Join Our Telegram channel to stay up to date on breaking news coverage

Cryptocurrency prices moved higher today, reflecting optimism over a regulatory shift under President Donald Trump and a decline in Treasury yields. The global crypto market now stands at $3.22 trillion, showing a modest 0.28% increase in the past day. Bitcoin trades at $97,843, while overall trading volume has dropped by 32.30% to $119.93 billion in the last 24 hours.

Despite lower trading activity, some investors see an opportunity in the current market conditions. They are increasing their holdings, expecting higher returns as confidence improves. Considering these factors, selecting the right cryptocurrencies requires careful analysis. Investors should focus on projects with strong use cases, active development, and clear long-term goals. As such, InsideBitcoins curates a list of the top cryptocurrencies to invest in now.

Top Cryptocurrencies to Invest in Now

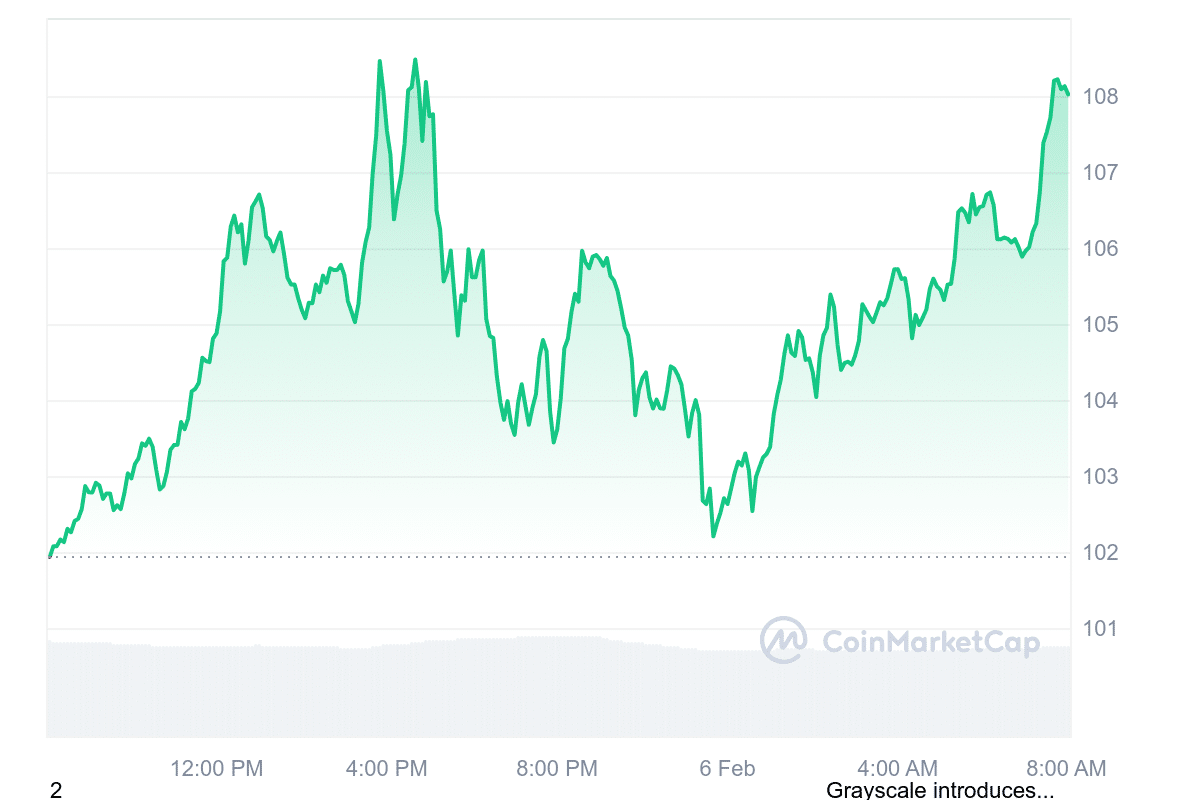

LTC is currently valued at $108, marking a 5.97% increase over the past 24 hours. Meanwhile, Cronos Labs has partnered with LayerZero, an interoperability protocol that facilitates seamless asset transfers across more than 115 blockchains.

Additionally, MIND has successfully raised approximately $5 million during its presale, with tokens priced at $0.0032662 each. In other news, Bitcoin ETFs have drawn in $1.1 billion in investment amid growing global tensions.

1. Litecoin (LTC)

Litecoin is designed for fast, secure, low-cost transactions using blockchain technology. It is based on Bitcoin’s framework but has key differences, including a different hashing algorithm, a higher supply limit, and a faster block time of 2.5 minutes. These features allow Litecoin to process transactions faster and with lower fees, making it suitable for small payments and everyday use.

Currently, LTC is priced at $108, reflecting a 5.97% increase in the last 24 hours. It trades above its 200-day simple moving average (SMA) of $92.86, showing a 16.47% gain over that threshold. Over the past month, it has had 15 positive trading days, indicating relatively strong market performance.

ETF's are cool, but Litecoin was also made to solve every day payments and optional privacy. Let's get excited about that too, because no government approval was needed for that to happen.

— Litecoin (@litecoin) February 5, 2025

Liquidity remains high, as seen in its 24-hour volume-to-market cap ratio of 0.4015. The annual inflation rate is 1.72%, which affects supply and market stability. The Relative Strength Index (RSI) over the last 14 days is 43.86, meaning Litecoin is in a neutral zone and could trade sideways in the short term. Price predictions suggest a potential 14.33% rise, bringing Litecoin to $123.12 by March.

2. Cronos (CRO)

Cronos Labs has integrated with LayerZero, a blockchain protocol that connects different networks. This allows developers to build applications that move assets between Cronos and over 115 other blockchains, including Ethereum and Solana. Users on Cronos can access more liquidity and interact with decentralized applications across multiple networks.

This is expected to lead to further integrations as applications built on LayerZero extend their services to Cronos users. Crypto.com has also announced plans to launch an exchange-traded fund (ETF) for its Cronos (CRO) token in 2025. The roadmap outlines a submission in the fourth quarter, but details remain unclear. If approved, the ETF could provide more exposure to traditional investors.

⛓️ Cronos Now Connected to 115+ Blockchains: We’re excited to announce that @LayerZero_Core, the leading cross-chain interoperability protocol, is now live on Cronos EVM and Cronos zkEVM!

🔗 Read the full announcement: https://t.co/cyNqsFQi5D

⚒️ This integration connects Cronos… pic.twitter.com/SDLNK238WV

— Cronos (@cronos_chain) January 31, 2025

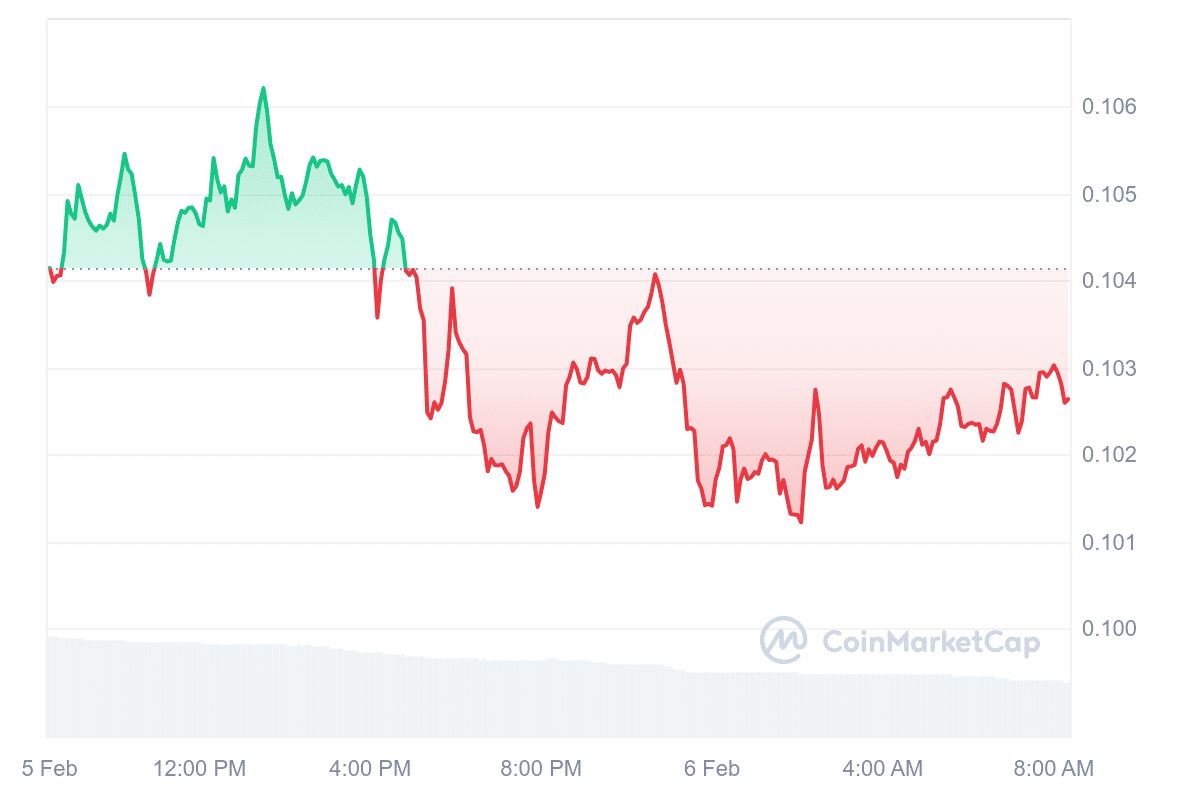

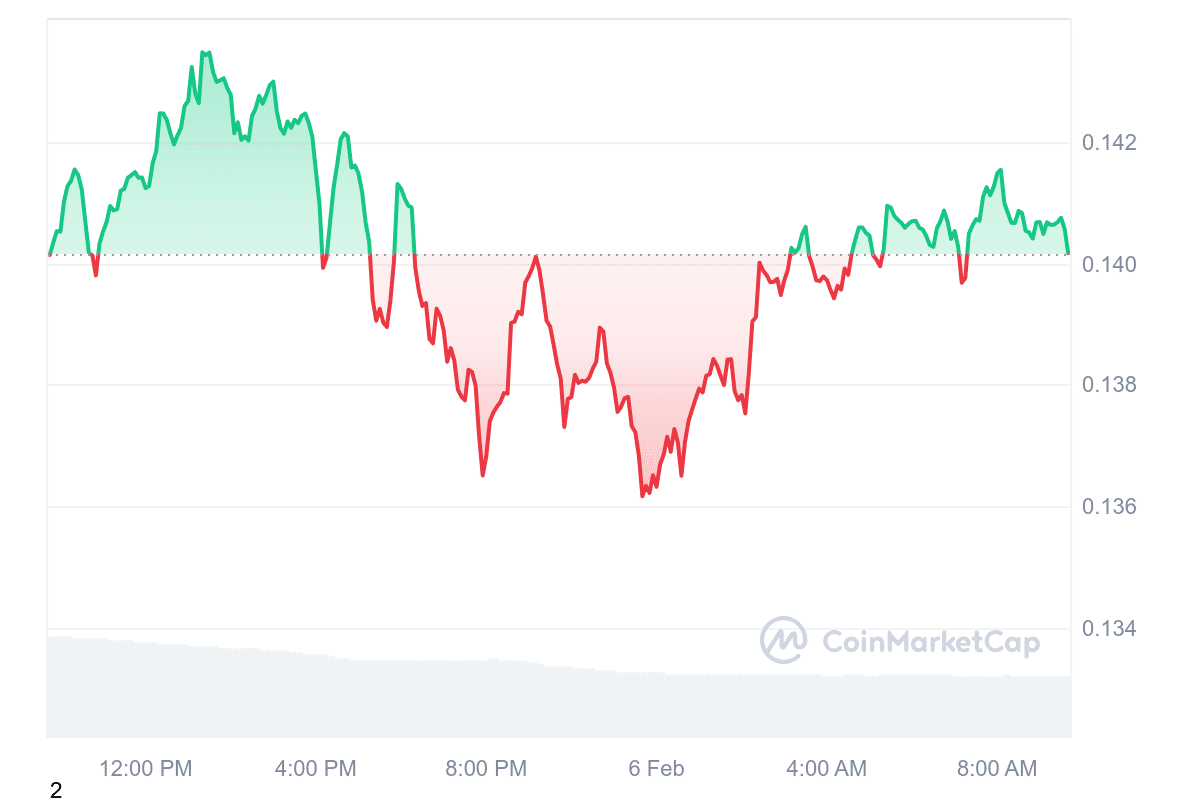

Meanwhile, Cronos is trading at $0.1026, down by 1.30%. Over the past year, it has increased by 26% and has outperformed half of the top 100 cryptocurrencies. The price remains above its 200-day simple moving average (SMA), which is $0.093226. The token is trading 10.23% above this level, suggesting a stable position.

The integration with LayerZero simplifies cross-chain transactions, making Cronos more accessible within the broader blockchain ecosystem. The upcoming ETF could bring further adoption. As for those searching for the top cryptocurrencies to invest in now, Cronos is worth considering, especially given its innovative features and the growing momentum in the market.

3. MIND of Pepe (MIND)

MIND of Pepe (MIND) is a cryptocurrency project combining artificial intelligence with the popularity of meme coins. It introduces an AI agent designed to operate independently on platforms like X, Discord, and Telegram. Instead of relying on traditional marketing or influencers, the AI monitors and reacts to real-time social media trends. This approach aims to create a more interactive and adaptive engagement model.

The project has raised about $5 million in its presale, offering tokens at $0.0032662 each. A quarter of the total token supply is allocated to the AI agent, allowing it to transact on-chain and seek profit-generating opportunities.

Moreover, these profits could support the ecosystem’s development. The AI may engage in trading, decentralized finance (DeFi) strategies, or other activities it deems beneficial for the project.

Furthermore, MIND of Pepe blends social media engagement with blockchain-based transactions. This mix may appeal to retail investors unfamiliar with complex crypto trading. By using AI to analyze trends and make automated decisions, the project explores new ways to integrate technology with cryptocurrency markets. Its combination of humor and utility sets it apart in a space where automated trading is gaining attention.

4. zkSync (ZK)

zkSync is a Layer-2 scaling solution for Ethereum that improves transaction speed and lowers fees using zero-knowledge rollups. This cryptographic technique processes multiple transactions off-chain before submitting a single proof to the Ethereum blockchain. By doing this, zkSync reduces congestion while maintaining security and decentralization.

Furthermore, zkSync ensures Ethereum’s core principles remain intact. Users retain control over their assets, and transactions remain secure. The protocol integrates with various platforms, making it easier for users to access Ethereum’s network without needing deep technical knowledge. This accessibility helps drive broader adoption.

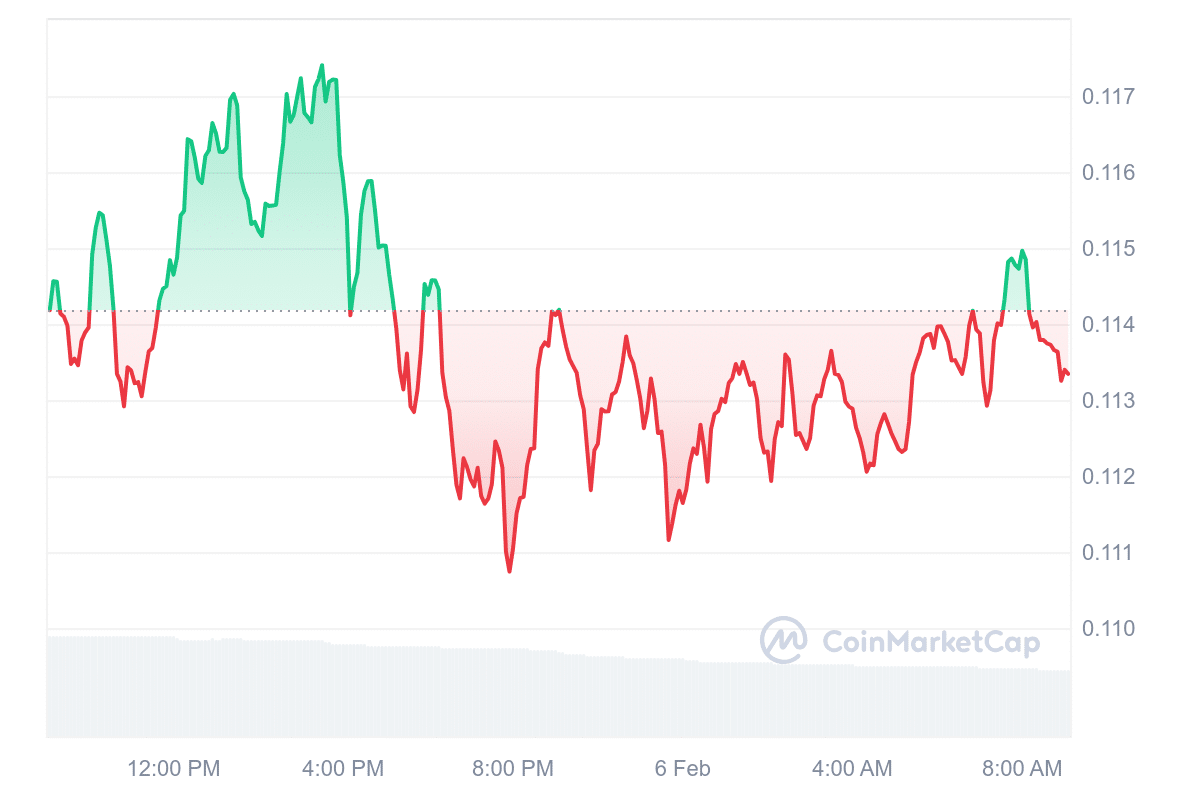

At the time of writing, zkSync’s price is $0.1133, reflecting a 0.88% decline in the last 24 hours. Market predictions suggest a potential increase of 227.17%, reaching $0.368829 by March. However, cryptocurrency prices are speculative and subject to change. Liquidity appears strong, with a 24-hour volume-to-market cap ratio of 0.1691.

Price volatility remains moderate, with a 30-day rate of 15% below the 30% threshold that signals high volatility. While fluctuations occur, the current trend suggests relative stability compared to more volatile assets.

5. Kaia (KAIA)

Kaia is a public blockchain designed to bring Web3 technology to a broad audience across Asia. It emerged from the merger of Klaytn and Finschia, two blockchains initially developed by Kakao and LINE. Kaia aims to make Web3 experiences as seamless as traditional internet services.

Users can access blockchain-based applications directly through their messaging platforms, enabling digital transactions, content creation, and collaborations. Market data suggests that Kaia has strong liquidity, as reflected in its 24-hour trading volume relative to its market capitalization, which stands at 0.0316.

Kaia is thrilled to team up with MEXC (@MEXC_Official) to accelerate the growth of the Mini Dapp ecosystem! 🤝

MEXC will support Mini Dapps on Dapp Portal (@dapp_portal) with:

✔️ Strategic consultation

✔️ Market entry guidance & educationYou can now enjoy zero-fee KAIA/USDC… pic.twitter.com/Jki7KsZnS4

— Kaia (prev. Klaytn & Finschia) (@KaiaChain) February 6, 2025

Liquidity measures how easily an asset can be bought or sold without impacting its price, and a higher ratio can indicate a more active market. In terms of price stability, Kaia’s 30-day volatility is at 13%, suggesting relatively low fluctuations compared to more volatile assets.

Current market sentiment appears bearish, meaning that investor confidence is low, which can impact short-term price movements. The Fear & Greed Index, a metric used to gauge investor sentiment, is at 49, indicating a neutral market stance. However, price forecasts predict a potential 226.27% increase, with a target price of $0.455893 by March.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage