Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin’s (BTC) price has suffered a dreadful last four days after a 15% slump. The decline sent the flagship cryptocurrency to the mid-June lows of around $25,174. Also, the fall saw BTC lose a crucial support level, which had kept the king of crypto bullish from an overall outlook. Efforts to restore the above essential support are underway, but on-chain metrics, like volatility and liquidations, suggest a gloomy outlook. This could fuel a miner-induced sell-off unless things improve.

Theories To Explain Recent Bitcoin Price Crash

Several theories have sprouted to explain the recent slump in Bitcoin price, but two stand out. Brief explanations for the two are as follows.

Convoluting Volatility

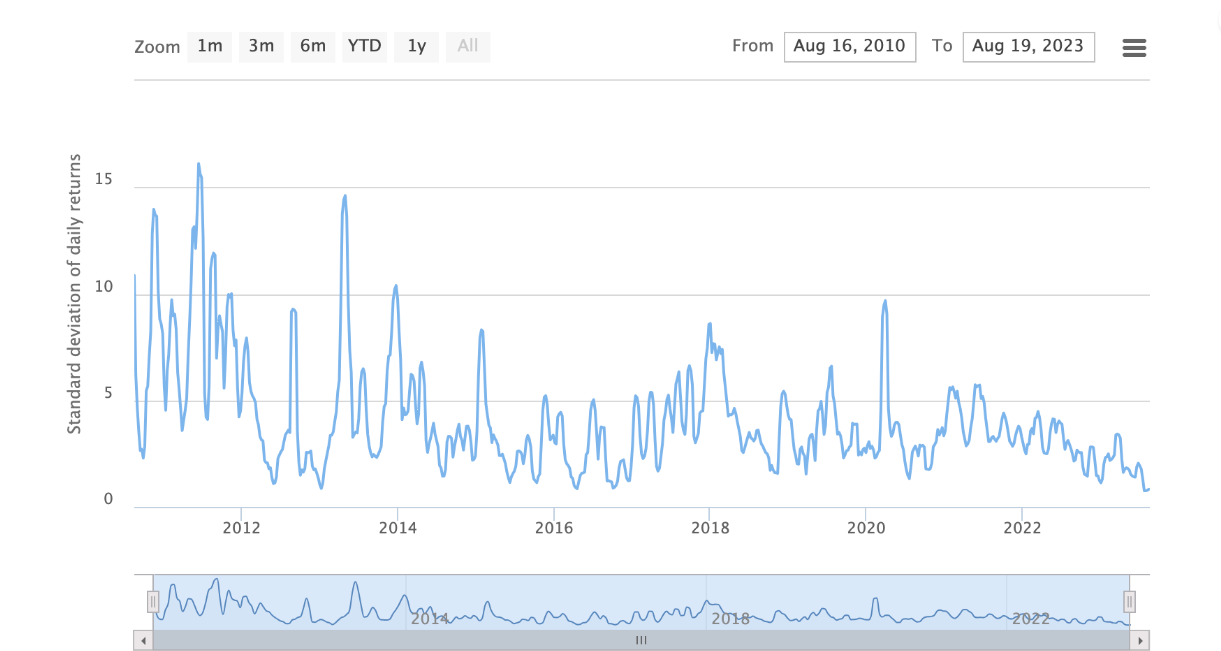

Notably, Bitcoin price has recorded multiple moving instances in a tight consolidation. First, it was before the 2023 rally established a $31,500 peak for BTC. This was made worse by broader macroeconomic conditions and a range-bound movement, leading its volatility score to an all-time low.

Bitcoin price has recorded many sequences of low volatility over its 13-year tenure. With every breach of each move, an explosive action followed.

Forced Liquidations

Forced liquidations is the second theory to explain the recent dip, and it majorly points to rumors of SpaceX selling its BTC holdings. Citing an excerpt from a QCP Capital publication:

Large BTC and ETH gamma related perp liquidations on options exchanges Deribit and OKX, which together accounted for an outsized 50% of all liquidation flow.

Bitcoin Price Forecast

Bitcoin price shows efforts by bulks to pull back up, but momentum remains abysmal, or in the simplest terms, awful. The Relative Strength Index (RSI) is at 19, while the histogram bars of the Awesome Oscillator show huge volumes of red. This means the bears still have a very tight grip on BTC prices.

Therefore, unless momentum increases, Bitcoin price could break below the immediate support level at $25,174 and record a new range low. It could slide 25% to the psychological $20,000 level in the dire case.

Industry investigators, investors, and traders agree that the market needs a positive impulse to catalyze an uptrend. If this happens, Bitcoin price could move north, recovering the ground lost in the recent crash. Potentially, it could restore above $28,738.

From the current standpoint, the most likely impulse would be the US SEC approving a spot BTC ETF. However, chances of such an outcome remain bleak, with an ETH ETF approval showing more promise, the Wall Street Journal reported.

In a highly bullish case, the price could extend higher than the $30,664 resistance level to record a new range high, potentially more elevated than the $31,804 level.

BTC Alternative

While Bitcoin price works out a recovery, consider WSM, the ticker for the Wall Street Memes ecosystem. The WSM token is an ERC-20 token running on the Ethereum blockchain with a maximum supply of two billion. It is one of the most significant communities in the cryptocurrency ecosystem, with some of the highest social engagement. It aims to legitimize loyal supporters of the movement.

WSM token is in the presale stage, offered in exchange for $0.0337 per token.

The fundraiser has already accrued $26.015 million in presale sales. Interested investors can buy WSM using Ethereum (ETH), Tether (USDT), or a card.

Also Read:

- Bitcoin Price Spikes Over $20k; What’s Next?

- Wall Street Memes Reaches $25 Million Raised In Record-Setting Crypto Presale.

- Wall Street Memes Presale Sees 460 ETH Whale Buys In Final Days, Ends Soon

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage