Join Our Telegram channel to stay up to date on breaking news coverage

Tim Draper, a billionaire venture capitalist, and investor, is making a bet on bitcoin to see significant increases in the next few years. Speaking in an interview with BlockTV late last week, the investor expressed his views on the future of Bitcoin and claimed that the halving would propel the world’s most valuable digital asset to new heights.

https://twitter.com/BLOCKTVnews/status/1207451791991955458

Draper Banks on the Halving

The halving is a process where the rewards given to Bitcoin miners is cut in half. There have been two of such events, and the next- where block rewards will be cut from 12.5 BTC to 6.25 BTC- is expected to occur in May 2020. Historical data has shown that the price of Bitcoin surges after each halving, so there’s a lot of excitement building up.

Draper, however, seems to be shooting for the moon as far as predictions go. He believes that Bitcoin could rise up to $250,000 within 6 to 12 months of halving.

Of course, Draper’s optimism goes beyond the price of Bitcoin. In the interview, he also expressed his displeasure at the pointless fees taken by commercial banks on his credit card, adding that Bitcoin will be able to provide true freedom, both as a transaction enabler and an investment vehicle.

Adoption and Excitement could Carry Bitcoin

As for the prospect of Bitcoin hitting such a mark by 2022 or 2023 like Draper believes, the jury is still out. Bitcoin has seen some massive gains in the past, most notably in 2017, when it rose by almost 2,000 percent between January and December. However, because this rally was fueled by FOMO and a lot has changed since then, it is also possible that these gains don’t materialize fast enough.

https://twitter.com/P_Hold/status/1209334971829301249

On the flip side, however, it’s worth noting that the cryptocurrency market hasn’t seen as much meaningful use cases as hoped. This hasn’t stopped companies from accepting it as a payment and countries drawing up proposals to integrate crypto into their framework. If the adoption of the assets continues to rise, then the market is sure to benefit immensely- including and especially Bitcoin. Coupled with the expected effects of the halving and the hysteria that it’s sure to bring, anything is possible.

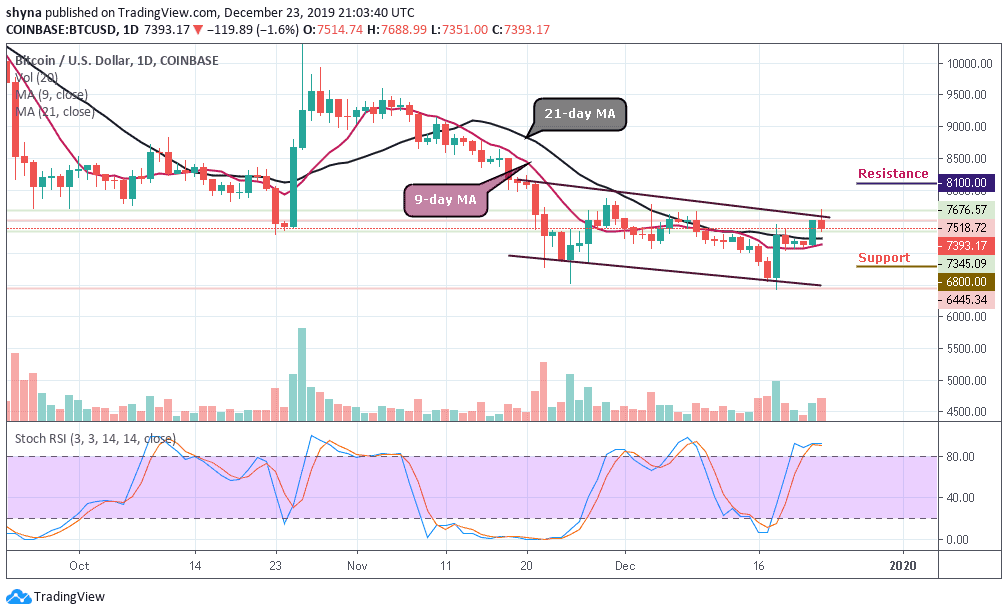

For now, the market is hoping that Bitcoin can somehow break the $10,000 threshold before the end of the year. Like just about every other large-cap digital asset, Bitcoin suffered a bit of a slump last week, and hasn’t made much progress in terms of profitability since the month began.

I wrote an essay on the question of if the bitcoin halving is "priced in." Frankly, it's a clumsy essay that explores the question and tries to give an answer within a different framing. https://t.co/tLYlLa88EB

— Ari Paul ⛓️ (@AriDavidPaul) December 23, 2019

The Crypto Fear & Greed Index currently shows that industry sentiment on the asset’s performance is not flattering. If Bitcoin finds a way to break $10,000 before the year ends, then, we’re off to a great start towards the lofty heights that Draper sees.

Join Our Telegram channel to stay up to date on breaking news coverage