Join Our Telegram channel to stay up to date on breaking news coverage

LTC Price Prediction – January 11

Today, out of the top-10, Litecoin (LTC) is one of the best-performing coins and the further recovery may be capped by $55.

LTC/USD Market

Key Levels:

Resistance levels: $55, $57, $59

Support levels: $45, $43, $41

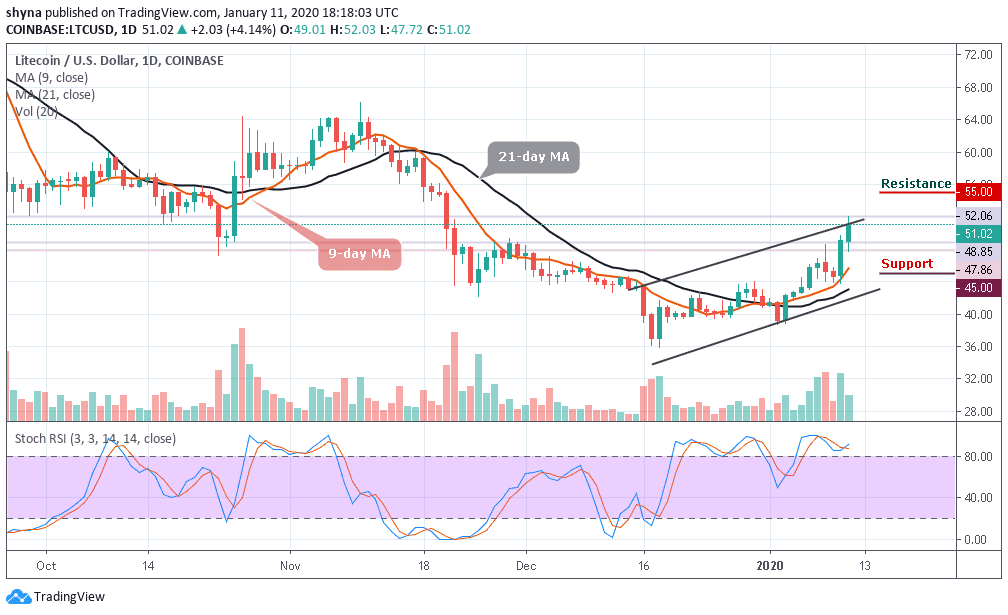

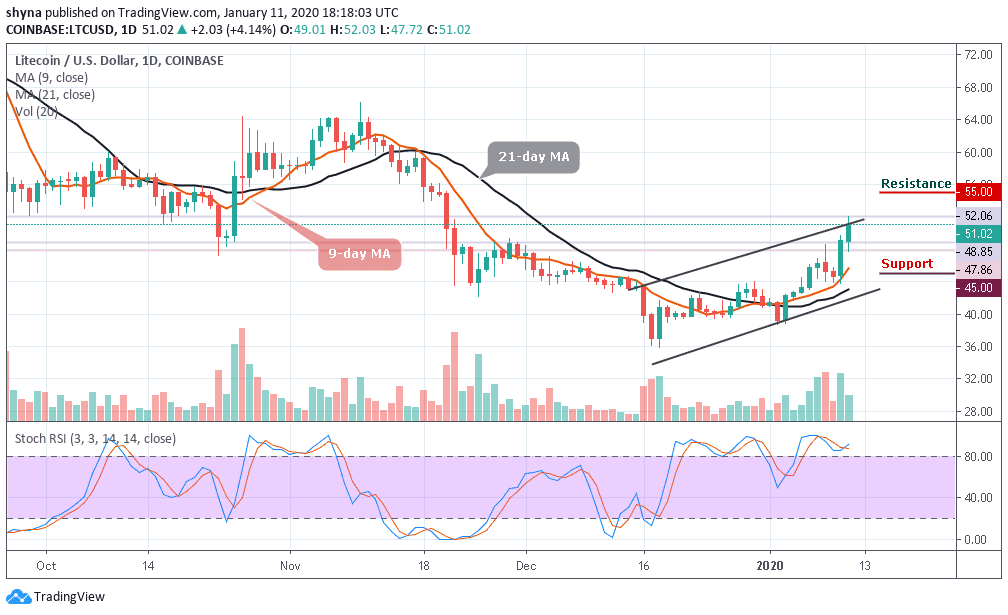

After reversing for 2days, moving from $46 to $44 on the price charts, LTC/USD underwent a much-needed break to the positive side. The coin posted gains of over 4.14% in the last 24 hours, with the coin trading far above the 9-day and 21-day moving averages and at a price of $51.02 as at the time of writing.

Today, LTC/USD has resumed back in the middle of consolidation after a slight drop from near the $46. The price is now roaming around the $51 level. If the market continues the surge and squeeze, the $55 resistance level is likely to surface in the next few positive moves. More so, the LTC/USD pair might further look for higher price levels if the bulls continue to show commitment.

However, the daily chart reveals that the trading volume is rising slowly and if the LTC/USD pair decides to stay under the control of bears, the price may roll back to previous supports at $45, $43 and $41. But on the upside, we can expect the next level of resistance at $55, $57 and $59. Meanwhile, the stochastic RSI is hovering at the overbought zone, which indicates more bullish signals are in focus.

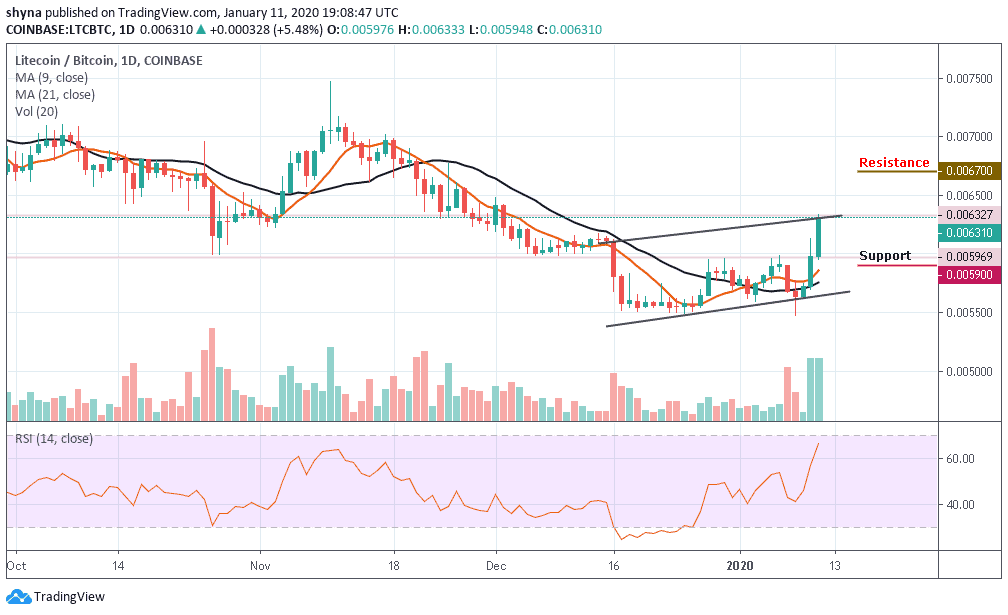

When compared with Bitcoin, Litecoin price is making an attempt to cross above the channel in other to reach the resistance at 6500 SAT. Unless this resistance is effectively exceeded and the price eventually closes above, there is no reason to expect a long-term bullish reversal.

However, trading below the moving averages could refresh lows under 6000 SAT and a possible bearish continuation may likely meet the major support at 5900 SAT before falling to 5800 SAT and below while the buyers may need to push the market to the critical potential resistances at 6700 SAT and above while the RSI (14) faces up moving into the overbought zone.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage