Join Our Telegram channel to stay up to date on breaking news coverage

EURCHF Price Analysis – June 05

There is a high probability that the price may find support at $1.108 as more bearish candles are emerging below the $1.116 level. Should the daily candle close above the $1.116 level, then, the Bulls may take over the EURCHF market.

EUR/CHF Market

Key levels:

Resistance levels: $1.116, $1.126, $1.134

Support levels: $1.108, $1.098, $1.021

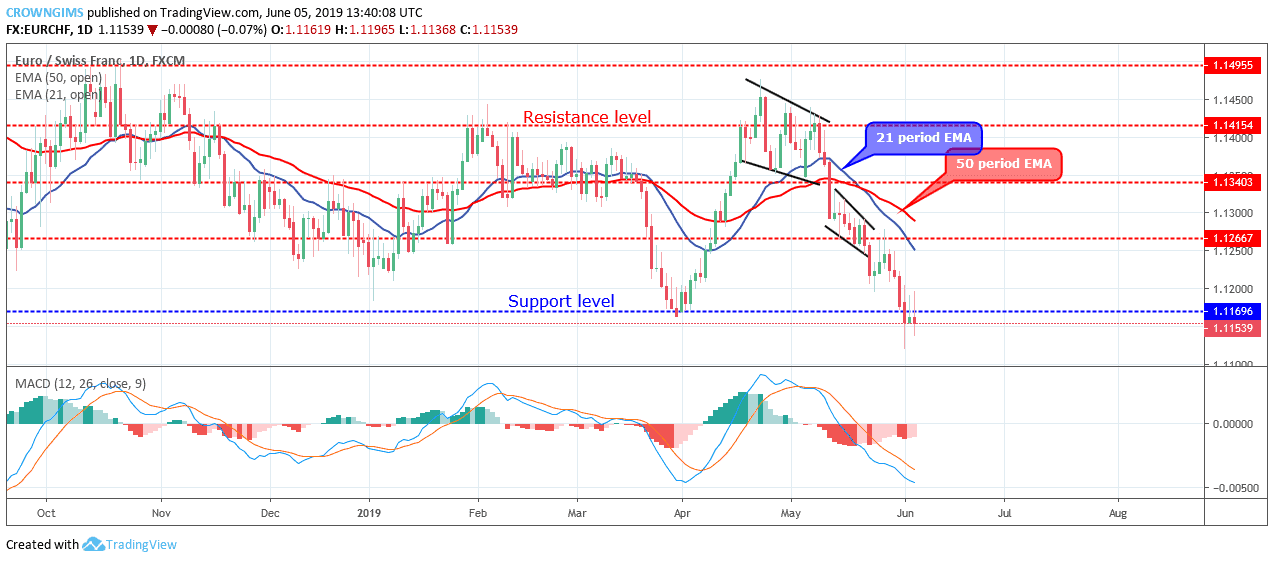

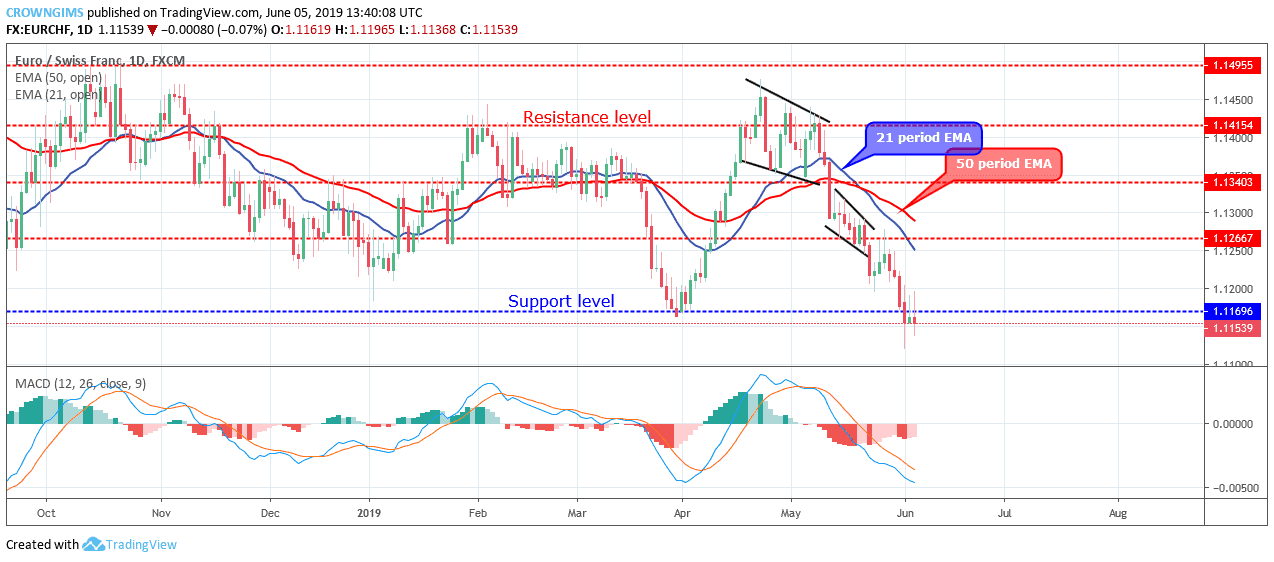

EURCHF Long-term trend: Bearish

On the long-term outlook, EURCHF continues its bearish trend. EURCHF is under strong bearish pressure. Immediately after the pullback that occurred on May 28, EURCHF resumed bearish trend and the pair was trending down towards $1.116 level. The Bears exerted pressure at the level and the barrier at the level could not withstand the Bear’s pressure, then, it gave way for the price and the support level of $1.108 was exposed.

The distance between the currency pair and the two EMAs is increasing as a sign of increased bearish momentum. EURCHF price continues its trading under the 21 period EMA and 50 periods EMA. The Moving Average Convergence Divergence period 14 with its histogram is below zero levels and the signal line points down to indicate sell signal. There is a high probability that the price may find support at $1.108 as more bearish candles are emerging below the $1.116 level. Should the daily candle close above the $1.116 level, then, the Bulls may take over the EURCHF market.

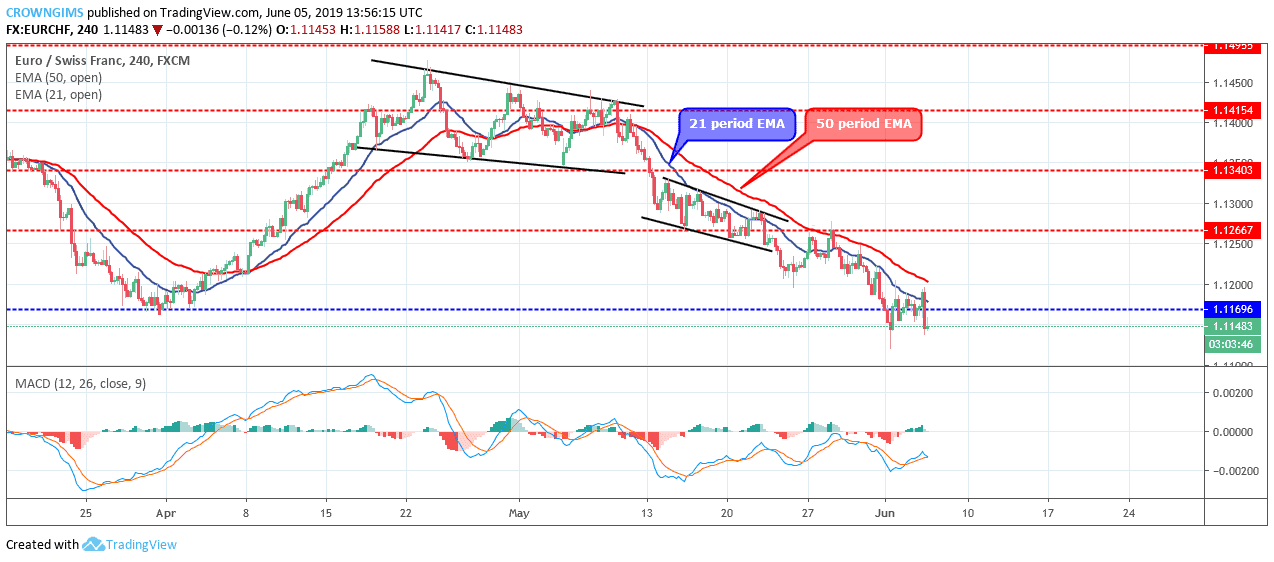

EURCHF medium-term Trend: Bearish

EURCHF remains bearish on the medium-term outlook. EURCHF price is steadily rolling down below the support level of $1.116 with the aid of the Bears pressure. The currency pair consolidated for two days at the support level of $1.116. Today, a big strong bearish candle emerged that broke down the level and the price is targeting $1.108 level

EURCHF is trading under the 21 periods EMA and 50 periods EMA.

The MACD period 12 with its histogram is above the zero levels and the signal lines pointing up to connotes buy signal which may be a pullback.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage