Join Our Telegram channel to stay up to date on breaking news coverage

The Trump administration is preparing an executive order aimed at addressing crypto banks’ access to master accounts. Expected to be signed soon, this order will focus on regulatory changes that have made it difficult for crypto firms to obtain banking services.

These policy changes and other recent developments aim to strengthen the crypto market. Despite the recent market downturn, these regulatory measures could trigger a recovery, potentially leading to significant market shifts. As a result, investors are actively searching for the best crypto to buy right now with strong growth potential.

Best Crypto to Buy Right Now

MNT is currently priced at $0.7047, marking a 2.25% rise in the past 24 hours. Radworks (RAD) stands at $1, showing a significant 37.45% gain over the same period. Meanwhile, Solaxy, a new Layer-2 project designed to enhance Solana’s scalability, has secured over $25.8 million in its presale. Unlike the broader cryptocurrency market, which has faced downward trends, Solaxy has attracted investor interest.

1. Mantle (MNT)

Mantle Network operates as a layer-2 solution designed to improve Ethereum’s scalability. It functions like an express lane on a highway, reducing congestion and transaction costs while maintaining Ethereum’s security. Its modular design enhances performance, allowing decentralized applications (DApps) to run more efficiently with lower fees and faster transaction finality.

The network integrates with Ethereum’s security while offering a smoother user experience. Developers can build applications with improved accessibility without compromising safety. Mantle also provides infrastructure and market support through collaborations with established partners, assisting projects from inception to launch.

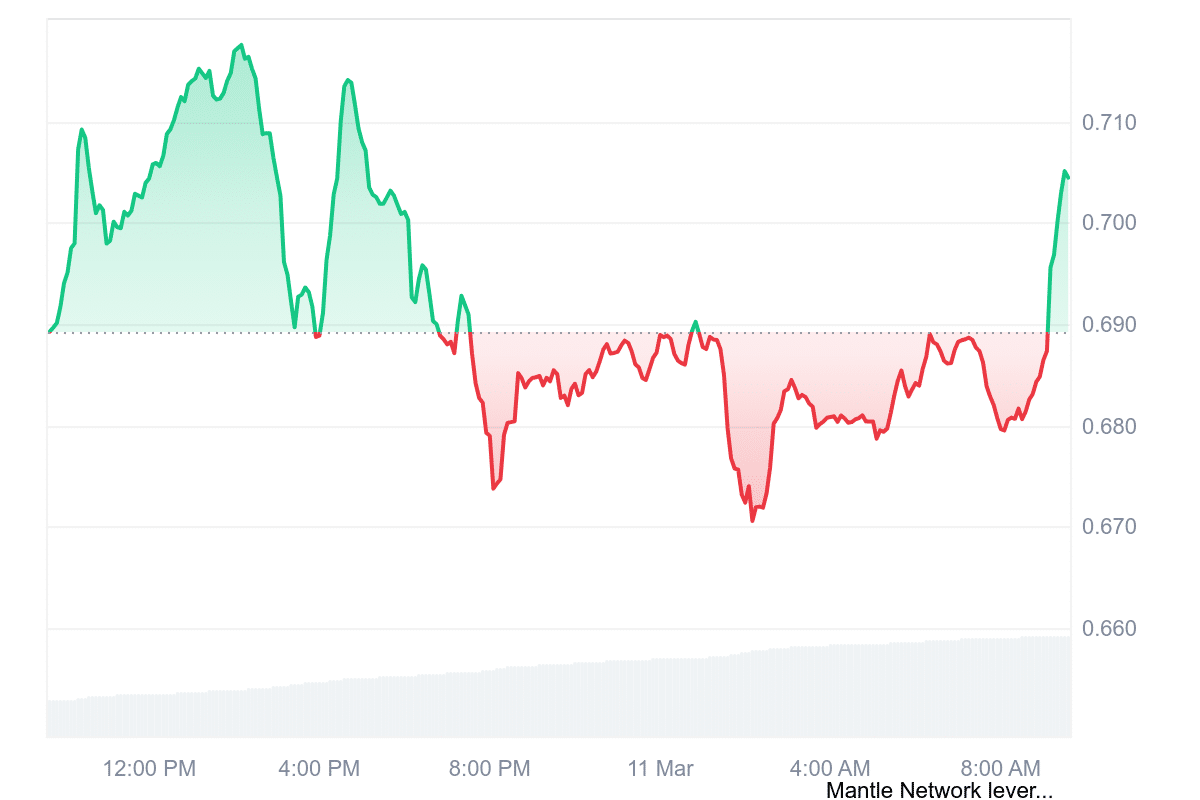

The native token, MNT, is currently valued at $0.7047, reflecting a 2.25% increase in the last 24 hours. The market cap is $2.37 billion, also up by 2.25%. Furthermore, the token’s trading volume has surged by 173.15% to $126.96 million, indicating increased activity. Mantle’s 24-hour volume-to-market cap ratio of 0.0531 suggests strong liquidity relative to its size.

Moreover, the 14-day Relative Strength Index (RSI) sits at 63.96, signaling a neutral market stance. This suggests the price may move sideways rather than trend strongly in either direction. The 30-day volatility is at 16%, staying below the 30% threshold, indicating relatively stable price movements.

Mantle Network aims to improve blockchain efficiency by offering a cost-effective and fast alternative to Ethereum’s mainnet. Its performance-driven approach and security framework make it a practical choice for users and developers seeking scalable blockchain solutions.

2. Arbitrum (ARB)

Arbitrum is an Ethereum layer-two scaling solution designed to enhance transaction speed and reduce costs. It operates using optimistic rollups, a method that processes transactions off-chain before settling them on Ethereum. This approach maintains Ethereum’s security while offering lower fees and higher throughput.

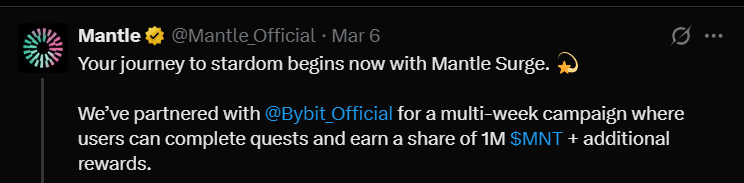

Meanwhile, Arbitrum trades at $0.33, reflecting a 7% decline in the last 24 hours. However, trading volume has surged by 58.25% to $310.1 million, indicating strong market activity. Its 24-hour volume-to-market cap ratio stands at 0.3487, suggesting relatively high liquidity.

The 14-day Relative Strength Index (RSI) is at 47.77, placing it in neutral territory, implying that the price could remain stable in the short term. The 30-day volatility is 9%, meaning price fluctuations have been relatively low.

Market analysis suggests Arbitrum may experience significant price growth, with projections estimating a 227.78% increase to $1.05 by April. Arbitrum’s design aims to address Ethereum’s limitations by reducing congestion and making transactions more efficient.

Although the recent price movement shows volatility, Arbitrum remains an active player in the Ethereum scaling space. Its technology continues attracting interest, making it one of the best crypto to buy right now.

3. Radworks (RAD)

Radworks is a community-driven network focused on supporting open-source software development. It emphasizes decentralization, allowing developers to collaborate, host projects, and receive rewards in a censorship-resistant environment. The network consists of independent organizations (Orgs), each with its governance model but sharing the goal of fostering innovation in software development.

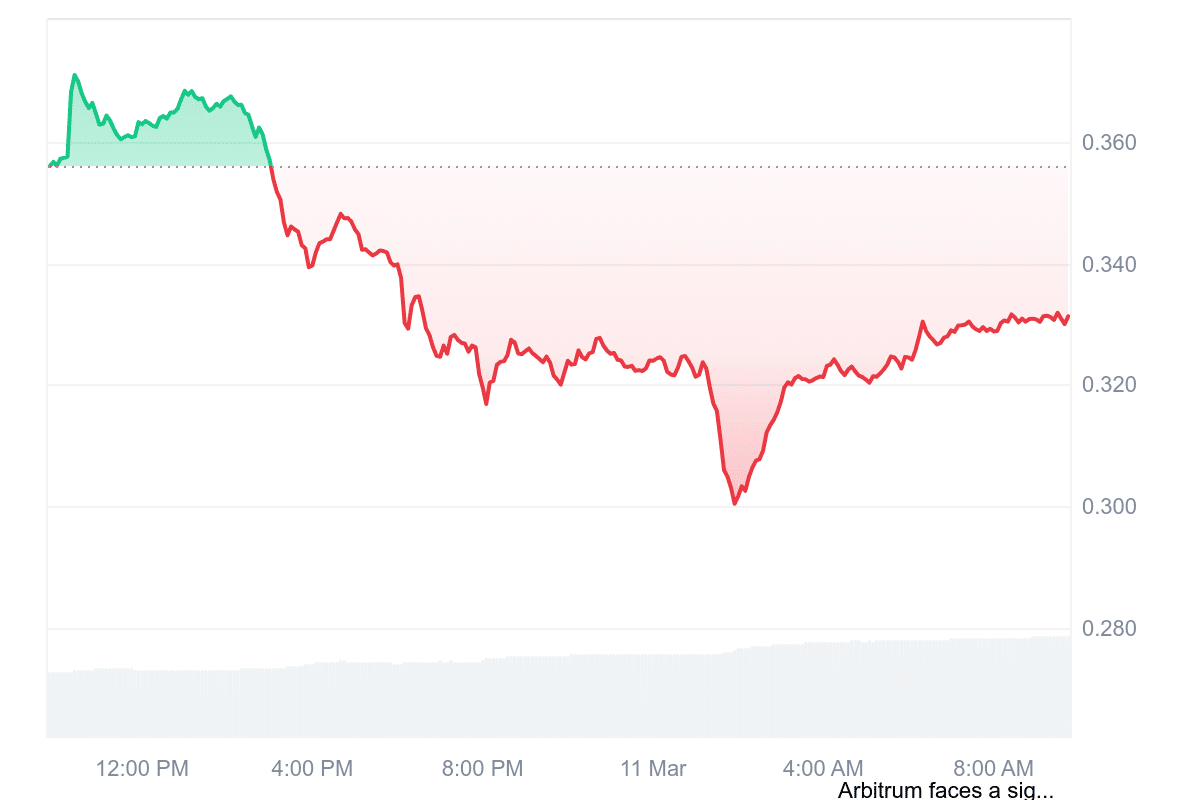

The price of Radworks (RAD) is currently $1, reflecting a 37.45% increase in the last 24 hours. Its market capitalization has risen by 39.81% to $52.24 million. Trading volume over the same period has surged by 349.78% to $227.01 million, indicating significant market activity.

Furthermore, the 24-hour volume-to-market-cap ratio stands at 4.5935, suggesting strong liquidity. RAD has a low annual inflation rate of 0.50%, staying well below the 2% mark. This controlled inflation can help maintain long-term stability. The 14-day Relative Strength Index (RSI) is at 46.68, signaling a neutral market stance with potential sideways movement.

Over the past 30 days, volatility has remained relatively low at 7%, staying under the 30% threshold. The data suggests that Radworks operates with steady inflation and liquidity while experiencing notable price and volume fluctuations. Its decentralized governance model enables flexibility, allowing developers to contribute in a secure and collaborative space.

4. dogwifhat (WIF)

dogwifhat is currently priced at $0.44, reflecting a 6.64% decline in the last 24 hours. Despite this drop, its trading volume has surged by 16.90% to $413.87 million, indicating significant market activity. The token is trading close to its recent high, down by only 0.31%, while maintaining a 13.29% gain above its cycle low.

A notable aspect of dogwifhat is its high trading volume compared to its market cap, with a ratio of 1.9526. This suggests strong liquidity, meaning buyers and sellers can execute trades with minimal price impact. The token also has a slightly negative yearly inflation rate of -0.01%, implying a slight reduction in overall supply over time.

Market trends suggest the price could rise significantly, with a forecasted increase of 229.92% next month, potentially reaching $1.48. However, price predictions are speculative and subject to market fluctuations. dogwifhat’s recent price movements highlight its volatility, which is common in cryptocurrency.

5. Solaxy (SOLX)

Solaxy (SOLX) is a new Layer-2 project aiming to improve Solana’s scalability. It has raised over $25.8 million in its presale, moving against the market downturn affecting significant cryptocurrencies. The project’s native token, SOLX, is available for $0.00166 during the presale. Investors can buy it with cryptocurrency, credit or debit cards, or through the Best Wallet mobile app.

After fundraising, the presale team plans to list SOLX on a decentralized exchange. Solaxy’s goal is to address congestion issues on Solana, which occur during periods of high trading activity, especially with meme coins. It processes transactions off-chain by bundling them together before settling them in batches. This method reduces network load and improves transaction speeds.

Another focus of Solaxy is interoperability. The project aims to connect Solana and Ethereum, allowing users to transfer assets between both networks. If successful, this could provide Solana with speed and lower costs while giving access to Ethereum’s broader ecosystem.

Solaxy blends infrastructure improvements with a meme-style branding approach. While the project presents potential solutions, it remains in its early stages. The effectiveness of its technology and adoption rate will determine its long-term success.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage