Join Our Telegram channel to stay up to date on breaking news coverage

On the 7th of January, 2020, the famous stablecoin issuer, Tether, officially conducted a cross-chain swap with Blockstream’s Liquid. Tether had shifted its 15 million USDT reserves from the Etereum network into the federated sidechain, one that runs parallel to Bitcoin’s. The possibility of this happening was announced last year in July.

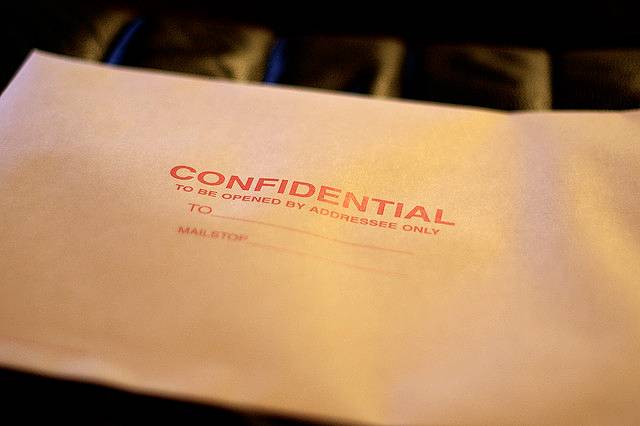

New Privacy Allowed For Tether

The fund transfers hold a large number of implications for both the Tether market, as well as crypto trading as a whole. The Tether market has seen a mass migration to the Bitcoin-based Omni protocol, even dallying into the Tron network through the span of 2019.

The Liquid sidechain offers something wholly unique, though: Privacy.

Confidential Asset Tools Hiding Volumes

Liquid makes use of the confidential assets tool. With it, it can blind asset values on public ledgers by way of a protocol aptly named “confidential transactions.” With this new feature, these Tether coins may never again be seen in complete transparency by the public, ever again. This entire transaction may very well be the first private crypto trading event that happens at this scale.

Through the use of hiding tether transfers between various Liquid-based off-exchange accounts, as well as the exchanges themselves, traders will be capable of trading without the risk of front-running. This was given by way of a statement from the Blockstream community manager, working under the pseudonym, Grubles.

Dodging Risk of Semi-Foul Play

The example given was that a trader would be capable of moving Tether based on the liquid network to the exchange, should they intend to buy Bitcoin in large volumes. The Liquid sidechain allows for the amount of Tether put in, to be hidden, thus not tipping their hand and potentially making their opponents drove the price of Bitcoin up before a purchase can be made.

Grubles explained that the movement of tether coins could be tracked in general, but especially so if funding is moved in or out of an exchange. This information could prove valuable to large-scale traders seeking that little edge to make a profit. With this information, Grubles considers the shift to a more privacy-focused network like Liquid to be a “no-brainer” when one considers trading.

Tether is by far the most-used stablecoin on the market, maintaining a 75-time advantage in trading volume when compared to other stablecoins. The closest competitor is the Paxos Standard (PAX), according to the Stablecoin Index of Messari. Grubles considers the addition of enhanced privacy technology as something that’ll only give Tether a further edge in the market.

Join Our Telegram channel to stay up to date on breaking news coverage