Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price tumbled 4% in the last 24 hours to trade for $66,716 as of 00:14 a.m. EST on trading volume that soared 87%.

The BTC price falls followed reports that the US Government moved $2 billion worth of BTC to a new address.

Data from blockchain analysis platform Arkham Intelligence revealed the transaction. It tracked the 29,800 Bitcoin tokens from a government wallet that stored the Bitcoin seized from the shuttered dark web marketplace Silk Road in 2022 to an unknown wallet address on July 29.

Like it happened with the German government, such transactions tend to turn heads, amid concerns of a possible sell-off.

BREAKING:

The US. Government just moved $2B of Bitcoin to a new address:

bc1qsl993y04xnq4fyhmrt6cnmctgjjv9ukdvrk0cd pic.twitter.com/JQvjKIuRNn

— Arkham (@ArkhamIntel) July 29, 2024

It comes only days after the Bitcoin 2024 Conference, where former US president Donald Trump pledged never to sell any of the US government’s Bitcoin.

He committed to create a “strategic national BTC stockpile” if reelected. Besides Trump’s remarks, Wyoming Senator Cynthia Lummis also declared the introduction of legislation to make Bitcoin a strategic reserve asset of the US.

We now have a bill to establish the United States Bitcoin Reserve, stored in a Digital Fort Knox. pic.twitter.com/0RphRTpmk4

— Michael Saylor⚡️ (@saylor) July 28, 2024

Trump supporters wasted no time lambasting the Biden government, with Tyler Winklevoss sarcastically calling the development a ”great look and great way to reset with our industry.”

On Saturday, @realDonaldTrump pledged to never sell any of the US government's bitcoin. Two days later, the Biden-Harris Administration moves $2 billion of Silk Road bitcoin. Great look and great way to reset with our industry. 🤡

— Tyler Winklevoss (@tyler) July 29, 2024

Galaxy CEO Mike Novogratz also commented on the transaction, calling it a “tone deaf” move by the Democratic government.

Tone deaf anyone??? Moving Silk Road BTC two days after Trumps pledge to not move them is just dumb!!!!

— Mike Novogratz (@novogratz) July 29, 2024

Nevertheless, some say it may be related to a July 1 agreement between the US Marshalls Service and crypto exchange Coinbase. According to a Coinbase report, the two parties signed a deal, where Coinbase would “safeguard” US Government crypto assets.

You guys freak out any time large coins move.

Remember that US Marshall’s *just* signed with Coinbase Prime to start custody of government held digital assets? https://t.co/wwxoFepggH pic.twitter.com/WlroZvrblm

— Adam Cochran (adamscochran.eth) (@adamscochran) July 29, 2024

The Bitcoin price retains its bullish stance, with one trader anticipating a golden cross pattern on the 12-hour timeframe. A golden cross is a technical analysis chart pattern that occurs when a short-term moving average crosses above a long-term moving average.

The pattern suggests that the overall trend is shifting to the upside and may indicate a potential increase in the price of the cryptocurrency. Traders often see this as a signal to buy or hold onto their positions.

$BTC golden cross approaching 🔥

The last time it happened, $BTC pumped 174% in just 4 months

You're not bullish enough!👀 pic.twitter.com/47ozJIdfQF

— Elja (@Eljaboom) July 29, 2024

Perhaps, one catalyst that could help activate this chart pattern is the upcoming Federal Open Market Committee (FOMC) meeting and press conference by Fed chair Jerome Powell.

The FOMC’s decisions are critical as they directly influence economic conditions, inflation rates, and monetary policies. As such, investors across all markets, including in the crypto sector, highly anticipate this meeting.

𝐁𝐢𝐠 𝐰𝐞𝐞𝐤 𝐟𝐨𝐫 𝐜𝐫𝐲𝐩𝐭𝐨 𝐡𝐨𝐥𝐝𝐞𝐫𝐬 #FOMC meeting is happening on Wednesday.

Currently the probability of no rate hike in July is almost 96%.

But things will get interesting in September, as right now there's a 90% probability of a rate cut in September. pic.twitter.com/XjP9xczYEu— Aaron Crypto (@Satoshicrypto0) July 29, 2024

Higher interest rates make borrowing expensive, which negatively impacts risk-on assets. This is because traders use leverage for gains in risk-on assets like crypto.

According to former Goldman Sachs executive Raoul Pal, the confluence of a weaker US dollar, a healthy correction on the Nasdaq, and US elections could catapult the Bitcoin price to a new all-time high amid a “macro summer.”

This confluence of events maybe take a little more time to play out, or could happen with the FOMC. Who knows… but good times lie ahead.

Enjoy Macro Summer.

— Raoul Pal (@RaoulGMI) July 29, 2024

Bitcoin Price Prediction Amid Concerns Over US Government BTC Transaction

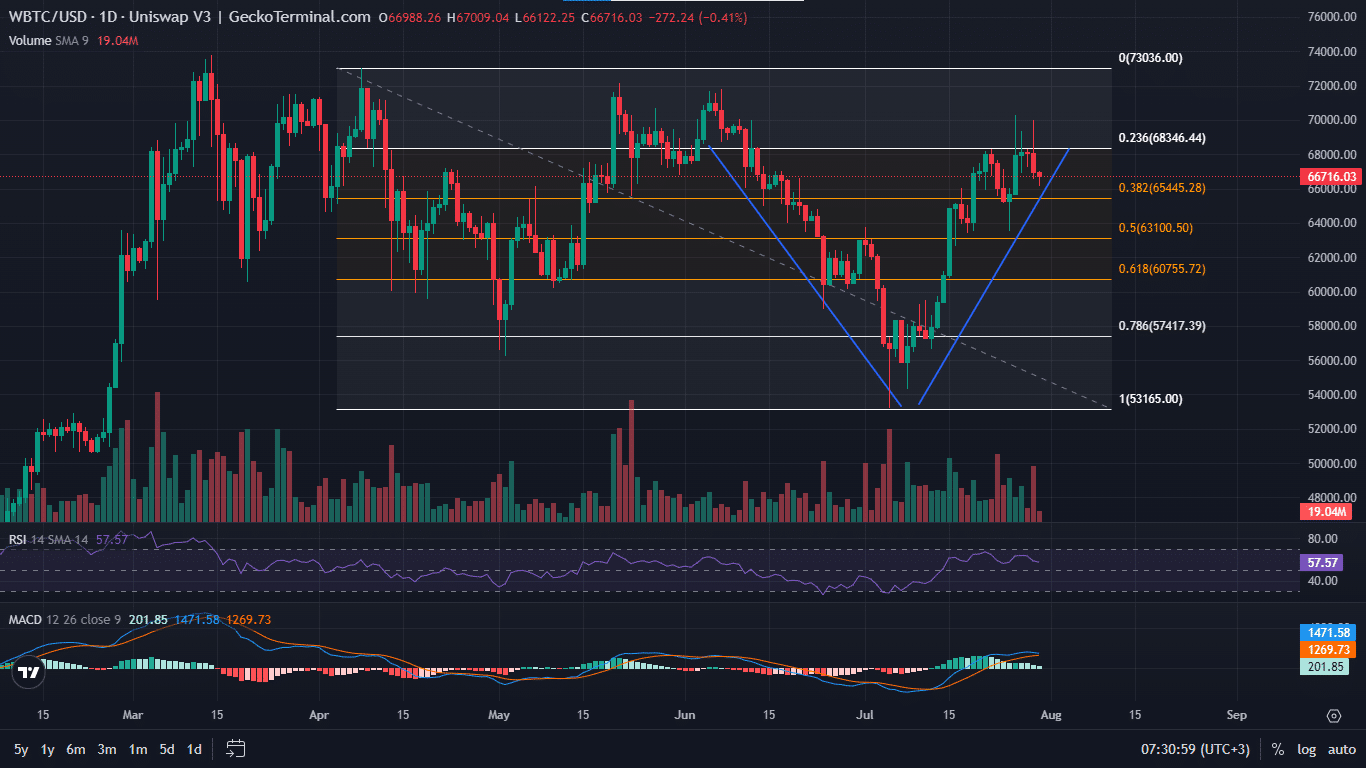

The Bitcoin price is trading with a bullish bias after completing a V-shaped recovery. However, the pioneer crypto faced a rejection from the $68,346 level. Despite the pullback, the odds continue to favor the upside.

Looking at the Relative Strength Index (RSI), which continues to hold above the mean level of 50, the bulls remain at play. Similarly, the Moving Average Convergence Divergence (MACD) is in positive territory, accentuating the bullish thesis.

Accordingly, the correction could provide a good entry for late bulls as the Bitcoin price continues to hold above the 38.2% Fibonacci retracement level of $65,445.

A bounce atop this support level could set the pace for a move north toward the $68,346 resistance level. In a highly bullish case, the gains could send the pioneer cryptocurrency ascend to reclaim the $73,036 threshold.

GeckoTerminal: BTC/USD 1-day chart

Conversely, if the downtrend continues, the Bitcoin price could slip below the $65,445 level. Nevertheless, only a candlestick close below $53,165 would invalidate the bullish thesis.

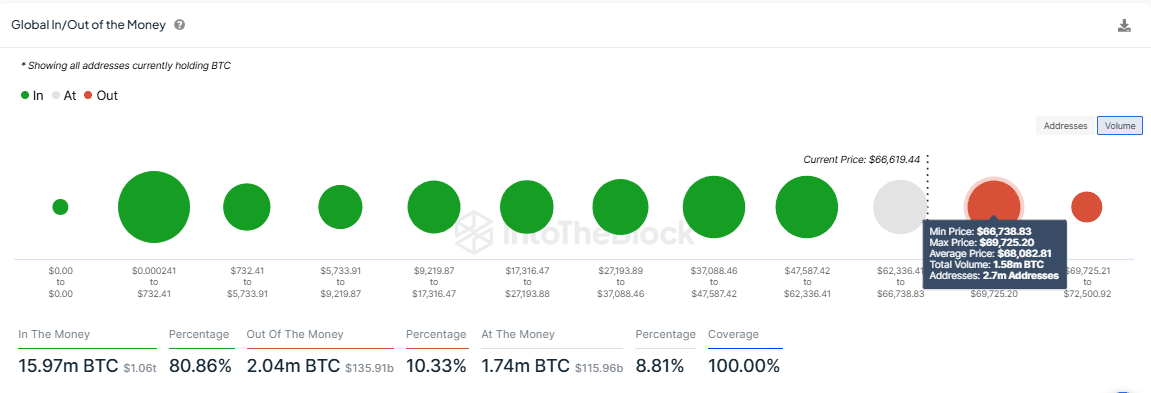

Meanwhile, data according to on-chain aggregator IntoTheBlock’s Global In/Out of the Money metric shows that the area between $66,738 and $69,725 offers strong resistance for the Bitcoin price. Within this range, 2.7 million addresses hold 1.58 million BTC bought at an average price of $68,082.

Bitcoin GIOM, Source: IntoTheBlock

The data also shows that at current prices, 80.86% of Bitcoin holders are sitting on unrealized profit. This is against the 10.33% of holders sitting on unrealized losses, and 8.81% that are breaking even.

Meanwhile, as the Bitcoin price confronts a critical barrier, investors are flocking to 99Bitcoins (99BTC), a Learn-to-Earn token offering up to 672% in annual percentage rewards (APY) and with only 6 days left until its presale closes.

According to Gossipator, a popular YouTube channel with over 11.6K subscribers, this project is an easy way to 100X your investment.

Promising Alternative To Bitcoin

99BTC is the native cryptocurrency for the 99Bitcoins ecosystem, a long-established educational platform that is pioneering a new Learn-to-Earn rewards model.

The groundbreaking project incentivizes learning through a unique mix of gamification and a leaderboard reward system.

This ensures users feel like their learning is bearing tangible and therefore spendable benefits. You earn crypto while learning about crypto.

🎉 Exciting News! 🎉

We’ve raised over $2.5 MILLION in the $99BTC presale! 🚀

The presale ends on August 6th, 2024. Secure your spot now!

Join here! 👉 https://t.co/NXD7DAamqr#99Bitcoins #BTC #Crypto #L2E pic.twitter.com/XMevJZHygh

— 99Bitcoins (@99BitcoinsHQ) July 29, 2024

If you would like to join investors who have already sent more than $2.5 million to the project, you can buy 99BTC tokens now for $0.00115. With a price hike coming in about 30 minutes, buy immediately to lock in the best deal.

Visit and buy 99Bitcoins here.

Also Read:

- 99Bitcoins Price Prediction – $99BTC Profit Potential in 2024

- 99Bitcoins Launches New Learn-to-Earn Airdrop Presale – TodayTrader Video Review

- Best Penny Crypto Investments: Top Picks for Explosive Growth in 2024!

Join Our Telegram channel to stay up to date on breaking news coverage