Join Our Telegram channel to stay up to date on breaking news coverage

The cryptocurrency market is experiencing heightened optimism following Donald Trump’s return to the White House, sparking renewed discussions about potential regulatory and legislative changes. The market is shifting rapidly, with developments like the SEC’s newly formed crypto task force and Trump’s executive order focused on creating a “digital asset stockpile.” These changes signal a more structured and diverse approach by the U.S. government to integrate and oversee digital assets.

This evolving regulatory framework has fueled growth across various altcoins and digital assets, reflecting the market’s reaction to these strategic initiatives. With this, investors are closely watching key opportunities. For those exploring the top cryptocurrencies to invest in now, this article analyzes tokens worthy of investing.

Top Cryptocurrencies to Invest in Now

TRON’s native token (TRX) is currently valued at $0.235, reflecting a strong performance as it trades 18.81% above its 200-day simple moving average (SMA) of $0.197925. This upward trend highlights growing investor interest and consistent momentum in the market. Meanwhile, Solaxy has drawn significant attention, raising over $15 million during its ongoing token presale.

1. SafeMoon (SFM)

SafeMoon (SFM) is trading at $0.00006333, reflecting a 6.7% price increase in the past day. However, its trading volume over the last 24 hours is $95,469.65, a 29.80% drop compared to the previous day. This suggests reduced market activity despite the recent price movement.

Over the last week, SafeMoon’s price has climbed by 30.70%, outperforming the broader cryptocurrency market, which saw a 6.30% decline in the same period. Furthermore, the current market sentiment around SafeMoon appears bullish. The Fear & Greed Index, which gauges market confidence, read 71, indicating a phase of “Greed.”

The 14-day Relative Strength Index (RSI), a measure of overbought or oversold conditions, stands at 67.29. This places SafeMoon in a neutral zone, suggesting the price could remain stable or move sideways without significant volatility in the short term.

SafeMoon’s lowest recorded price, $0.00001638, occurred on January 15, 2025. Since then, the token’s value has risen by 289.04%. According to current predictions, SafeMoon’s price may increase further, potentially reaching $0.000229 by February, representing an expected gain of 229.28%.

These trends highlight SafeMoon’s recent growth and market activity, though the reduced trading volume may indicate a slowdown in momentum. Investors should consider these metrics, including RSI and market sentiment, when evaluating SafeMoon’s potential trajectory.

2. TRON (TRX)

TRON is a blockchain-based operating system developed by the Tron Foundation. Initially, its tokens were based on Ethereum’s network but transitioned to TRON’s blockchain in 2018. Recently, TRON founder Justin Sun introduced USDD 2.0, an updated version of its decentralized stablecoin.

This version offers users an annual yield of up to 20%, with all interest distributed to a publicly viewable on-chain address. The announcement sparked mixed reactions, with some investors optimistic about TRON’s financial framework while others remain cautious.

Moreover, USDD functions as a stablecoin within the TRON ecosystem, aiming to compete with popular assets like Tether (USDT) and USD Coin (USDC). On the same day as the USDD 2.0 release, TRON recorded $3.6 trillion in daily USD transfers, the second-highest amount in its history. This significant transaction volume suggests growing activity and interest in the network.

Currently, TRON’s token (TRX) is priced at $0.235, trading 18.81% above its 200-day simple moving average (SMA) of $0.197925. This places it in a favorable position compared to its token sale price, and the token benefits from strong liquidity relative to its market cap. Historically, TRON’s ecosystem announcements have coincided with transaction surges, indicating that news often drives activity.

3. Cardano (ADA)

Cardano is a proof-of-stake blockchain platform designed to promote global change by empowering individuals and encouraging transparency, security, and fairness. The platform’s open-source nature allows developers and innovators to build projects to decentralize power and enhance societal equity.

Currently, Cardano’s price is $0.877563, reflecting a 0.22% increase over the last 30 days. Despite this modest rise, market sentiment around the ADA token remains bearish. However, the Fear & Greed Index, which gauges market behavior, shows a reading of 71, suggesting investor optimism. Cardano trades 24.54% above its 200-day simple moving average (SMA) of $0.703474, a key indicator often used to evaluate long-term trends.

The 14-day Relative Strength Index (RSI) for Cardano stands at 45.25, indicating a neutral position in terms of buying and selling pressure. This implies ADA may continue to move sideways in the near term. Of note, Cardano recorded 17 positive days in the last 30, signaling some consistency in its performance.

With a 24-hour trading volume-to-market cap ratio of 0.0572, Cardano shows a healthy level of liquidity for its market size. Predictions suggest a potential price increase of 97.82% by February, with an estimated value of $1.9937.

4. The Graph (GRT)

The Graph is a protocol designed to organize and make blockchain data accessible. It allows developers to create and publish open APIs, called subgraphs, which applications use to retrieve blockchain information through GraphQL. This helps power decentralized finance (DeFi) and Web3 applications by streamlining access to on-chain data.

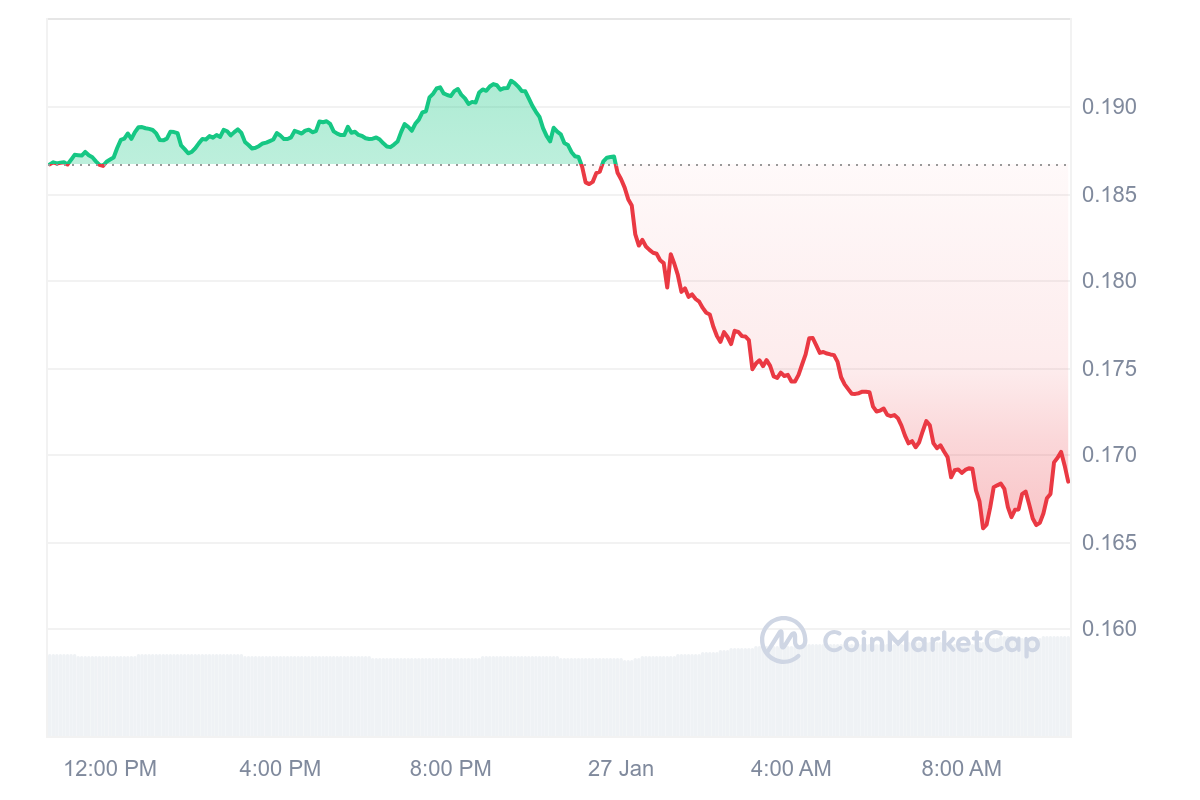

Currently, The Graph is priced at $0.1683, reflecting a 9.84% drop in the past 24 hours. Market sentiment appears bearish, while the Fear & Greed Index shows a reading of 71, suggesting market participants lean towards greed. The asset has a high 24-hour trading volume relative to its market cap, with a ratio of 0.1111, indicating notable liquidity in relation to its size.

The yearly inflation rate for The Graph stands at 1.69%, which is relatively low and below the commonly acceptable threshold of 2%. Its 14-day Relative Strength Index (RSI) is 44.82, signaling neutral momentum and suggesting the price may move sideways in the short term.

Forecasts suggest the price of The Graph may rise by 37.25% over the next month, potentially reaching $0.265543. This projection reflects expectations of upward momentum despite recent volatility.

5. Solaxy (SOLX)

Solaxy (SOLX) is positioned as the first Layer-2 protocol for the Solana blockchain, aiming to address key issues like congestion and transaction failures. By focusing on scalability, Solaxy seeks to improve Solana’s overall performance, which has faced limitations during periods of high activity.

This initiative has garnered attention from investors, raising over $15 million during its ongoing token presale. The protocol introduces measures to streamline Solana’s network by reducing bottlenecks, enhancing reliability, and supporting its scalability goals.

Moreover, Solaxy has partnered with Best Wallet, a platform allowing users to purchase and stake SOLX tokens securely. An added feature ensures tokens purchased through Best Wallet appear in user accounts before the official claim date, simplifying access for investors.

Staking SOLX provides a high potential annual yield of up to 1,523%. However, the yield adjusts dynamically as more tokens are staked, incentivizing early participants while balancing rewards as adoption grows. Currently, 1 billion SOLX tokens have already been staked.

SOLX tokens are priced at $0.001616, with the next price increase scheduled within 29 hours. This time-sensitive pricing provides an opportunity for investors to enter the market early.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage