Join Our Telegram channel to stay up to date on breaking news coverage

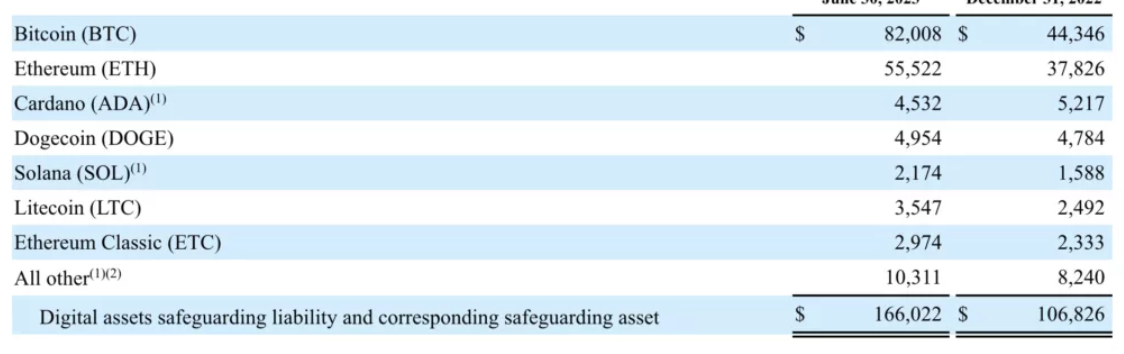

San Francisco-based SoFi Bank has revealed in its quarterly earnings report that it holds $170 million worth of crypto, made up of Bitcoin, Ethereum, Litecoin, Solana, Ethereum Classic, and Dogecoin.

Bitcoin forms the bulk of its crypto holding, valued at $82 million, followed by Ethereum ($55 million) and Dogecoin $5 million. Cardano comes fourth as SoFi holds $4.5 million worth of ADA tokens.

The bank offers a unique value to investors by allowing them to invest a portion of their deposits in terms of digital assets without any digital fees. According to the official website, US users also get up to $100 worth of Bitcoin for trading crypto.

The FAQ section of the official page of the SoFi crypto trading app says that once conditions are met, SoFi deposits the Bitcoin bonus within 7 days of creating an account.

SoFi Bank – From Crypto Trading App To A Bank

When SoFi started its crypto trading facilities in 2019, it wasn’t a bank. Back then, the 800,000 customers it aided could trade upwards of 10 crypto assets.

The trading platform’s transition to bank happened in February 2022 when it was acquired by Golden Pacific Bancorp and Golden Pacific Bank

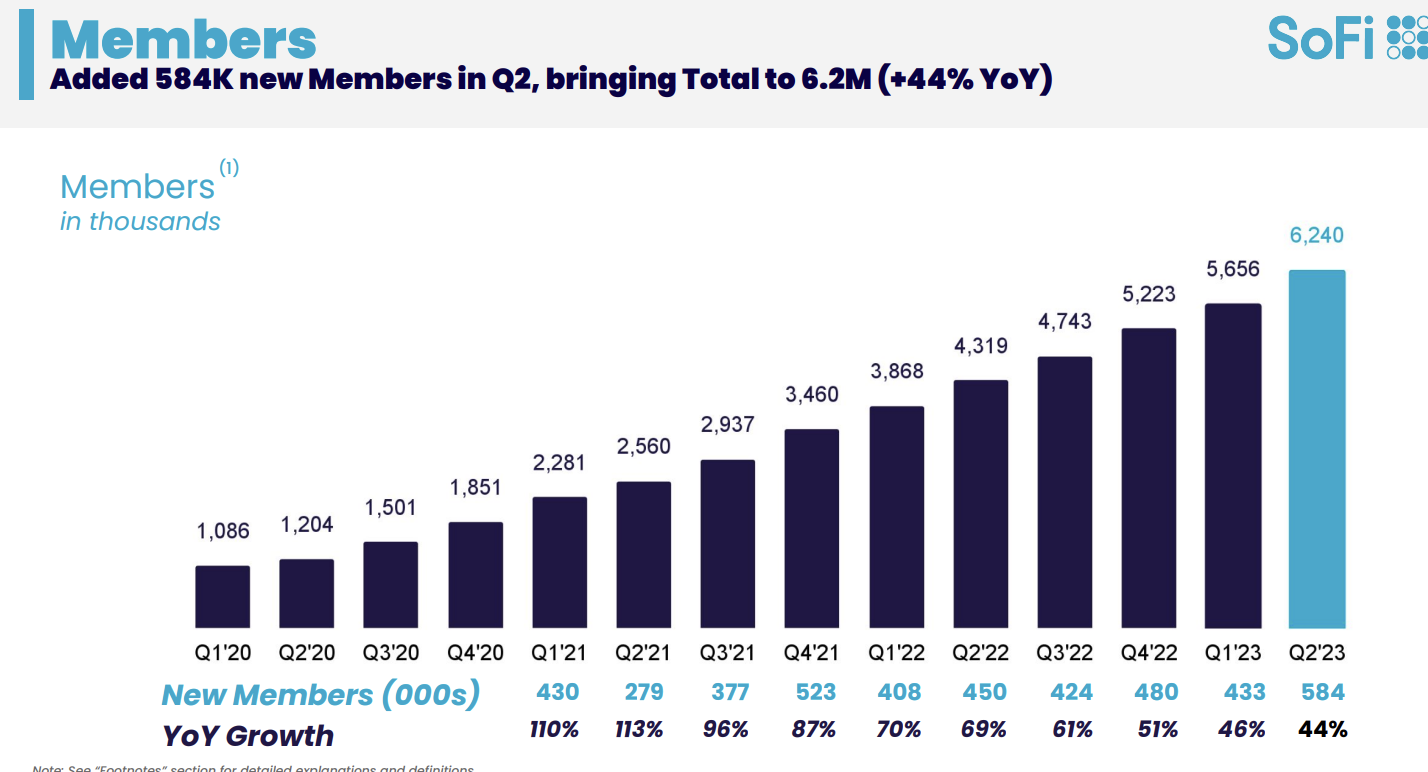

An investor presentation accompanying the Q2 earnings report revealed that SoFi had onboarded 584,000 more customers and now supports over 22 cryptocurrencies. It also holds Federal Reserve stocks and offers users crypto via its Coinbase partnership.

During SoFi’s transition to a full bank, Fed presented a roadblock, stating that the company was engaged in crypto trading. It gave SoFi two years to align with Fed’s policies, meaning the bank has until January 2024 to bring its policies up to Fed’s standards.

The reason was the missing capital reserves. Banks are legally required to hold some capital in reserves when they put loans in their balance sheets, allowing them to offset some losses using the capital inside the reserves.

However, SoFi only holds loans for six months before collecting interest and selling them to investors. This added dynamism means SoFi doesn’t hold any capital in reserves in case of potential losses.

The quarterly earnings report doesn’t go into any progress it has made regarding aligning its policies with the Federal Reserve, nor does it discuss how many crypto customers it has.

What it does show, however, is that it holds $12.7 billion in deposits, an increase of $2.7 billion in the second quarter of 2023.

SoFi’s Quarterly Earnings Report Show 37% Year-on-Year Growth

The press release by SoFi, which is accompanied by a quarterly earnings report, shows that the company has made 37% year-on-year growth.

Five years ago, we focused on strong unit economics per product. Now, Q2 marks our 9th consecutive quarter of record revenue and 4th consecutive quarter of record adjusted EBITDA.

Watch CEO, @anthonynoto and the @CNBC team discuss $SOFI. ⤵️ pic.twitter.com/BJlhV8J1Yn

— SoFi (@SoFi) August 3, 2023

Related

- Imposter Tokens Using PYUSD Pop-Up on Several Blockchains

- Digital Commerce Chamber Lauds SEC vs Ripple Ruling in New Report

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage