Join Our Telegram channel to stay up to date on breaking news coverage

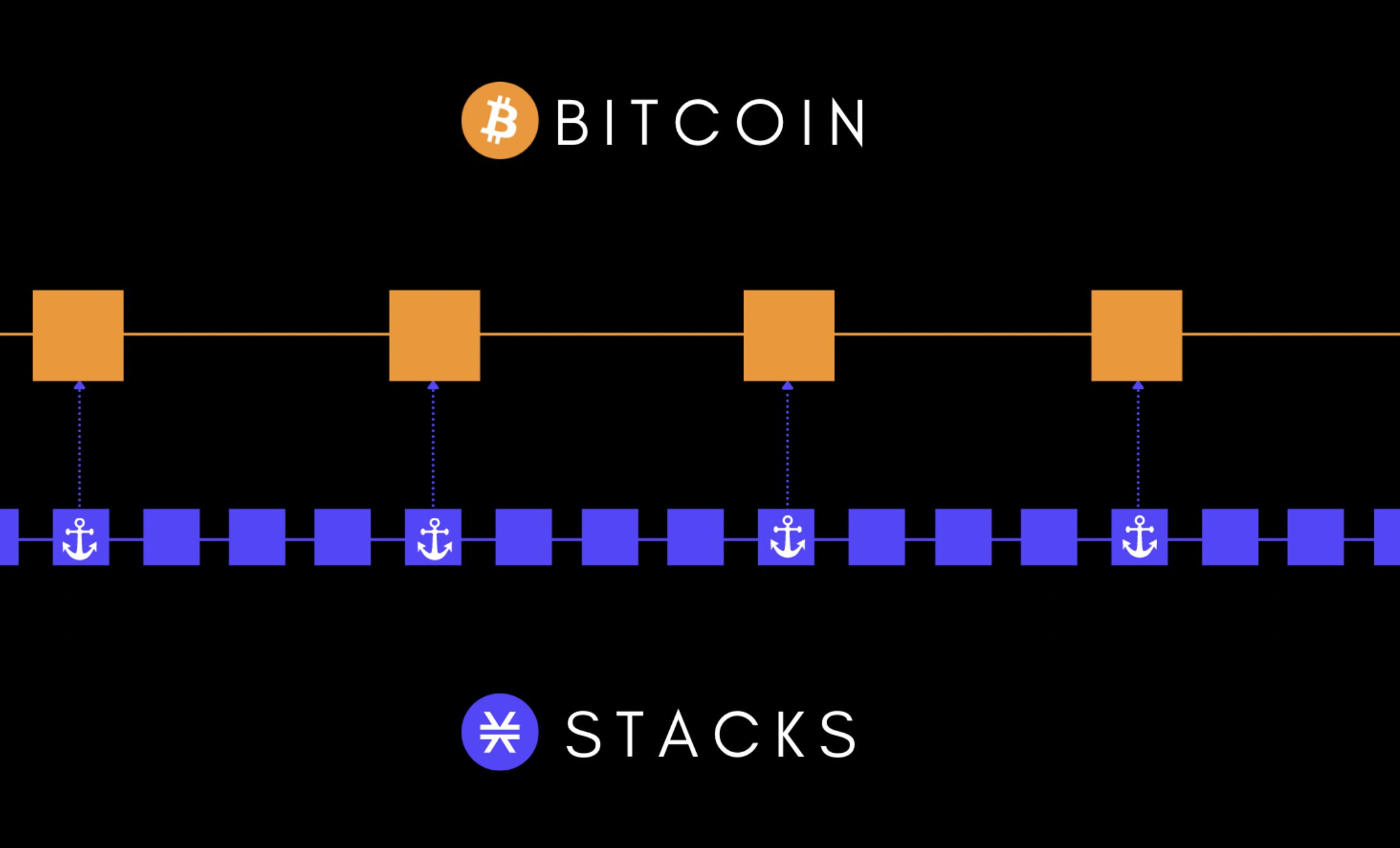

Stacks price is closing in on $1.0 after posting over 212% gains over the last two weeks to reach a high of $0.8993 on Thursday. This has led to increased investor interest in this open-source blockchain network functioning as Bitcoin’s layer for smart contracts and dApps.

Stacks boasts of being the first-ever token to successfully receive SEC qualification for sale in the United States. It has posted impressive rallies over the past few weeks leaving traders speculating where it is headed next.

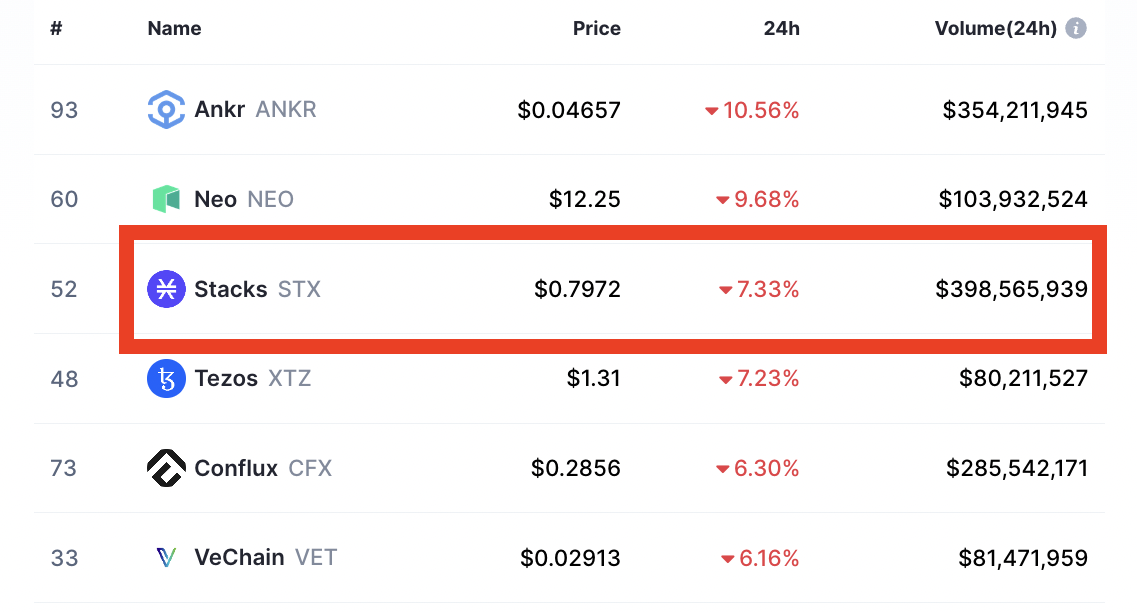

At the time of writing, STX was trading at $0.8008, down 7.33% on the day. This placed the token among the top biggest losers on Friday coming in third behind Ankr (ANKR) and Neo (NEO) which had lost 10.56% and 9.68% of their value over the last 24 hours respectively. Closing the top five was Tezos (XTZ) which was trading at $0.7972 after dropping 7.33% over the last day.

Top Crypto Losers

The losses were recorded across the board with the flagship cryptocurrency Bitcoin (BTC) still trading below the $24,000 mark after posting 2.22% losses on the day. Ethereum (ETH), Binance Coin (BNB), and XRP were down 0.96%, 0.36%, and 2% respectively, over the same timeframe.

The overall crypto market value was also down 1.96% to $1.09 trillion. The total crypto market volume over the last 24 hours is $56.29B, representing a 4.78% decrease.

Can The Ordinals Buzz Boost The Stacks Price?

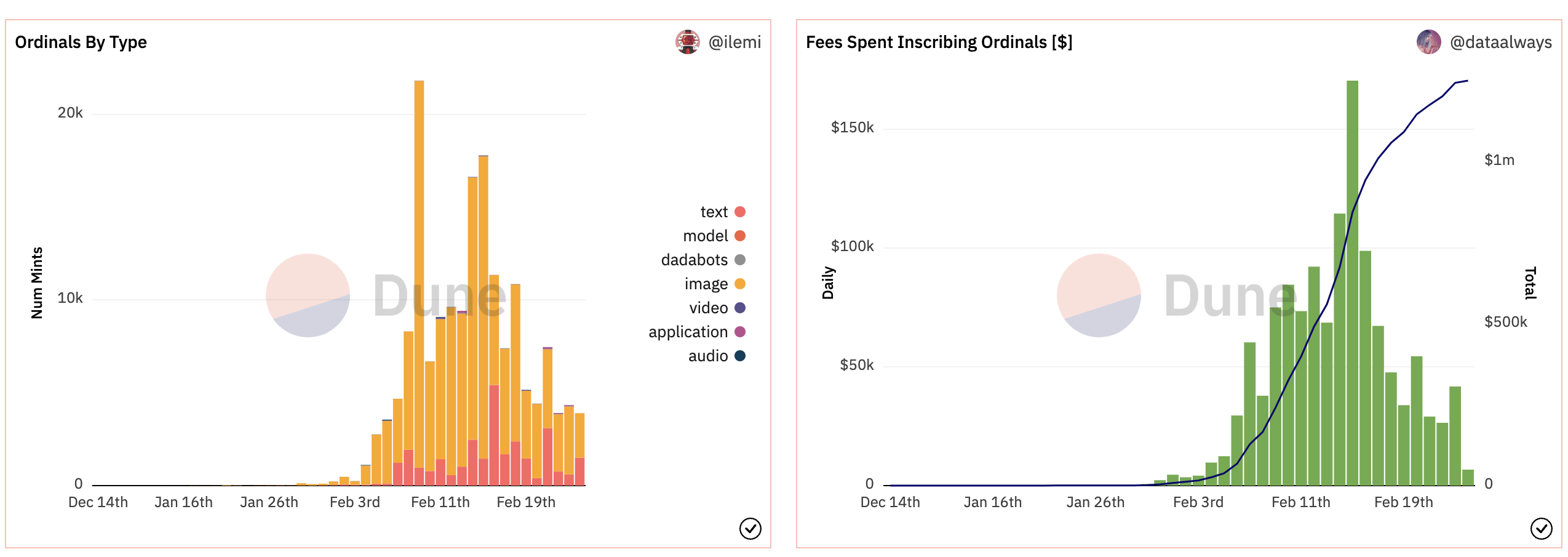

The latest seismic rallies in the STX price could be attributed to the development referred to as Ordinals (Ordinal Inscription), NFTs built on Bitcoin Satoshis. According to data from Dune, a blockchain data analytics platform, over 170,000 inscriptions have taken place already. Most of these occurred between February 8 and 23. In addition, the fees spent inscribing the ordinals have been increasing exponentially over the same time frame.

This points to increasing network activity as users continue becoming aware of this Uprising Bitcoin Layer. One Twitter user @louiseivanvp has said that Stacks could be “one of the most significant projects for 2023.”

2/ I've seen a lot of wrong info from various influencers, This thread is your DYOR, and I'll sum up why it can be one of the most significant projects for 2023. DISCLAIMER: not a financial advice, and I have exposure to some of the projects mentioned. pic.twitter.com/OTJvwCI6oA

— Louise | CEO @Ryder (@louiseivanvp) February 23, 2023

According to Louisevan, Stacks is the number one Web3 project on Bitcoin and has taken years to build leading to the birth of Blockstack FKA, STX, BNS & the virtual chain design. And given that the team behind stacks took the heavy route of first registering the token with the SEC, this plays to its advantage in a time when the regulator is cracking down one crypto project after another.

STX Price Analysis: Key Levels To Watch

Stacks price rallied an impressive 212.6% from the $0.28 support wall to a high of about $0.889 between February 11 and 23. At the time of writing, the STX price is trading at $0.8008 with a bearish bias, 11% below the aforementioned swing high. A rise above the immediate resistance level at $0.82, would clear the path for an extended uptrend.

The first barrier would emerge from the 100% Fibonacci retracement level at $0.8893, and then the $1.0 psychological level. Above that, the altcoin may rise to tag the 123.6% retracement level, marking a 30% uptick from the current price.

STX/USD Daily Chart

Supporting this positive outlook for the Stacks price were the upward-facing moving averages as well as the position of the Relative Strength Index (RSI) in the positive region. The price strength at 88 suggested that the STX price was firmly in the hands of the buyers, adding credence to the bullish thesis.

The Moving Average Convergence Divergence (MACD) indicator was also moving upward in the positive region. Note that the call to buy STX sent by this oscillating indicator when the 12-day Exponential Moving Average (EMA) crossed above the 26-day EMA on February 15 was still in play. This suggested that the upward momentum was still intact as buyers continued to control the price.

On the downside, a daily candlestick close below the $0.8 psychological level would see the price drop to tag the 78.6% retracement level at $0.7589. A slip below this point could see a decline to the $0.6565 intermediate support level where the 61.8% Fibonacci line sat, and later to the 50% extension level at $0.5847.

In highly bearish cases, the Stacks price may breach the said defense lines to revisit the 38.2% and the 23.6% extension levels at $0.5128 and $0.4238 respectively, before tagging the SMAs below that and later the $0.28 support floor. This would complete the retracement, undo all the recent gains, and completely invalidate the bullish narrative.

Read More:

- Investors are Moving Away from Propy to Buy Metropoly

- Bitcoin Price Prediction for Today, February 24: BTC Falls as It Might Recur at $23.5K

- Dogecoin Price Prediction: DOGE Remains Unchanged Despite Musks Tweets

- How to Buy Bitcoin

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage