Join Our Telegram channel to stay up to date on breaking news coverage

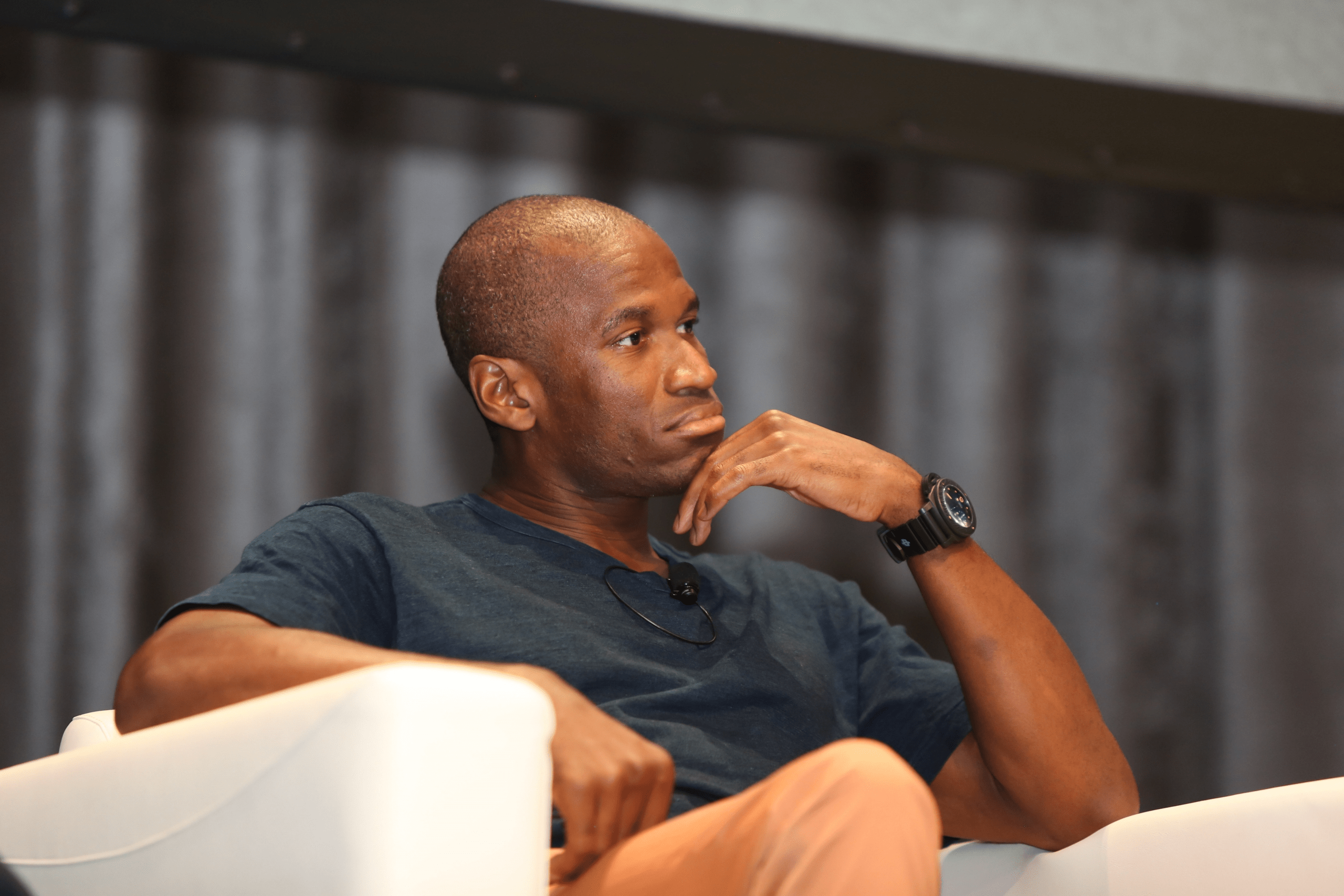

Arthur Hayes, the former CEO and co-founder of BitMEX, has put forward an intriguing perspective on the future of the crypto market.

Hayes reiterates his belief that Hong Kong will serve as the gateway for Chinese capital to enter the crypto financial asset space. He presents a thought-provoking market outlook that hinges on the actions of the Chinese economy and the deliberate steps taken to weaken the yuan, ultimately stimulating a crypto rally.

Arthur Hayes’ Perspective and Hong Kong’s Gateway Potential

In his recent blog post, he suggests that the actions of the US Securities and Exchange Commission (SEC) could have a negative impact, causing the market to spiral further. However, Hayes argues that it is China, not the US, that will have the greatest influence on the upcoming crypto rally.

He points to the potential resurgence of Chinese traders as a significant catalyst, especially in light of the weakening Chinese yuan.

Hayes draws parallels between the current market situation and the “nuclear bear market” of 2015, which was triggered by the Mt. Gox collapse. Just as back then, the current bear market, including the FTX implosion, has seen diminished trading volumes and price volatility, resulting in a tedious sideways price movement.

In contrast, the unexpected devaluation of the Chinese yuan against the US dollar by the People’s Bank of China (PBOC) in August 2015 led to a surge in Chinese interest in Bitcoin, propelling its price to triple within a few months. Hayes suggests that a similar scenario could unfold in 2023.

According to Hayes, this outlook aligns with his observations of China’s economic landscape, where he foresees an aggressive credit issuance spree. He argues that concerns about the US regulatory environment should not prompt premature selling, as he believes the market will eventually stabilize into a sideways phase until a trigger reinvigorates crypto traders’ spirits.

This trigger, Hayes asserts, will be a slowdown in China’s economy accompanied by a substantial increase in money printing, which will weaken the yuan and drive significant capital inflows into cryptocurrencies.

He emphasizes that as the Chinese economy falters, credit issuance will surge, resulting in a weaker currency and allowing capital to flow into appropriate channels. This, in turn, will ignite the crypto capital markets and hopefully initiate a rally in the autumn.

Hayes envisions that the People’s Bank of China (PBOC) will employ strategic measures to devalue the yuan, and one of these tactics involves fostering credit expansion in targeted industries. These sectors include semiconductors, artificial intelligence (AI), clean energy, and property. By channelling credit towards these areas, the PBOC aims to influence economic dynamics and create conditions conducive to weakening the currency.

By granting these sectors access to higher loan quotes, the central bank aims to stimulate economic activity. Additionally, Hayes highlights the importance of Hong Kong in attracting crypto and blockchain investments as part of China’s focused strategy.

China’s Changing Approach to Cryptocurrencies: Will It Lift The Ban?

China’s stringent restrictions on cryptocurrencies have not been able to completely quash activity in the sector, as underground crypto markets have emerged, with enthusiasts finding ways to circumvent the bans. However, recent indications suggest a possible change in China’s approach to cryptos.

There are signs that China may be easing its hardline stance on cryptocurrencies, which is significant considering the substantial impact its crackdown had on the crypto market in 2021. The crackdown was part of China’s broader efforts to regulate the fintech sector and align with its plans to introduce the digital yuan.

The global crypto community is closely monitoring these signs of a potential shift in China’s stance. However, the specific details and outcomes of this shift are still uncertain.

It is important to note that even if China were to relax restrictions, it would likely maintain tight control over the sector to ensure consumer protection, mitigate financial risks, and retain control over its own digital currency initiatives.

China’s acceptance of cryptocurrencies has the potential to increase global demand, raise prices, and revive crypto mining within its borders, shaping the future of digital currencies.

While the unbanning of cryptos could bring opportunities, it may also present challenges. Increased market volatility and regulatory complexities, such as consumer protection, money laundering, and financial stability concerns, could arise.

The potential shift in China’s stance on cryptocurrencies carries significant implications for the global crypto market. However, until more concrete information emerges, the true impact of this development remains to be seen.

Related News

- China Introduces Digital Yuan at Summer World University Games

- Hong Kong Monetary Authority Urges Banks To Sign Crypto Exchanges As Clients

- Is it Too Late to Buy Bitcoin?

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage