Tezos is a self-upgradable, open-source blockchain technology for storing decentralized assets. Tezos stakeholders are in charge of overseeing protocol updates, including changes to the governance process. A tezzie, or Tez, is the native digital token. Tezos was one of the most successful initial coin offerings in history, raising over two hundred and thirty million dollars in 2018. Tezos is gaining momentum due to the popularity of its staking mechanism, despite management and legal problems that hampered the open-source project until far into 2020.

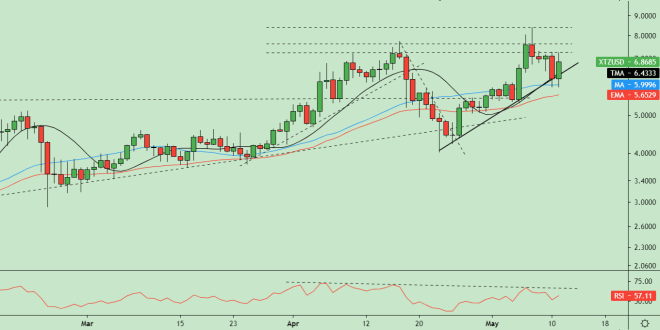

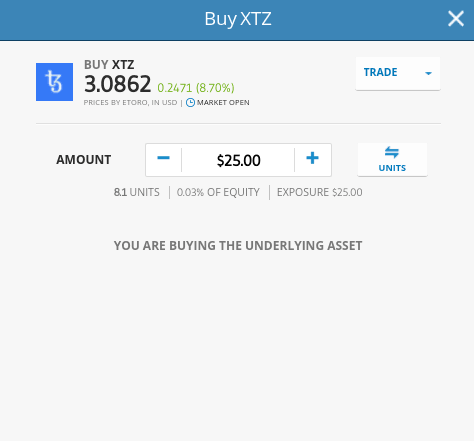

Founded in July 2017, XTZ is a well-known cryptocurrency. While Coinsquare does not support this token, it may be bought with any major cryptocurrency, such as ETH, BTC, or XRP, or fiat money, such as the US dollar, Canadian dollar, or Euro, on other trading platforms. The majority of people who sell XTZ do so in exchange for Ethereum or Bitcoin. You can trade XTZ for Ethereum or Bitcoin on an altcoin exchange. Tezos is a cryptocurrency that enables everyone who holds the XTZ token to vote on any future network rule modifications. The program immediately updates the rules across all network nodes once an agreement has been achieved on these rule modifications. This effectively puts the power of guiding Tezos’ destiny in the hands of its users. Adopting this governance structure offers the network a significant boost in user happiness, as well as a near-zero probability of a hard fork happening. Tezos’ introduction was momentous because its new concept divided cryptocurrencies into two groups. Tezos received a lot of public attention because of this fresh and unusual concept, as shown by its successful fundraising round in 2017, following which it became online in 2018. While Tezos has many of the same characteristics as other cryptocurrencies, its operating system is very different. The Tezos blockchain is divided into two parts: network she’ll and network protocol. The network shell is the portion of the code that performs administrative tasks, transactions, and self-amends depending on user votes. The portion of the code that sends suggestions to the shell for evaluation is known as a network protocol. Tezos utilizes a liquid proof-of-stake consensus process, which is a variant of the traditional proof-of-stake consensus mechanism. Users stake or bake XTZ to make this process function. A single node must bake eight thousand XTZ tokens to become a baker. Bakers play an important role in blockchain governance by voting on code modifications submitted by developers. The maximum and circulating quantity of Tezos tokens are a little around 760 million XTZ tokens. The present method introduces approximately 80 XTZ tokens every block per minute, resulting in a five percent annual inflation rate. Even though the Tezos blockchain has yet to be fully used, it has experienced modest acceptance. Developers interested in launching decentralized apps may be interested in this project. On the Tezos platform, projects like tzBTC and Tezsure have already developed completely functioning apps. Tezos is presently mostly used as a staking currency, which is appealing due to its potential to reward the passive creation of additional Tezos XTZ tokens. It may also be used as a method of payment and a speculative investment instrument. XTZ may only be sold with the assistance of a broker. Liquidity is provided by brokers or crypto exchanges for cryptocurrencies such as XTZ. This information is designed to help you make the best broker decision possible. We’ve included a few brokers that you may contact anytime you need to sell your XTZ below. Note that these brokers have satisfied de facto industry-recognized criteria and are regarded as acceptable platforms for both newcomers and experienced investors. The brokers on the list above all operate in the same sector and enable thousands of investors to buy and sell crypto assets, as well as trade them for profit. They have marketplaces in a variety of locations throughout the globe. Furthermore, they comply with current laws in the countries where they operate, while also expanding their services to allow consumers in these nations to get more out of them. It’s critical to search for particular benchmarks before choosing a broker. When a broker fails to meet these criteria, his or her integrity is called into doubt. A clear and comprehensible user interface, quality customer service, adherence to standards, security, and several trading desks are just a few of these criteria. The aforementioned exchanges are highly recommended by key players in the sector due to their ability to fulfill the stated standards. Tezos may be loaded into a Bitcoin ATM or used to finance an account on an altcoin market. Because it’s ridiculous to expect to sell an asset that you don’t already own, buying XTZ is the first step before any selling can take place. Clients may buy XTZ on eToro, or they can buy it from another exchange. Then, after purchasing, you may sell it on eToro. Only authenticated customers are allowed to purchase XTZ on eToro. As a result, you’ll need to complete verification criteria after signing up. You may deposit financial assets into your account after entering the required information for verification, such as your country of residence, date of birth, actual name, profession, and income threshold. The overwhelming majority of cryptocurrency traders choose to fund their accounts using USDT. eToro offers a variety of ways for you to deposit funds into your account. You may deposit money into your eToro account using your credit card, debit card, local bank account, or third-party services like Skrill, PayPal, or Neteller. Once the money transferred through any of the aforementioned methods appears in your eToro account, you may either buy XTZ using a fiat currency of your choice or purchase USDT first and then XTZ. The latter is preferred by most people since USDT is a stablecoin that is not susceptible to the same volatility as other cryptocurrencies. Depending on your choice, you may use any of the two methods. Buy XTZ Image Every investor buys a tradable asset with the intention of profiting. Understanding when to purchase a crypto asset like XTZ is essential, but knowing when to sell is even more critical unless you want to incur unexpected losses. Even long-term investors who buy crypto assets for the long term are aware of when they are profitable and may sell. If you know what you’re doing, you can prevent losing money on your investments. Furthermore, the values of digital assets may be very volatile. As a result, you may be able to benefit from your investments today and in the next few days if the price of the asset you bought has fallen. Furthermore, no one has authority over the pricing of these assets. A selling goal for your XTZ investment is a good idea. Failure to do so may mean disaster for your investments, resulting in a loss of money. To assist traders in making informed investment choices, eToro has incorporated charts for each crypto asset, including XTZ. Candlesticks and patterns are used in these charts to analyze the historical data of an asset, such as XTZ. Similarly, you may use these charts to figure out whether it’s time to buy XTZ or other cryptocurrencies. On eToro, clicking XTZ will lead you to a page with additional information about the asset, including the exchange’s traded volume. XTZ Chart on eToro Aside from XTZ, you may have other assets in your account since eToro provides a wide range of cryptocurrencies and trading pairings. The asset, XTZ, is the focus of our attention in this tutorial. Along similar lines, understanding the total value of your portfolio can help you determine if the amount of XTZ you want to sell is sufficient. The minimum amount that may be withdrawn from eToro is $50. As a result, you’ll need that much XTZ before you can sell. eToro Overview To find out how much your portfolio is worth, go to the top left corner of the site and select ‘Portfolio.’ You can view all of your crypto assets and their values by clicking on the ‘Portfolio’ icon. You may click on any asset other than XTZ that you want to sell there. Before you sell the item, make sure you have the required amount of cash on hand. You’ll need to close current positions to sell your XTZ asset. Closing your active positions refers to selling the asset. Furthermore, you won’t be able to do so if the item is still in its original state. The highly volatile character of cryptocurrencies is a cause for worry. Leaving your XTZ investment without selling it for your chosen currency—fiat or USDT—is a dangerous decision since you will almost certainly lose your money. Because of how unpredictable prices may be, if you don’t sell at your target price after it’s been reached or wait a time thereafter, you could find that prices have retraced. You must act quickly to protect your earnings. As previously stated, ending current holdings necessitates the exchange of XTZ for USDT or another digital currency. When you close or sell these positions, the equivalent or less is shown in your portfolio. Similarly, if you sell at market price, the actual quantity of XTZ sold may differ from the amount shown in USDT. When an asset settles at a price lower than the planned target price, this is known as slippage. Slippage may be seen in either a good or bad light. A transaction is completed at a lower price than the planned goal when negative slippage occurs, while positive slippage occurs when an asset settles for a higher price than the intended price. Closing Trade on eToro If you need to cancel an active XTZ position via your eToro account, you click on the portfolio symbol, which displays all of your assets. You may then choose XTZ, which will take you to the trading section. You may choose the amount of XTZ you wish to sell in this section, whether it’s all of it or just a portion of it. Alternatively, you may use the search sign to find a XTZ pair that you want. After you’ve found your chosen pair, click on it to be brought to the trading area, where you may sell. Your portfolio is still affected by the quantity of XTZ you sold. This amount may also be withdrawn to a local bank account, a PayPal account, or a credit card associated with your account. Withdrawing assets from eToro is simple as long as all of the withdrawal requirements are met. On eToro, the withdrawal procedure has received mainly favorable feedback. Withdrawals on the exchange are simple to understand, especially for newcomers. There are times when withdrawal symptoms may appear, although they are uncommon. It’s also possible that a customer is using an account from a nation that’s been banned. Incomplete verification, problems while starting withdrawals, and failure to establish withdrawal channels are only a few examples. eToro is focusing on making withdrawals on its platform as simple as possible. As a result, selling your XTZ is easy and hassle-free for you as a user. eToro guarantees that any crypto asset held on its platform may be traded. Whenever you can convert your XTZ to fiat currency. While other exchanges maintain a larger base withdrawable amount, eToro has lowered the threshold without sacrificing the quality of its services. The minimum withdrawal amount for XTZs on eToro is fifty dollars, with a 0.5 percent charge. The minimum withdrawal charge on eToro is one dollar, and the maximum is fifty dollars. This shows eToro’s thoughtfulness when it comes to withdrawal costs. Update – As of 2025, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum. In the United States, crypto taxes do not yet exist. The US is proposing a new infrastructure law that would require crypto companies operating in the US to file tax returns. Because cryptocurrency is decentralized, imposing tax responsibilities on its owners may be difficult. The use of cryptocurrency for illicit purposes has long been a source of worry for US officials. As a result, they are attempting to create laws that would include and protect against such actions. Around the world, there are many controlled and decentralized exchanges. Crypto exchanges are often used to make cryptocurrencies available to investors and enthusiasts. They also offer platforms for crypto traders to trade such asset types. Despite having a single goal, these platforms may provide a variety of services. This implies that, in addition to buying and selling cryptocurrency, these exchanges may provide other services. As a result, your requirements will determine which exchange is best for you. Some crypto exchanges have managed to stand out and connect with thousands of individuals across the world, even though there are many. This is not because the services they provide are unique, but rather because they go above and beyond to ensure their customers’ satisfaction. The top crypto exchanges are distinguished by a set of recognizable characteristics. User-friendly interface, security, effective customer service, a growing community, and a tutorial on how to utilize the exchange are among these criteria. In light of the above, several exchanges have been able to pass these characteristics on to their users to provide the best service possible. Other exchanges have fallen short of these benchmarks, with fewer signups and lower daily trading volume than the former. A few exchanges let their clients utilize copy trading or trading bots services, providing premium services to its users. Traders who aren’t cut out for manual trading may XTZlicate deals from other experts or use bot trading to automate the process. We’ve compiled a list of the top cryptocurrency exchanges available. It’s critical to have XTZ on hand. XTZ and other cryptocurrencies are kept in digital wallets. Cryptocurrency investors and holders may store their digital assets in a variety of ways. Some people keep their money in hot and software wallets, while others put it in hardware wallets, also known as cold wallets. They may also leave their tokens on the market after they buy them. Read our guide to Bitcoin wallets, many of which also allow other cryptos such as XTZ to be held on them. If you’re going to invest and sit back, you’ll have to keep an eye on the price of XTZ, particularly if you don’t have a goal price in mind. It may be difficult to keep track of an asset’s price since you need to be aware of what’s going on in the crypto market to decide whether to sell or retain your XTZ holdings. Essentially, the investing strategy you choose determines your ability to sell your XTZ assets. If you choose a short-term approach, you must wait until the appropriate moment comes to exchange your XTZ. As a result, there is no one-size-fits-all approach to selling. When your investing plan says so, it’s the appropriate moment. Given the volatile nature of the crypto market, a lot may happen in the time between when your investment reaches the goal you set. A piece of negative news may have an impact on any open positions or holdings you have. This is why anytime you wish to invest, you should always do research. Even when the transaction is heading in the wrong direction, the analysis keeps you in check. You may have to wait longer than required to strike your target. Suddenly, Bitcoin has piqued everyone’s attention. Of fact, you may have acquired a similar passion, but you are concerned about the outcome. When investing in cryptocurrency, one must exercise caution. A crypto investor is supposed to have a variety of additional characteristics. It’s important to realize that no one influences the market. As a result, it must be maneuvered with care. Greed is a significant issue that most traders face. A trader is one step closer to being an expert if he can resist the temptation to be greedy. The market may be extremely unexpected at times. During such times, a crypto trader should stay away from the market. Also, as a trader, you should never trade vengeance. This entails attempting to recover from a loss after it has occurred. Trying to make up for losses by trading may result in even greater losses. The best thing to do at this point is to take a step back and rethink your strategy before returning to the market, not to recoup your losses. Aside from the money required, crypto trading is an activity that requires a high level of commitment from traders. Aside from examining charts, traders usually keep up with significant market developments by reading news. Combining such tasks may be exhausting. If he splits his attention between other commitments and the charts, one or both of them may suffer. He is prone to making expensive trading errors on occasion. With the introduction of trading bots, automated trading has come to the rescue of these traders, making trading simple for them. As a result, they are not required to participate actively in the trading process. Trading bots automate the trading process, allowing traders to focus on other tasks. To trade cryptocurrency, trading bots use algorithms. They do, however, need some human interaction to operate well. They cannot operate independently; instead, a trader must activate a trading range based on his approach, which these bots rely on. Trading bots are essential because they are intended to react to market opportunities quicker than humans. When you make a profit, you may sell your XTZ tokens. Before selling your XTZ in 2021, keep the following in mind: Remember to hold where you haven’t met your goal yet. When it comes to investing in cryptocurrency, patience is essential. If you are an international Tezos client, owning XTZ has many advantages, including lower costs and the opportunity to earn income on your investments. Regulatory changes are the token’s greatest danger if you’re not a Tezos client and want to invest in it. Stronger restrictions on crypto derivatives in the United States and across the globe may stymie Tezos’s ambitions to expand its presence in the US market and have an effect on its overseas operations. However, if Tezos is successful in working with authorities as planned, the price may rise much higher. XTZ has a market value of more than six billion dollars and a daily trading volume of more than thirty million dollars. Because it is a digital asset, it can be easily purchased, saved, and sold. Apart from the brokers mentioned above, XTZ may be available on most exchanges. You can close positions to sell XTZ on eToro and other brokers’ platforms. You may exchange the asset for USDT or your home country’s fiat money, then withdraw to your local bank account. XTZ may be kept in either a hardware or software wallet. If you want to purchase a cryptocurrency, you should do it after doing your research and not because the asset seems to be lucrative. Invest just what you can afford to lose, as the saying goes. The crypto market is very volatile, and it cannot be traded based on hope or conjecture. This article may serve as a reference guide for you to refer to anytime you wish to invest in XTZ.

We suggest selling XTZ through an exchange in this tutorial since you will be assured safety and get your fiat. There are a variety of different ways to sell. P2P is another option, although it's a little dangerous.

When you utilize a broker like eToro, you can sell your XTZ in minutes with only a few clicks. Withdrawal alternatives are also available on the exchange.

To sell XTZ, you may utilize a variety of brokers. Expert traders who have looked into choices, however, believe the following to be the finest. Capital, eToro, Libertex, Coinbase, Plus500, Binance, Revolut, AvaTrade, Changelly, and Cryptorocket are the names of the exchanges.

Taxes on selling cryptocurrencies vary from one country to another. So consult your local government website or financial regulator to find out more.

You'll need an exchange that allows you to pay using your local bank or a third-party payment provider to sell your XTZ for USD. Coinbase, eToro, Binance, and AvaTrade are some of the finest options.

Capital, eToro, Libertex, Coinbase, Plus500, Binance, Revolut, AvaTrade, Changelly, and Cryptorocket are among the exchanges where XTZ may be purchased.

You'll need an account with eToro or one of the other exchanges mentioned above to rapidly sell your XTZ. It doesn't take long to set up your account. If you already have XTZ, you may transfer them to the exchange's wallet and sell them there right now.

To sell XTZ for cash, set up a withdrawal channel on eToro or any of the other exchanges mentioned above. Make sure you've chosen your preferred currency. When you make a withdrawal, the exchange assists you in converting your money to cash and deposits them into the appropriate channel.

Only four cryptocurrencies are supported by PayPal: Bitcoin Cash, Bitcoin, Litecoin, and Ethereum.

Some wallets allow you to sell your XTZ on the spot. You must integrate a payment mechanism and complete the required steps to sell XTZ on wallets to sell them.

On exchanges like Coinbase or eToro, you may often exchange your XTZ for other cryptocurrencies. The real value of XTZ sold reflects on the crypto you select after you've completed an exchange. On this Page:

Tutorial on How to Sell XTZ

Steps 1: Buy XTZ

Steps 2: Always Know When to Sell

Steps 3: Know the Total Value of Your Portfolio

Steps 4: Close All Active Positions

Steps 5: Withdrawal Requirements and Exchange Rates

Crypto Taxation in the US

Best Crypto Exchanges

Storing XTZ in the Best Wallets

When is the Best Time to Sell my XTZ?

Price of XTZ

Guide for Automated Trading

Should I Sell XTZ in 2021?

Conclusion

FAQs

Where to Sell XTZ

How Easy it is to Sell XTZ?

What are the Best Brokers for Selling XTZ?

What are the Taxes for Selling XTZ?

Where to Sell XTZ for USD?

What Exchanges Sell XTZ?

How to Quickly Sell XTZ

How to Sell XTZ for Cash

How to Sell XTZ for PayPal

How to Sell XTZ from Wallet

How to Sell XTZ For Other Cryptocurrencies