Whether you’ve just skimmed over the news or are an avid researcher of financial technology, there’s a large chance you’ve heard of cryptocurrencies. Bitcoin, the first publicly traded ‘new-era’ cryptocurrency, is considered the father of cryptocurrencies. However, cryptocurrencies are not limited to just Bitcoin, in fact, there are thousands of them.

We call these altcoins, essentially ‘alternative’ forms of the main underlying cryptocurrency considered to be Bitcoin. Altcoins can range in value, purpose, utility, as well as pure technology, so consequently, they are fairly difficult and complex to use as well as buy. As a result, we’re going to, in this guide, overview how to buy altcoins in the new age of the internet, what this entails, as well as the benefactors you can extract in terms of investment and usability when purchasing altcoins, which will help understand the process for buying cryptocurrencies as a whole.

Buying Altcoins

This guide assumes you have a working internet connection, a valid email address, as well as funds to actually make a purchase for altcoins. Buying altcoins can be complicated for beginners, and is nonetheless a sensitive procedure that involves putting your funds at risk – as a result, follow instructions carefully, ask questions if you’re unsure, and do extensive research prior to making any buying decisions that you might be unsure of.

What Are Altcoins?

Altcoins, which is a nickname for ‘alternative cryptocurrencies’, are volatile tradeable and market-priced currencies that are essentially digital forms of value. Altcoins are cryptocurrencies, in fact they are classified as all cryptocurrencies that are not Bitcoin. Altcoins do not have to run on a blockchain; they simply need to be a form of technology that can be transferred to others in a cryptographic manner. While a majority of cryptocurrencies do run on blockchains, a cryptocurrency doesn’t have to. As long as it can be digitally and cryptographically sent to other people, it’s considered a cryptocurrency.

Altcoins are volatile and digital assets. They are 100% digital and are therefore treated as such.

What Can Altcoins Be Used For?

Altcoins are unique/different from one another and most of them have their own respective characteristics that make them wanted as opposed to the others. Examples:

- IOTA is an altcoin that runs on an alternative to blockchain technology, called the tangle, which has a goal of being faster and more decentral than blockchain.

- The altcoin Monero (XMR) is an alternative cryptocurrency that runs on a private blockchain and gets rid of all transaction information as soon as a transaction on the blockchain is made; as a result, Monero is entirely (At least at this moment) anonymous. Sender and receiver information is hidden as opposed to Bitcoin, where transactions and identity is only pseudonymous.

- Binance Coin (BNB) is an altcoin distributed by the cryptocurrency exchange giant Binance that is used to facilitate exchange transactions making it faster and easier to use Binance-related products. Buying BNB gives you various perks on their exchange.

How Altcoins Make People Rich

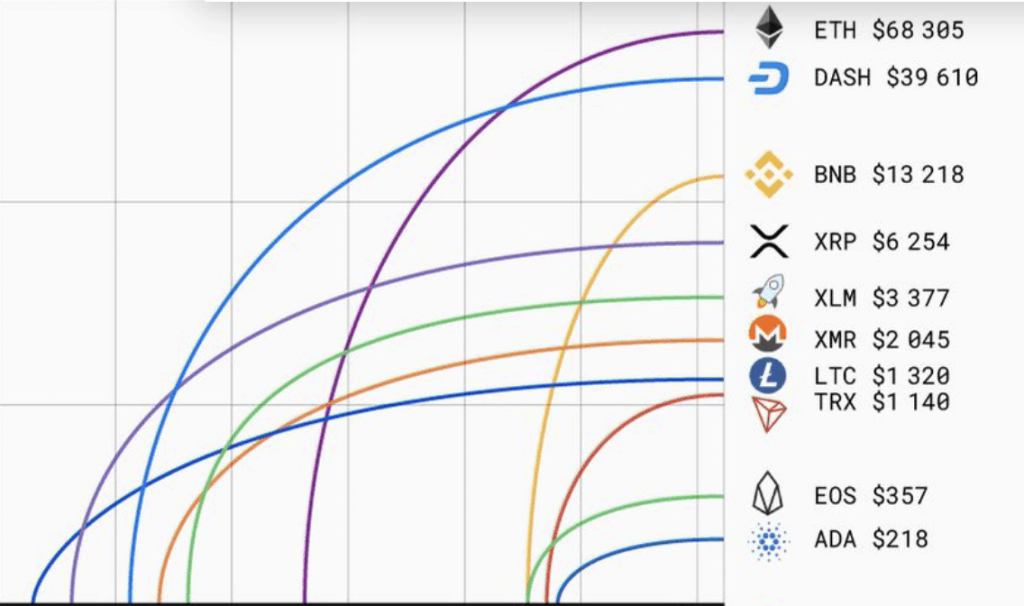

The majority of the population engages with altcoins with the hope that they will strike rich with purchases of these coins. This is mainly because of the volatility behind altcoins and their fluctuation in times of cryptocurrency market growth such as the year 2017. Altcoins are traded on public markets such as Binance (That we show you how to use later in this guide) where they are paired either to fiat value or to major pair cryptos such as Bitcoin (A non-altcoin). When the demand for these altcoins increase, in short, their price will and sell-rate will. Meaning as an example, you can purchase an altcoin for $100 and sell it for $1,000 at statistically faster rates than other markets like stocks or bonds.

The above shows the return of the altcoin Lisk in just 3 years time. That is nearly 96 times the amount of profit that the average stock market investment profited in 3 years time. So what’s the catch? Altcoins are much more volatile – while they saw monumental increases in 2017, the general altcoin market lost over 85% of its value. As a result, while these altcoins can yield outstanding long-term returns, they are only newly established markets which means they can just as equally produce the opposite of large profit.

Altcoins can make people who buy them rich when and if they increase in exponentially movements and then that same person sells it for a profit, and in the past, it has done just this. Always keep in mind, previous results do not indicate future performance, and same applies for altcoins. Also, keep in mind, altcoins are in fact correlated in some instances, but they are not and never will be finitely correlated to one another. This means that just because most altcoins increase in price, it does not mean the altcoin you’re holding has to as well. While we can sugarcoat things and say ‘buy altcoins and you will be rich!’, we rather feel it necessary the best method for profiting in markets is to assess all angles of the market, including the hard truths such as the fact that this is not a one-stop shop for massive profit.

[/su_spoiler][/su_accordion]

Let’s get to it then – we’ll nextly review how to buy altcoins, the various methods you can use to purchase them, and some tips and tricks to get along the way. Whether you’re a beginner or experienced in buying cryptocurrency/a blockchain veteran, refining your skills and learning new and improved methods is always a smart choice.

How to Buy Altcoins

Fast Step Guide to Buy Altcoins

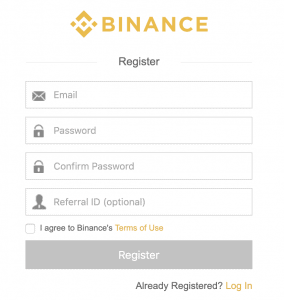

- Create an account on an exchange/platform that supports the trading of altcoins; we’ll assess some of the best options below.

- Verify your account if the platform you’ve chosen requires ID validation and add a 2FA – for added security (This can be a phone number or additional email)

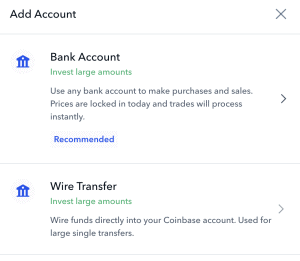

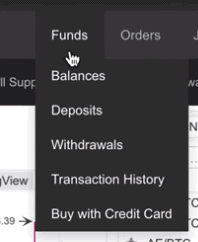

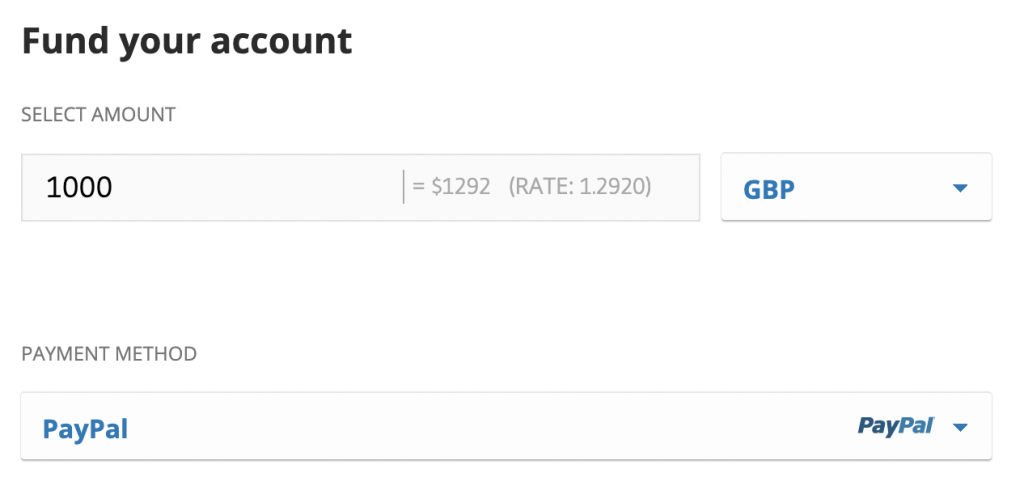

- Deposit funds to your account through your method of choice and wait for the deposit processing to complete.

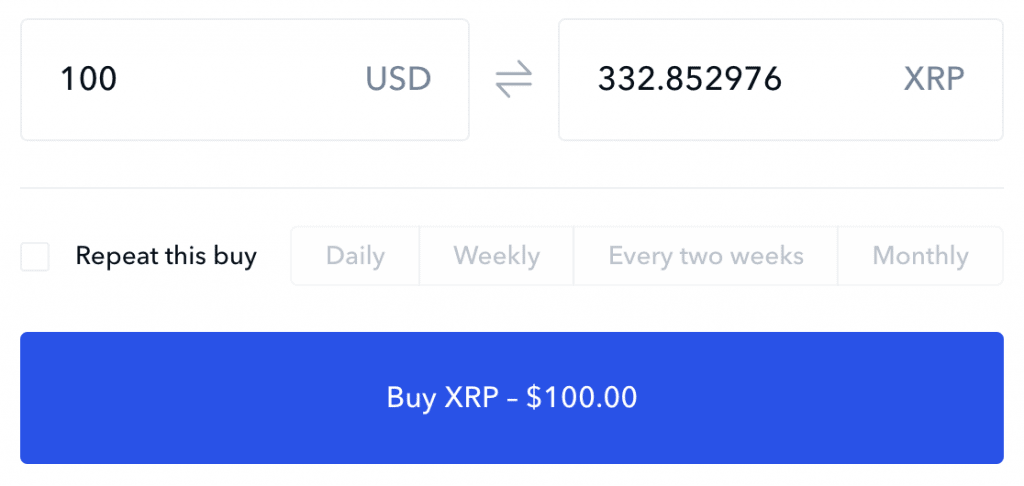

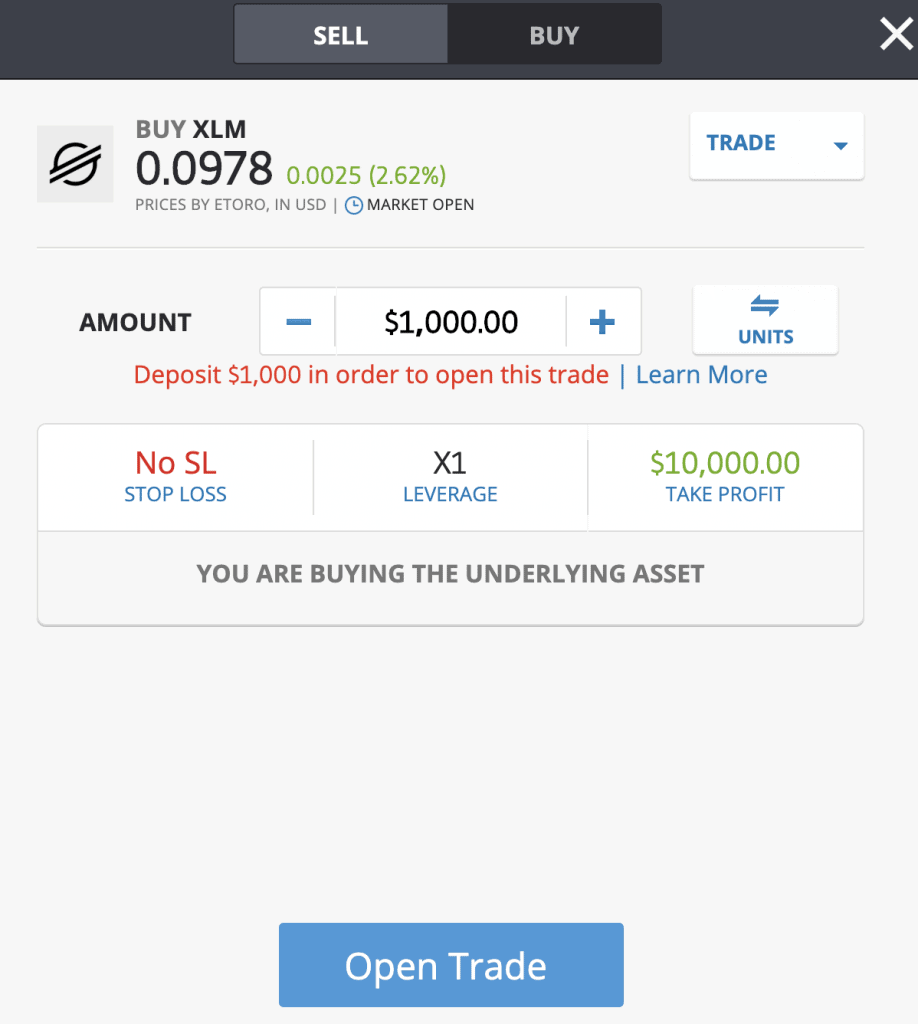

- Navigate to the markets and find the ‘cryptocurrencies’ section; select the altcoin of your choice and click on the ‘Order’ or ‘Trade’ section.

- Select ‘Market’ and then input the number of funds you want to spend on the altcoin.

- Press ‘Buy’ and wait for order execution.

- Upon execution, check your created account wallets (On the platform) and you’ll see you now own that altcoin.

Differences Between Buying and Trading Altcoins

Buying:

- The underlying altcoins are in your ownership.

- Can extract the utility of the altcoin when buying.

- You can use altcoins for payment services when buying.

- Altcoins can only be staked when bought.

Trading:

- Trading altcoins only looks to make profit off of the altcoins price movements

- When trading altcoin CFDs (Most common trading method), you don’t own the underlying asset.

- Trading is typically consisted of multiple buys and sells

- You can only use margin in trading where higher risk is imposed

FAQs

How Can I Tell Which Cryptocurrencies Are Altcoins?

The classification amongst altcoins is really simple: if you are not buying Bitcoin, but buying a different cryptocurrency you are considered to be buying an altcoin. In mainstream cryptocurrency today, Bitcoin is the singular head-pillar and the subsequent cryptocurrencies were deviations of the initial technology. As a result, every cryptocurrency that is non-Bitcoin is an altcoin, technically.

Are Altcoins Better Investments Than Bitcoin?

Altcoins are not explicitly better investments in comparison to Bitcoin, however, they have in recent years demonstrated statistically larger price increases which means more profit for investors. Bitcoin maintained lower volatility than most altcoins, however, so keep that in mind also.

How Can I Find the Best Altcoins?

Doing your own research and completing as much due diligence as possible is the most efficient way to find the altcoins with the most potential. You can utilize InsideBitcoins news as leverage through our guides, constant news updates, as well as additional content to find the best options.

Are Altcoins Safe?

Altcoins are independent technologies, they are coded by individual users, so not all are safe; this is why you should do extensive research prior to investments.

After submitting the documents as instructed above, you’ll be asked to establish a 2FA method which is simply a phone number or alternative email address. Once done, your application including the documents and materials needed to verify your identity will be sent for review. Wait for verification, which traditionally takes 12-24 hours for U.S. residents and 1-4 days for external customers, and then you’ll be able to proceed.

After submitting the documents as instructed above, you’ll be asked to establish a 2FA method which is simply a phone number or alternative email address. Once done, your application including the documents and materials needed to verify your identity will be sent for review. Wait for verification, which traditionally takes 12-24 hours for U.S. residents and 1-4 days for external customers, and then you’ll be able to proceed.