Join Our Telegram channel to stay up to date on breaking news coverage

Kraken, a leading cryptocurrency exchange established in 2011, has announced plans to go public with an Initial Public Offering (IPO) slated for the first quarter of 2026. This move positions Kraken to become one of the prominent crypto exchanges entering the public market, following in the footsteps of companies like Coinbase.

The decision to pursue an IPO comes amid a favorable regulatory environment under the current U.S. administration, with policies such as the Strategic Bitcoin Reserve signaling the government’s long-term confidence in digital assets.

Kraken’s IPO Timeline and Strategic Considerations

Kraken’s anticipated IPO in early 2026 aligns with a period of increasing global adoption of cryptocurrencies and blockchain technologies.

According to a Bloomberg report, Kraken recently received favorable regulatory news, as the SEC (Securities and Exchange Commission) has agreed in principle to dismiss its lawsuit against the exchange.

In response to inquiries about the IPO, Kraken indicated that it is monitoring market conditions to determine the optimal timing for its public offering. Furthermore, the exchange is also preparing for this transition by enhancing its transparency and regulatory compliance measures.

Potential Impact of Kraken’s IPO on Crypto Investors

Below are a few reasons why the Kraken IPO 2026 could matter for crypto investors:

Boosting Market Confidence and Investor Trust

Transitioning to a publicly listed company is expected to bolster investor confidence in Kraken. Public companies are subject to stringent regulatory requirements, including regular financial disclosures and audits, which enhance transparency. This shift could attract a broader investor base, including those who may have been hesitant to engage with privately held crypto exchanges.

Greater Liquidity and Growing Institutional Interest

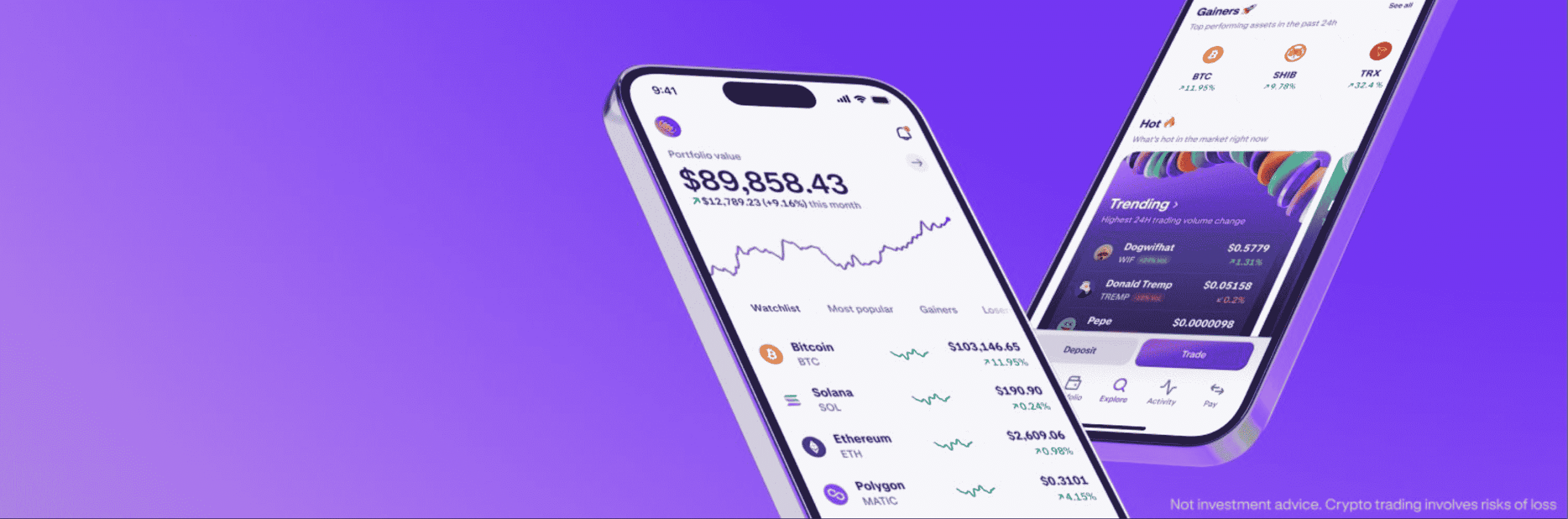

Kraken’s IPO could serve as a catalyst for increased institutional investment in the cryptocurrency market. Publicly traded shares provide traditional investors with a regulated and familiar avenue to gain exposure to the crypto sector. This influx of institutional capital may lead to higher trading volumes and improved liquidity across various digital assets.

Broader Product Range and New Financial Services

With the additional capital raised through the IPO, Kraken may have the resources to diversify its product offerings. Potential expansions could include new financial services, enhanced trading platforms, and innovative decentralized finance (DeFi) solutions.

Potential Impact of Kraken’s IPO on the Broader Crypto Market

The crypto market has previously reacted positively to major exchanges going public. For example, when Coinbase’s IPO debuted on the Nasdaq in April 2021, its stock surged over 52% at market open, jumping from a $250 reference price to $381 per share.

If Kraken also undergoes a positive debut, it could influence the prices of major cryptocurrencies like Bitcoin and Ethereum, as increased mainstream adoption and validation may drive demand.

Additionally, a successful IPO could set a precedent for other crypto companies considering public offerings, potentially leading to a more mature and regulated market environment.

Influence of Pro-Crypto Policies on Kraken’s IPO

In the sections below, we study the potential influence that Trump’s pro-crypto policies can have on the Kraken crypto exchange IPO:

White House Crypto Policies and the Strategic Bitcoin Reserve

The current administration recently hosted the White House Digital Asset Summit on March 7, 2025, hoping to position the United States as a global leader in the cryptocurrency space.

Key discussions included the establishment of a Strategic Bitcoin Reserve, which aims at holding Bitcoin as a strategic asset and ensuring financial resilience in the digital economy.

Regulatory Tailwinds and Their Impact on Kraken’s IPO

The favorable regulatory climate resulting from these pro-crypto policies provides an encouraging environment for Kraken’s IPO. Government-backed initiatives signal long-term confidence in digital assets, potentially making the public markets more receptive to crypto-related companies. This supportive backdrop may influence Kraken’s decision to proceed with its IPO in 2026, aligning with a period of anticipated growth and stability in the crypto sector.

Kraken vs Coinbase: Comparing the 2 Crypto Exchange IPOs

Coinbase’s IPO in 2021 marked a significant milestone for the crypto industry, achieving a valuation of approximately $86 billion on its first trading day. However, the company faced challenges post-IPO, including regulatory scrutiny and market volatility, which impacted its stock performance.

The Kraken IPO’s emphasis on compliance and security may position it favorably to capture market share post-IPO, especially if it can navigate the public markets with greater resilience.

Anticipated Changes for Kraken Users Post-IPO

Here are a few changes that platform users can accept after the Kraken public offering:

Strengthened Security and Regulatory Compliance

As a public company, Kraken will be subject to heightened regulatory oversight, likely leading to enhanced security protocols and compliance measures. Users can expect increased transparency and adherence to financial reporting standards, which may enhance trust and reliability in the platform.

Evolving Fee Structures and Platform Enhancements

To meet shareholder expectations and drive profitability, Kraken might reevaluate its fee structures and introduce new platform features. This could include tailored services for institutional investors, diversified financial products, or adjustments to existing trading fees. Such changes aim to balance user satisfaction with business growth objectives.

Preparing for Kraken’s IPO

Investors interested in Kraken’s IPO should monitor the company’s pre-IPO financial performance and public communications for insights into its strategic direction.

Evaluating investment opportunities in Kraken’s stock post-listing requires a thorough understanding of the crypto market’s dynamics and the company’s competitive positioning. Diversification strategies remain essential to mitigate the inherent volatility associated with the crypto industry.

Staying Informed on Kraken’s IPO Developments

To stay updated on Kraken’s IPO progress, individuals can refer to official announcements and press releases by following Kraken on X, as well as reputable financial news outlets such as Bloomberg and Reuters.

Engaging with these sources will provide timely and accurate information as the IPO date approaches.

Final Verdict: Implications of Kraken’s IPO for the Crypto Industry

Kraken’s planned IPO in 2026 signifies a pivotal moment for the cryptocurrency industry, reflecting its maturation and integration into mainstream finance. For investors and users alike, this development presents opportunities to engage with a publicly traded entity that is deeply embedded in the digital asset ecosystem. Staying informed and critically assessing the evolving landscape will be crucial as the industry continues to evolve.

References

- Fact Sheet: President Donald J. Trump Establishes the Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile (The White House)

- Crypto Exchange Kraken Preparing for IPO in 2026 (Bloomberg UK)

- Legal guide to public limited companies (Harper James)

- Coinbase Valued at $86 Billion in ‘Landmark Moment’ for Crypto (The New York Times)

Join Our Telegram channel to stay up to date on breaking news coverage