Futures trading is an exciting and widely used crypto trading strategy that allows traders to speculate on the future price of a cryptocurrency without actually owning the asset.

Even though crypto futures trading is becoming remarkably popular, most crypto users still don’t fully understand it, and diving in headfirst before fully understanding what you’re doing can be extraordinarily risky.

In this guide, we will discuss the top crypto futures trading platforms on the market today. Let’s start with the basics.

What Is a Crypto Futures Trading Platform?

Before we discuss the best crypto futures trading platforms, let’s talk a bit about futures trading and what this means.

Futures are contracts. When you buy a futures contract, you are agreeing to buy or sell an asset at a set price on a set date. Futures (and similar agreements) have been around for millennia because they’re ideal for farmers looking to lock in prices ahead of harvest and protect themselves from natural market volatility. Naturally, they have since evolved and are now used by traders as well as businesses and financial institutions.

Crypto futures are just like traditional futures, but with crypto coins. In this case, you are trading contracts, not the actual coins. A futures contract is a specific type of crypto derivative.

So, what is a futures trading platform, then?

A crypto futures trading platform is a website or an app where you can trade crypto futures. Crypto futures are special kinds of bets on where the price of a cryptocurrency (like Bitcoin or Ethereum) will go in the future.

It’s not like buying and holding Bitcoin in your wallet. With crypto futures, you won’t own the coins. You are just speculating on price movements, deciding if it will go up or down.

But why would people trade crypto futures instead of actual coins? Some of the reasons for this include:

- Shorting: You can profit when the prices fall

- Leverage: You can make big (albeit risky) trades with small investments

- No need to own the coin: You are not owning or storing any actual crypto

- Hedging: Traders and businesses use futures to protect themselves from price swings

Types of Crypto Futures

Even though some find futures to be more profitable or flexible, they are still highly risky, especially when leverage is involved. With leveraged futures trading, it’s possible to lose more than your initial investment.

There are two main types of crypto futures:

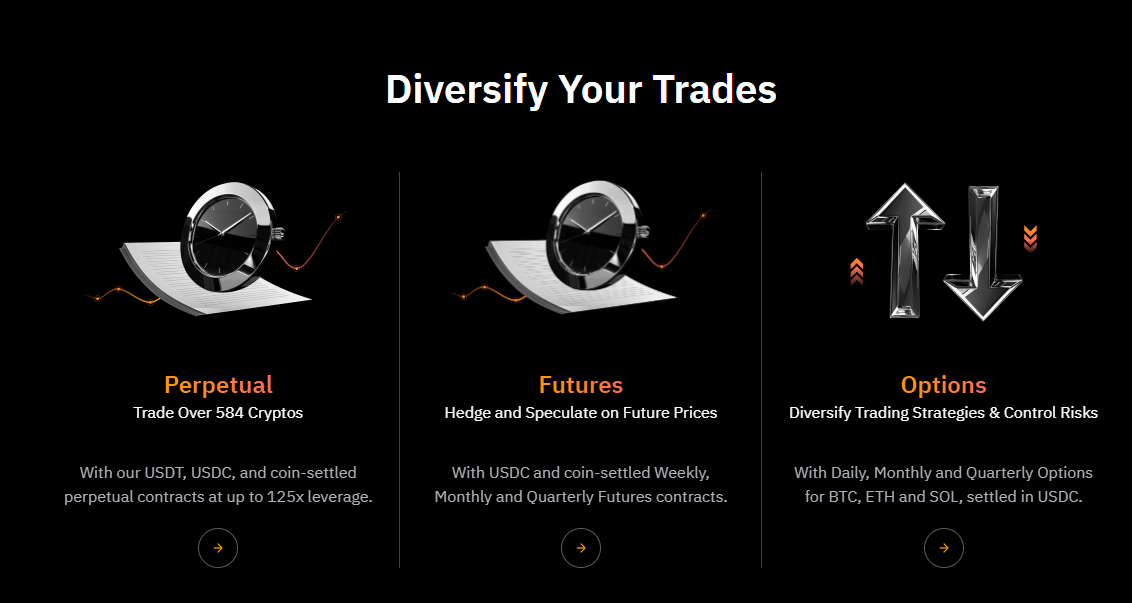

Perpetual Futures

Perpetual futures come without an expiration date. You can hold them as long as you want. Most traders choose this type of futures.

Traditional Futures (Delivery or Expiry Contracts)

Traditional futures have a fixed end date. When the time comes, the futures contracts are settled in crypto or cash, depending on the exchange.

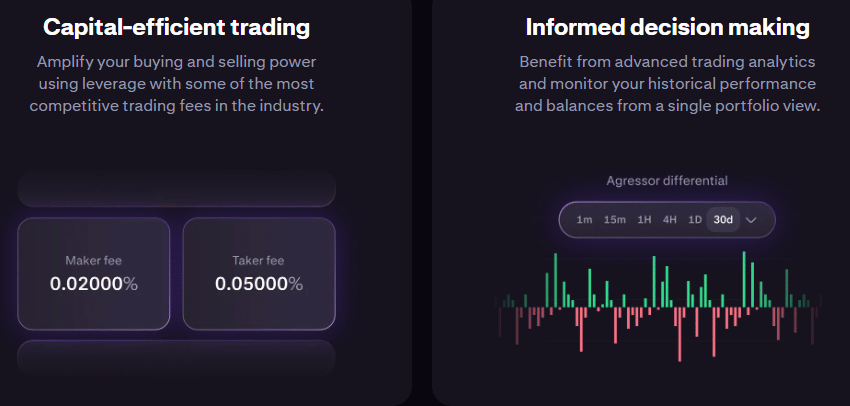

Crypto Futures Trading Fees

Crypto futures exchanges make money by charging trading fees. Here are the most common fees charged by these platforms:

- Maker fees: Charged when you place an order that adds liquidity to the order book (e.g., a limit order that isn’t immediately filled).

- Taker fees: Charged when you place an order that removes liquidity by matching an existing order (e.g., a market or limit order that immediately fills).

Fees usually range between 0.01% and 0.1% per trade, but there can be exceptions. Some platforms offer discounts if you use their native token (like Binance’s BNB). They can also give discounts to high-volume traders.

Other fees you should watch out for are:

- Funding fees: For holding perpetual contracts

- Withdrawal fees: When you’re moving money off the cryptocurrency exchange

Popular Features to Know About

Many exchanges will come with helpful tools like:

- Leverage: Allows you to control bigger trades with a smaller amount of money

- Stop-loss orders: Protect you from big losses

- Mobile apps: Used for trading on the move

- Copy trading: Allows you to follow moves from advanced traders

- APIs and bots: Used for automated or professional trading

10 Best Crypto Futures Trading Platforms

Crypto futures trading allows you to speculate on the future price of cryptocurrencies and potentially make a profit. However, since futures trading can be so risky, it is important to choose the best platform for you. Let’s take a look at the best crypto futures trading platforms on the market in 2025.

1. Coinbase Futures

Coinbase, the largest crypto exchange in the U.S., recently expanded into futures trading. In 2023, it launched an offshore derivatives exchange in Bermuda for institutional clients outside the U.S. The derivatives exchange offers up to 5x leverage on perpetual futures settled in USD Coin (USDC).

By 2023, Coinbase secured approval from the National Futures Association and can now offer federally regulated crypto futures trading to eligible U.S. customers. This approval allows the company to operate as a futures commission merchant, overseen by the Commodity Futures Trading Commission.

Futures offered: Bitcoin and Ethereum perpetual contracts

Supported regions: United States (regulated offering) and Bermuda (offshore exchange)

2. Binance Futures

Binance is the largest crypto exchange in the world by a large margin, offering a wide range of futures contracts and deep liquidity. The platform offers over 300 perpetual contracts and 22 regular futures pairs with expiry.

On Binance Futures, users can leverage up to 125x. Still, such a high leverage comes with major risks and is only recommended to experienced crypto traders.

Futures offered: 300+ perpetual futures contracts and 22 regular futures pairs

Supported regions: Not available in the United States, but it operates in many other countries

3. Kraken Futures

Kraken was established in 2011 and it has become one of the most popular and trusted crypto exchanges in the world. The U.S.-based exchange now offers futures trading with up to 50x leverage on a selection of cryptocurrencies.

In 2025, Kraken acquired NinjaTrader, a U.S. retail futures trading platform, for $1.5 billion. The idea was to expand its user base and diversify into other asset classes.

Futures offered: Various crypto futures contracts

Supported regions: Available in most U.S. states and internationally

4. ByBit Futures

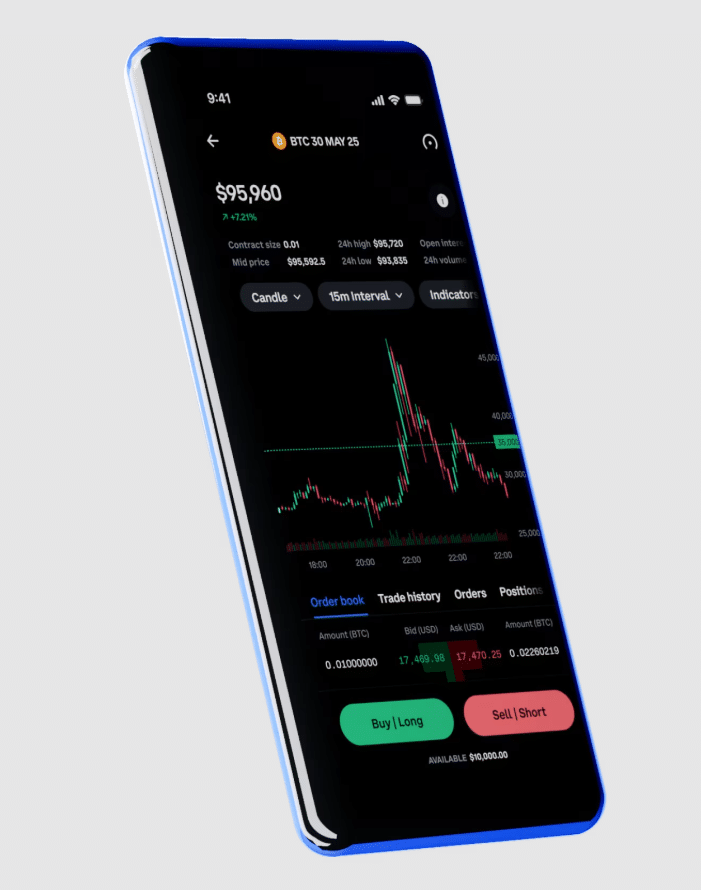

Bybit is famous for its user-friendly interface, advanced trading tools, and fast execution of trades. The cryptocurrency exchange offers a large selection of cryptocurrencies for futures trading, as well as six-month delivery contracts for Bitcoin and Ethereum.

On ByBit Futures, users can leverage up to 125x, which makes the platform ideal for beginners and experienced traders alike.

However, ByBit is not available to users in the United States, Canada, and has faced regulatory actions in countries like the United Kingdom and Japan.

Futures offered: 100+ cryptocurrencies supported

Supported regions: Available in 160 countries. Not available in the United States, Canada, Japan, and the UK.

5. MEXC Futures

MEXC offers a massive selection of over 2,800 cryptocurrencies and over 3,100 trading pairs. This makes it a great choice for altcoin traders. The platform offers up to 200x leverage on futures trading and boasts zero maker fees. Its taker fees are among the lowest fees on the market, as well (starting at 0.02% for futures).

Futures offered: 200+ cryptocurrencies, including newer tokens

Supported regions: Available in over 170 countries. Not available in the United States

6. OKX Futures

OKX is another leading cryptocurrency exchange, which also offers futures trading. It is trusted by over 20 million people in over 180 regions globally. Today, OKX suppors perpetual contracts for 163 cryptocurrencies, and regular futures contracts for six major cryptocurrencies including Bitcoin and Ethereum.

On OKX Futures, users can leverage up to 125x.

Futures offered: Perpetual futures for 163 cryptocurrencies. Regular futures for six major cryptocurrencies

Supported regions: Available in over 180 regions. Not available in the United States

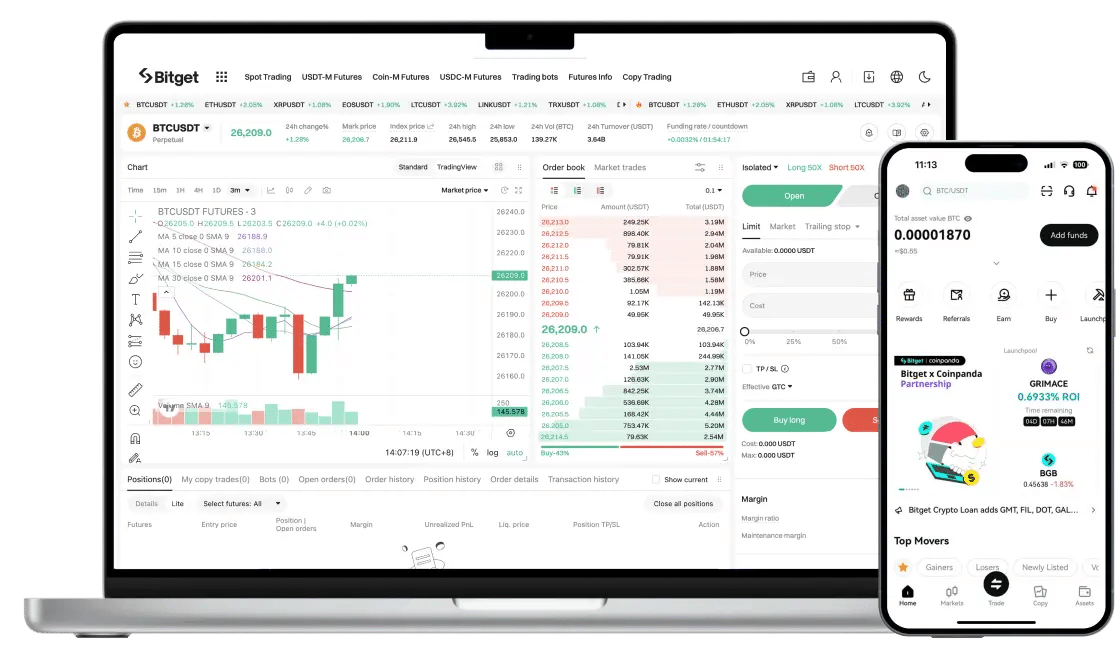

7. Bitget

Bitget was founded in 2018 and is based in Singapore. The crypto exchange has gained popularity for its copy trading feature, which allows users to follow the strategies of successful traders.

Today, Bitget offers a wide array of futures contracts and supports over 100 cryptocurrencies. In October 2024, the company launched the futures iceberg order feature, which is specifically designed for executing large trades by breaking down large orders into smaller ones.

Futures offered: 100+ cryptocurrencies supported

Supported regions: Available in 100+ countries. Not available in the United States

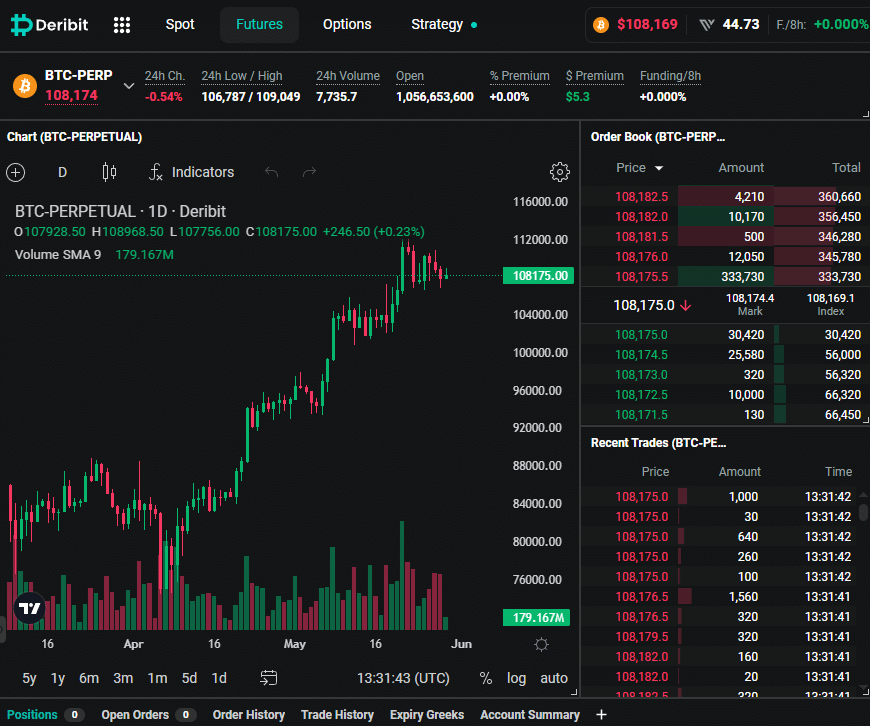

8. Deribit

Deribit is an exchange based in Dubai. It is widely recognized for its crypto derivatives offerings, particularly options and futures on Bitcoin and Ethereum.

In 2025, Coinbase agreed to acquire Deribit for $2.9 billion, establishing itself as the premier global platform for derivatives.

Futures offered: Bitcoin and Ethereum futures and options trading

Supported regions: Available globally. Not available in the United States.

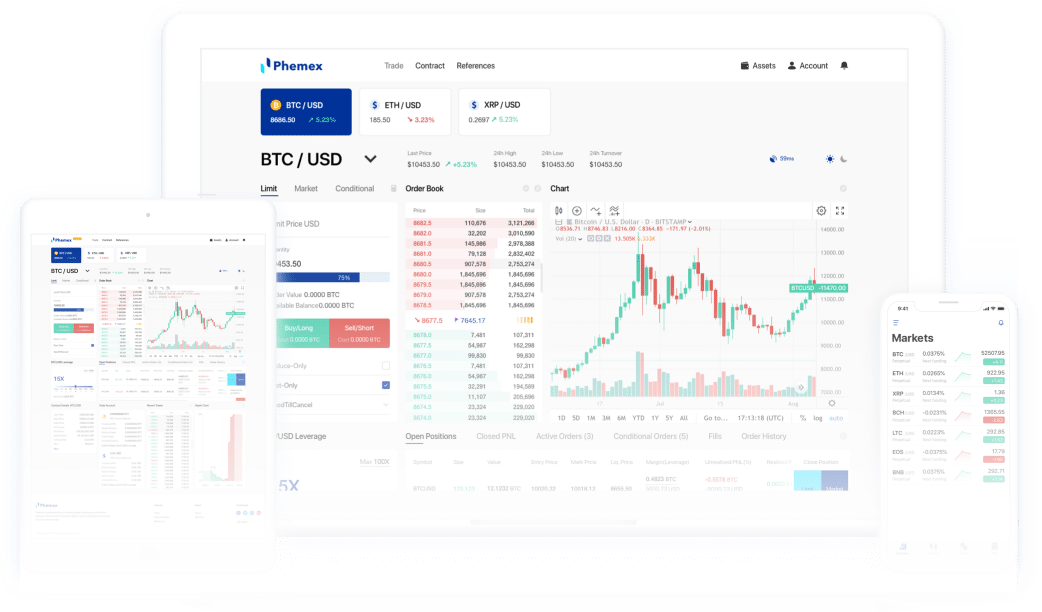

9. Phemex

Phemex was founded in 2019. This is an exchange based in Singapore, which offers both derivatives and spot trading. It provides up to 100x leverage on futures contracts and is known for its user-friendly interface.

Futures offered: Various perpetual contracts on major cryptocurrencies

Supported regions: Available globally. Not available in the United States

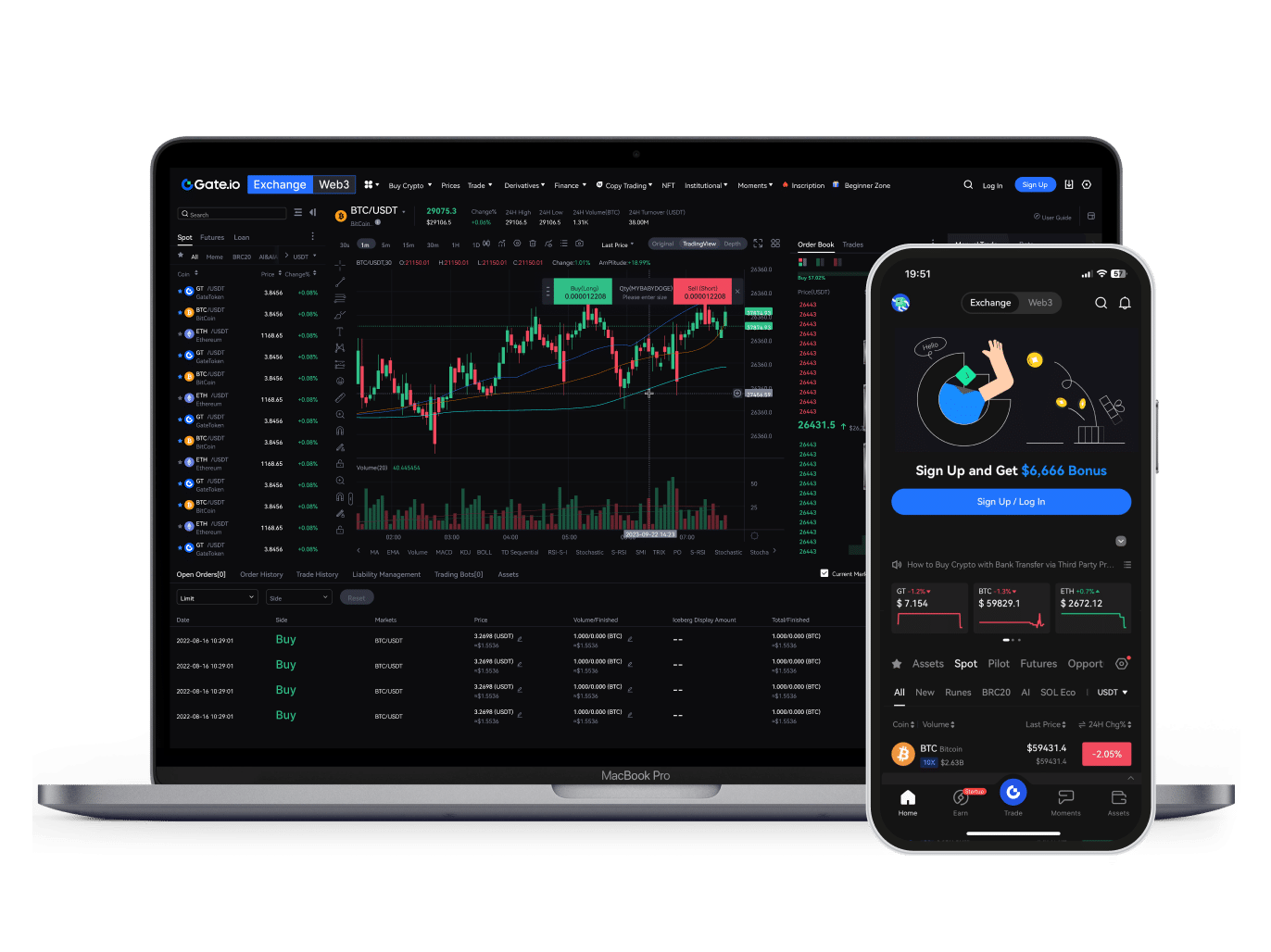

10. Gate.io

Gate.io was established in 2013 and is based in the Cayman Islands. This exchange is known for its wide selection of over 2,500 cryptocurrencies and it is often one of the first major exchanges to list emerging tokens. It offers advanced trading features like margin trading, copy trading, and automated trading bots.

In 2024, Gate.io’s future trading base saw impressive growth, increasing by 135.38%.

Futures offered: Various perpetual contracts on major cryptocurrencies

Supported regions: Available in over 100 countries, not available in the United States, mainland China, and several other countries.

The Best Crypto Futures Trading Platform Compared

Let’s make a general comparison between the 10 best crypto futures trading platforms listed above:

| Exchange | Futures Offered | Maker Fee | Taker Fee | Maximum Leverage | Notes | U.S. Availability |

| Coinbase Futures | BTC, ETH, LTC, BCH | 0%+ | 0.05% | 5x | Fees may vary. Specific rates aren’t publicly disclosed on the website. | Yes |

| Binance Futures | BTC, ETH, XRP, ADA, and 100+ others | 0.02% | 0.04% | 125x | Discounts are available for VIP users and BNB holders. | No |

| Kraken Futures | BTC, ETH, LTC, BCH, XRP | 0.02% | 0.05% | 50x | The fees decrease with higher 30-day trading volumes. | Yes |

| ByBit Futures | BTC, ETH, XRP, EOS, and 100+ others | 0.02% | 0.055% | 125x | Lower fees are available for higher VIP tiers. | No |

| MEXC Futures | BTC, ETH, XRP, ADA, and 100+ others | 0%+ | 0.02% | 200x | Discounts are available for MX token holders. | No |

| OKX Futures | BTC, ETH, XRP, ADA, and 100+ others | 0.02% | 0.05% | 125x | Discounts are available for OKB token holders. | No |

| Bitget Futures | BTC, ETH, XRP, ADA, and 100+ others | 0.02% | 0.06% | 125x | Fees may vary based on trading volume and VIP level. | No |

| Deribit Futures | BTC, ETH | 0.01% | 0.05% | 100x | The platform primarily offers BTC and ETH futures and options. | No |

| Phemex Futures | BTC, ETH, XRP, LINK, and 100+ others | 0.01% | 0.06% | 100x | Standard rates. | No |

| Gate.io Futures | BTC, ETH, XRP, ADA, and 100+ others | 0.02% | 0.05% | 100x | Extensive selection of over 2,500 cryptocurrencies. | No |

What to Look for In a Crypto Futures Trading Platform

Getting into crypto futures trading is exciting, but it is not as simple as one might think. There are dozens of crypto futures exchanges out there, and not all of them are created equal.

Some platforms are built for beginners, while other platforms are packed with advanced tools for professional traders. And of course, there are platforms that might look good at first, but fall short when it comes to important matters like security or regulation.

Here is a breakdown of what you should look for in a crypto futures trading platform.

Security Measures

Security is the most important factor to consider when you choose a platform for crypto trading. Make sure that the platform you are considering employs robust security protocols such as:

- Two-factor authentication (2FA) adds an extra layer of security to your account.

- Cold storage that keeps the majority of funds offline, so that you don’t lose your entire futures account balance in case of a hack.

- Regular audits: Third-party audits can verify a platform’s security measures.

Take, for instance, Kraken and Coinbase. Both platforms are famous for their strong security measures, including cold storage and 2FA. As such, neither exchange has experienced a major hack.

Regulatory Compliance

Trading on a regulated platform will offer you peace of mind. Regulated platforms are subject to oversight by financial authorities. This should go without saying, but the ‘yes’ from a financial authority provides an additional layer of trust and security.

For instance, Coinbase secured regulatory approval from the National Futures Association, which builds more trust with its users. Not to mention, this allowed it to offer federally regulated crypto futures trading in the United States.

Liquidity

High liquidity ensures that users can enter and exit positions with minimal slippage in the price. ByBit, for instance, has a daily trading volume exceeding $60 billion, which provides deep liquidity for traders. Some platforms simply have much higher liquidity than others.

User Interface and User Experience

A user-friendly interface can significantly boost your experience when you are trading. That being said, look for platforms that offer:

- Intuitive design that offers easy navigation and a clear layout

- Customizable dashboards allow you to tailor your workspace to fit your trading style

- Mobile compatibility and preferably even a mobile app

A good example of a quality user interface is OKX. The platform has advanced charting tools and a mobile app, which is how it caters to both beginners and experienced traders.

Trading Tools

Advanced tools can also give a crypto trading platform a competitive edge. Look for platforms that offer:

- Leverage options that allow you to control larger positions with a smaller amount of capital (but more risk)

- Order types such as limit, market, stop-loss, and take-profit orders

- Analytics and technical analysis tools

Geographical Availability

Naturally, you should only pick a futures trading platform that supports your region and meets the necessary regulatory requirements. Many platforms come with restrictions or limited services based on a location.

For instance, even though it is considered one of the best crypto exchanges in the world, Binance has faced regulatory challenges in several countries, which have affected its availability and services in those regions.

Pricing and Fees

When you are trading derivatives and futures, fees can eat into your profits faster than you might expect. This is why you should always check the platform’s fee structure before you sign up to start trading.

Some platforms offer tiered fee discounts based on your trading volume or if you hold their native token. For example, Binance charges 0.02% maker and 0.04% taker fees for futures trades, but it also offers discounts for high-volume traders and BNB holders.

Kraken’s fees start at 0.02% (maker) and 0.05% (taker) for low-volume traders, but go lower as your volume increases.

In addition to chasing discounts, you should keep an eye on hidden fees like:

- Funding rates for perpetual contracts

- Withdrawal fees

- Inactivity fees (less common, but worth checking)

Final Thoughts: Choosing the Right Futures Platform

When choosing a futures platform, it can be tempting to plump for the biggest name, the flashiest features, or the lowest fees. But if you want to have a reliable trading experience, you need to find the platform that best fits you, your goals, experience level, and your location. Look at liquidity, fees, tools, user experience, and any other feature that you feel like you would benefit from.

Of course, you shouldn’t be afraid to test a few options. Don’t be afraid to shop around and try out a few different futures platforms before committing to a specific one. Many platforms will let you start small, and some might even offer demo accounts, which can be helpful ahead of making your final selection.

FAQs

What's the difference between spot trading and futures trading?

Spot trading involves buying and selling actual crypto assets. Futures trading lets you speculate on price movements without owning the asset.

Is crypto futures trading legal in my country?

It depends on where you live. In the U.S., for instance, regulated platforms like Coinbase can legally offer crypto futures. In other regions, certain platforms like Binance or Bybit may have limited services due to local regulations.

What kind of fees should I expect on crypto futures trading platforms?

Most platforms charge maker and taker fees, usually ranging between 0.01% and 0.06%. Some also have funding rates, withdrawal fees, or inactivity charges.

Are all crypto futures exchanges safe?

No. Many major platforms like Coinbase and Kraken have strong security measures, but this doesn't mean that every futures platform is secure.

Can beginners trade futures?

Yes, but this is risky and requires some experience. Futures involve leverage and fast-moving markets. This can lead to losses if you are not experienced or trade with high amounts.

What is leverage, and how does it work?

Leverage lets you control a larger position than your actual capital. For example, 10x leverage means $100 can open a $1,000 position.

References

- Coinbase Launches Crypto-Derivates Exchange – Investopedia

- Coinbase U.S. crypto futures approved – APNews

- Kraken Buys $1.5B Futures Trading Business – WSJ

- Bybit restricted countries list – Bybit

- Bitget futures launch – Bitget support

- Coinbase to acquire Deribit – Coinbase blog

- Gate.io futures market analysis – MPost

- Bybit futures trading strategy – Bybit