Join Our Telegram channel to stay up to date on breaking news coverage

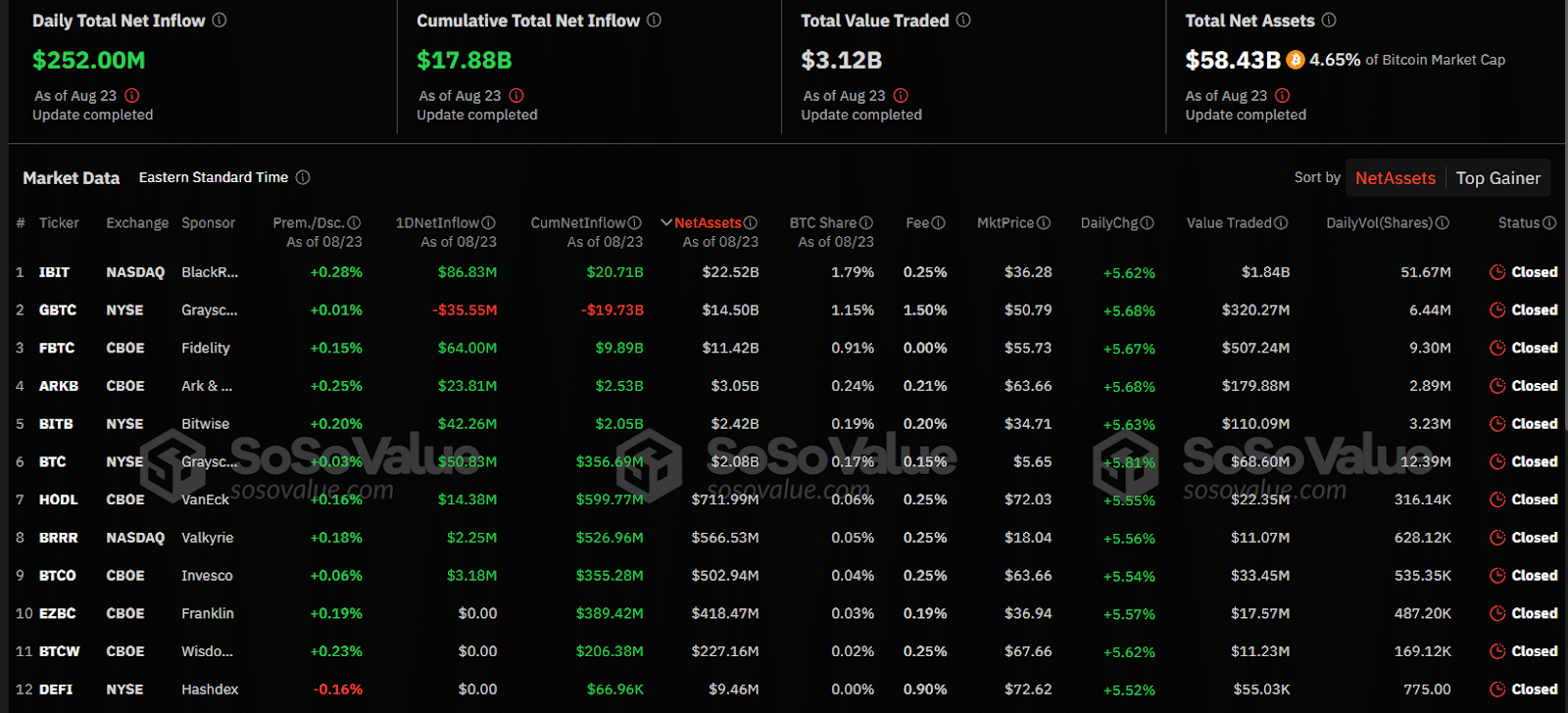

US spot Bitcoin ETFs (exchange-traded funds) recorded 5-week high net inflows of over $250 million on Aug. 23, with the investment products belonging to BlackRock and Fidelity leading the way.

According to data from Soso Value, BlackRock’s IBIT and Fidelity’s FBTC posted the highest inflows. Grayscale’s GBTC was the only product that recorded outflows at $35 million, although its mini Bitcoin fund registered $50 million in inflows.

Bitwise Says Bitcoin ETFs Lead In Institutional Adoption Despite Retail Traders Holding Most Of The AUM

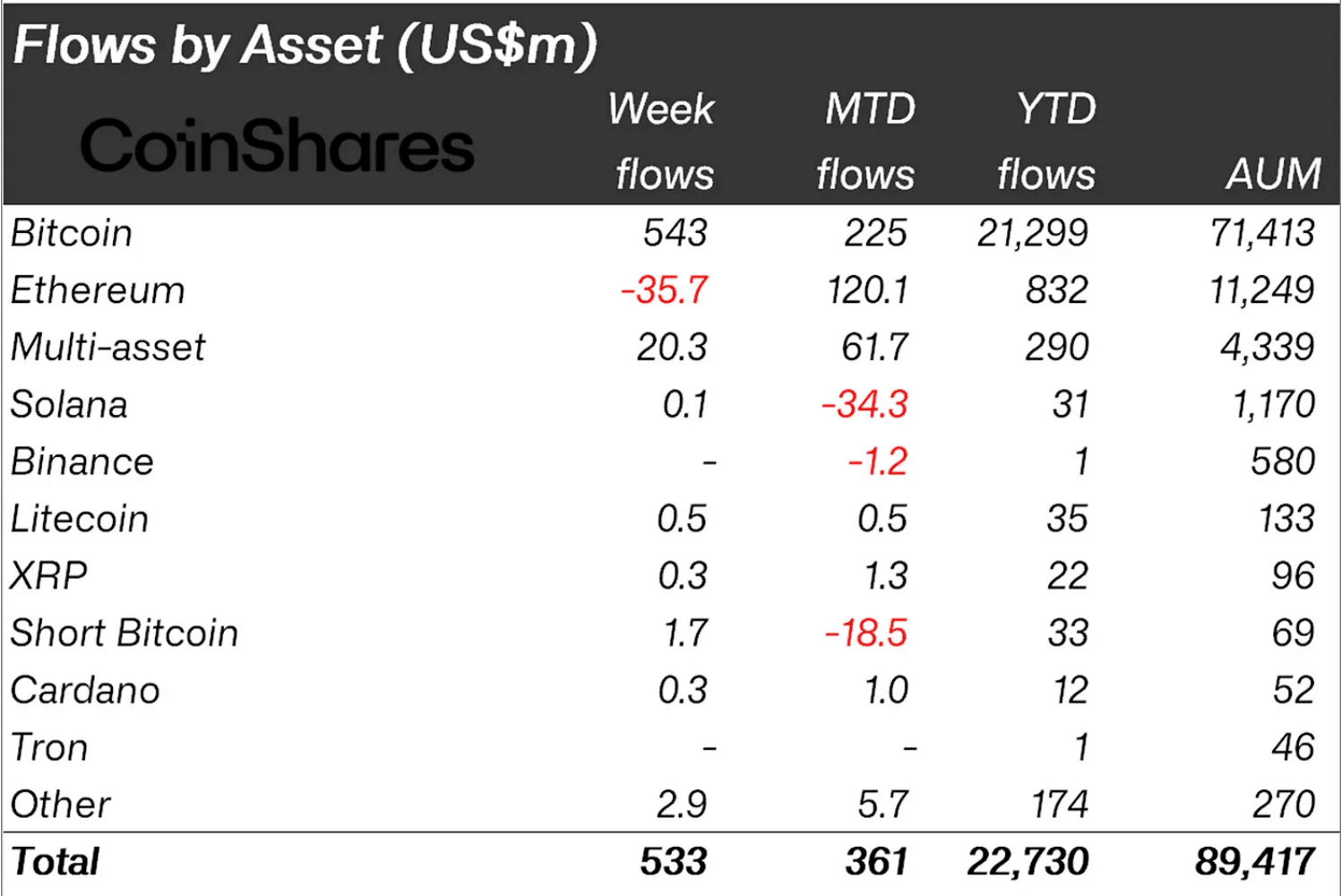

Coinshares data shows that Bitcoin-related ETPs (exchange-traded products) were the best-performing among all crypto investment products, totaling $543 million last week. Most of this inflow came from BlackRock’s IBIT, which saw $318 million during this period.

Bitwise’s chief investment officer Matt Hougan said in an Aug. 21 thread on X that Bitcoin ETFs are the “fastest-growing ETFs of all-time.” After the investment products pulled in over $17.5 billion since their launch in January, the funds are on track to “smash the previous record,” which is held by the Nasdaq-100 QQQs, he added.

2/ Bitcoin ETFs are the fastest-growing ETFs of all-time. They've pulled in $17.5 billion in net flows since launching in January. This is on pace to smash the previous ETF record, held by the Nasdaq-100 QQQs, which gathered ~$5 billion in their first year. It's not even close.

— Matt Hougan (@Matt_Hougan) August 21, 2024

Most of the interest in spot Bitcoin ETFs comes from retail investors, Hougan said in the thread. While around 79% of the current Bitcoin ETF assets under management (AUM) is held by retail traders, he said that Bitcoin ETFs are “by far the leaders in terms of institutional adoption.”

BTC Rises On September Interest Rate Cut Hopes

Federal Reserve Chairman Jerome Powell’s comments, “The time has come for policy to adjust,” signaled the Fed’s confidence that inflation is returning to target and caused the Bitcoin price to rally, pushing it above the $62,000 resistance level. As a result, the market now expects a potential rate cut in the next FOMC meeting, which will happen on Sept. 17. CoinMarketCap data shows that the leading crypto is up by more than 8% over the past week to trade at $63,386 as of 11:25 p.m. EST.

Despite a dovish tone, Bank of America (BofA) notes that Chairman Powell did not indicate the need for 50bp cuts but suggested gradual cuts, with 50bp cuts likely only if recession risks increase significantly.

Related News

- How to Buy Bitcoin with Debit Card

- Crypto All-Stars Raises Over $770K In ICO – Limited Time To Unlock 1,882% APY

- Bitcoin (BTC) Price & Future Predictions

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage