Join Our Telegram channel to stay up to date on breaking news coverage

Ethereum (ETH) has formed a so-called ‘Death Cross,’ but history suggests it may not necessarily prove deathly for the cryptocurrency’s price.

This Death Cross occurs when a short-term moving average crosses below a long-term moving average. In this case, it is the 50-day Simple Moving Average (red) and the 200-day SMA (green). The name comes as the crossover often triggers a bearish phase in the market in the long run.

With the Death Cross executed on the daily chart for the ETH/USD trading pair, a prolonged downside may be imminent and the price may drop below the psychological $1,000 level to the critical support of $882. This level, which is about 46% down from the current price level, has provided crucial support in the history of Ethereum’s price action.

Ethereum Price Support from a Historical Perspective

If we take a look at the extended daily price chart of ETH/USD since 2018, the cryptocurrency has experienced six Death Crosses. Yet it has often moved contrary to expectations.

Out of the previous five death crosses, ETH’s price has experienced significant losses only twice. The above chart’s first and last death cross shows downside price movement. However, after the 2nd Death Cross, prices have remained in consolidation.

Furthermore, the prices have moved in the upside direction after the 3rd and 4th Death Crosses. These contrary movements were due to the formation of the Golden Cross immediately after the Death Cross.

Possible Outcomes

Now, given this scenario, we can assume two outcomes:

- Ethereum price will continue to fall until $882, its critical support in the long run, and it will experience double-digit losses following this Death Cross.

- Ethereum price might move in consolidation and reverse back to the upside on the formation of Golden Cross in the next few days.

To conclude, the formation of the Death Cross is expected to decrease prices a little. However, it should be noted that the Death Cross indicator alone is not a reliable method for analyzing the future price movement of an asset.

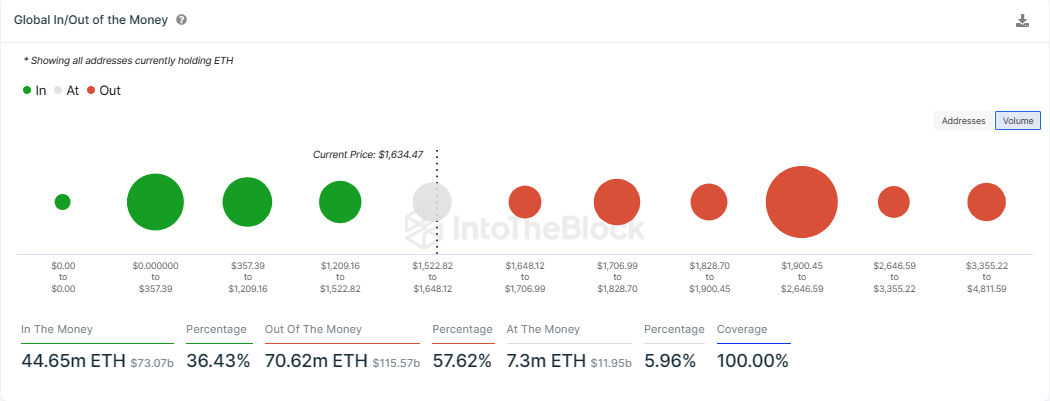

On-chain Metric: IntoTheBlock

Data from IntoTheBlock shows that at current prices, 57.62% of token holders are incurring losses (out of the money), while only 36.43% are making a profit (in the money). Meanwhile, 5.96% of token holders are breaking even (at the money).

With the lion’s share of token holders suffering losses, Ethereum’s price could fall soon. This will come as the cohort that is “out of the money” looks to sell to avoid suffering more losses. They could either sell at current prices or wait for when they finally break even. The ensuing selling pressure is likely to send ETH market value downward, thereby activating the death cross effect.

A Promising Alternative To Ethereum

Given the risky outlook for Ethereum, investors may want to consider alternatives such as SONIK Coin. Inspired by Sonic the Hedgehog, it has recently gained significant momentum. In its presale, the project has raised nearly $960,000 in total. Currently available at a presale price of just $0.000014 per token, investors have the opportunity to get in early. Once the project reaches its $2 million target, it will be listed on exchanges, potentially driving its value higher.

Only 3 days and 20 hours are left for the presale to end. This limited time period is an alarm for interested investors to join the project for future benefits.

Don't just stand there, $SONIK's moving!

Only 4 days left to join the #Presale!!!!!

👉 https://t.co/s1fTdXDQCK pic.twitter.com/qUyeYgSNTE— SONIK COIN (@Sonikcoin) September 1, 2023

The Sonik Coin team is ambitious, aiming for a market capitalization of $100 million. The market is expecting to see nearly fiftyfold return on initial investments following the end of presale.

Furthermore, Sonik holders can stake their tokens to earn rewards along with the potential price gains.

The team has allocated about 40% of the total supply for distribution among stakers over the next four years. The current staking rate offers an annual percentage yield (APY) of 88%, which is above industry’s average. This stake-to-earn feature of a newly appeared memecoin is what giving strength to this project.

Also Read:

- Ethereum Price Prediction: ETH Drops to $1,640 – SEC Delays Depressing Price?

- Altcoin Season Gains Momentum as Viral Meme Coin Sonik Draws $750k Investment; Only 6 Days Remaining for Low-Price Purchases

- Sonik Coin Poised for 10x Gains – A Chance to Get in Early on the Next Big Meme Coin

- Sonik Coin Price Prediction – SONIK Price Potential in 2023

- Crypto News Channel Reviews The Sonik Coin Presale – Next 10x Meme Token?

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage