Aave is the native and governance token of the AAVE protocol, a decentralized protocol that supports the lending and borrowing of tokens. Lending and borrowing were only peculiar to the legacy system until the emergence of decentralized finance, which seems to be phasing out the former owing to its numerous benefits. Aave protocol was founded by Stani Kulechov, a blockchain enthusiast in 2017 but was known as EthLend at the time. ETHLend was different in the sense that it only matched borrowers and lenders together via a peer-to-peer system and used LEND as the native token.

In 2018, a name change would later occur for the protocol with ETHLend becoming a subsidiary of Aave, meaning ‘ghost’ in Finnish. The Aave protocol runs on the Ethereum blockchain such that even its native token, AAVE, is compliant with ERC20, the standard for token creation on the blockchain.

Aave protocol contains numerous pools from which users can borrow several tokens such as stablecoin DAI, ETH, Basic Attention Token (BAT), MANA, etc. However, before borrowing they have to deposit collateral either in the form of stablecoin DAI or any other cryptocurrency including ETH and AAVE. Using AAVE as collateral entitles borrowers to discounted fees. Lenders on the protocol earn interest on the tokens they deposited such that they are issued with a pegged token having the same value as their deposited tokens.

Due to the relevance of the Aave protocol in decentralized finance (DeFi), AAVE token has become a major attraction for investors just like the native tokens of other DeFi protocols such as Uniswap (UNI), Compound (COMP) and many more. Besides, AAVE is a deflationary token that reduces in supply as 80% of the fees generated on the protocol are burnt and taken out of circulation forever while the remaining 20% is shared as interest among lenders on the protocol. As such, as supply decreases and there is constant demand, this is bound to have a positive effect on the price of AAVE, which has crossed $400.

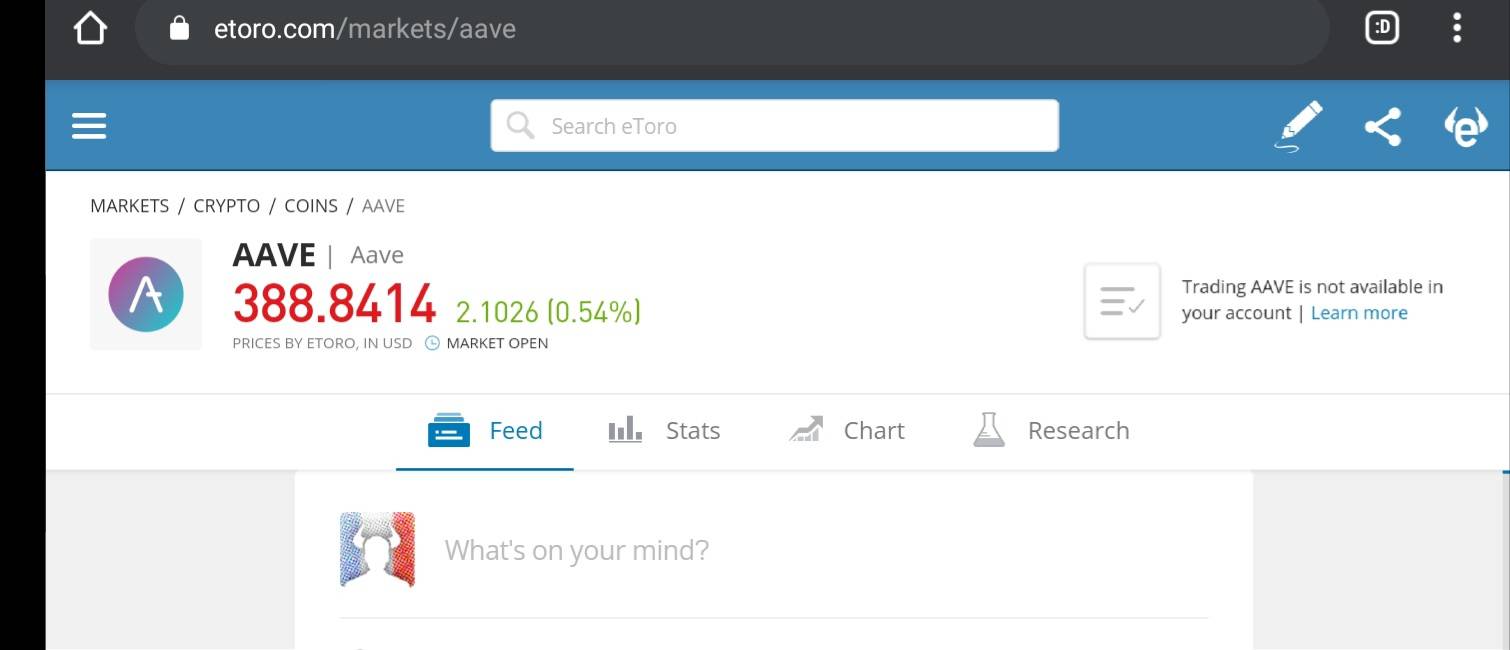

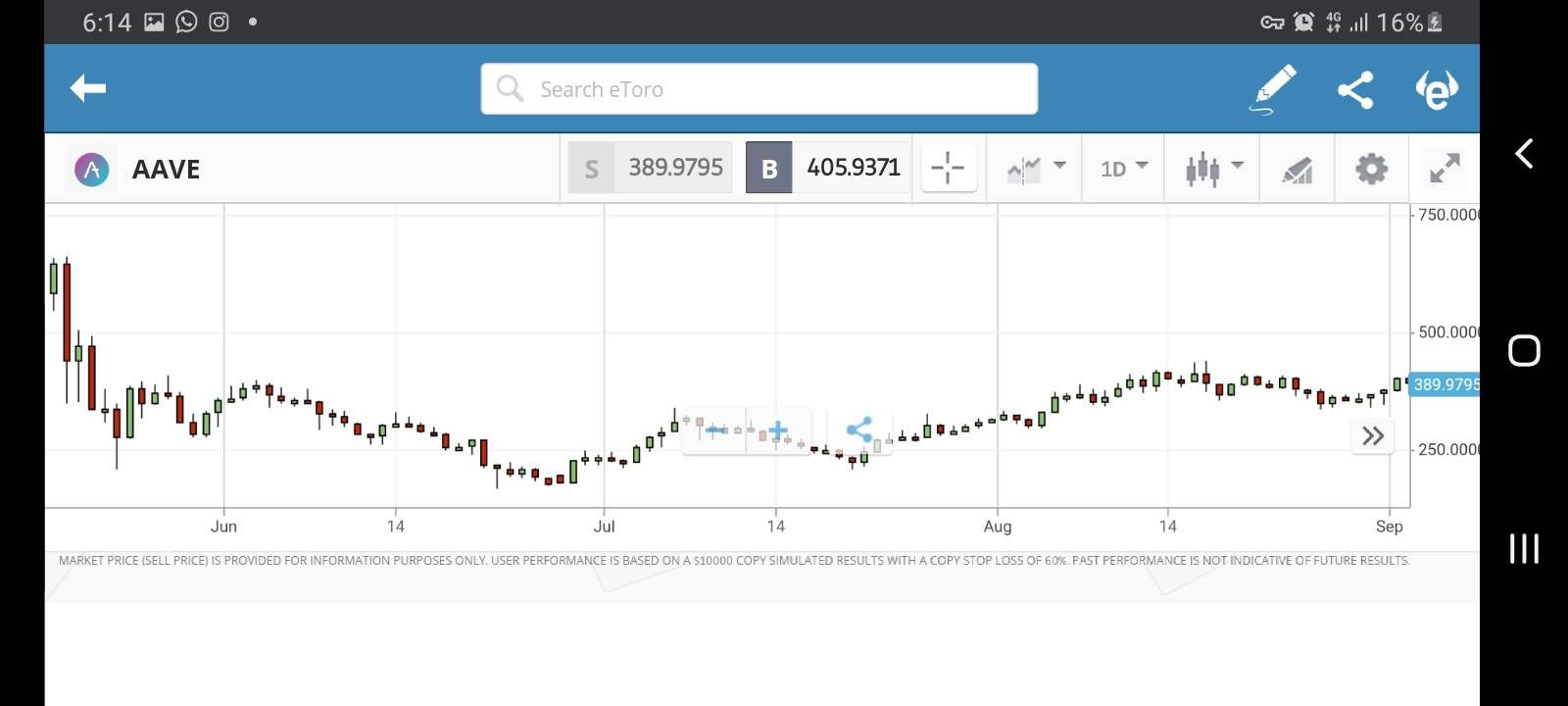

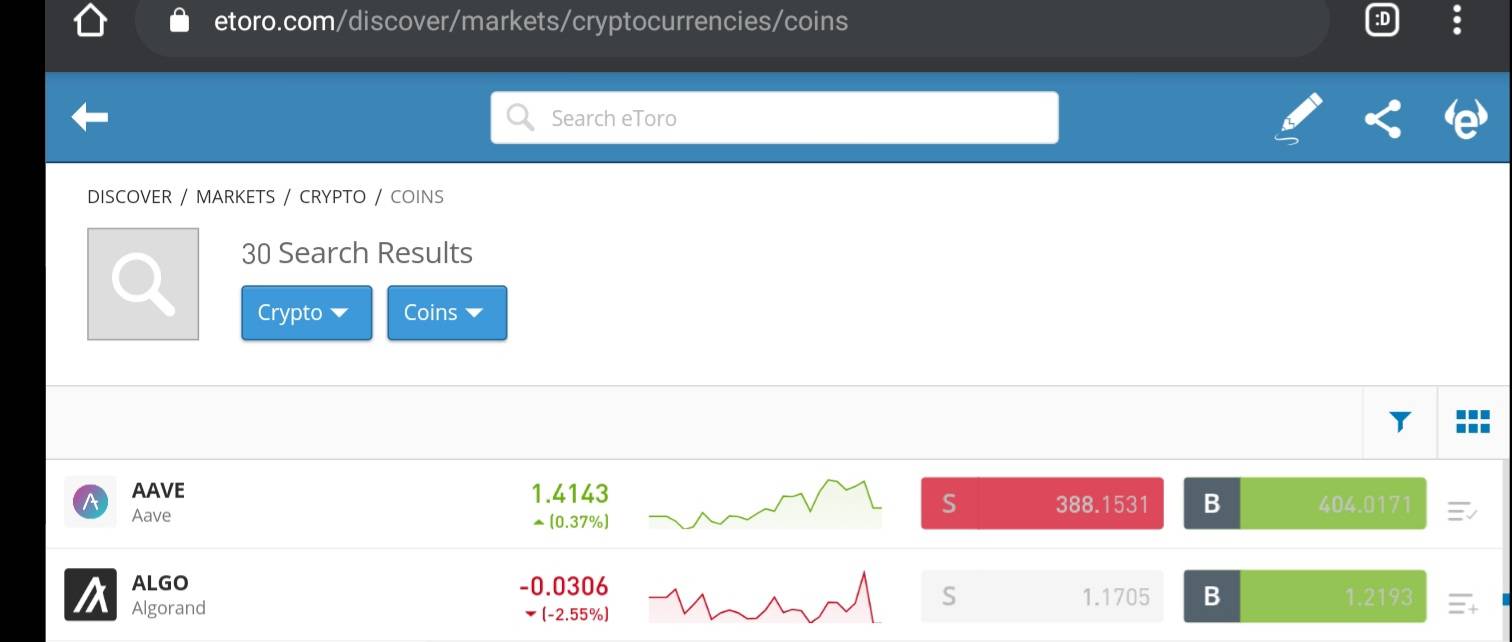

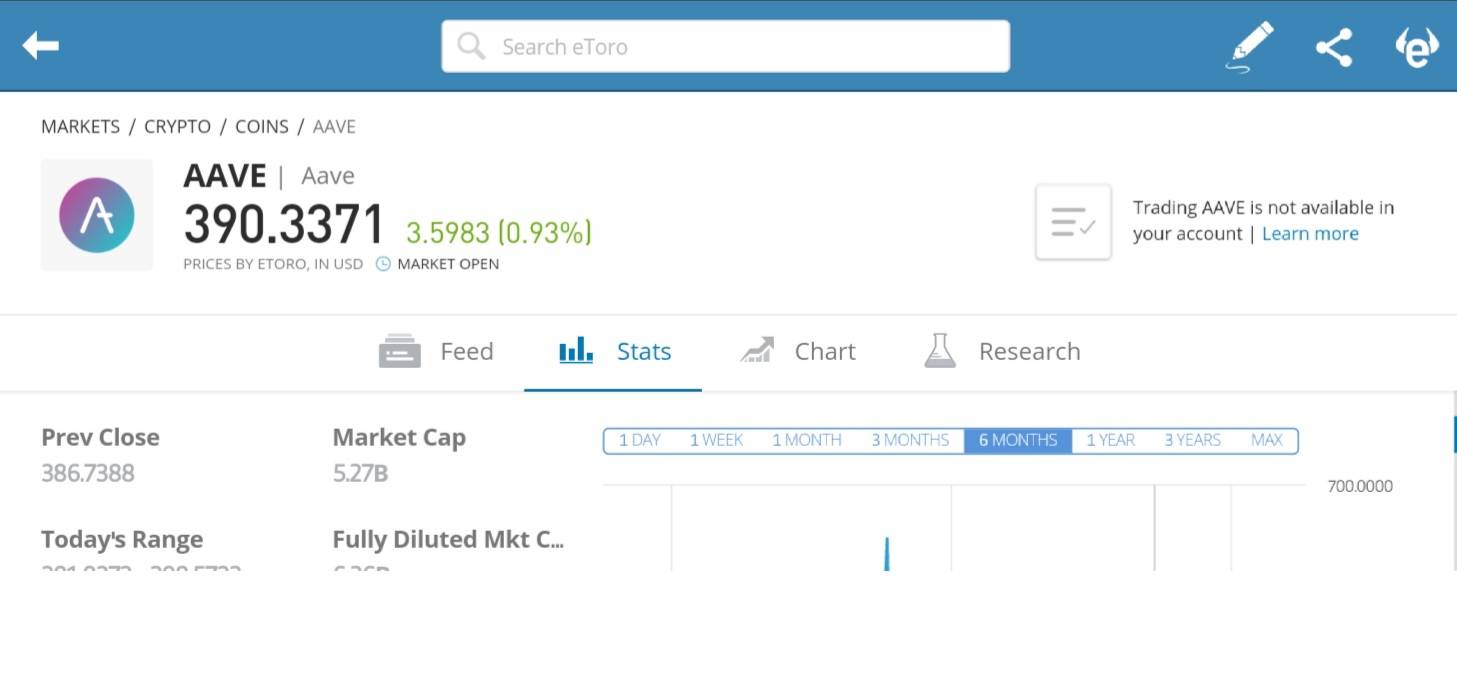

In light of the above, investors see AAVE as a token to buy and hold. Buying cryptocurrencies including AAVE is possible as there are several brokers available that have listed AAVE on their platforms. Intending to profit from a price increase, investors sell AAVE after a while. However, new investors are sometimes normally at loss on how to buy AAVE, much less sell it. In this guide, you’ll be learning how to sell AAVE. Selling AAVE tokens cannot be done without the help of a broker. Although AAVE can be sold in a peer-to-peer transaction, most investors prefer selling AAVE through a broker, otherwise known as an exchange. You can perform other transactions on an exchange apart from selling or buying cryptocurrencies. As regards selling, we have identified some exchanges in this guide where you can trade your AAVE tokens with assurance. Also, note that these exchanges have been properly vetted by industry experts and are likewise considered by experienced investors and traders as reliable. These brokers offer a wide range of services. They allow their users to exchange their AAVE tokens for USDT or any other crypto or fiat pair available on their platforms. Preferably, most traders enjoy trading their AAVE tokens for Tether (USDT) due to the low or zero volatility on the price of the stablecoin. The aforementioned brokers are some of the leading crypto brokers globally. Apart from complying with existing regulations in countries where they have markets, they also parade a plethora of features, some of which are distinct and are geared toward making trading enjoyable for their users. While trying to choose a broker, there are certain requirements to look out for, the absence of which may be a red flag. On their part, brokers or exchanges try to live up to the expectations of their users, firstly by providing an easy-to-understand trading interface. Still, traders have their preferences when it comes to trading with a broker or on an exchange. Some of these preferences include- numerous trading pairs, security, reliable customer support. We have selected these exchanges because of their reputation among other exchanges. Notably, there is high liquidity for the AAVE token on their platforms. Liquidity is of high significance to traders because, without it, traders cannot easily trade the AAVE token. Aside from just buying and selling AAVE, traders also engage in futures trading due to the massive trading volume on these exchanges. Selling AAVE is just as easy as buying it. AAVE is in high demand because of its DeFi protocol. In 2020, the DeFi sector gained traction and has gone ahead to pool a massive total value locked (TVL) of over $80 billion in 2021. The lending protocol has contributed to the immense growth of the DeFi industry as traders look forward to borrowing other tokens to conduct transactions. Being a decentralized protocol is what has made Aave garner the interest of traders. In the mainstream sector, interest rates are usually high and the hassles that come with a centralized system can sometimes be a turn-off while obtaining a low. According to the protocol’s founder, he thought of a better way to address the challenges of loans in the legacy system. Hence, why he came up with the protocol. On Aave, there is also a provision for what is known as flash loans. This gives traders access to loans without depositing any sort of collateral. However, whatever transaction the trader is using such a loan to perform must be completed within a short while, which is usually 10 seconds because transactions on the Ethereum blockchain are added to the block within that period. Otherwise, the transaction will be cancelled and be revered as if no loan was ever borrowed. For selling AAVE, we will look at a leading cryptocurrency broker, eToro. eToro has featured in all of our buy and sell cryptocurrency guides. The eToro platform boasts millions of users and offers a wide range of cryptocurrencies and their trading pairs. The cryptocurrency exchange is US-based and has limited jurisdiction. Thus, if you are in Africa or in some parts of the Middle East, you cannot access the platform. eToro has a simple trading interface that ensures that traders do not find it difficult to sell AAVE and other cryptocurrencies. Even if you are a newbie, you can navigate your way around the platform to sell your AAVE assets. Below are five steps you are required to follow in case you prefer to sell your AAVE on eToro. If the following steps are duly followed, you can sell AAVE on the platform. As you cannot sell AAVE without owning or having it in your possession. Buying the DeFi token is the first step you have to follow before selling can happen. eToro allows users to buy AAVE or you can buy from another broker, then send it to eToro to sell. Update 2025 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum. eToro only allows verified users to purchase AAVE. Thus, after opening an account, you’ll need to go through a verification process. As soon as you’ve verified your account and the details you submitted, eToro permits you to deposit funds into your account. Several traders prefer to deposit stablecoin USDT. eToro has provided many channels through which you can transfer funds into your account on the platform. If you prefer, you can send fiat to your eToro account and this may be done through your credit/debit card, local bank account or via third party payments services like PayPal, Skrill or Neteller. When the funds have reflected in your account, then you can go ahead to buy AAVE directly in the fiat currency deposited or instead buy USDT and then buy AAVE. Alternatively, you can use the demo account on the platform. eToro assigns a demo account with $100,000 to every user so they can test the platform to see if it meets their expectations. AAVE overview and trading feed on eToro Everyone who buys a crypto asset does so to make profits. While it is necessary to know when and where to buy an asset, it is also necessary to know when to sell. No trader or investor buys cryptocurrencies with a preconceived thought of losing. Even investors who buy crypto assets to hold for the long term always know when they are in profits so they can sell. Cryptocurrencies are volatile assets such that their prices can fall unexpectedly. It is always advisable to have a sell target. Without this, you are more likely to lose your money in the negative direction of the market. For this, eToro, in a bid to help traders make wise trading decisions, provided trading charts for every crypto asset including AAVE. These charts consist of candlesticks and patterns that help you study both the past and present price movements on different timeframes. You can also study these charts to know when to make a buying decision on AAVE or other cryptocurrencies. Clicking on AAVE on the interface for cryptocurrencies takes you to where you can buy or sell AAVE. AAVE Chart on eToro Besides AAVE, there may be other assets you are holding in your portfolio because eToro offers several crypto assets and their trading pairs. In this guide, we are focusing on the asset, AAVE. Thus, knowing the total value of your portfolio will help you determine if the amount of AAVE you wish to sell is up to the required amount. eToro has a minimum withdrawable amount which is $30. So you should have at least that amount of AAVE before you can sell. eToro Overview To know the value of AAVE in your portfolio, click the top left corner of your dashboard. After clicking on the icon, you get to see all your crypto holdings and their value. There you can click on any other asset apart from AAVE that you wish to sell. Note that you must have the required withdrawable amount before you can sell the asset. While trading on eToro, you may have an open position on the AAVE token. Otherwise, you may not be able to sell unless there is a significant amount of the token in your wallet that is not part of the open position. Leaving your tokens without going ahead to sell, you could lose whatever gains you have made on the crypto asset. After converting your tokens to fiat or stablecoin, the equivalent balance reflects in your portfolio. Sometimes, it could be less due to what is referred to as ‘Slippage.’ Slippage occurs when an asset settles for a price different from the initial price target. This could either occur positively or negatively. Closing Trade on eToro If you want to close an active position on AAVE via your eToro account, you click on the portfolio icon where you are shown all the assets you hold. There, you can click on AAVE and then you are taken to the trade section. In this section, you can choose if you want to sell all your AAVE (AAVE) or just a portion of it. On the other hand, you can use the search icon to look for an AAVE pair of your choice and you’ll still find yourself at the trade section. The equivalent value from the conversion becomes withdrawable. You can withdraw the balance to your local bank account or credit card. Withdrawing funds on eToro is a simple process, as long as you’ve fulfilled verification requirements. There are instances when withdrawal challenges could arise, but it is not likely to happen if you already have an idea of what to do. It could either be that a user is operating an account from a country that the platform is not open to. Other instances include incomplete verification, errors while initiating withdrawals or missing withdrawal channels. eToro is dedicated to making withdrawals on its platform as easy as it can get. eToro makes sure that every cryptocurrency listed on its platform can be liquidated. At any time, you can convert your AAVE to fiat. While some other exchanges peg their minimum withdrawable amount at a higher limit, eToro brought the threshold low. The minimum limit for AAVE withdrawals is $30 worth of AAVE with a percentage fee of 0.5. eToro’s min withdrawal fee is $1 while the max is $50. This goes to show that eToro is user-friendly not only in terms of user interface but also in fees for every operation executed on the exchange. There are currently no taxes for cryptocurrencies in the US. However, the proposed infrastructure bill is set to introduce taxes for capital gains within the country, with varying tax percentages on short and long term gains. As regards the taxes on short and long term gains, short term means gains made on taxes within the space of a year, while long term represents gains made for more than a year. These taxes extend to a bunch of crypto-related activities including airdrops, DeFi yields, mining and transaction fees. Due to the evasive nature of cryptocurrencies, enforcing tax obligations on their owners might be a difficult thing to pull off. US authorities have continually expressed concerns over cryptocurrencies being used for illegal activities. Thus, they are looking to enact regulations that will encapsulate and safeguard against such acts. The infrastructure bill will serve as one. There are more than 100 exchanges around the globe with varying jurisdictions. Some offer global services with few exceptions while others may be native to a country or region. Usually, crypto exchanges are meant to make cryptocurrencies accessible to investors and crypto enthusiasts. Despite being bound by one aim, you may find different services on these platforms. This means that apart from buying and selling crypto, you can enjoy other benefits like staking, lending or even automated trading depending on your need. Amongst all crypto exchanges, some have been able to stand out and resonate with millions of people around the globe. There are certain benchmarks used to identify the best crypto exchanges. These benchmarks include security, friendly UI, efficient customer support, a guide on how to use the exchange, and a growing community. Only a few exchanges have been able to meet these benchmarks to offer the best to their users. Below, we have a list of reputable and reliable crypto exchanges: Since AAVE is a digital asset, it requires proper and secure storage. Cryptocurrencies like AAVE are stored in digital wallets. Crypto holders have different ways of storing their digital assets. Some store theirs in digital wallets while others transfer the assets to hardware wallets, also known as cold wallets. Each of these wallet types has its pros and cons. Based on your preferences, you can decide to store your AAVE in any wallet of your choice as long as you will take precautionary measures to protect your assets. Here, in another guide, we have compiled some of the best crypto wallets you can store your AAVE tokens in. Investors normally adopt different methods when investing. Some take the short-term path where they only have to wait within the range of a day to a week before deciding to sell. Others could buy AAVE and keep it for a medium-term, meaning in some weeks or months, they’ll come back to check if they have made any profits on their investments. A long-term investment strategy means holding for years before selling off. In essence, you only sell if the price of the token has hit your target. As an investor, you can also take advantage of the market opinions of industry experts. However, don’t rely solely on it or follow these opinions blindly, without doing diligent research. These experts are humans and they are fallible as well. You can access the updates released by professionals on eToro, too. AAVE’s price has done well over the past few months, more so this year when DeFi became a big thing. Given that the market is volatile, the price of the asset is not stable. Where the market fluctuates, it means that prices will go up at certain times, then experience a downtrend following a bearish report or when investors start selling off. The price movements are normally noticed on the chart via candlesticks and other patterns created. Because of the utility of the AAVE token, it is bound to perform well. Being a native token to the protocol puts it in a great position among DeFi tokens. As long as decentralized finance continues to appeal to investors, there are great prospects for all DeFi tokens including AAVE. As of 2020, the token was trading at $100. Now AAVE has gone beyond $400 registering almost a 1000% increase in its price last year. AAVE has a circulating supply of 13.15 million and an overall supply cap of 16 million. Its supply is bound to reduce due to the burning of fees on its lending protocol. Automated trading was created to assist traders who hardly have the time to monitor their trades. A lack of attention could lead to huge losses. As part of trading rules, a trader is meant to be in the right frame of mind to maximize opportunities in the market. This is why apart from risk management, a trader is supposed to have strong trading psychology as well as emotional stability. Trading bots automate the trading process such that traders can have time for other engagements. Trading bots utilize algorithms to trade cryptocurrencies. Nonetheless, they require a bit of human involvement to function effectively. They cannot function on their own, a trader has to activate a trading range based on his strategy, which these bots rely on. One reason trading bots are important is that they are designed to respond to opportunities in the market faster than humans. The main reason for the creation of automated trading is to ensure that little price surges are capitalized on. Sometimes, there are opportunities that traders may be blind to due to their busy schedules. With the help of trading bots, every market activity is observed and this assists trading in making more profits than they would have made if they were trading themselves. The disadvantage of trading bots is that when the market is going the wrong way and the trader is not there to observe, it could result in massive losses. As such, trading bots are not 100% reliable. Automated trading is also known as Robo Trading. Bot programs can involve risk – those interested should only deposit a small amount at first to test them out and avoid bots we’ve blacklisted on our trading robot page. These are some bots we’ve reviewed: Lately, everyone is interested in investing in cryptocurrencies because of their benefits. The thing is crypto is not something to jump into without first learning the ropes. It is beyond having the capital to invest. The volatile market should be a red flag to a new investor. There are a whole lot of other qualities a crypto investor is expected to possess. Patience, risk management, strong trading psychology, emotional stability, technical and fundamental analysis expertise all combine to make an expert trader before capital. One must understand that the market is not controlled by anybody. Hence, it must be skillfully manoeuvred. Greed is a major challenge most traders battle with. Once a trader can overcome the lure to be greedy, he is one step closer to becoming an expert. There are times when the market is very volatile and highly unpredictable- a trader should learn to avoid the market during those periods. Also, as a trader, never revenge trade. This means trying to recover from loss after suffering one. While trying to revenge-trade, it could lead to more losses. The best thing to do at such a point is to sit back and restrategize and head back to the market not with a mindset to recover from that loss. Note: As a trader, you must never trade the crypto market without a tested and proven strategy. AAVE (AAVE) has prospects, owing to its utility in decentralized finance. Thus, it is a crypto asset to watch out for. Its price is likely to get to $1000 before the year ends. Here are some key things to note before selling your AAVE: AAVE (AAVE) is undoubtedly one of the top cryptocurrencies with a market capitalization of $5.28 billion. It is a digital asset, so it can be bought, stored and sold without hassles. AAVE can be found on most exchanges including on the platforms of the brokers listed above. To sell AAVE on eToro and other brokers’ platforms, you need to close positions. You can trade the asset against USDT or the fiat currency of your residing country and then withdraw to your local bank account. AAVE can be stored in a wallet, whether hardware or software. It is safe to the extent of the owner’s diligence and security consciousness. If you have the intention of trading cryptocurrency, you should do so from an informed standpoint and not based on mere speculations. As they say, invest what you can afford to lose. This guide can suffice as a handbook you can revert to whenever you want to make investments in AAVE. Our recommended best exchange to sell Aave in 2025 is eToro as they are regulated internationally and support withdrawals by bank wire, VISA, Skrill, Neteller and a range of other methods.

In this guide, we recommend selling AAVE via an exchange as you are guaranteed the safety of the transaction. There are other means through which you can sell. P2P is an alternative, but this is somewhat risky.

When you use a broker like eToro, selling your AAVE can be concluded in minutes after a few clicks. The exchange features withdrawal options as well.

Several brokers can be used to sell AAVE. However, the following are considered the best by expert traders that have explored other options. They are eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly.

There are different regulations on crypto globally. So if you are willing to know if selling AAVE incurs any tax, you may have to resort to the financial regulations in your country.

To sell your AAVE for USD, you need an exchange that permits payment to your local bank or third-party payment service. Some of the best choices are eToro, Coinbase, AvaTrade, and Binance.

Some of the exchanges where AAVE can be sold include eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly.

To quickly sell your AAVE, you need an account with eToro or any other exchange listed above. Setting up your account doesn't take a lot of time. If you have your AAVE already, you can transfer them to the wallet on the exchange and sell them there instantly.

To sell AAVE for fiat, you should integrate a withdrawal channel on eToro or any other exchange. Ensure that you've chosen your desired currency. When you withdraw, the exchange helps you convert the funds to cash and pays into the proper channel.

PayPal only supports four cryptocurrencies, which include Bitcoin, Bitcoin Cash (BCH), Ethereum (ETH) and Litecoin (LTC). However, you can buy AAVE with any of the supported cryptocurrencies.

Some wallets help you sell your AAVE directly. To sell them on the wallets, you need to integrate a payment method and follow the necessary procedures to sell AAVE.

Often, you can swap your AAVE for other cryptocurrencies on brokers like eToro or Coinbase. Once you complete a swap, the actual value of AAVE sold reflects in your portfolio. On this Page:

Best Brokers to Sell Aave in 2025

How To Sell AAVE

Step 1: Buy AAVE

Step 2: Always Know When to Sell

Step 3: Know the Total Value of Your Portfolio

Step 4: Close All Active Positions

Step 5: Withdrawal Requirements and Exchange Rates

Crypto Taxation in the US

Best Crypto Exchanges

Storing AAVE in the Best Wallets

When is the Best Time to Sell my AAVE?

Price of AAVE

Guide to Automated Trading

How to Invest Responsibly in Crypto

Should I Sell AAVE in 2025?

Summary

FAQs

Where to Sell AAVE

How Easy it is to Sell AAVE

What are the Best Brokers for Selling AAVE?

What are the Taxes for Selling AAVE?

Where to Sell AAVE for USD?

What Exchanges Sell AAVE?

How to Quickly Sell AAVE

How to Sell AAVE for Cash

How to Sell AAVE on PayPal

How to Sell AAVE from Wallet

How to Sell AAVE for Other Cryptocurrencies