Join Our Telegram channel to stay up to date on breaking news coverage

The overall feeling in the market was positive from the close of October 2024 until the beginning of this year, but things have been sluggish for the past month. After a month of bearishness and losses, many investors hope to make gains reminiscent of the November/December 2024 bull run.

Determining the next cryptocurrency to explode might be challenging as most funds are attracted to pumping assets. However, this article will explore the performance of cryptocurrencies with much growth potential, especially before the year runs out. The aim is to identify coins with some potential and help investors and traders make informed decisions about each token.

Next Cryptocurrency To Explode

Today’s article discusses the performance of potentially explosive cryptos that investors should add to their watchlist. It also includes a special mention of the presale token Solaxy. This new meme coin offers a unique blend of these two dynamics by combining meme coins’ excitement and reward potential with the practical utility of a Layer 2 blockchain solution.

1. Creditcoin (CTC)

Creditcoin ($CTC) is making a name for itself by revolutionizing cross-chain credit transactions. Integrating traditional finance with blockchain technology creates a decentralized credit network where users can build verifiable credit histories within the Web3 space. This innovation positions Creditcoin as a force in the evolving world of blockchain-based financial services.

At press time, $CTC is trading at $0.7084, reflecting a 5.56% increase in the past 24 hours and a 10.42% rise over the last week. This positive momentum has driven its market capitalization to $307.75 million, while trading volume has surged by 284.77%, reaching $61.74 million. These statistics indicate growing investor interest. Meanwhile, the Fear & Greed Index sits at 40 (Fear), suggesting a cautious but optimistic market sentiment.

Beyond credit transactions, Creditcoin is expanding its impact through strategic collaborations. A partnership with Spacecoin, Sui, and Walrus, announced on December 6, focuses on using satellite technology to improve blockchain-based financial access in underserved regions. This initiative aims to bring decentralized financial solutions to more users worldwide by addressing connectivity challenges.

From clunky order books to sleek AMMs — on-chain trading has come a long way. Now? New DEXs like Penguinswap are ushering in the next era in DeFi.

✅ AMM-powered

✅ Zero trading fees

✅ Built on @creditcoin L1

✅ RWA & DePIN ready

Experience the future of crypto trading 🐧 pic.twitter.com/PcfZSiqTqn

— Creditcoin 🐧 (@Creditcoin) March 24, 2025

Adding to its momentum, Credit Labs, the development team behind Creditcoin, recently launched the $10 million Creditcoin Ecosystem Investment Program (CEIP). This program provides $25,000 to $250,000 in funding to support startups, developers, and businesses building on the Creditcoin network.

By investing in innovative blockchain-based credit and payment solutions, Creditcoin is strengthening its ecosystem and expanding its influence in decentralized finance.

Creditcoin focuses on financial inclusion, groundbreaking partnerships, and a commitment to fostering innovation. Consequently, it is bridging the gap between blockchain technology and real-world financial applications.

2. BNB (BNB)

Binance Coin ($BNB) has been showing steady upward movement, signaling the potential for a strong breakout. Over the past day, week, and month, its price has increased by 0.69%, 0.28%, and 5.24%, respectively, bringing its current trading value to $636.48. This gradual rise and favorable technical indicators suggest that BNB may be on the verge of a more significant rally.

Short-term price targets for BNB range between $657 and $695, with the possibility of a bullish breakout. This breakout could push it toward $740, based on the 1.272 Fibonacci projection. On the downside, the $705 support level, backed by the 100-day EMA, provides a solid foundation for price stability.

Despite a Fear & Greed Index score of 40 (Fear), market sentiment around BNB remains highly positive. Over the past year, the token has recorded an impressive 142% increase, outperforming Bitcoin, Ethereum, and nearly 69% of the top 100 cryptocurrencies. Additionally, it is trading 1.57% above its 200-day simple moving average (SMA) of $626.34, reinforcing its overall strength in the market.

Got questions about the BNB Chain $100M Liquidity Incentive for CEX Listings?

Check out our FAQ for everything you need to know! 🔍👇https://t.co/afssdvxaX1

If your question isn’t covered, drop it in the comments, and we’ll update the FAQ! pic.twitter.com/JnbAZuKOAi

— BNB Chain (@BNBCHAIN) March 26, 2025

Several key factors contribute to BNB’s strong performance. It operates with a negative annual inflation rate of -2.71%, making it a deflationary asset. Moreover, its 30-day price volatility is just 4%, indicating relative price stability. The token has also posted 47% green days in the past month, reflecting consistent growth. Its proximity to its cycle high, supported by intense trading activity on Binance, further strengthens its bullish outlook.

Analysts predict that if its current trajectory continues, BNB could reach $842.11 by Q2 of 2025. With solid fundamentals, consistent market performance, and growing investor interest, BNB remains a promising asset for both short—and long-term investors.

3. Solaxy (SOLX)

Solaxy is making waves as a new layer-2 scaling solution for Solana, attracting over $28.1 million in its presale. Designed to tackle Solana’s congestion problems, Solaxy uses off-chain processing to improve transaction speed, just like Ethereum’s well-known layer-2 platforms, Arbitrum and Optimism.

By handling transactions off the main Solana network, bundling them, and later submitting them for final verification, Solaxy enhances efficiency without compromising security. This approach has already proven effective in the blockchain space, making Solaxy a promising addition to the Solana ecosystem.

🔥 Solaxy Dev Update 🔥

We're excited to share some significant updates focused on boosting TPS and data throughout:

🛸 Soft Confirmations 🛸

• Integrated a new sequencer implementation from the Sovereign SDK.

• Enjoy faster confirmations as transactions are quickly… pic.twitter.com/IrhpmhqUUQ

— SOLAXY (@SOLAXYTOKEN) March 26, 2025

Once fully launched, Solaxy will offer developers a smooth platform to build decentralized applications and create new tokens without affecting Solana’s core performance. Investors also have an opportunity to earn high rewards, as staking SOLX provides an impressive annual yield of 145%.

For those looking to get in early, SOLX tokens are available at $0.001676 during the presale. Investors can purchase using BNB, ETH, USDT, or a bank card, and the price is expected to increase in just over a day.

4. JUST (JST)

JST plays a key role in decentralized finance (DeFi) by providing a fair and transparent lending system on the TRON blockchain. The platform operates through two primary tokens: USDJ, a stablecoin, and JST, the governance token. JST holders contribute to network stability by paying transaction fees, voting on proposals, and ensuring smooth platform operations.

Currently, JST is priced at approximately $0.03139, with price fluctuations ranging between $0.03161 and $0.03004. The token has demonstrated resilience while facing minor downward pressure, suggesting investors remain confident in its long-term potential. The dual-token model enables seamless stablecoin lending, filling a crucial gap in the TRON DeFi ecosystem.

Recently, JUST announced an ecosystem partnership with UQUID, combining the Shop-to-Earn model and exclusive crypto deals with JUST’s lending platform. This collaboration offers users enhanced liquidity options, cashback rewards, and flexible payment solutions, further integrating JST into real-world use cases.

📢We’re excited to announce our ecosystem partnership with @uquidcard!

Uquid’s Shop-to-Earn model and exclusive crypto deals, combined with #JustLendDAO’s seamless lending platform on TRON, bring you the ultimate solution for borrowing, lending, and shopping!

Unlock liquidity,… pic.twitter.com/LGyfLFwd2H

— JUST DAO (@DeFi_JUST) March 27, 2025

Additionally, the JUST Foundation provided updates on market activity within #JustLendDAO, its lending protocol. TRX leads the platform with a supply value exceeding $3 billion, followed by STRX at $1.86 billion and BTC at $760.65 million. This distribution underscores JUST’s growing influence in the DeFi space and highlights its increasing role in lending and borrowing within the TRON ecosystem.

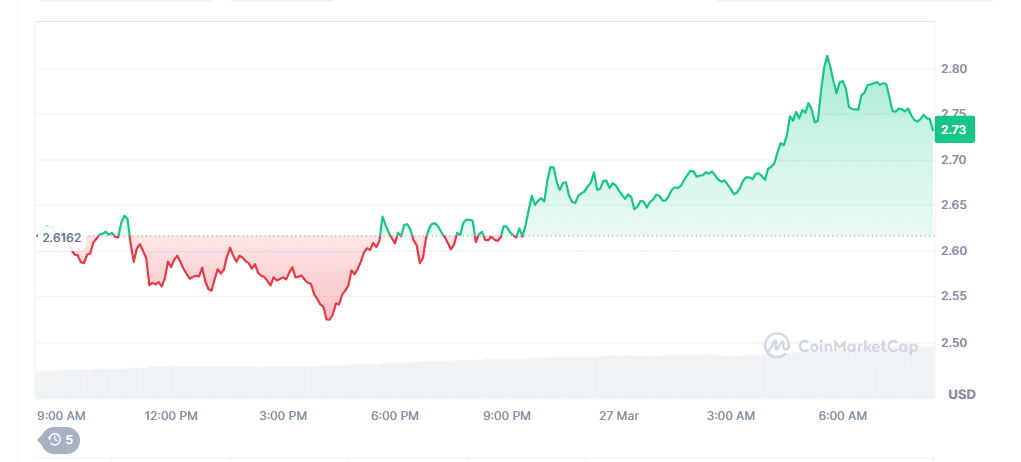

5. Sui (SUI)

Sui ($SUI) is making significant strides in blockchain technology by addressing critical challenges such as scalability, decentralization, and security. Unlike networks with congestion issues and centralization risks, Sui’s modular design enables more efficient processing, positioning it as a strong competitor to Ethereum and Bitcoin.

Currently, SUI is trading at $2.73, retesting its breakout trendline while finding support from the 25-day simple moving average (SMA). If the token maintains this level and rebounds, it could trigger a recovery, with key resistance levels at $2.97 and $3.73. A successful breakout beyond these points could open the door for a climb toward $5.09.

Holding above the breakout level is crucial for sustaining upward momentum. Investors are monitoring technical indicators and broader economic factors, such as global trade policies, to assess SUI’s potential future movements.

Sui Network has been gaining traction in the DeFi sector, surpassing Polygon in decentralized exchange (DEX) trading volume earlier this year. In February, SUI’s cumulative DEX volume reached $55.55 billion, outpacing Polygon’s $51.29 billion. This rapid growth highlights increasing adoption and strong network activity.

Life after Mainnet? Still building.

Join @walrus_protocol + our founders from @Mysten_labs on Friday for a celebratory X Space. https://t.co/fnjqnn72ht

— Sui (@SuiNetwork) March 26, 2025

In January 2024, Sui and Polygon were nearly equal in trading volume, but Sui’s expanding partnerships and ecosystem development have given it an edge. If this momentum continues, SUI’s bullish outlook remains strong. However, if Polygon introduces competitive upgrades to reclaim its market share, SUI may face challenges in maintaining its current growth trajectory.

For now, Sui’s expanding adoption and strategic growth indicate that it remains one of the most promising blockchain networks. Investors and developers are closely monitoring its progress, as continued success could drive further price appreciation and solidify its position in the DeFi sector.

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage