Join Our Telegram channel to stay up to date on breaking news coverage

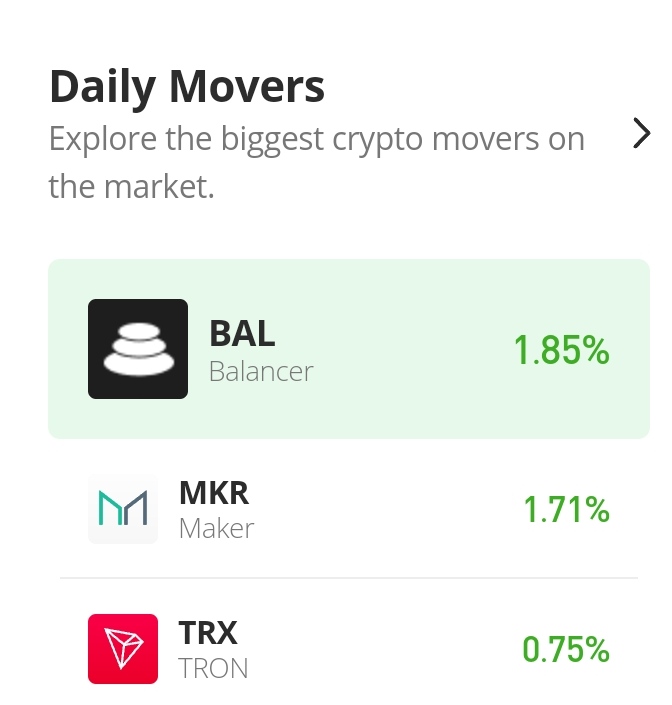

The Maker bullish trend started on the 21st of September and it has continued to go in a bullish way since then. At some point, though, some traders consider it the peak of the price height so they sell. This resulted in a short period of indecision or flatness in the market. But the price continues to rise after such periods. The market may continue to trend upward.

Maker Market Price Statistic:

- MKR/USD price now: $1139.38

- MKR/USD market cap: $1,066,793,472.48

- MKR/USD circulating supply: 977,631

- MKR/USD total supply: 977,631

- MKR/USD coin market ranking: #47

Key Levels

- Resistance: $1200, $1300, $1400

- Support: $1000, $900, $800

Maker Market Price Analysis: The Indicators’ Point of View

The point at which the market experienced some period of deadlock is now serving as a new support level for more bullish performance. The Bollinger band is widening its bands (especially to the upside) creating more room for bullish price actions. Although The RSI line is now moving in the overbought zone measuring 80.8%, the probability that the trend will continue is still high (judging from the bullish momentum). And this may be the reason for the reduction in the bullish momentum as the price is correcting itself from the overbought zone.

MKR/USD 4-Hour Chart Outlook

The third session of today’s market is showing very strong bearish activities. This is a result of the price correction from the overbought zone. The RSI line retraced 67.8% from 78%. The market may establish another support level at this point as the momentum is slowing down.

Related

Join Our Telegram channel to stay up to date on breaking news coverage