Join Our Telegram channel to stay up to date on breaking news coverage

ETH Price Prediction – July 7

The price to buy Ethereum is seeing dropping below $240 following rejection at $243.

ETH/USD Market

Key Levels:

Resistance levels: $260, $265, $270

Support levels: $220, $215, $210

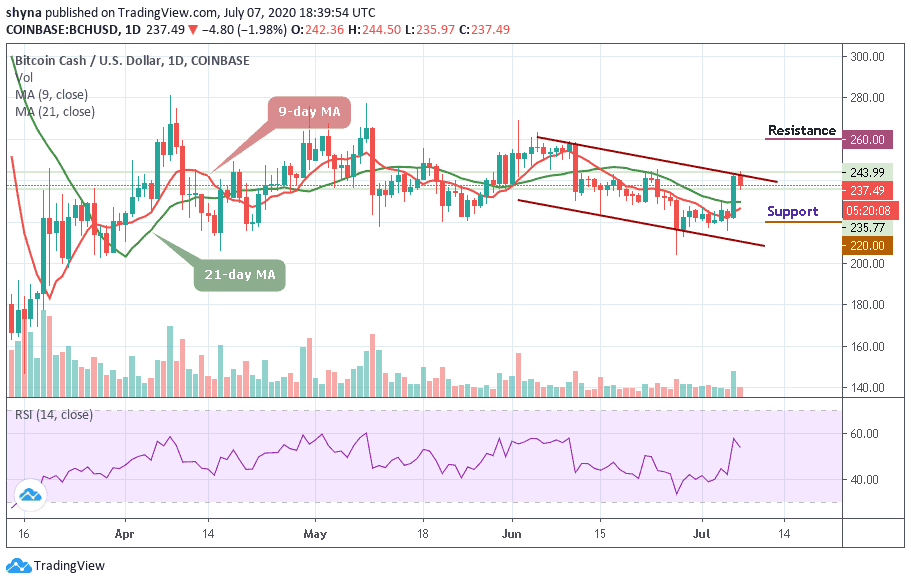

According to the daily chart, ETH/USD is currently hovering at $238.15 following a 1.45% loss on the day. The whole market is mainly in the red, with most cryptos having succumbed to downward pressure. Bitcoin (BTC), for example, touches the daily low of $233 today. More so, if the bears strengthen the onslaught, then ETH/USD may likely return to the nearest support of $233.

Moreover, further bearish movement may likely hit the critical supports at $220, $215, and $210. On the other hand, the daily chart reveals that the technical indicator stochastic RSI lines have not yet reached the overbought zone and there is still some potential for growth. Technically, after a short pause, the bulls might try to test the resistance levels at $260, $265, and $270.

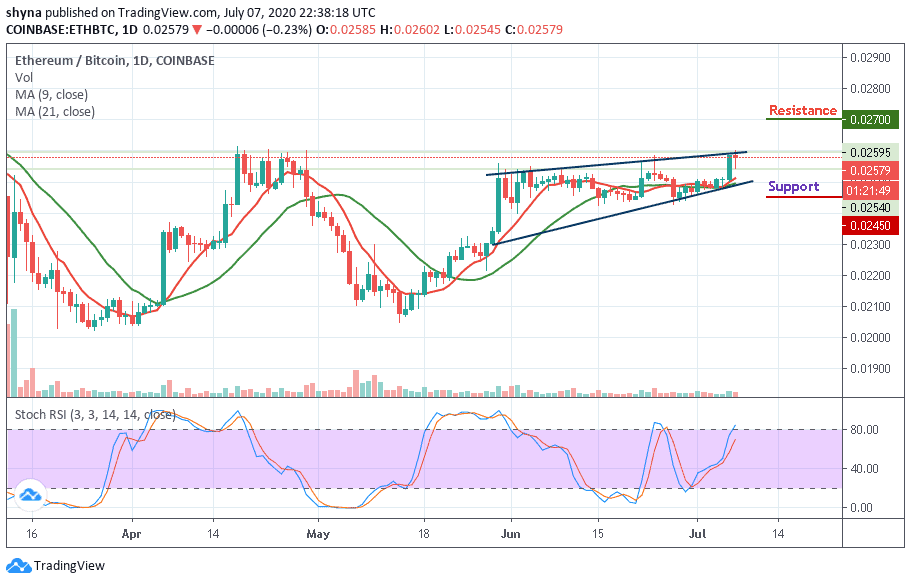

When compares with Bitcoin, the daily chart shows that Ethereum’s price is trading well in a strong uptrend around 0.0257 BTC. As soon as the price is above 0.0260 BTC, there is a possibility that additional benefits will be obtained in the long term. The next resistance key above 0.0265 BTC is close to the 0.0270 BTC level. If the price keeps rising, it could even break the 0.0275 BTC and above in future sessions.

Meanwhile, if the bears regroup now, the 0.0255 BTC and 0.0250 BTC support may play out before rolling to the critical support at 0.0245 BTC and this may create a new weekly low for the pair. However, the daily outlook is still looking bullish as the stochastic RSI is moving into the overbought zone to enhance the bullish movement.

Read more:

- EURCHF Broke Down $1.116, Currently Expose $1.108 Level

- Bitcoin Price Prediction: BTC/USD Holds $10,000 While Other Markets Tumble

- BCOUSD Price Carried Out Price Retracement at $64 Level, Further Price Increase Envisaged

Join Our Telegram channel to stay up to date on breaking news coverage