Trading Bitcoin can be incredibly exciting and profitable, but it is also risky. Even though it is the biggest cryptocurrency in the world, BTC is inherently volatile. Its price fluctuates quickly and short term price movements can be incredibly difficult to predict. This is where Bitcoin options come in.

Instead of having to buy or sell Bitcoin directly, options allow traders to speculate on its future price or hedge their existing positions. While Bitcoin options are certainly more complex than regular spot trading, they give active traders more flexibility to manage risk or capitalize on price movements.

What Are Bitcoin Options?

A Bitcoin option is a special kind of contract. It gives you the right to buy or sell Bitcoin at a fixed price, but not the obligation. You can do this on or before a certain date.

There are two main types of Bitcoin options:

- A call option that lets you buy Bitcoin later at a set price

- A put option that lets you sell Bitcoin later at a set price

Based on this, options are great for three things:

- Speculating on Bitcoin’s price

- Protecting your existing BTC from price drops

- Making a profit with less capital upfront

How Bitcoin Options Work

Options are crypto derivatives. They are commonly used for speculation or hedging purposes. For instance, an investor who anticipates a rise in BTC’s price might purchase a call option to benefit from the increase. Conversely, owning a put option can protect the trader against potential declines in BTC’s value.

Think of it like this: Say that Bitcoin’s price is $60,000 right now. You buy a call option that lets you buy 1 BTC at $62,000 sometime in the next month. If Bitcoin’s value jumps to $70,000 before the expiration date, your option is “in the money,” and you can sell it or exercise it for a profit.

If Bitcoin stays below $62,000 and you just let the option expire, you still lose money, but only the amount you paid for the option (which is called the premium). You can also sell the option before expiration if you expect that it won’t move into the money to try to minimize losses.

Key Option Terms and Parameters

If you want to trade Bitcoin options, there are three main parameters you need to understand:

- Strike price: The price at which you have the right to buy (call option) or sell (put option) Bitcoin.

- Expiration date: The date by which you must decide whether to exercise the option. After this date, the option becomes void.

- Premium: The upfront cost you pay to purchase the option. This price is influenced by factors like Bitcoin’s current price, the strike price, time until expiration, and market volatility. Even if you decide not to exercise the option, you still need to pay the premium.

Another key term to know when trading Bitcoin options is open interest. Simply put, this is the total number of active option contracts that haven’t been closed or settled yet. This is different from trading volume. Volume tells you how many contracts changed hands today. Open interest tells you how many are still “live” in the market.

This is important because:

- More open interest usually means more liquidity, so it will be easier to get in or out of positions without major price slippage.

- A spike in open interest can be a sign that new money is entering the market.

- Low open interest is a red flag. It can tell you that it will be harder to exit your trade later.

Moneyness: ITM, ATM, and OTM

Moneyness describes the relationship between Bitcoin’s current market price and the option’s strike price. Let’s see what ITM, ATM, and OTM mean:

| Moneyness | Call Option | Put Option | What It Means |

| In the Money (ITM) | Market price above strike price | Market price below strike price | Exercising the option is profitable |

| At the Money (ATM) | Market price equals strike price | Market price equals strike price | No profit or loss (ignoring the premium paid) |

| Out of the Money | Market price below strike price | Market price above strike price | Exercising the option is not profitable |

Now, let’s see moneyness in action.

For example, let’s say Bitcoin is currently trading at $65,500.

In-the-Money (ITM)

- A call option with a strike price of $60,000 is an in-the-money option. You would have the right to buy Bitcoin for $5,000 less than it’s worth right now.

- A put option with a strike price of $70,000 is also ITM. You could sell Bitcoin for more than the market price, locking in a profit.

At-the-Money (ATM)

- A call or put option with a strike price of $65,000 is ATM. That’s the exact market price, so there isn’t any real gain or loss if you choose to exercise it (aside from the premium you paid).

Out-of-the-Money (OTM)

- A call option with a strike price of $70,000 is OTM. You would have to buy BTC for more than it is worth. If BTC fails to spike above $70,000 before the expiration date (and you don’t sell it early), it will expire worthless.

- A put option with a strike price of $60,000 is also OTM. You’d be selling Bitcoin for less than the market price, so it’s not worth exercising.

Bitcoin Options vs. Bitcoin Futures

Bitcoin options are derivatives, and, as such, they are traded on cryptocurrency exchanges, just like Bitcoin futures. The value of options and futures is derived from an underlying asset like Bitcoin, Ethereum, stocks, or commodities. In fact, many Bitcoin options use Bitcoin futures as the underlying asset instead of spot Bitcoin. While both options and futures let you speculate on or hedge against price movements, they function very differently. Let’s take a look at the key differences:

| Feature | Bitcoin Futures | Bitcoin Options |

| Obligation | Buyer must buy or sell at expiry (unless closed earlier) | Buyer has the right, but not the obligation, to buy or sell |

| Risk | Potentially unlimited for both parties depending on leverage | Limited to the premium paid (for buyers) |

| Cost upfront | Usually requires margin or collateral | Buyer pays a premium upfront |

| Settlement | Often automatic or cash-settled at expiration | Buyer chooses to exercise, sell, or let it expire |

Popular Bitcoin Options Strategies

Once you understand how options work, you can start using them in creative ways. Below, you can find a few common strategies Bitcoin traders use these days.

1. Protective Put

Let’s say you own 1 BTC and are worried the price might drop. A protective put is like buying insurance for your crypto holdings.

The protective put strategy is commonly used before high-risk events like U.S. inflation reports or ETF approvals. For instance, Kaiko reported that protective puts became increasingly popular during the March 2023 U.S. banking crisis when Bitcoin became extra volatile.

How it works: You buy a put option with a strike price below the current price of Bitcoin. If Bitcoin fails, your put gains value and will help offset (or sometimes exceed) the losses on your BTC.

Example: You own BTC at $65,000. You buy a $60,000 put. BTC drops to $55,000, but thanks to your put, you get the right to sell at $60,000, wiping out most of your spot BTC losses.

2. Covered Call

In this case, you are holding Bitcoin and think the price will stay flat or rise only slightly. By selling a covered call, you aim to earn income from the option premium.

Deribit Insights has shared that covered calls are a primary strategy for professional traders because they are easy to manage and have the potential to deliver significant, steady returns. However, if the price of BTC shoots up after selling a covered call, you could lose out on larger profits from the price surge.

How it works: You sell a call option at a strike price above the current price of BTC while still holding your BTC. If BTC stays below the strike price, you keep the option premium and your BTC. If it rises above the strike, you can sell your BTC at that price, but you still keep the premium.

Example: You hold 1 BTC at $65,000 and sell a call with a $70,000 strike. If BTC stays under $70,000, you keep the premium. If it rises above this number, you can sell your BTC at $70,000, but you’ve locked in profit and income from the premium.

3. Long Call

If you don’t own BTC but believe the price will rise, you can buy a call option instead of buying Bitcoin outright. This is simply a leveraged bet that Bitcoin will increase in value before the expiration date.

How it works: You buy a call option with a strike price you expect BTC to rise above. If BTC rises past the strike (plus the cost of the premium), you make a profit. If not, you only lose the premium.

Example: You buy a $68,000 call option when BTC is at $65,000. If BTC climbs to $73,000, your call gains value. You can either buy BTC at $68,000 or sell the option and make a profit.

4. Long Put

The long put is a bearish bet on Bitcoin and the opposite of the long call. You do this when you believe Bitcoin will drop in price by the expiration date.

How it works: You buy a put option with a strike price above where you think BTC will fall. If it falls below the strike before the expiration date, your put increases in value. If it rises, you only lose the premium.

Example: You buy a $65,000 put when BTC trades at $66,000. If BTC drops to $60,000, your put gains value and you can sell it to make a profit.

Best Bitcoin Options Platforms

If you are ready to trade options, several platforms are exceptionally popular on the Bitcoin market. Let’s take a look at the top 5.

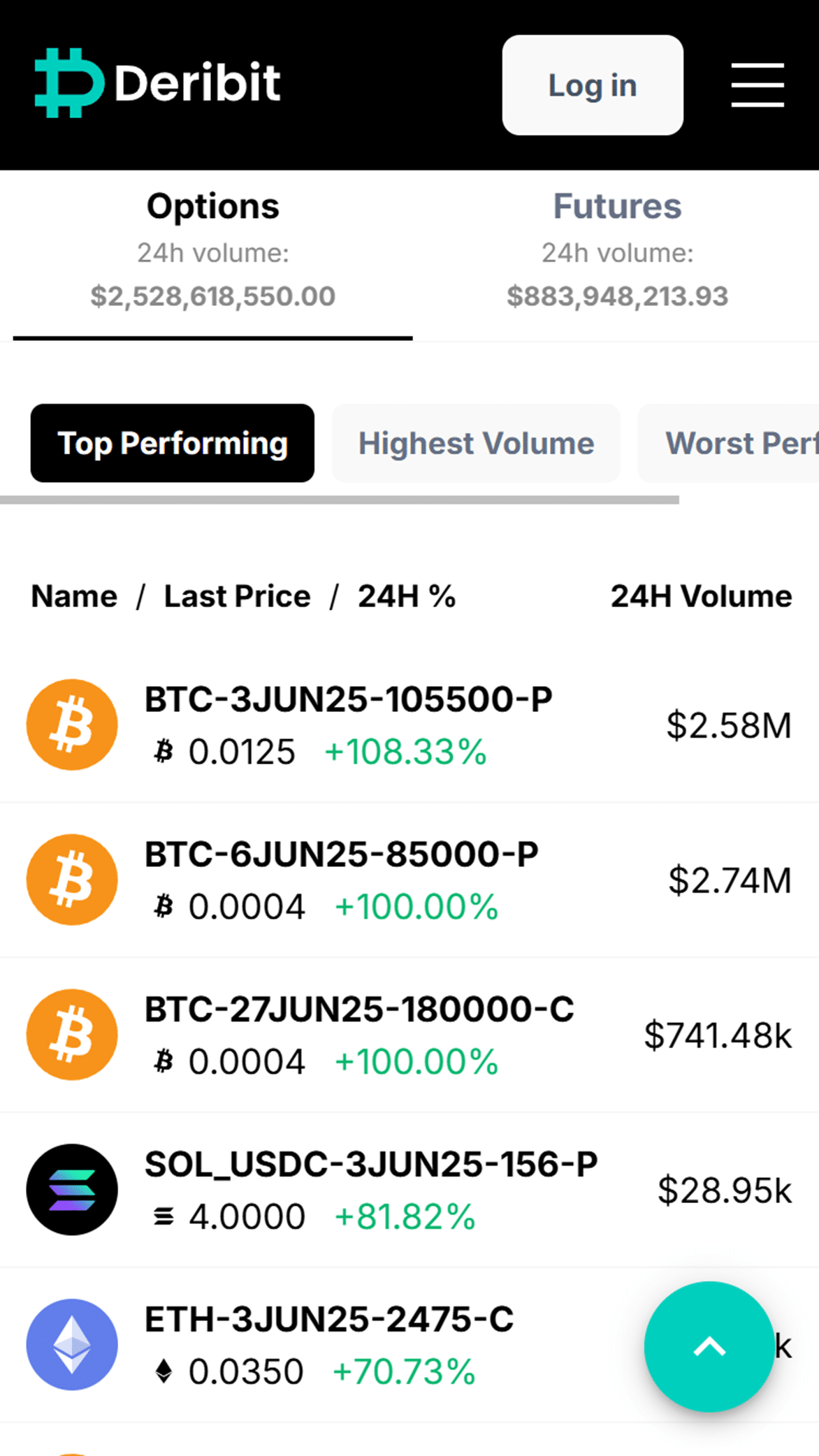

1. Deribit

Deribit is the largest crypto options exchange in the world, accounting for nearly 80% of the global activity on the options market. As of May 2022, the platform hit a record $42.5 billion in Bitcoin options open interest.

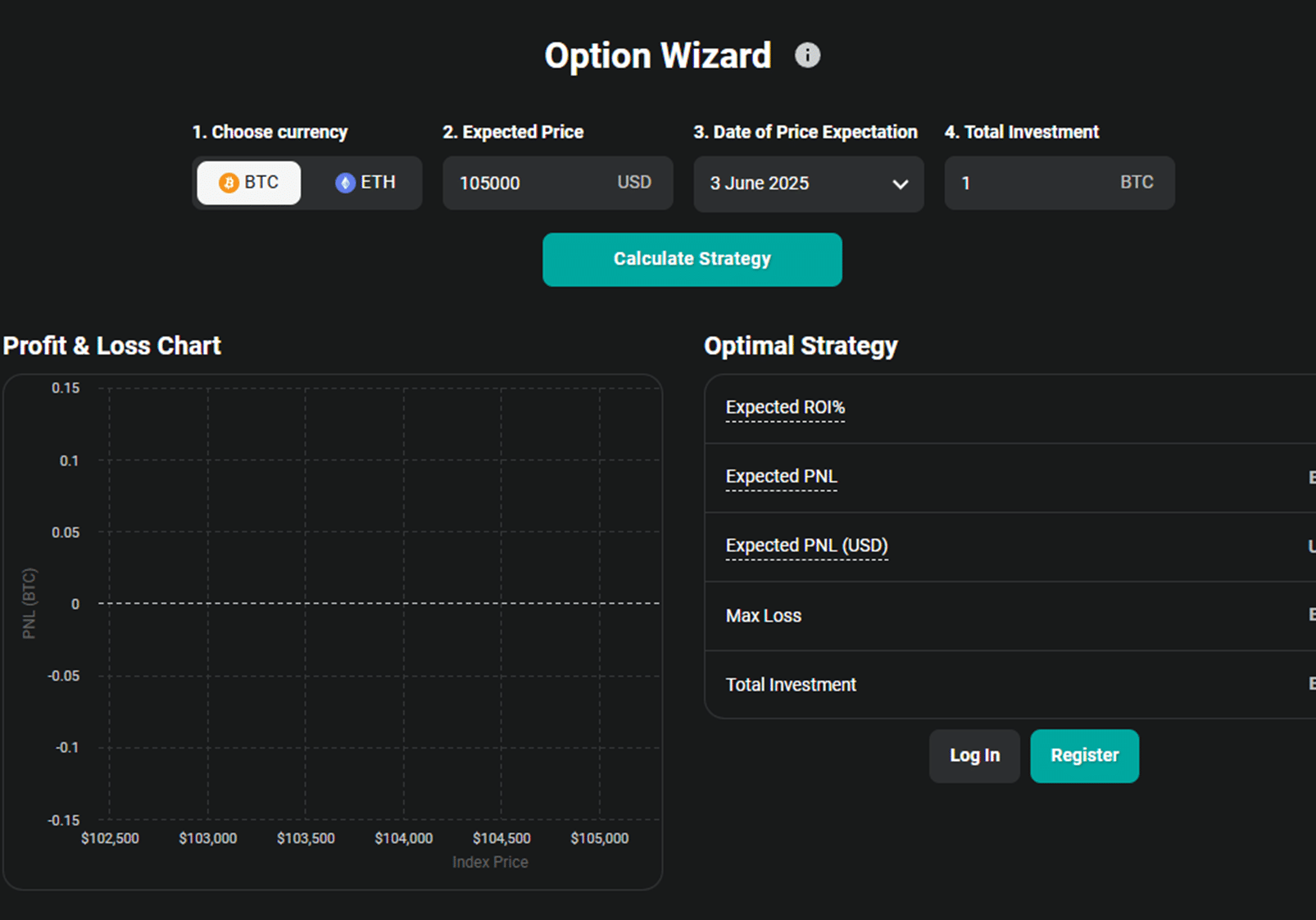

Deribit offers European-style options and is famous for its deep liquidity, advanced trading tools, as well as its “Options Wizard” feature.

| Pros | Cons |

| High liquidity and tight spreads for BTC options | Not available in the United States |

| Advanced tools for trading and analytics | Complex interface, not ideal for beginners |

| “The Option Wizard” feature to assist in selecting a strategy |

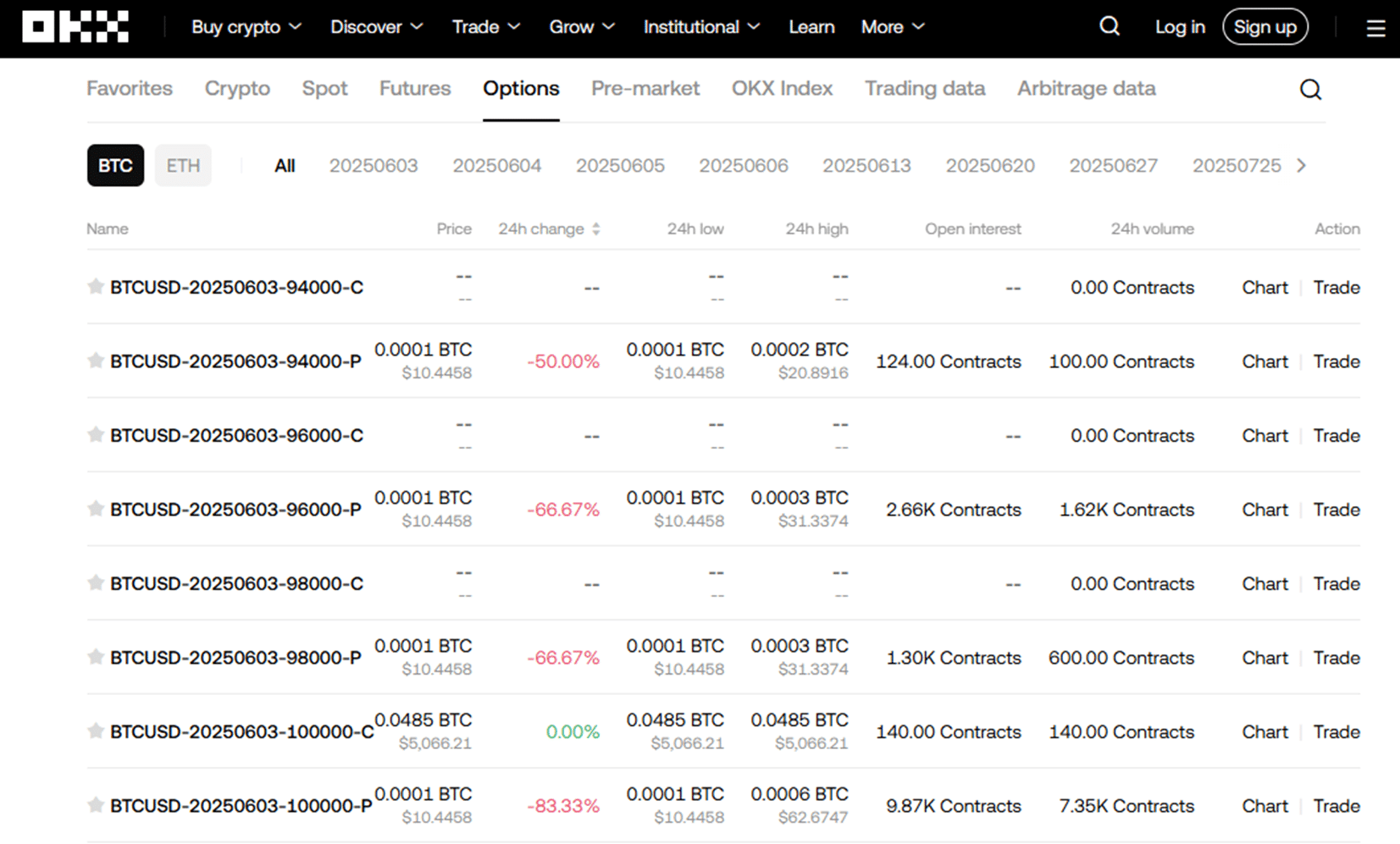

2. OKX

OKX is another versatile crypto exchange that offers many features and trading tools. It supports spot trading, futures, as well as options. As of 2025, it offers options trading for both Bitcoin and Ethereum. It stands out for its low fees, large selection of coins and derivatives, and its beginner-friendly user interface. You can trade with even lower fees if you hold its native token OKB.

| Pros | Cons |

| User-friendly interface, suitable for beginners | Limited availability in certain jurisdictions |

| Supports European and American-style options | Customer support tends to be slow during peak times |

| Offers a variety of trading options |

This is what options trading at OKX looks like:

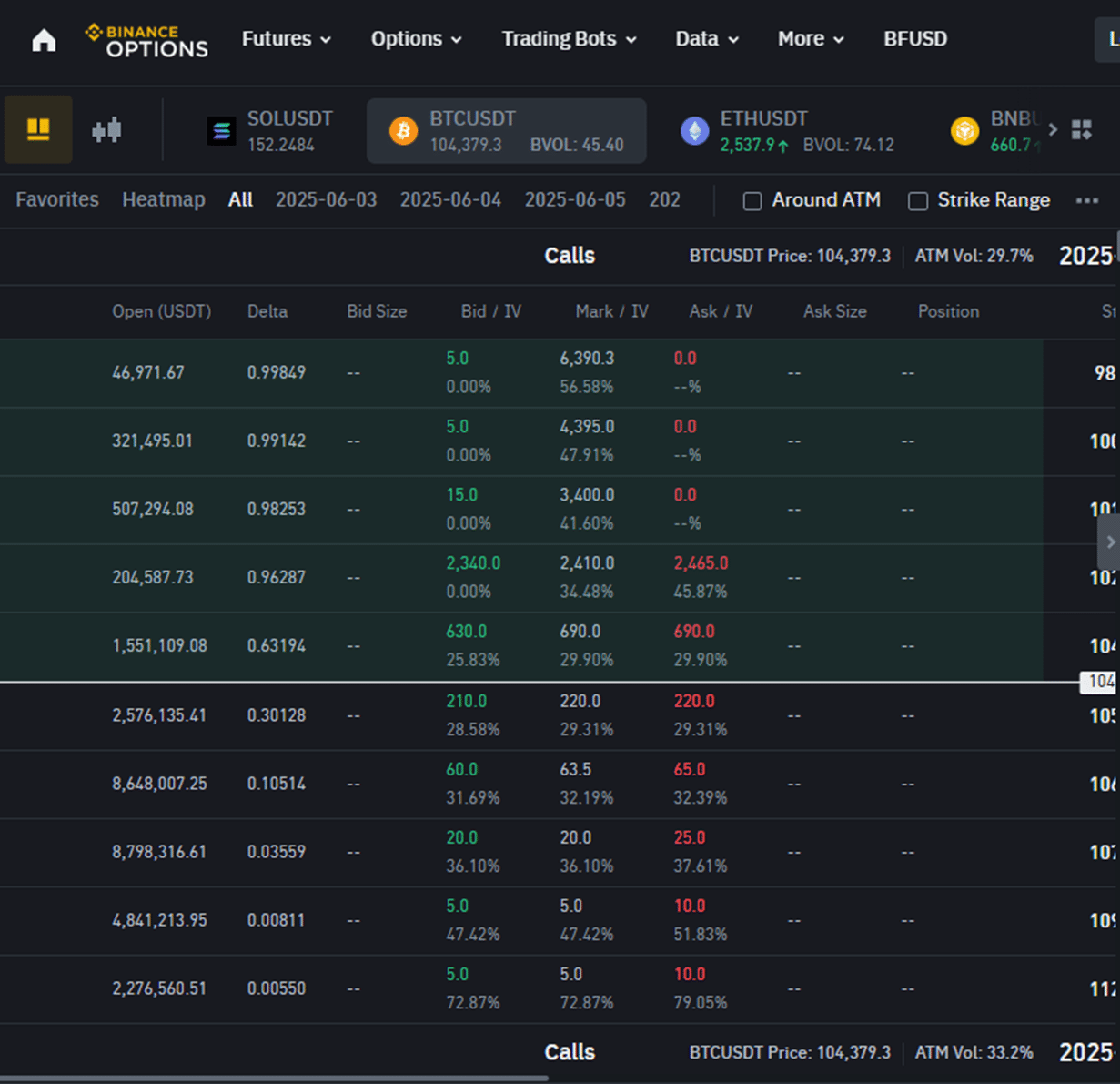

3. Binance

Binance was founded in 2017 and is has been the largest cryptocurrency exchange in the world for many years. It offers many trading options, including spot, crypto futures, and options. Binance introduced Bitcoin options trading in 2020. Like OKX, it also allows users to reduce their fees by holding its proprietary token, BNB.

| Pros | Cons |

| High liquidity and trading volume | Regulatory restrictions in some countries |

| Intuitive interface, good for beginners | Advanced features can be complex for beginners |

| Wide range of trading pairs and cryptocurrencies |

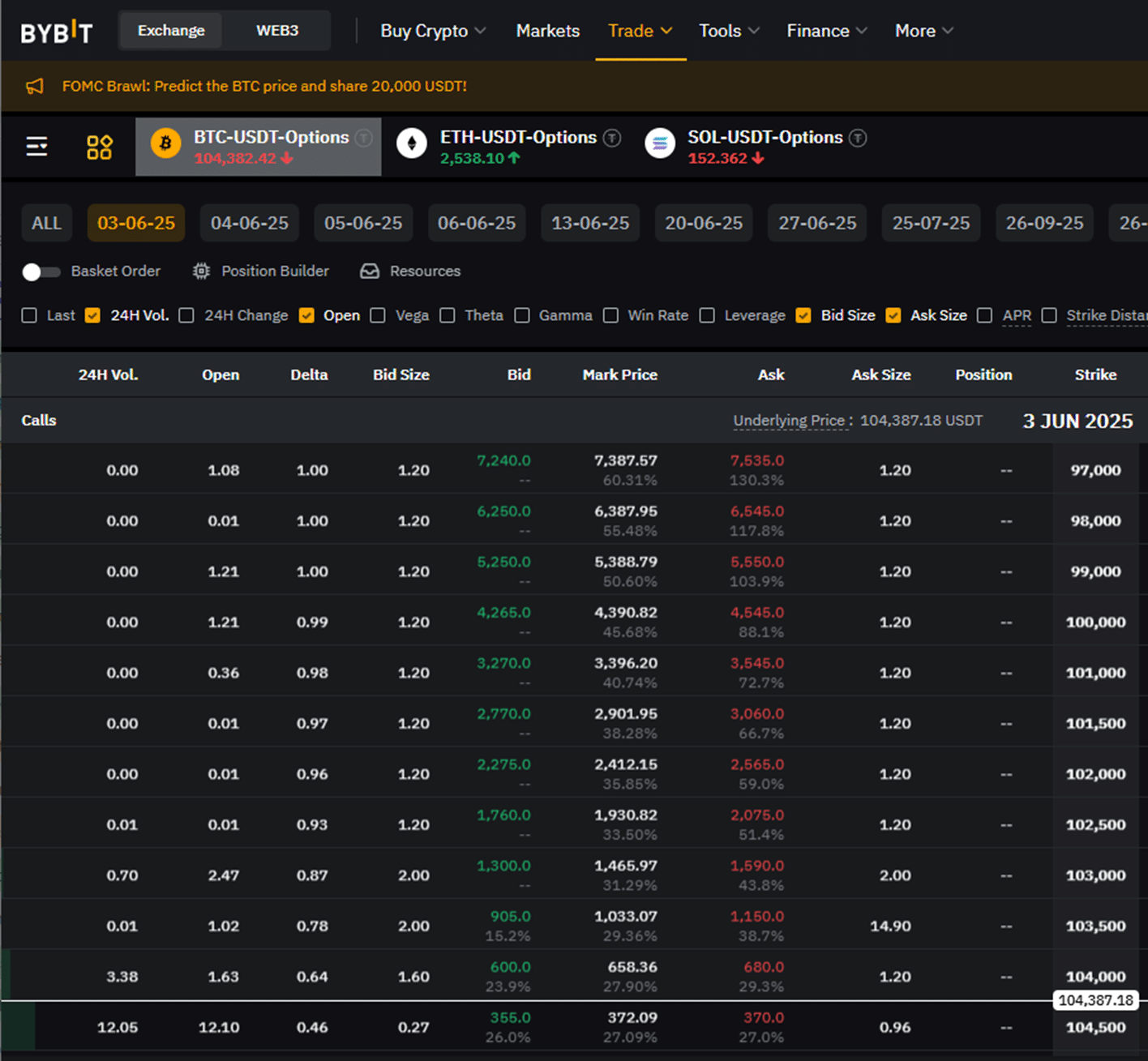

4. Bybit

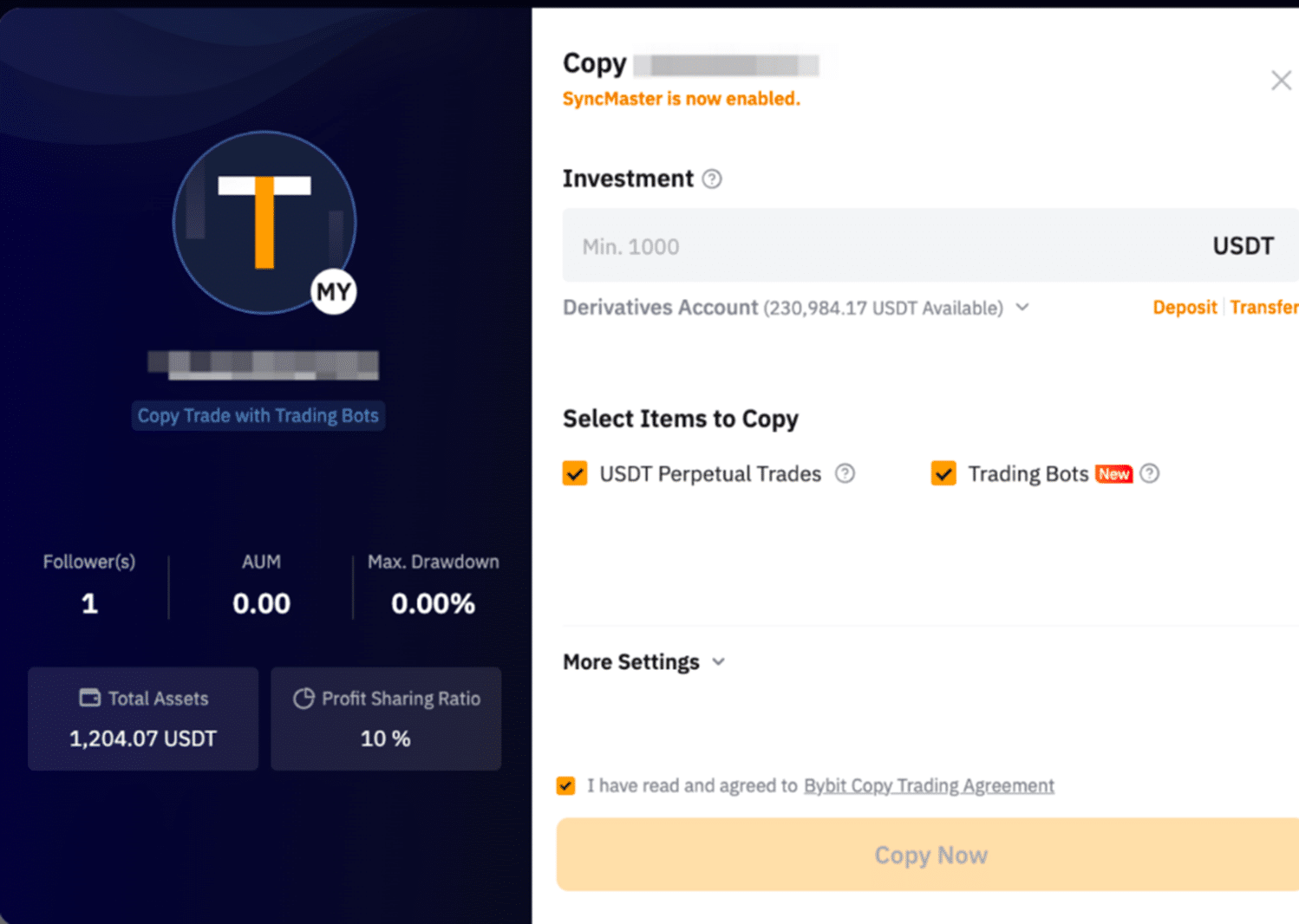

Bybit was established in 2018 and is the second-largest crypto options provider after Deribit. This is a cryptocurrency derivatives exchange with a user-friendly interface and options trading for Bitcoin with contracts settled in USDC. It has a massive selection of coins and derivatives, and its fees are relatively competitive.

| Pros | Cons |

| Endless choices for derivatives and coins | Not available in certain jurisdictions |

| Competitive options prices | Limited fiat currency support |

| Strong customer support |

5. Lyra

Lyra was launched in 2021. Unlike the other examples in this list, Lyra is a decentralized options trading protocol built on Ethereum Layer 2 solutions. This means that it offers relatively low gas fees and a non-custodial trading experience.

| Pros | Cons |

| Decentralized and non-custodial platform | Lower liquidity compared to centralized exchanges |

| Low gas fees because of Layer 2 integration | Steeper learning curve for beginners |

| Transparent, community-governed |

How to Start Trading Bitcoin Options

Bitcoin options can be a powerful tool for speculating on Bitcoin’s price or hedging. However, to succeed with this, you need more than just luck. Here is a short guide to get you started:

1. Choose a Crypto Exchange

Not all crypto exchanges offer Bitcoin futures and options trading. The first step is picking the right one for you. Consider factors like supported jurisdictions, your experience level, security features, offerings, and decentralization.

2. Create an Account

Once you choose a platform, it’s time to create an account. If required, verify your identity through the KYC process (most centralized platforms require this). Make sure to secure your account using two-factor authentication to keep your funds safe.

3. Deposit Funds

Most of these platforms support USDT, USDC, or BTC for options trading and some support fiat currencies as well. You can use on-chain transfers, or fund your account through bank card or P2P services (depending on what the platform allows).

On decentralized platforms like Lyra, you’ll need to connect a crypto wallet and fund it with supported tokens.

4. Learn the Basics of Bitcoin Options Strategies

Before you make your investments in options, it’s vital to understand the essentials like call options, put options, strike price, expiration date, and implied volatility. It’s also smart to go the extra mile, researching popular strategies that advanced traders use to manage risk and secure profits. You can use educational tools like Deribit Insights, OKX Academy, or Binance Academy to help you along your trading journey.

5. Pick Your Trading Strategy

Options trading is more than just buying calls or puts. Luck is a major factor here, but it is far from being the only factor. If you want to maximize your chances, you’ll need a good strategy. Before you get started, you can gather market data, research the stats, and pick a strategy based on what you think will happen to Bitcoin’s price soon.

Some platforms, like Deribit’s Option Wizard, help traders choose a strategy based on market outlook.

6. Test Your Strategy

If you aren’t entirely confident with your trading strategy, you can test it using the following options:

- Use paper trading features, if available

- Use testnets (common on DeFi platforms). Lyra, for instance, has a testnet trading mode on some frontends

- Try copy trading features to learn from experienced traders (offered by Bybit and OKX)

7. Manage Risks

Now, it is time to execute your trades. Choose your BTC options contract by carefully selecting the best type of option, expiration date, and strike price. Then, you can enter your trade amount and place the order.

Options can expire worthless, so never invest more than you can afford to lose. Here are some tips to help you:

- Use stop-loss or limit orders

- Hedge positions when necessary

- Diversify your strategies

The Risks of Trading Crypto Options Explained

Trading Bitcoin options can come with a huge upside, but it also comes with significant risks, especially for beginners. Some of the biggest risks of trading crypto options include:

You can lose 100% (or even more) of your investment:

If you buy an option and it expires out of the money, it becomes worthless. This means that you lose 100% of the premium you paid.

This can get even worse. If you are selling options without proper hedging, your losses can be theoretically unlimited. This is why experts recommend most traders avoid selling options with the possible exception of covered calls.

Short-expiration options are basically gambling:

Options with very short expiration dates, such as one day or one week, are often priced with extreme volatility in mind. If the market doesn’t immediately move your way, the value can drop to zero fast.

Crypto is already a highly volatile market:

Even without options, Bitcoin and other cryptocurrencies are notoriously volatile. When you add leverage, expiry deadlines, and complex price behavior, the risks multiply.

Bitcoin’s annualized volatility has often exceeded 100% throughout history. Its 30-day annualized volatility often surpasses 80%, at least in recent years. This means that highly significant price swings, such as a 5% move within an hour, are not uncommon.

Thin liquidity means more slippage and wilder price swings:

The crypto options market remains relatively small, especially compared to traditional financial markets. In many cases, this means lower liquidity, more slippage, and less predictable prices.

Options are complicated and easy to misuse:

A large part of the risk comes from misunderstanding how BTC options work. New options traders often overleverage themselves, misprice implied volatility, or hold bad positions for too long.

Emotions can destroy your trading strategy:

Options come with a fast pace and often bring dramatic swings. This can push traders into making emotional decisions, especially if they have little experience in this method. Panic selling, overtrading, and even revenge trades are common, which often lead to rapid losses of capital.

How to Reduce Risk

While this is not written in stone, there are a few ways you can use to reduce risk:

- Start trading with smaller amounts

- Use platforms that support testnet and paper trading first

- Don’t trade short-term options unless you fully understand the risks

- Learn how Greeks (Delta, Theta, Vega) affect pricing

Conclusion

Bitcoin options can be a powerful tool to gain leveraged exposure to Bitcoin without having to directly buy or sell the asset. You can use them for hedging, speculation, or to generate income in sideways markets.

However, options come with high risks, and as such, they are not an ideal trading strategy for beginners. If you are looking to trade BTC options, you can start small and educate yourself to minimize the risks. Consider using demo accounts or at least low-risk strategies until you are more confident.

FAQs

References

- The State of Crypto Derivatives – Kaiko

- Deribit Insights’ Live Series – Deribit

- Bitcoin Options OI Hit Record $42.5 billion on Deribit – CoinDesk

- Binance Introduces Bitcoin Options – Binance

- ByBit as the Second Largest Cryptocurrency Exchange – ByBit

- Deribit Insights – Deribit

- OKX Academy – OKX

- Binance Academy – Binance

- Bitcoin Sits at Record High – MarketWatch