Join Our Telegram channel to stay up to date on breaking news coverage

The supply of stablecoins is rising significantly in the cryptocurrency market, which many analysts think could trigger the price increase of Bitcoin. This pattern was brought to light in a recent tweet by Crypto Rover, which claimed that the exploding stablecoin supply frequently precedes major fluctuations in the price of Bitcoin. This finding is consistent with past trends showing that rising stablecoin issuance frequently corresponds with bullish movements in prominent cryptocurrencies such as Bitcoin.

The cryptocurrency market constantly changes, and some of the most exciting prospects are simmering beneath the $1 threshold. The creative use cases, robust development teams, and expanding ecosystems of projects like Axelar, Ethena, Jupiter, and Kava are helping them acquire significant traction while staying surprisingly accessible to regular investors.

6 Best Cheap Cryptos to Buy Now Under 1 Dollar

What is causing the recent surge in demand for these coins? What distinguishes them in such a crowded market? More significantly, are these inexpensive tokens destined to become tomorrow’s big stars? Knowing what motivates these cheap assets could provide you with a much-needed advantage, regardless of whether you’re new to cryptocurrency or just planning your next strategic move.

1. Axelar (AXL)

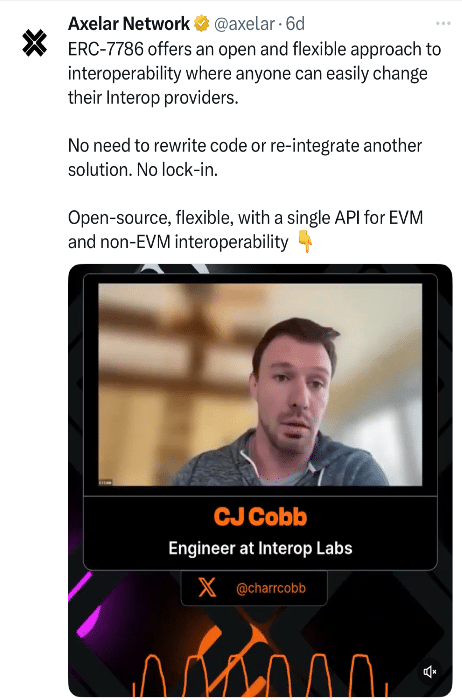

The blockchain ecosystem is dispersed, with multiple networks functioning in silos. This fragmentation limits the potential of decentralized apps (dApps) and services and impedes the free flow of assets and information. Axelar solves this problem by offering a decentralized network that permits safe cross-chain communication, making it simple for dApps to communicate with various blockchains.

In March 2025, the Axelar Foundation stated that recognized cryptocurrency investment funds, such as Arrington Capital and Electric Capital, had made significant investments totaling more than $30 million. These investments demonstrate faith in Axelar’s mission and its ability to develop into the “internet of blockchains.”

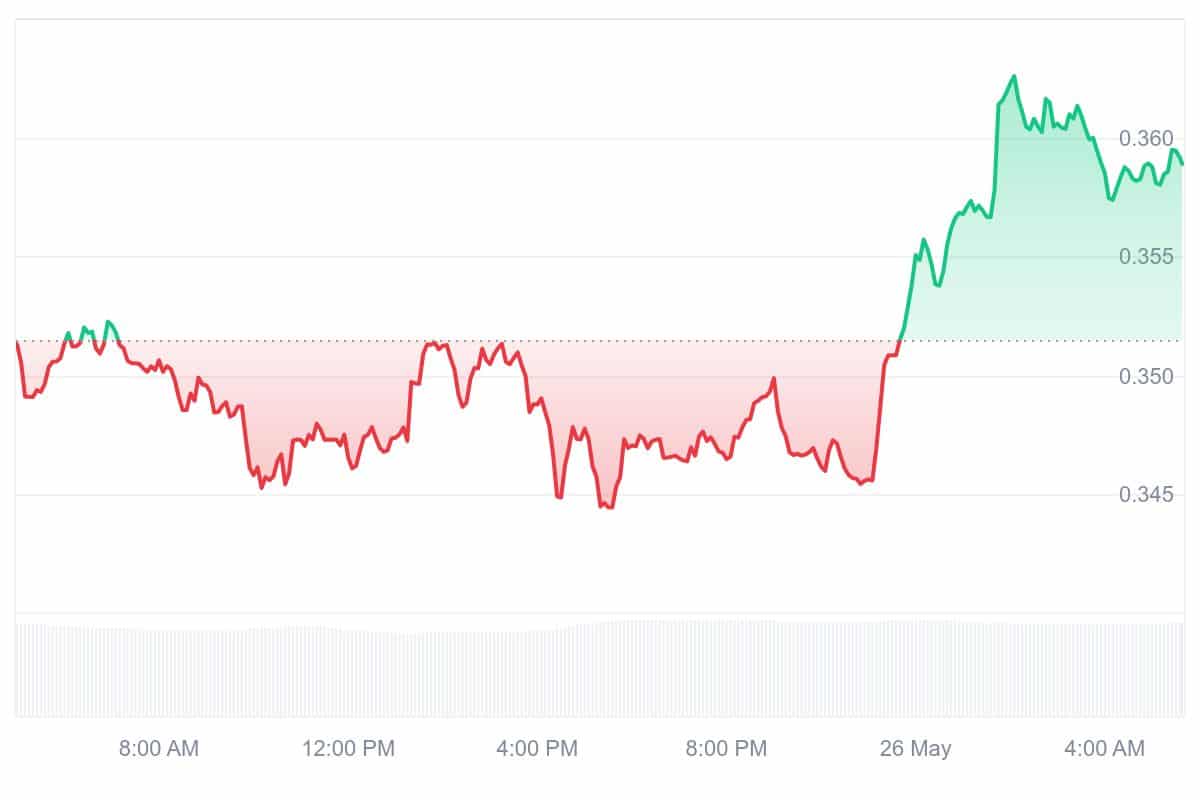

It’s essential to notice that AXL’s price has dropped by more than 85% from its peak of $2.66. Both a decline in user engagement and wider market volatility are reflected in this slump. Nonetheless, the current price increase points to a possible rebound, maybe driven by rekindled investor interest and tactical advancements inside the Axelar ecosystem.

Moreover, Axelar’s integration with well-known platforms such as Microsoft’s Azure marketplace, Uniswap, MetaMask, and J.P. Morgan’s Kinexys demonstrates its expanding acceptance and importance. The nomination of Brian Brooks, the former legal chief of Coinbase, to Axelar’s Institutional Advisory Board, is an important step toward institutional acceptance and regulatory alignment.

2. Ethena (ENA)

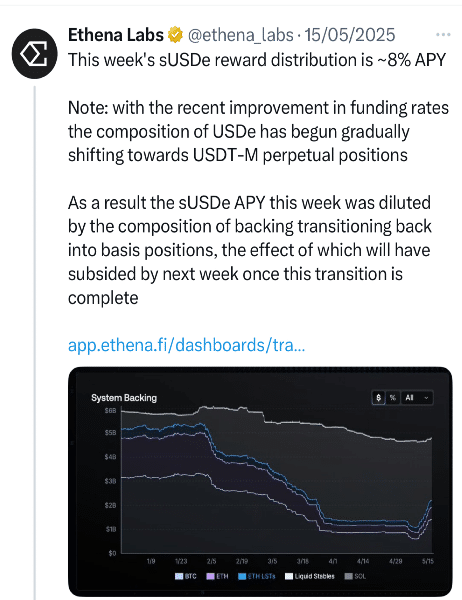

Ethena’s significant achievement is the creation of USDe, a synthetic dollar that provides stability without depending on conventional currency reserves. USDe offers its holders yield-bearing options while maintaining its peg to the US dollar through delta-neutral hedging procedures.

In addition to improving user accessibility, the protocol has been linked to popular exchange wallets, including Binance, Bybit, OKX, and Bitget. Users who lock USDe for at least seven days through these platforms will receive a 20% incentive boost.

ENA’s market value is currently about $3.41 billion, and its present value is around $0.38. The market is very active, as seen by the $1 billion 24-hour trading volume. The coin has grown significantly since its introduction, rising by a noteworthy 157% from its lowest price.

Converge, an institutional-focused Layer-1 blockchain developed by Ethena in partnership with Securitize, aims to bridge the gap between traditional finance and DeFi by enabling tokenized asset movements. As a result of Ethena’s relationship with WLFI, Ethena’s position in the DeFi market has also been strengthened by adding sUSDe as a core collateral asset in WLFI’s upcoming Aave instance.

3. Jupiter (JUP)

Jupiter’s primary advantage is its function as a Solana network liquidity aggregator. By combining several DEXs, Jupiter guarantees that consumers obtain the best swap rates with the least amount of slippage.

Significantly, the protocol declared a 50% buyback fee scheme to lower the amount in circulation and possibly raise the token’s value. Jupiter Lend is a lending company that introduces a dual-layer architecture to the DeFi sector through a partnership with Fluid, a DeFi infrastructure protocol.

Due to profit-taking and general market volatility, JUP’s price has dropped by almost 72% since hitting its highest point ever on January 31, 2024, at $2.00. However, recent price fluctuations indicate a potential rebound and increased investor interest, with a 13.3% increase over the last week and a 4.37% increase over the last 24 hours.

$2 trillion in volume

1.8 billion transactions

7 million assets

300 yards pic.twitter.com/O2ZrXtVCsi— Jupiter (🐱, 🐐) (@JupiterExchange) May 24, 2025

Furthermore, Moonshot, a business that lets users purchase and sell meme coins on mobile devices, was acquired by Jupiter in the majority. With this acquisition, Jupiter is demonstrating its desire to expand its product line and reach new market niches.

4. Kava (KAVA)

Kava’s distinguishing characteristic is its ability to combine the finest aspects of Ethereum and Cosmos to create a platform that facilitates quick, safe, and compatible DeFi applications.

The Ankr Partner Spotlight highlighted Kava’s goal of bridging the Ethereum and Cosmos ecosystems in February 2025. Through this partnership, Kava intends to become more visible and spark interest from both blockchain communities.

The token’s 3.3% rise over the past day suggests the market is upbeat. Its current market capitalization is approximately $458.71 million, and 1.08 billion KAVA tokens are in circulation.

The EVM powers every major DeFi app on Ethereum.

What happens when an AI layer gets added? 🧠

KAVA AI explores how smart contracts and decentralized compute can evolve through real-time, intelligent automation.

Learn more at https://t.co/1wJodFLzbQ pic.twitter.com/r2LTbIZ5Wz

— Kava (@KAVA_CHAIN) May 21, 2025

Arrowhead Contracting was purchased by Kava Equity Partners, a company connected to the Kava ecosystem, which broadened its holdings to include federal government contracting. This calculated action supports Kava’s objective of expanding and fortifying its position across various industries.

5. Best Wallet Token (BEST)

Best Wallet is quickly becoming an ideal cryptocurrency wallet among regular users and presale aficionados. With its cutting-edge functionality and user-centric design, it seeks to reinvent the way people engage with digital assets.

The “Upcoming Tokens” gateway is a noteworthy feature that gives customers early access to verified cryptocurrency presale programs. This tool offers consumers the opportunity to invest before these coins are listed on major exchanges, showcasing successful projects like Pepe Unchained and Wall Street Pepe.

BEST intends to launch the “Best Card,” a cryptocurrency debit card that offers up to 8% cashback on purchases. By bridging the gap between digital assets and regular spending, this function seeks to increase the value of cryptocurrencies in day-to-day living.

Visit Best Wallet Token Presale.

6. EOS (EOS)

EOS seeks to provide enhanced scalability and faster transaction speeds by using a Delegated Proof of Stake (DPoS) consensus process, enabling industrial-scale decentralized applications (dApps).

By rebranding as Vaulta, the EOS Network made a clear shift toward Web3 banking services and repositioned itself in the changing financial landscape. This shift intends to provide Web3 users with contemporary banking services by bridging the gap between decentralized finance (DeFi) and traditional finance (TradFi).

With a market valuation of over $1.17 billion and a 24-hour trading volume of about $136.98 million, EOS is currently trading at about $0.78. Over the past day, the token has increased by 1.10%, suggesting a slight upward trend.

Banking is Broken. Vaulta is Rebuilding It.

Legacy finance can’t keep up. Vaulta can.

From sub-second payments to institutional-grade custody, Vaulta is purpose-built to power the future of finance.

🔗 Read the full post: https://t.co/lSZLu5XB9Z pic.twitter.com/VQQmK6cX98

— Vaulta (prev. EOS) (@Vaulta_) May 22, 2025

Additionally, Trump-backed cryptocurrency fund World Liberty Fi purchased EOS tokens prior to the token’s conversion to Vaulta. The acquisition has sparked concerns about the project’s future while adding to the fund’s expanding portfolio.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage