On this Page:

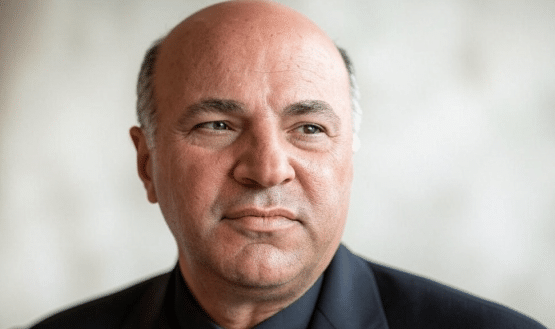

Best recognized for his business acumen and no-nonsense approach on the hit investing show Shark Tank, O’Leary first made a fortune through the software company SoftKey, which saw massive success in the 1990s. He has since expanded his wealth through smart investments, financial products, and media ventures. On top of this, Kevin O’Leary is known for being a major promoter of FTX. He has frequently shared his views on virtual assets.

In this post, we will explore O’Leary’s success and fortune over the years.

Breaking Down Kevin O’Leary’s Net Worth in 2025

Kevin O’Leary’s net worth has been consistent over the years, reflecting the stability of his business ventures and diverse investments. Still, it is doubtful that such a successful individual has the same net worth of $400 million for three to four years in a row, especially since O’Leary is known to invest in cryptocurrencies and stocks, which are highly volatile.

His assets and investments remain largely undisclosed to the public, but it’s safe to assume that today, O’Leary is worth at least $450 million – if not significantly more.

Let’s see what contributes to his impressive fortune.

| Asset or Income Source | Contribution to Net Worth |

|---|---|

| Sale of SET shares | $25,000 |

| TLC sale | $11.2 million |

| StorageNow sale | $4.5 million |

| O’Leary Funds sale | Undisclosed |

| Shark Tank salary | $50,000 per episode |

| Cryptocurrencies | ~20% of his portfolio |

| Stocks and ETFs | Undisclosed |

| Total Net Worth | $450+ million |

Kevin O’Leary Net Worth: Early Life and Education

Kevin O’Leary was born Terence Thomas Kevin O’Leary on July 9, 1954, in Montreal, Canada. While he is Canadian by birth, he also holds Irish citizenship due to his paternal heritage. His father, Terry O’Leary, worked as a salesman before his passing. His mother, Georgette, who was of Lebanese descent, owned and managed a small business.

Kevin grew up in Mount Royal, Quebec, alongside his brother Shane. He had a tough upbringing as his parents divorced in his childhood, and his father struggled with alcoholism. Following Terry O’Leary’s death, Georgette took over his business, stepping into the executive role. Kevin O’Leary later shared that it was his mother who became a key influence in his financial mindset.

During his childhood, O’Leary was diagnosed with dyslexia, a learning disorder that affects reading and processing of written information. Instead of letting this hold him back, O’Leary credits the conditions with shaping his problem-solving skills and contributing to his business success.

Interestingly, Kevin O’Leary is not the only Shark Tank star battling with dyslexia. Barbara Corcoran is also dyslexic. Like O’Leary, she has turned her learning challenges into strength.

“You have to put it in your own mind that this is not an affliction that will negatively impact your future.” – O’Leary shared in an interview with Entrepreneur Magazine.

After his father’s death, O’Leary’s mother remarried George Kanawaty, an economist who worked with the UN’s International Labour Organization. Due to Kanawaty’s career, the family relocated for international assignments, which allowed Kevin to experience life in many different countries, including Cambodia, Tunisia, Cyprus, and Ethiopia.

https://twitter.com/kevinolearytv/status/1018862302810894337

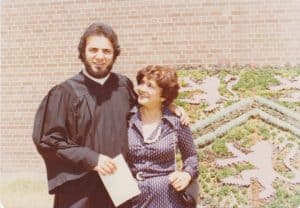

Despite his initial ambition to become a photographer, Kevin’s stepfather encouraged him to pursue higher education. Following his advice, he attended Stanstead College and St. George’s School in Quebec before enrolling at the University of Waterloo, where he earned a Bachelor’s degree in Environmental Studies and Psychology in 1977.

Following his graduation, O’Leary continued his education at the Ivey Business School at the University of Western Ontario, where he obtained an MBA in entrepreneurship in 1980.

In 1990, O’Leary married Linda Greer, with whom he has two children, Savannah and Trevor. The family resides in Toronto and owns several properties worldwide, including residences in Boston and Ontario.

Kevin O’Leary Net Worth: Entering the Business World

These days, O’Leary’s net worth mostly stems from his venture capital and cryptocurrency investments, as well as his deals from Shark Tank and Dragon’s Den. However, this is not how O’Leary first made his fortune. Let’s see how his career progressed over time.

Early Business Career

Kevin O’Leary developed an interest in investing at a young age, largely influenced by his mother. She regularly invested a third of her weekly paycheck into dividend-paying stocks, interest-bearing bonds, and large-cap stocks – a strategy that paid off significantly over time. However, she kept her investment portfolio private, so O’Leary only discovered her financial success after her passing when her will was executed.

It was O’Leary’s mother who taught him the most important financial principle in life – saving and reinvesting a third of his income.

In 1978, while he was studying for his MBA at the University of Western Ontario, O’Leary started interning at Nabisco in downtown Toronto, where he worked as an assistant brand manager in the company’s cat food division.

Following his time at Nabisco, he co-founded Special Events Television (SET) alongside his MBA classmates Dave Toms and Scott Mackenzie. As an independent TV production company, SET handled sports programming, including The Original Six, Don Cherry’s Grapevine, and Bobby Orr and the Hockey Legends. The company found moderate success with local programming and sports documentaries but struggled financially.

In 1986, O’Leary sold his shares in SET for $25,000. Just two years later, the company folded since it was unable to compete with giants like ESPN.

Launching into Success with SoftKey

The year 1986 marked a pivotal moment in O’Leary’s life. He used the proceeds of the Special Events Television sale and $10,000 that he borrowed from his mother to found SoftKey Software Products in the basement of his Toronto home. He co-founded Softkey with partners John Freeman and Gary Babcock. Initially, the company focused on producing CD-based personal computer software for Windows and Macintosh platforms.

“My mother was a special person. When I started The Learning Company (initially SoftKey), I had to borrow $10,000 from my mother. Later, when I sold the company for $4.2 billion, I said to her, “Mom, you made a fortune on that $10,000.” She said, “Great! Just give me my $10,000 back.” – O’Leary shared later on.

The early days of SoftKey were rocky at best. Just as the firm was about to secure a $250,000 investment, a major backer pulled out the day before they were supposed to sign the papers.

Despite the early financial difficulties, SoftKey slowly gained traction and battled major competition by convincing printer manufacturers to bundle their software with hardware. The company developed educational software programs in subjects like mathematics and reading and targeted home users, as well. The programs were often sold in bundles with freeware or shareware games or CD-ROMs.

In 1993, SoftKey became a major player in the industry and started acquiring rival companies like Spinnaker Software and WordStar. In 1996, the company was so successful that O’Leary was able to acquire TLC for an impressive $606 million. He decided to change the company’s name to TLC following the acquisition and relocated its headquarters to Cambridge, Massachusetts. O’Leary reportedly got about $11.2 million from this deal.

In the ‘90s, TLC was already the biggest educational software company in the world, and O’Leary was considered a mastermind.

“Kevin was an early version of Mark Zuckerberg,” said his former CFO, Scott Murray. “He was thoughtful about what the market might become even when it wasn’t there.”

In 1998, the firm struggled, recording a loss of over $105 million in revenues. By this point, TLC was struggling as its field of competitors continued to grow, and Microsoft had started bundling competitor software with its computers, making the situation even more difficult.

Despite its financial struggles, TLC acquired another former rival, Brøderbund, in June 1998 for $416 million. The acquisition would turn out to be too little too late, failing to regain TLC’s dominant market position.

In 1999, Mattel acquired TLC for roughly $3.8 billion, with O’Leary remaining on as an executive. Unfortunately for Mattel, this acquisition turned out to be one of the worst in modern history as TLC’s financial status turned out to be significantly worse than it thought. The disaster led to a lawsuit from shareholders who accused the executives of misleading investors about the state of TLC.

Ultimately, O’Leary blamed the culture clash between the two companies, as well as the technology meltdown, for the downfall. This led to quite a controversy, but the deal remained a massive financial milestone for Kevin O’Leary. Mattel settled the lawsuits in 2003 for $122 million and eventually gave TLC away for free to unload it.

“People criticize deals every day. It’s part of being in business,” O’Leary said. “I don’t apologize for the deal in any way.”

The Founding and Sale of Storage Now

Kevin O’Leary’s fortune made another major leap in 2003 when he invested $500,000 from his TLC payout in Storage Now, a company that specialized in climate-controlled storage facilities. In just a few years, O’Leary and his partners turned this business into the third-largest operator of storage services in Canada, with facilities across 11 cities. The business quickly blossomed and was able to secure contracts with major clients like Merck and Pfizer, among others. By selling storage services to businesses, O’Leary mirrored his earlier success with SoftKey.

In 2007, Storage Now was sold for $110 million. The exact figure he earned from this sale remains private, but it has been speculated that he made around $4.5 million from the deal.

Kevin O’Leary Net Worth: Other Businesses, Funds, and Investments

Kevin O’Leary wears many hats these days. While he made his fortune through the companies discussed above, he has also dabbled in funding, venture capital, ETFs, cryptocurrencies, and even TV.

O’Leary Funds

In 2008, Kevin O’Leary co-founded O’Leary Funds Inc. with his brother Shane O’Leary. The mutual fund company primarily focused on global yield investing. Kevin O’Leary was the chairman and leader of the brand, and by 2011, O’Leary Funds had reached $400 million in assets under management.

Only one year later, this number skyrocketed to $1.2 billion. However, in 2014, the firm faced a setback when it was penalized by the Autorité des Marchés Financiers for violating some provisions of the Securities Act. The penalty resulted in fines and corrective measures.

In 2015, O’Leary Funds was sold to Canoe Financial for an undisclosed amount. Canoe Financial is a private investment management company owned by Canadian businessman W. Brett Wilson.

O’Leary Ventures

In addition to this business, Kevin O’Leary founded O’Leary Ventures, a private venture capital investment platform that invests in seed through late-stage companies. Some of the firms established under O’Leary Ventures are O’Leary Books, O’Leary Mortgages, and O’Leary Fine Wines.

Shark Tank and Other TV Appearances

Kevin O’Leary has starred in the hit investing show Shark Tank alongside Daymond John, Barbara Corcoran, Mark Cuban, Robert Herjavec, and Lori Greiner since 2009. While on the show, he earned the sarcastic nickname “Mr. Wonderful”.

This wasn’t his first appearance on such a show, though. In 2006, O’Leary appeared as one of five venture capitalists on one of the most popular shows on CBS, Dragons’ Den. The idea of this show was the same – to give small business owners a chance to impress them and convince them to invest in their businesses.

For a while there, O’Leary appeared on both shows. However, in 2014, he decided to leave Dragon’s Den to focus on Shark Tank.

https://twitter.com/JamieMusicAcc/status/1891589902526996819

Back in 2016, Variety estimated that each of the sharks earned around $50,000 per episode, but this number has probably grown a lot since. Since there are generally 24 episodes in a season, this adds up to at least $1.2 million a year.

In addition to these appearances, O’Leary also appeared on:

- Money Court (since 2011)

- Discovery Project Earth (2008)

- The Lang and O’Leary Exchange (2009)

- Redemption Inc (2012) – his reality show, which he hosted and produced

https://www.youtube.com/watch?v=9BWav3dVfU4

Authorship

O’Leary has also published a series of books, detailing the many insights he has learned over the years for other investors. His books are:

- Cold Hard Truth: On Business, Money & Life (2011)

- Cold Hard Truth On Men, Women, and Money: 50 Common Money Mistakes and How to Fix Them (2012)

- Cold Hard Truth on Family, Kids, and Money (2013)

Kevin O’Leary’s Crypto and NFT Holdings

Mr. Wonderful has made a major pivot toward the crypto world in recent years. He is now a strong advocate for cryptocurrencies. In 2021, he made a major move by taking an ownership stake in the now-defunct FTX exchange as part of his role as a brand ambassador. He reportedly got over $10 million for the deal but lost it all after FTX collapsed, along with his entire crypto investment.

“I put about $9.7 million into crypto. I think that’s what I lost. I don’t know. It’s all at zero. I don’t know cos my account got scraped a couple of weeks ago. All the data, all the coins, everything.” – he said.

Despite this setback, O’Leary remains a strong proponent of crypto. His crypto portfolio now includes 32 different coins and tokens, with cryptocurrencies representing 20% of his net worth. Among the most notable assets he owns are Bitcoin, Ethereum, Solana, Polygon, and FTX Token.

The full details of O’Leary’s crypto investments remain private, but he has made it clear that his belief in the long-term potential of the digital currency market is strong. In 2021, he shared that he had allocated about 3% to 5% of his investment portfolio to Bitcoin – and even more to Ethereum.

“Ether is my largest position, bigger than Bitcoin. It’s because so many of the financial services and transactions are occurring on it. Even new software is being developed, like Polygon, that consolidates transactions and reduces the overall cost in terms of gas fees on Ethereum. I’m an investor in that as well.” – he shared.

Even today, O’Leary continues to support the industry and has moved all of his crypto holdings to WonderFi, a Canadian-based regulated crypto platform. He has been involved with the company since 2021. He backed the DeFi platform to purchase Bitbuy for $162 million in 2022, as well as Coinberry for $38.5 million.

Launching an ETF

In 2015, O’Leary launched an ETF under O’Shares ETF Investments. He launched OUSM, the O’Shares U.S. Small Capitalization ETF, one of a suite of six ETFs that offer access to O’Leary’s investment methodology.

https://twitter.com/kevinolearytv/status/1775888759193538831

Is Kevin O’Leary Pro Crypto?

O’Leary is now a fervent supporter of crypto, but he wasn’t always so supportive. Initially, O’Leary was skeptical about cryptocurrencies and didn’t believe that Bitcoin had real value. He also argued that crypto couldn’t be used for large transactions because of its volatility.

However, O’Leary’s views started shifting around late 2020. He recognized crypto, especially Bitcoin, as a potential hedge against inflation. He blamed unregulated exchanges and rogue players for the negative perception he initially had of the crypto space. By 2021, he had fully embraced cryptocurrencies and became one of the major proponents of the industry.

Following the major fallout from the FTX crash, O’Leary testified before the U.S. Congress and continues to push for regulatory clarity in the industry.

“We need to get to the bottom of what happened at FTX, but we can’t let its collapse cause us to abandon the great promise and potential of crypto.” – he said in his closing statement.

What Kevin O’Leary’s Crypto Journey Can Teach Us

Kevin O’Leary’s story is a testament to the power of perseverance, strategic investments, and adapting to evolving markets. Despite his early challenges, his commitment and talent have led him to tremendous success.

O’Leary’s strategy of always being on the lookout for emerging technology with massive potential has been one of his greatest assets. By pivoting to companies and assets with massive growth potential like cryptocurrencies and NFTs, he has been able to stay one step ahead of the market.

O’Leary’s career hasn’t always been a success. He has faced significant losses, such as the collapse of FTX, but has demonstrated a great deal of resilience. His ability to move forward despite these setbacks is a crucial trait for long-term success.

Finally, O’Leary has been able to harness intelligent diversification to sustain and grow his wealth across industries and he regularly talks about the importance of a diversified portfolio.

FAQs

In 2025, Kevin O’Leary’s net worth is estimated at over $450 million.

O’Leary made his first millions through his software company, SoftKey, later known as The Learning Company or TLC.

O’Leary has a significant portion of his net worth invested in cryptocurrencies like Bitcoin, Ethereum, and Solana.

Yes, O’Leary was a major investor and ambassador for the now-collapsed FTX exchange. He lost millions of dollars in the fallout but remains a supporter of cryptocurrencies as a whole. What is Kevin O’Leary’s net worth?

How did Kevin O’Leary make his first millions?

What is Kevin O’Leary’s involvement in cryptocurrencies?

Did Kevin O’Leary lose money in the FTX collapse?