21 billion tokens.

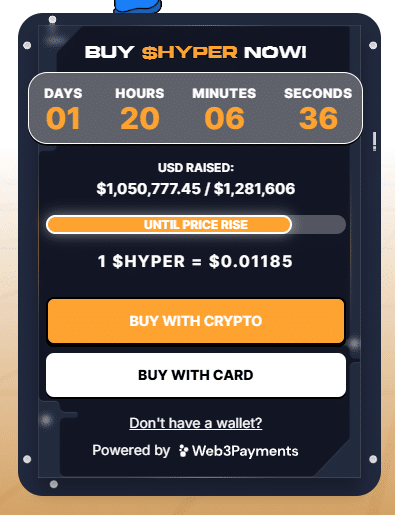

The Bitcoin Hyper initial presale price opened at $0.01150 per token on May 6, 2025, climbing every 3 days per stage, as was described in the white paper. As of June 2025, Bitcoin Hyper has officially passed $1 million in its ICO in just five days. This marks the rise of the first true Layer-2 built for Bitcoin.

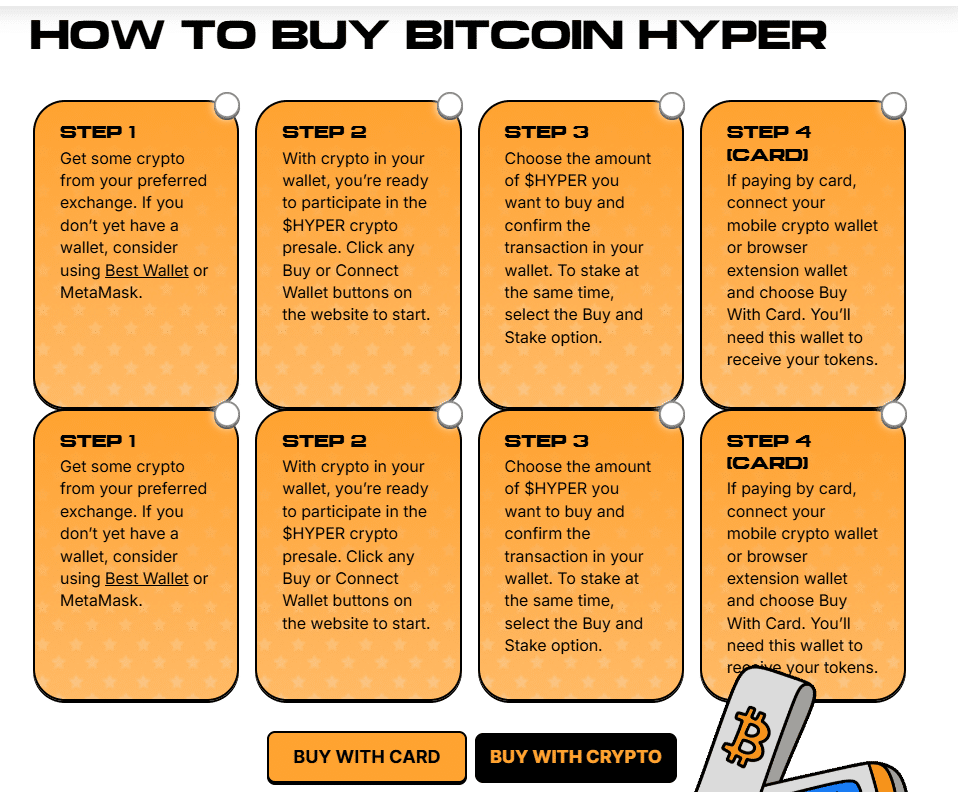

Early presale buyers are already earning up to 622% APY on their $HYPER tokens, though this may decrease somewhat as more users stake. The Bitcoin Hyper presale is fully public without private or VC-only rounds. The Bitcoin Hyper website accepts ETH, USDT, BNB, and even credit card payments via OTC widgets.

Tokens will be generated at $0.012975, which is a premium of around 12% on the Bitcoin Hyper presale price, with public listing targeted for Q3-Q4 2025, starting on Uniswap and followed by other major exchanges.

Bitcoin Hyper Price Prediction

So far, many analysts have shared their projections based on the token launch, roadmap success, and trends in the market.

We anticipate that Bitcoin Hyper will close the year at $0.080445, reflecting a 6.2x gain from the TGE. 99Bitcoin, on the other hand, estimates that $HYPER could launch on exchanges in fall 2025 at around $0.0425, with a possible rise to $0.21.

A CryptoNews model offers a range of $0.0115 to $0.0583 with an average near $0.03 in their Bitcoin Hyper price prediction.

What To Look For When Deciding Whether a Project Is Legit

Before you dive into such an attractive crypto project and any crypto project in general, it is smart to carefully analyze it first. To do that, you need to know what signs point to something legit and what might be a red flag. The crypto space is full of bold promises, but only a few projects truly live up to the hype.

When looking at Bitcoin Hyper, we need to ask the tough questions. Is Bitcoin Hyper a scam or is it legit? Does it solve a major problem? Is the technology behind it secure?

Let’s take a closer look at the main things we should look out for in new projects before you go and buy Bitcoin Hyper.

1. Does Bitcoin Hyper Solve a Major Problem?

Any legit crypto project should solve a real problem. Bitcoin Hyper aims to tackle the well-known issues of the Bitcoin blockchain network: slow transaction speeds, high fees, and limited smart contract capabilities.

Bitcoin’s network currently processes about 3.3 to 7 transactions per second, which is much slower compared to other blockchains like Ethereum or Solana. Additionally, fees are high even when the network isn’t busy, and they can spike much higher during congestion.

Bitcoin Hyper absolutely offers a solution to a real problem. It promises to build a Layer-2 solution using Solana’s virtual machine and solve the problems above while anchoring security back to Bitcoin’s mainnet. This is important because Bitcoin itself is struggling to scale and lacks native DeFi capabilities.

However, many projects already aim to improve Bitcoin’s scalability and utility. The Lightning Network is already widely adopted for faster payments, and RSK adds smart contract capabilities secured by Bitcoin’s merged mining.

The key question here is whether Bitcoin Hyper can deliver the same level of security as Bitcoin and DeFi flexibility, while being better than the existing solutions.

2. Security Audits

Security audits are independent, expert code reviews done to identify vulnerabilities before hackers can exploit them. Projects that don’t have audits or have incomplete audits risk serious security flaws.

So far, Bitcoin Hyper has been audited by Coinsult, a reputable crypto security firm, which is a good sign. However, the full Layer-2 chain isn’t finished or audited yet, so some of the fork’s core components remain to be tested publicly.

This means that investors should be cautious until full audits are completed and published to the public.

3. Roadmap Progress

A clear roadmap will signal whether the team can meet its goals and deliver on its promises. It provides transparency and helps the users monitor the project’s progress.

Bitcoin Hyper’s roadmap includes presale and staking, mainnet and cross-chain bridge launch, SDK releases, exchange listings, and DAO governance setup into early 2026. Let’s take a look at the detailed roadmap as published in the Bitcoin Hyper whitepaper:

Now, while the roadmap is clear and detailed, the project is currently in the presale phase with no live mainnet or testnet. This means that critical technical milestones are yet to come, so these early stages require close monitoring.

Since the project is still in its early presale phase, the current Bitcoin Hyper price is speculative. Future exchange listings and releases are likely to impact its valuation, as well.

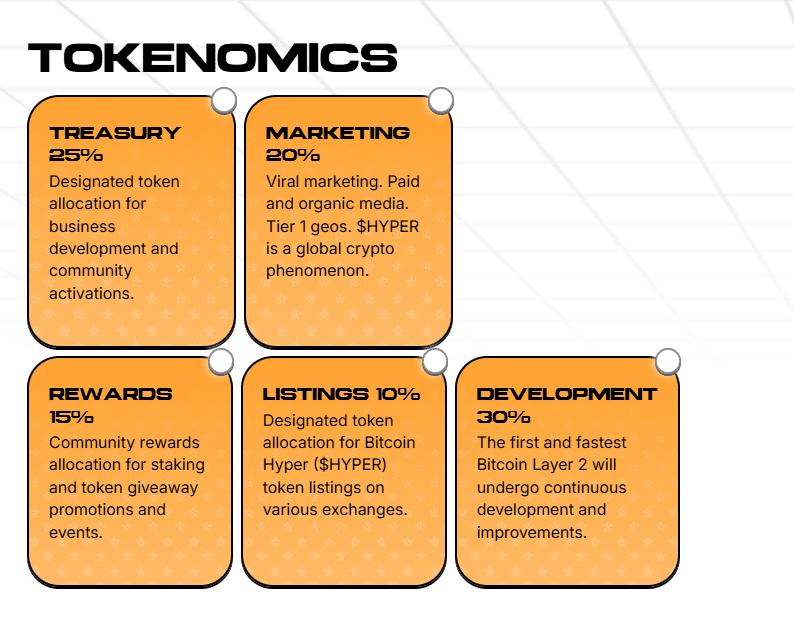

4. Bitcoin Hyper Tokenomics

Tokenomics show us how tokens are distributed and incentivized, which can affect sustainability for the project, as well as investor confidence.

Bitcoin Hyper’s total supply is capped at 21 billion $HYPER tokens. A large portion is allocated for community staking rewards and development, which encourages engagement from users, as well as project growth.

Still, a significant share also goes to treasury and marketing budgets, which can easily cause future selling pressure if it isn’t managed transparently.

5. Competitor Analysis

Knowing the competition will also help you assess the potential of a new project. Bitcoin Hyper competes with Lightning Network, which is already widely adopted for Bitcoin payments, as well as RSK, which offers smart contracts.

Now, Bitcoin Hyper will offer a DeFi-enabled Layer-2, which makes it very unique. Still, competing with already established networks is difficult. Lightning and RSK already have big user bases and proven infrastructure.

Bitcoin Hyper is yet to prove the reliability of its technology, as well as its unique advantages, though it has proposed a promising roadmap.

6. Team and Transparency

Lastly, a project’s team and their transparency are paramount for building trust with users. Public teams give accountability and allow their community to verify credentials.

And yet, Bitcoin Hyper’s team is anonymous. Keep in mind that anonymity isn’t always a bad thing in crypto. After all, Bitcoin’s founder, Satoshi Nakamoto, remains a mystery to this very day.

Still, anonymous teams tend to raise risks since investors cannot learn more about the founders’ backgrounds. Without known developers, the projects must rely on transparent communication, audit reports, and regular updates if they want to earn trust with users.

Other Warning Signs to Watch Out For

Even if a project looks promising on the surface, and Bitcoin Hyper surely does, investors must remain vigilant for red flags. The warning signs in the crypto world often show up around new or unregulated coins. Some other signs to look for include:

Phishing and Fake URLs

Always make sure to double-check that you are on the official project website. Scammers often create copycat sites, especially when there is such a high interest in a new project. Their idea is to trick you into entering the keys to your crypto wallet or sending them funds.

Always look for HTTPS security and confirm URLs through official project social media or GitHub links. For this project specifically, that means that you should only use links shared through their official website.

Token Concentration

Another major red flag is when a handful of wallets control most of the token’s supply. This creates price manipulation risk since large holders can dump tokens and crash the price in an instant.

Use tools like Etherscan and Solscan to review token distribution. For instance, if a coin has a market cap of only a few million dollars, and 70% or more of the tokens sit in just three crypto wallets, this is a highly risky investment.

Bitcoin Hyper’s tokenomics are mostly balanced, but the treasury and marketing wallets still hold large allocations, so you should keep watching how the tokens are moved and unlocked.

No Locked Liquidity

Many legit projects will lock liquidity to prevent rug pulls (when creators drain the liquidity pool and disappear). You can use platforms like Unicrypt and Team Finance to check whether liquidity is locked. If it isn’t locked for at least 6-12 months, this could be a red flag.

Fake Engagement and Bots

A high number of followers or Discord members doesn’t automatically mean high interest or real users. Use tools like Twitter Audit to check for fake followers, and maybe watch how active Telegram and Discord conversations are. If you see a chat full of bots and mods that delete questions, this is a clear sign that something is wrong.

No Real Product

If a project has no working product, no testnet, MVP, audits, or open-source code and only pushes promotions and marketing hype, be very careful. Bitcoin Hyper currently lacks a live testnet and a product demo, so this is definitely something to monitor.

So, Is Bitcoin Hyper a Scam or Legit?

Bitcoin Hyper doesn’t currently show obvious signs of being a scam. Still, it hasn’t totally proven itself either. This is a risky, real-stage crypto product with a very ambitious vision, but it still lacks key elements like a working product and an extensive audit history.

| Signs It is Legit | Concerns and Risks |

| Clear whitepaper and roadmap | Anonymous teams without verifiable identities |

| Strong narrative to solve real Bitcoin limitations | No mainnet yet, just presale |

| Active marketing and great community interest | Current staking rewards are likely unsustainable |

| Staking utility (The token has defined use cases within the Bitcoin Hyper ecosystem) |

Conclusion

Bitcoin Hyper is a brilliant concept. The idea is to create a true Bitcoin Hyper ecosystem that bridges Bitcoin’s security with modern scalability and DeFi tools. However, since many projects are already working on this and similar problems, the key question here is whether this particular ecosystem can outperform the more established solutions.

There is no guarantee of safety. Bitcoin Hyper is a high-risk investment without a working product, anonymous founders, and a token that may or may not gain traction. Its presale is building a large amount of interest and hype, but no one knows for sure if that will continue.

If you are thinking of investing in Bitcoin Hyper, treat it like a speculative bet. Invest only if you are prepared to lose money, but do hope that the project will pan out – the hype is certainly going in that direction.

If you decide to do this, monitor the project closely for product development updates, security audits, follow-ups, and other changes. Good luck!

FAQs

What is Bitcoin Hyper (BTH)?

Bitcoin Hyper is a proposed Layer 2 solution for Bitcoin that uses the Solana Virtual Machine to bring faster transactions, smart contract capabilities, and cheaper fees to the existing Bitcoin ecosystem.

Is Bitcoin Hyper a real Layer 2 for Bitcoin?

Not yet. The project claims to be building a Layer 2 network using a wrapped version of Bitcoin and Solana technology, but no functional mainnet or bridge has been released (yet).

Who is behind Bitcoin Hyper?

The team is currently anonymous, and no GitHub contributions or leadership bios have been shared with the public.

Is Bitcoin Hyper audited?

It has, but only partially. The smart contract has been audited by Coinsult, but the mainnet components, such as the bridge, network, and validators, haven't been independently audited as of June 2025 as they aren't complete yet.

Where can I buy or stake Bitcoin Hyper?

Bitcoin Hyper is only available through its official presale on the official website. Staking is available during the presale, and funds are locked for a set duration, depending on the staking plan.

References

- Bitcoin Hyper Whitepaper

- Bitcoin Hyper Launches the World’s Fastest Bitcoin – PRNewsWire

- Solving BTC’s Speed and Cost Problems While Offering Staking Rewards – Bitcoinist

- 99Bitcoin’s Bitcoin Hyper Price Prediction – 99Bitcoin

- Bitcoin Hyper Price Prediction – CryptoNews

- On Scaling Decentralized Blockchains – A Position Paper

- How Bitcoin Hyper Enhances Bitcoin – Cryptonomist