Join Our Telegram channel to stay up to date on breaking news coverage

Since the last bull market, the number of crypto companies has shot up and have been providing services to investors across the world. While several such companies flooded the market, the quality of services often ended up deteriorating by the day. However, as government scrutiny increases, these organizations are starting to bleed financially for any kind of investor negligence from their end; the most recent example being the popular trading platform Robinhood.

The cryptocurrency market is highly volatile and often requires traders to take positions and exit within minutes. Even a minute level of inefficiency from the exchange can end up costing the investors largely, which is why these platforms have to be highly responsive and updated with the latest prices. Robinhood had reported several system outages recently which had enraged investors since they ended up losing funds in huge quantities.

Robinhood Faces Multi-State Settlement for Operational & Technical Failures

While this may not be Robinhood’s first encounter with the law, it is surely one that may influence its way forward in terms of operations. The company behind Robinhood, known for its trading platform that enables users to trade stocks, exchange-traded funds (ETFs), and cryptocurrencies, was forced to pay a sizable fine due to operational and technical errors that had a negative impact on its investors.

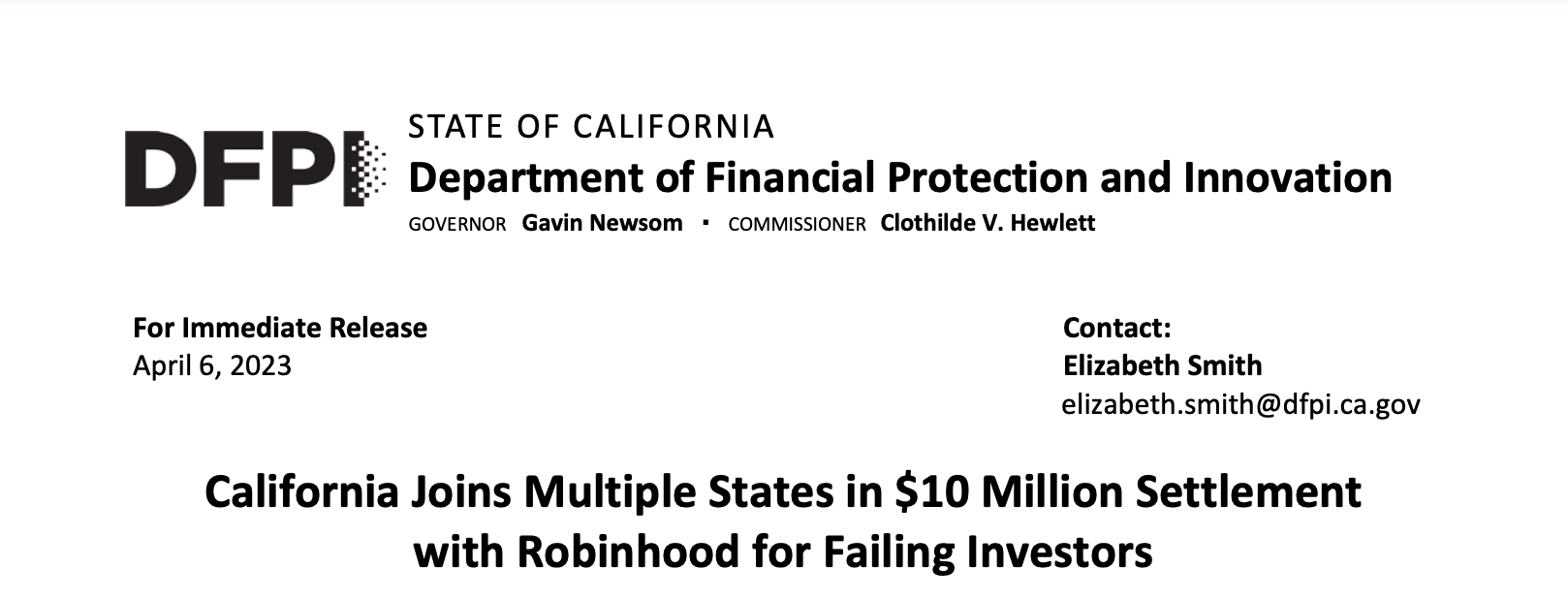

As per the statement released on April 6 by the California Department of Financial Protection and Innovation, Robinhood will be required to pay a fine of about $10 million.

The North American Securities Administrators Association, along with securities regulators from a number of states, including California, Alabama, Colorado, South Dakota, Delaware, New Jersey and Texas, conducted the investigation that led to this monetary fine. The authorities discovered that Robinhood failed to address significant operational and technological problems, which led to system disruptions in March 2020. This affected a massive number of investors and their potentially profitable trades.

Customers of Robinhood who were unable to access the trading platform during the system disruptions suffered severe financial losses. Additionally, authorities determined that Robinhood’s customer support was inadequate during these system disruptions, leaving clients with no way to get their problems resolved.

As a result, Robinhood will make fines totalling up to $10.2 million, as stated by the committee. This agreement acts as a severe warning to Robinhood to fulfil its duties in terms of customer care and correct the issues. This fine sends a clear message to other financial institutions that they must put the requirements of their customers first, which could pave way for better service and quality from several crypto companies in the future.

The committee also mentioned that they will be closely monitoring the activities of such organizations to ensure that investors are prioritized and that none of them has to face losses solely due to a shortcoming from the respective platforms’ end.

Robinhood- An Overview and Past Encounters with the Law

Baiju Bhatt and Vladimir Tenev established the financial services firm Robinhood in 2013, and it is situated in the US. In 2015, the business debuted its Robinhood app, which enables users to trade stocks, options, ETFs, and cryptocurrencies without incurring commission costs. Young investors took a liking to Robinhood, which later developed into one of the most renowned brands in the online brokerage sector.

Its cryptocurrency trading platform, Robinhood Crypto, which enables users to purchase and sell cryptocurrencies like Bitcoin and Ethereum was introduced by Robinhood in 2018. Due to its intuitive user interface and commission-free trading approach, the platform was soon to rise in popularity.

But over the years, Robinhood has seen a number of significant episodes that have raised questions about it. After restricting trading in a few stocks, including GameStop during the market turbulence brought on by the Reddit-driven short squeeze in 2021, Robinhood received a lot of negative press. Several users and lawmakers who accused the firm of siding with Wall Street and manipulating the market criticised this decision.

Robinhood has also encountered a number of regulatory issues. In December 2020, the Securities and Exchange Commission (SEC) fined Robinhood $65 million for failing to disclose significant conflicts of interest and deceiving clients about the sources of its revenue. For a number of violations, including inadequate oversight of its options trading platform, Robinhood paid a $70 million punishment to the FINRA in 2021.

Notwithstanding these instances, investors who are searching for a user-friendly and affordable way to trade stocks, options, and cryptocurrency continue to utilise Robinhood as a popular platform. The company’s cutting-edge investment strategy has upended the conventional financial sector and cleared the way for new, more approachable investment solutions for a larger audience. However, the recent incident has surely left a major mark on the platform but may end up impacting its actions in the future in an investor-friendly manner.

Conclusion

While Robinhood has been fined a considerable amount of money, it may not be rare for one to come across multiple such instances. Companies throughout the industry have often been accused of being the primary reason for investors losing funds. The best way to save oneself from such situations is to practice trading on highly reputed platforms with a clean history. It is also advisable to only invest funds that one can afford to lose.

Read More:

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage