Join Our Telegram channel to stay up to date on breaking news coverage

After a shaky start to the week that saw billions wiped from the crypto market, select tokens are showing strong signs of recovery. Projects like Euler, Arweave, Polymesh, and Morpho are not just bouncing back—they’re leveraging fresh partnerships, protocol upgrades, and rising momentum to carve out their edge in an evolving DeFi landscape. These top crypto gainers stand out by addressing real infrastructure gaps and creating more resilient, scalable solutions for Web3 users.

In this article, we explore how each of these projects is making waves: Euler’s strategic backing from Wintermute, Arweave’s push for cross-chain compatibility, Polymesh’s regulatory-first approach to asset tokenization, and Morpho’s powerful DeFi integrations. Together, they reveal a promising trend—real utility and innovation thrive even in uncertain market conditions.

Biggest Crypto Gainers Today – Top List

Euler is an Ethereum modular DeFi lending platform that lets users create and manage custom lending markets. Arweave is a decentralized storage network built for permanent data storage. Polymesh is a permissioned blockchain for regulated assets, offering secure and compliant tokenization of financial instruments. Morpho is a decentralized platform for earning yield and borrowing assets through optimized, non-custodial vaults and markets. Let’s dive deeply into why today’s top crypto gainer’s tokens are surging.

1. Euler (EUL)

Euler (EUL) is a modular DeFi lending platform built on Ethereum. It is designed to let users create and manage custom lending markets without needing permission. With tools like the Euler Vault Kit and Ethereum Vault Connector, anyone can deploy tailored lending vaults, enabling flexible and innovative financial products.

Euler supports many crypto assets, including long-tail tokens, and features an on-chain pricing system to ensure secure and accurate asset valuations. Its open, composable design makes it a powerful tool for earning interest, borrowing assets, and building next-gen DeFi solutions.

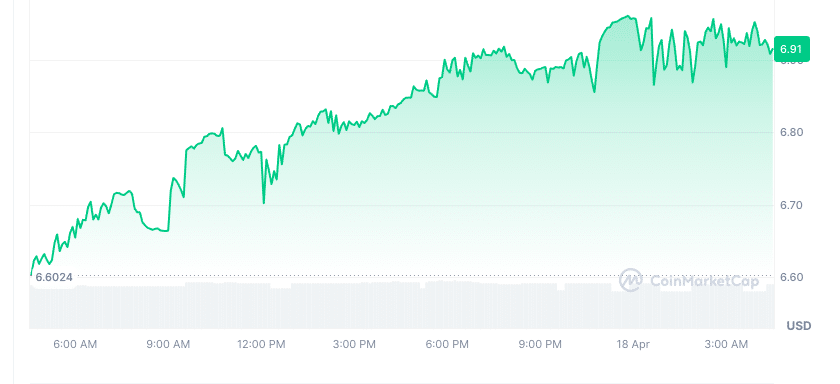

Euler (EUL) is trading at $6.92, reflecting a 4.81% gain over the past 24 hours and an 11.25% increase over the last 7 days. During the past day, its price ranged from a low of $6.57 to a high of $6.99. This consistent upward movement suggests growing interest and momentum behind the project, positioning EUL as a token to watch in the DeFi space.

Euler has secured a strategic investment from Wintermute Ventures, marking a strong vote of confidence in the protocol’s mission to redefine on-chain money markets. This collaboration highlights Euler’s innovation, particularly around its native technologies—Euler Vault Connector (EVC) and Euler Virtual Kernel (EVK)—which are pushing boundaries in capital efficiency and protocol flexibility.

This is a major signal of trust and growth for the community and potential investors. Wintermute’s backing validates Euler’s long-term vision and enhances its credibility in the DeFi space, potentially driving further adoption and development momentum.

2. Arweave (AR)

Arweave, one of today’s top crypto gainers, is a decentralized storage network designed for permanent data storage. It powers what it calls the “permaweb” — a tamper-proof, community-owned web of permanently accessible information and applications. It leverages a unique data structure called the block weave, where each block connects to the previous one and a random older block, encouraging long-term data storage.

The network uses its native token, AR, to pay miners for storing data indefinitely. Beyond storage, Arweave fosters a sustainable ecosystem through initiatives like profit-sharing tokens, which reward developers with dividends, and programs like Boost, which support early-stage startups building on the permaweb.

Arweave (AR) is trading at $5.23, showing a solid 6.10% gain against the U.S. dollar and a 5.08% increase against Bitcoin over the past 24 hours. The token’s price has moved between a low of $4.82 and a high of $5.22 within the day. Known for its permanent data storage solution on the blockchain, Arweave continues to gain traction, especially among developers and decentralized applications looking for long-term, tamper-proof storage.

In case you missed it, Arweave now supports ECDSA signatures.

This is big news – but what does it actually mean in practice? pic.twitter.com/8M3OON2VMM

— Only Arweave (@onlyarweave) April 15, 2025

Arweave has introduced support for ECDSA signatures, marking a major step toward improving cross-chain compatibility and user experience. With this update, users can now generate Bitcoin, EVM, and Arweave addresses using a single private key—no more juggling multiple wallets or key files.

This reduces friction for developers and wallet providers while paving the way for smoother liquidity movement and adoption. RSA keys remain the default, but ECDSA could become a powerful gateway for onboarding users across ecosystems.

3. Solaxy (SOLX)

Solaxy ($SOLX) is a Layer 2 solution for Solana designed to enhance scalability, reduce congestion, and lower transaction costs. The project has already raised over $30.5 million in its presale, with the token priced at $0.001698, offering early buyers a chance to invest before the official launch.

During the presale, investors can stake their $SOLX tokens to earn up to 133% APY. Staked tokens remain locked until the Token Generation Event (TGE), after which they can be claimed along with presale purchases. Once the TGE happens, $SOLX will be listed on major centralized and decentralized exchanges, providing liquidity and trading opportunities.

$SOLX is so hot you couldn't put out this fire even if you tried. 🔥

Be a part of something out of this world. 🪐🛸https://t.co/mdaTX9aVVx pic.twitter.com/FcWQ87Lfjo

— SOLAXY (@SOLAXYTOKEN) April 18, 2025

With a focus on scalability, staking rewards, and early investment advantages, Solaxy positions itself as a promising project in blockchain technology. Investors can passively grow their holdings while supporting a network built for efficiency and long-term growth. Backed by strong investor interest and a clear roadmap, $SOLX is poised to impact the Solana ecosystem significantly.

4. Polymesh (POLYX)

Polymesh is a permissioned blockchain purpose-built for regulated assets, offering institutions a secure, compliant infrastructure for tokenizing real-world financial instruments. It addresses key issues like identity, governance, compliance, and settlement, which general-purpose blockchains often overlook. Using identities instead of public keys, Polymesh ensures that only verified participants can interact with the network. Its native token, POLYX, powers transactions, staking, and governance.

The network supports on-chain rule enforcement, privacy in governance voting, and streamlined settlement without third-party verification. With built-in financial primitives and support for ERC-1400 standards, Polymesh enables the compliant issuance and transfer of security tokens and stablecoins, making it ideal for financial institutions.

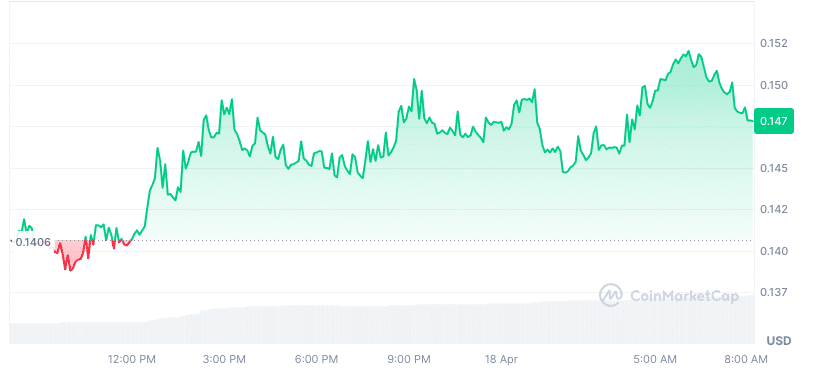

Polymesh (POLYX) is trading at $0.1497, showcasing a solid 8.97% gain over the last 24 hours. The token’s price further grew by 11.19% over the past week and 11.25% for the month. The token’s price fluctuated between $0.1373 and $0.1502 in the last day, reflecting strong upward momentum. As a blockchain purpose-built for regulated assets, Polymesh continues to gain investor confidence by addressing compliance, identity, and governance challenges that traditional blockchains struggle with.

Hard not to notice $5 billion in token value vanishing in mere hours. 🌪️ Hard for the industry not to panic.

This week's events remind us: #RWA must be built differently.

Many are regulated assets. Hype, vague compliance promises, and false transparency won't cut it. 👇🏼…

— Polymesh 🅿️ (@PolymeshNetwork) April 17, 2025

This week’s events, which saw $5 billion in token value vanish in hours, highlight the need for a more robust approach to Real-World Asset (RWA) tokenization. The loss underlines how essential regulatory clarity and dependable infrastructure are to ensure the stability of tokenized assets.

Polymesh offers a solution by providing the infrastructure that meets institutional needs and fosters confidence in RWA tokenization. This approach, while slower, may avoid future complications and confusion.

5. Morpho Morpho(MORPHO)

Morpho is a decentralized platform that allows users to earn yield and borrow assets through simple, efficient, and resilient infrastructure. Lenders can maximize their earnings using Morpho Vaults, non-custodial lending vaults that optimize yields, while borrowers can access assets directly from Morpho Markets.

The platform is trustless and efficient, offering high collateralization factors, improved interest rates, and low gas costs. It provides a flexible and permissionless environment where developers can create markets, curate vaults, and build decentralized applications. With minimal governance and immutable contracts, Morpho ensures a seamless and user-friendly experience.

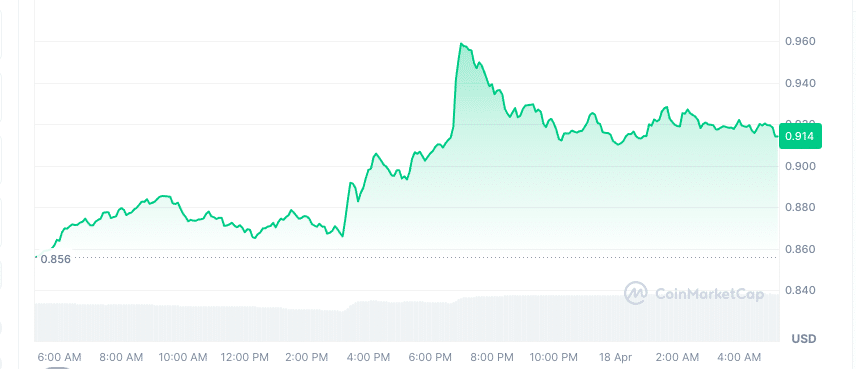

Morpho (MORPHO) is priced at $0.9157, reflecting a 6.91% increase in the last 24 hours. However, it has experienced a 9.59% decrease over the past week. In the past day, the token’s price ranged from a low of $0.8637 to a high of $0.9597. Morpho’s unique focus on optimizing decentralized finance (DeFi) protocols to maximize efficiency has captured attention despite recent fluctuations in its weekly performance.

Level up on Morpho@levelusd is bringing more borrowing and lending use cases to lvlUSD, slvlUSD, PT-lvlUSD and PT-slvlUSD, enabled by @pendle_fi, @M11Credit, @SteakhouseFi, and @hyperithm.

Learn more 👇 https://t.co/5LY56z4Upc

— Morpho Labs 🦋 (@MorphoLabs) April 15, 2025

Morpho is teaming up with Pendle, M11 Credit, SteakhouseFi, and Hyperithm to enhance borrowing and lending capabilities for lvlUSD and related tokens. This integration brings utility, yield, and capital efficiency to the ecosystem, significantly boosting lvlUSD’s adoption across major DeFi protocols. This collaboration opens up new DeFi use cases, unlocking value and expanding the opportunities for users in the decentralized finance space.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage