Over a decade ago when the very first cryptocurrency was launched, no one would have believed it could rise to its current high. Its success has paved way for lots of altcoins. Many of which have also become very successful.

Times are changing and the crypto world is moving with the tide. A few years back, all investments were mainly coins and commodities. Today, investors now have the choice of purchasing virtual estates with crypto coins like MANA.

This became possible after the launch of Decentraland which is a decentralized land where exchanges are done with MANA coins. Investors can own estates that gain attention and profit over time. The lands purchased are beautified with professional designs to draw the attention of tourists.

Tourist attraction has been a major source of revenue. The investor’s profit increases according to the volume of tourists drawn to the site. Other sources of revenue include advertising and display content.

Companies and numerous brands often take advantage of the environment created on the platform. They pay to make use of the beautifully designed lands possessing the potential to draw many visitors. The investor and the brand being advertised end up profiting evenly.

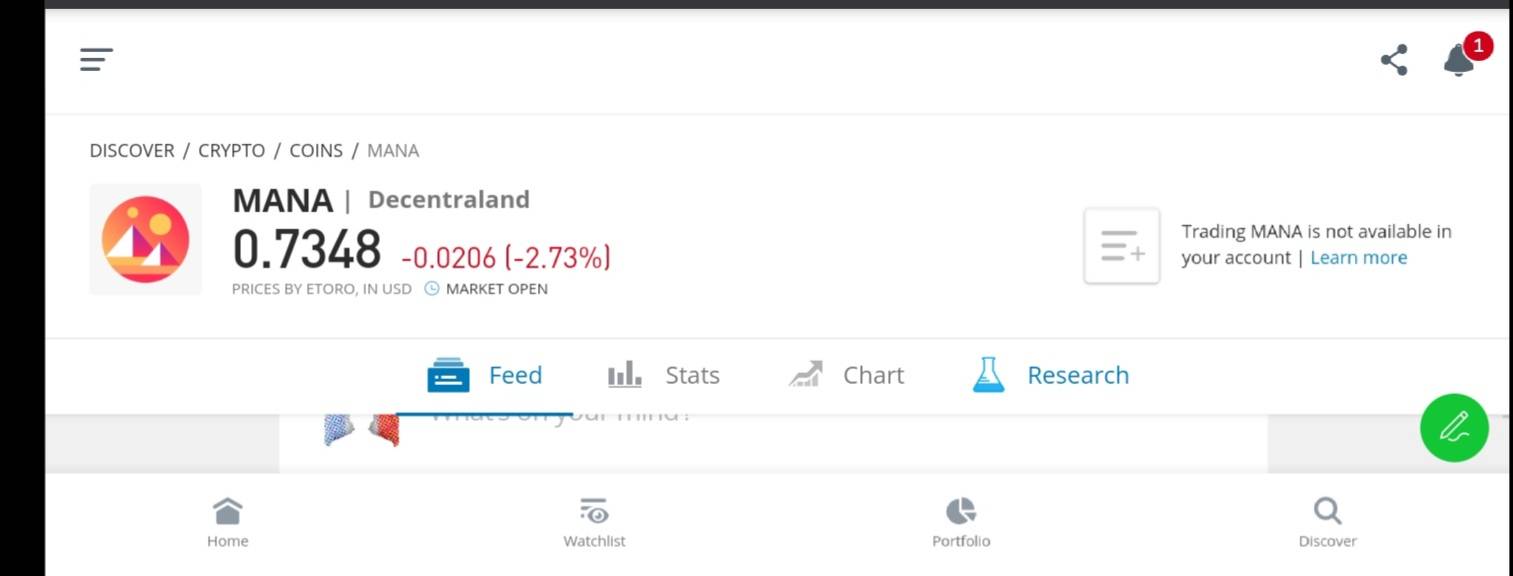

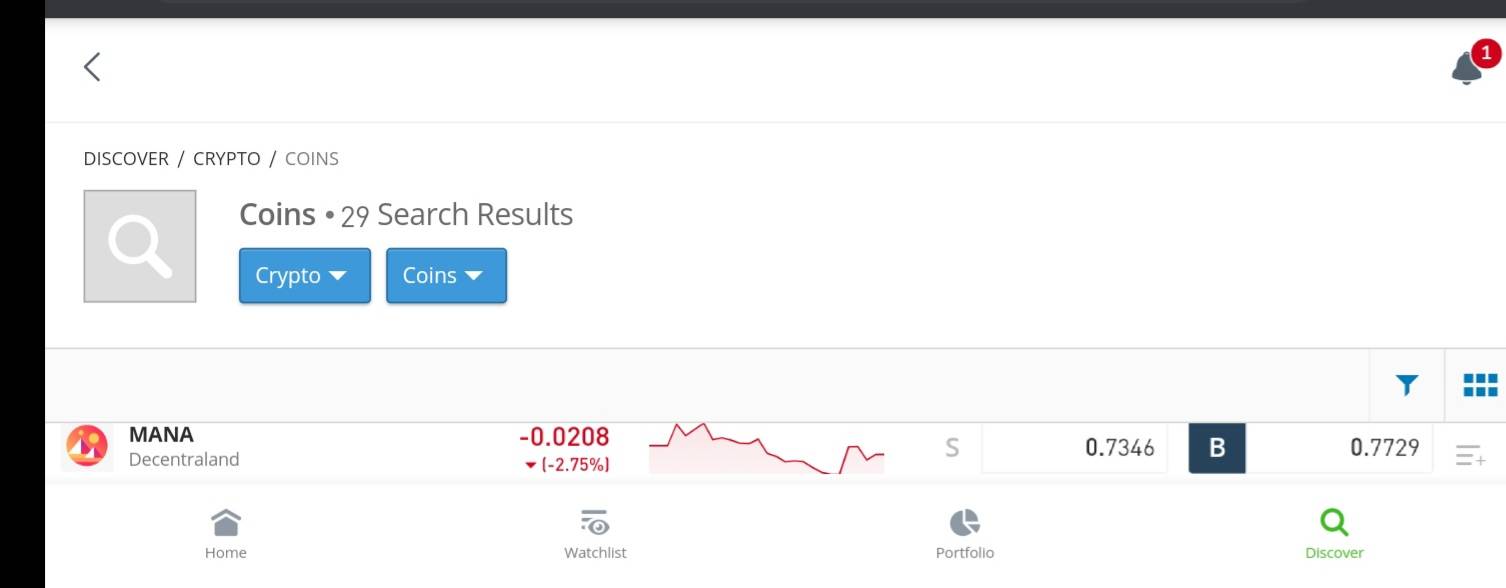

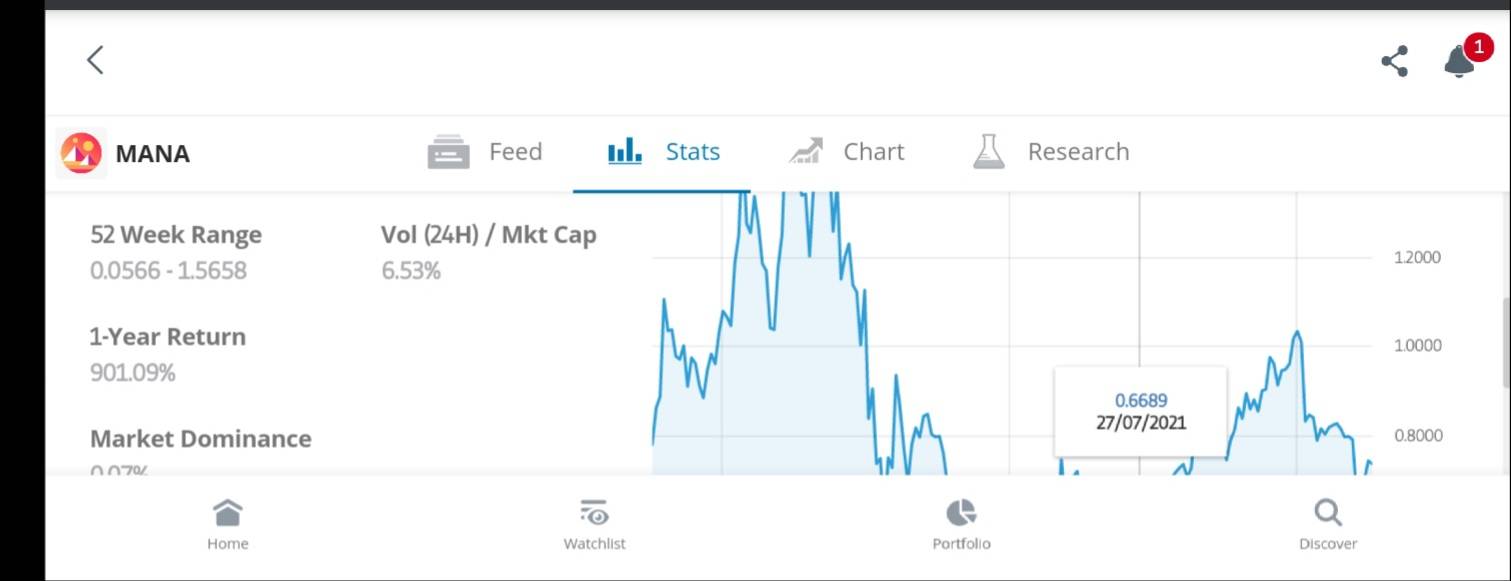

Decentraland was founded in 2015 by two people whose origin has been linked to Argentina. It is built on the Ethereum blockchain. Due to its affiliation with Ethereum, gas fees on transactions are quite high. Nonetheless, it is a valuable asset that most investors consider adding to their portfolio. It does have a huge potential to grow exponentially and this is often the motivation behind the investments. However, caution is essential for any investment to be prosperous. The choice of the broker to be used in investing is very important. As a result, investors should only settle with a broker when its features meet basic requirements. With a great broker, an investor can easily supervise their asset and adjust selling strategy when required. Brokers categorized as the best have met the laid down requirements and more. In the process of curating this list, we made use of endorsements by experts and users. The ten brokers listed below made it to the list after proper assessment. Either of them can be used to carry out crypto transactions easily. Although, a few processes like account creation and funding must be done first. All the requirements will be discussed in the next section of this guide. Investors have ever changing strategies for selling. At the time of purchase, many are already calculating their expected profit based on predictions and a possible rise in liquidity. When the investment matures, the calculated profit mostly falls within the expected range and selling becomes the next step. The selling process can be a bit tricky as there are lots of factors to be given due consideration. Regulations on some brokerage sites also reduce the number of profit investors can gain. This is why we have recommended some of the best brokers an investor can use. Selling Decentraland coins or MANA on any of the above-listed platforms is very simple. There are just a few processes to be followed. The transaction is usually completed within a few minutes. We would now look at the steps needed and how to go about it. For this guide, we would be making use of eToro. This platform is highly recommended and considered the best for both inexperienced and experienced traders. Update 2025 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum. After purchasing MANA, many investors store their assets in external wallets. These wallets could be hardware wallets or software wallets. To be able to sell some or all of one’s assets, it has to be transferred to the chosen brokerage site. This is done by funding the wallet provided on the platform. However, before jumping to this step one must create an account on the platform. The process for creating an account is short. Navigate to the broker’s website. Move to the signup button and click on it. The next prompt will require you to fill in details like first name, last name, and email address. A link will to sent to your email address. It is to verify the email address given. Log in to your email account and click on the link to complete the first verification. Now, you have an account on eToro. Certain features will be available. It is best to complete the registration before carrying out trades. eToro regards the worldwide anti-money laundering policies hence they have to collect some personal details. This ensures they know the kind of clients trading on their platform. To finalize the verification, submit a government-issued ID card and a proof of address document. All valid documents are acceptable. The kind of documents required may vary for some countries, so, check for detailed guidelines for your country. The verification usually lasts a short while and the account will be approved afterward. At this point, you can now build your portfolio. At the left section of the webpage, you would find a button that indicates portfolio. Below it, you will see a button to fund your account. For investors whose coins are already stored in external wallets, the wallet-to-wallet transfer is faster for account funding. Click on it, specify the wallet you will be transferring from and the amount being transferred. The process takes a few minutes before the asset is reflected in your portfolio. Short-term investors may be looking to sell a while after their purchase. The buying process is also straightforward. The desired amount of coins can be purchased using a credit card or any other convenient channel. MANA coin on eToro When investors share their success stories, it is easy to fall for the belief that all it required was buying and selling. Meanwhile, a lot of calculations went into the selling process. To be successful as an investor, one must understand the factors that drives the market. With the right tools and proper education, you can manipulate the market to meet your needs. It may be impossible to control the market but avoiding loss is possible. In the aspect of education, eToro has a huge library that all investors can benefit from. Taking time to study the market and master the science behind price analysis places you at the top of your game. It becomes easy to play safe and avoid the wrath of the market. The platform provides many charts and graphs for all accounts so investors can be well equipped for success. MANA price chart on eToro There are several reasons why you should know the total value of your assets. Most investors have a clear target range in mind. The time frame of the investment is likely to be dependent on the target value. The price of coins fluctuates daily. Investors must know the lump sum at the very moment. Monitoring the price levels becomes less stressful as the total sum is the only value kept in mind. Asides that, all platforms have minimum withdrawal limits. On eToro, the limit is $50. The value estimate of the asset to be sold will serve as a guide in determining the amount to be placed for exchange. This will save the investor the stress of waiting or repeating the process when the withdrawal limit becomes a hinderance. The total value of your asset is indicated in the portfolio section. This can be viewed by moving to the left of the page, clicking on the portfolio button, and selecting the asset. eToro Overview The trade execution step needs to be carried out smartly. This is because prices fluctuate within minutes and could either rise or fall. Once the price surges to a certain high, it is best to sell immediately especially if the volatility level is normal. This step demands lots of tactfulness from the trader. Trades should not be carried out abruptly. The timing should be well calculated to ensure you get the most from your trade. As stated earlier, selling is very easy. Navigate to the left side of the page and hit the portfolio button. The asset page will be presented. Clicking on it will take you to the page for executing trades. The price of the coin is displayed at the top of the page. Do a last-minute price confirmation before selecting the sell button. By hitting the sell button, your intended trade will be executed. Decentraland coin is then exchanged for your chosen fiat currency. The account is credited with the new figure which can be confirmed from the account dashboard. Withdrawal should be enabled so long as the new figure meets the minimum withdrawal limit. Trade Execution on eToro When estimating the value of an asset, it is good to also check the exchange rate a broker works with. This will prepare you for the withdrawal step. It is noteworthy that withdrawal requests placed on eToro are processed quickly. Although, some traders have complained about facing issues with withdrawal. In the course of the research, we discovered they had not met the withdrawal requirements. If you have followed all the steps listed above, withdrawal should be very easy. To place a withdrawal request, hit the icon at the top left of the page. The new prompt has a display with a withdrawal button at the end. Once you click on withdrawal, specify the amount to be withdrawn. Your request will be received and processed. Shortly after, you will be credited with the said amount via any of the withdrawal outlets you select. Cryptocurrencies may come off as very confusing assets. This could be linked to the fact that they are created with the goal of serving as a means of value exchange. And now, they are playing out to be valuable assets for investors. The crusade to have cryptocurrencies accepted as a legal tender has met stubborn resistance globally and the US is no exception. At the moment, these coins are seen as assets. Hence, they are classified as taxable property just like the more conventional virtual assets. Many people have joined the investment spree unaware of the legal obligations tied to holding cryptocurrencies. Taxes are to be paid on any kind of crypto a US citizen possesses. Although, the way taxes are calculated is dependent upon the length of time it is held. Investors who hold crypto for short term gains will pay taxes on each individual possession in accordance with revenue generated yearly. Taxes on long term investments are calculated with fixed rates. This is also dependent on the total amount of coins in one’s possession. Citizens are expected to have a clear report of transactions carried out and know the taxes they are liable for. Failure to do this may not cause legal consequences at the moment, but it could in the future. If the bill to have crypto assets regulated is passed, exchanges will be duty bound to report transactions to the government. Anyone with the intention of joining the industry must find a compatible broker to trade with. There are so many exchanges available today. Most people find the process of picking a broker burdensome. Checking out reviews and recommendations may be a good start. But, reviews are majorly based on individual opinions and most likely cannot suffice professional assessment. Also, there are so many platforms with awesome reviews. Verified experts had taken a look at popular platforms with a large number of traders. Based on their survey, the following platforms are the best for traders. On the above platforms, every process is easy and clear. The interface is very simple for hitch free navigation. They employ high tech features to guarantee the security of the platform. Also, the best trading practices are followed. Deposits and withdrawals are instant. Fiat currencies of many countries are available with varying payment channels to pick from. The hot wallet and the cold wallet are the major classification of wallets used in storing cryptocurrencies. The cold wallets is otherwise known as the hardware wallet. Hot wallets are alternatively called software wallets. They both have specific advantages with a few shortcomings that can be managed. In the aspect of security, they are relatively secure. The hardware wallet is regarded as the more secure type. The hot wallet requires an internet connection to function. Coins stored here can only be accessed with the set security code. Due to the constant need for an internet connection, this wallet type is regarded as less secure and prone to the activities of hackers. The cold wallets does not require an internet connection. Storage is possible with the aid of physical drives. This wallet is generally more secure as hackers cannot have the assets swapped. Loss is only possible if the device is misplaced or physically damaged beyond repair. Lock codes are also necessary to gain access. This storage method makes it impossible to retrieve a forgotten lock code. Investors can store their coins in either type. Although, it is advisable to keep the larger volumes of one’s possession in cold wallets as it tends to be safer. The general rule is to sell when prices rise. At least, this is the logic most bitcoin investors followed when they sold their coins before it’s all time high. The more patient investors are now getting more yields from their investment. There are also cases where some coins crashed. Sellers who sold impatiently when the prices seemed to be going nowhere saved themselves from loss. The investors who chose to be patient were rewarded with bitter losses. This is the reality of the cryptocurrency world. There are some self acclaimed experts that say certain times are best for selling. It is obvious that there is no such thing. Every investment has its own perfect selling time. This is something the trader has to come up with. A strategy to guide the length of the investment should cover for this. All investors who hope to make profits from the market must be active enthusiasts before making purchases. This is a very basic requirement as monitoring one’s asset closely is not a duty that can be relegated. It is the only way to determine the best time to sell your asset.. In the course of analyzing the market, it is necessary to pay a close attention to the general predictions and calculations by experts. This is a vital source of guidance. On this website, relevant predictions from experts are published regularly to help individual analysts in drawing conclusions. Decentraland’s coin is one of the very few currencies growing at a quick pace. This coin has been taking many baby steps lately. As of now, it’s value ranges between $0.7426 and $0.6495 on brokerage sites. At the time of its launch in 2015, it was recorded that there are about 2 billion MANA coins. However, the total supply available is not known. There is no concrete data in this regard. The market enjoys a circulating supply of 1.8 billion coins. Some of it is constantly being traders while some are owned by small scale and large scale investment accounts globally. As usual, actions by whale accounts often has a ripple effect on it’s liquidity and market volatility. Decentraland coin according to popular predictions could climb over $15 in a few years from now. It appears that there is so much to gain from keeping these coins. Technological advancement has paved the way for many brilliant inventions. One of such inventions is the use of algorithms for trading. This trading method is also referred to as automated trading. The process involves the use of bots to execute trades. The frequency of trades executed with the trading bots is far greater than that of a human trader. This makes it possible for traders to raise their yields from trades without having to spend too much time. The only responsibility left to the trader is deriving the data the bots will work with. This information is inputted following a couple of steps. Traders only run into loss when they fail to pay due attention to the market. To avoid losses, account owners must constantly analyse the market to predict possible changes. This way the data inputted can be adjusted before unfavorable trades are executed. Bot programs can involve risk – those interested should only deposit a small amount at first to test them out. These are some bots we’ve reviewed: It is impossible to speak of responsible investing without talking about analysis. Most experienced investors already know the outcome of investment choices before making them. This is the main reason why they turn out to be successful. The good thing is there are no tricks as all that is required is careful analysis.This involves studying the commodity in question, all past bullish moves and factors that promote price growth. This way, predicting the coin’s success becomes simple . Some analysts believe this coin could reach $25 and above soon. Predictions like this are backed by the previous lines of growth the coin has taken. Having the potential for growth sure is a green light to invest. The second part of getting this whole investment thing right is knowing just how much of your portfolio should be dedicated to the coin. The popular belief is to only invest around 5 percent of your total portfolio. This reduces the risks attached to crypto investment. The market is so uncontrollable that rosy shores today may start to look like death traps tomorrow. The best way to invest in MANA is to design a selling strategy to follow. Understand how your income and expenditure works before allocating a certain amount to this investment. And lastly, constantly assess the market and try to stay on the safe side as much as possible. There are no clear cut rules when it comes to selling. All transactions are done at the trader’s discretion. Moreover, some factors must be considered before selling irrespective of the time chosen. All buying, selling and investment moves in general can be highly profitable when done after serious calculations. Although, this is not a guarantee that there will be no occasion of loss, it reduces it to the barest minimum. Investors should have flexible investment strategies as this will guide every transaction. Like any form of investment, one must be super enthusiastic about the coin before investing. This makes the responsibility of staying up to date easier. Our recommended best exchange to sell Decentraland in 2025 is eToro as they are regulated internationally and support withdrawals by bank wire, VISA, Skrill, Neteller and a range of other methods.

Decentraland coin can be sold on an exchange site. The exchange site should meet the basic requirements for a successful exchange.

To sell MANA, the trader has to create an account on an exchange site, fund it then carry out the exchange.

There are so many brokers that can be used to sell MANA. The best among them are: eToro, Libretex, Capital, Changelly, Binance, Coinbase, Avatrade, Plus 500, Cryptorocket, Revolut.

Taxes are not been charged for selling the coin at the moment. Though, there is a high tendency there would be taxes soon.

MANA can be sold for USD on an exchange site that supports the fiat currency. Some of these exchanges include: eToro, Revolut, Cryptorocket.

Decentraland coin is sold on many exchange platforms. Some of such exchanges are: eToro, Capital, Libretex, Binance.

Normally, the selling process on a site like eToro should only last a few minutes as it takes just five steps.

Getting a cash equivalent is simple once the exchange process is complete. The trader should signify the desired currency in the course of the exchange. It can then be withdrawn for cash afterwards.

MANA can not be exchanged for PayPal at the moment as it is not one of the supported cryptocurrencies. You'd need to sell it for Bitcoin first.

Selling from a wallet can be done by moving the funds in the external wallet to the account on the brokerage site. Afterwards, the process for trade execution should be followed.

A cryptocurrency equivalent will be deposited to the trader's account after an exchange so long as it is indicated when executing the transaction. On this Page:

How To Sell MANA in June 2025

Step one – Funding Your Wallet

Step Two – Perfect Your Selling Strategy

Step Three – Total Value Estimation

Step Four – Trade Execution

Step Five – Withdrawal Requirements And Exchange Rate

Crypto Taxation In The US

Best Crypto Exchanges to Sell Decentraland

Storing MANA In The Best Wallet

When Is The Best Time To Sell MANA?

Decentraland Price

Guide to Automated Trading

How To Invest Responsibly In MANA

Should I Sell Decentraland in 2025?

Summary

FAQs

Where Do I Sell Decentrand Coins?

How Easy Is It To Sell MANA?

What Are The Best Brokers For Selling MANA?

What Are The Taxes For Selling Decentraland Coins?

Where Do I Sell MANA For USD?

What Exchanges Sell Decentraland Coins?

How To Quickly Sell MANA?

How To Sell Decentraland Coins For Cash?

How To Sell MANA For Paypal?

How To Sell MANA Coin From A Wallet

How To Sell Decentraland Coins For Other Cryptocurrencies?