1inch (1INCH) is an Ethereum-based token that drives 1inch, a decentralized exchange that seeks to provide great prices. Users may trade tokens without going via an intermediary on decentralized exchanges like 1inch. To discover the cheapest pricing for customers, 1inch combines token values from decentralized exchanges.

Decentralized exchanges are cryptocurrency exchanges that are not governed by a third party. There are no one business custody assets, keeping order books, or calling the shots on a decentralized exchange. A decentralized exchange allows everyone to trade. Traders merely need to link their wallets. There is no need for people to allow firms access to their money or personal information.

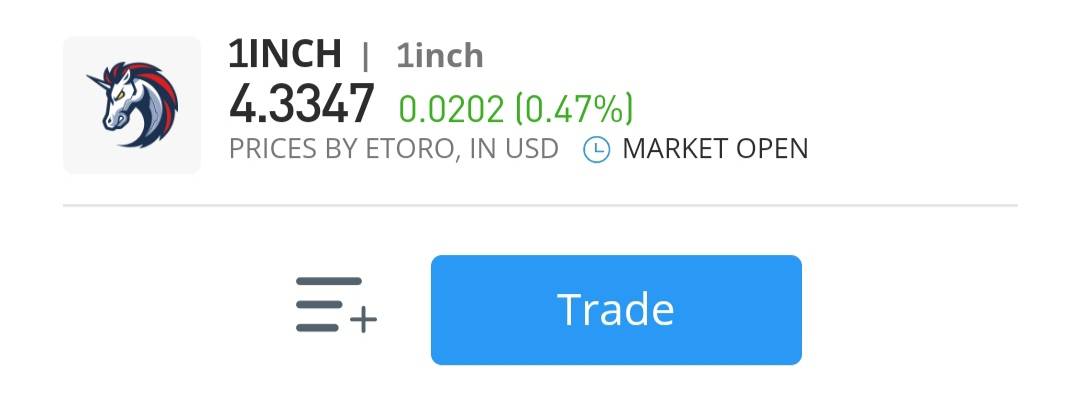

There are a handful of these exchanges, but they all offer cryptocurrencies at somewhat different prices, even though they are all very young and organized differently. Ethereum may trade for a different price on one exchange than it does on another, not to mention that each platform may levy different fees. However, there is a method for determining how to acquire the greatest price on a decentralized exchange, and it is known as 1inch. 1inch’s algorithm identifies the cheapest method to execute the deal by using all of the available exchanges and liquidity protocols. Before arriving at Wrapped Bitcoin, you could want to switch your Ethereum between multiple various protocols and for numerous different currencies to get the best deal. The benefit of doing so is that you may be able to get Wrapped Bitcoin at a lower price. 1inch released its cryptocurrency, the 1INCH token, on Christmas Day 2020. It’s also a governance token, which means you may vote on how the 1inch platform is run using it. In an airdrop near the end of 2020, 1inch issued a large number of tokens. If you provide money to 1inch’s liquidity protocol or if you utilize it before December 24, 2020, you may claim 1inch tokens. Providing liquidity to 1inch’s liquidity platform is the most common method to earn 1INCH tokens. This entails staking currency that may be used by others to make deals. Other cryptocurrencies may be earned in the same manner. The 1INCH token is traded on several major cryptocurrency exchanges as well as 1inch’s platform. Binance is the most popular exchange for trading 1INCH for Bitcoin, while the 1INCH exchange is the most popular exchange for exchanging Tether. To purchase 1INCH token on a cryptocurrency exchange like Binance, you must first fill your wallet with the coin that 1INCH is paired with, then utilize the proper trading pair page to swap it for 1INCH. Everything became cheaper and faster with the debut of 1inch’s V2 platform in late 2020, which included some more sophisticated deals to keep costs low, such as rerouting money allocated as collateral for loans on decentralized lending protocols. It was followed by the introduction of 1inch’s v3 aggregation protocol in March 2021, which cut gas expenses by 30%. The Limit Order Protocol was introduced in June 2021, replacing the app’s prior limit order feature with an in-house solution that decreased gas prices and execution delays while eliminating protocol fees. 1inch’s destiny is inextricably linked to the future of decentralized finance. In comparison to powerful centralized exchanges like Binance, decentralized exchanges are still sluggish, costly, and inconsequential. However, as centralized exchanges experience 1INCHeated outages during moments of crypto price volatility, demand for DEXs is increasing, and aggregators like 1inch are stepping in to fill the need. Some of the 1inch token supply is set aside for development, allowing the exchange to quickly implement new liquidity methods. There’s no reason to believe that the rate of development will reduce any time soon as long as the market doesn’t bottom out. As a result, in this article, we’ll look at why 1INCH is a must-have, as well as how to purchase and trade 1INCH on an exchange. Only with the aid of a broker can you sell 1INCH. Liquidity is provided by brokers or crypto exchanges for cryptocurrencies such as 1INCH. This article is designed to help you make the best broker decision possible. We’ve included a few brokers below that you may contact at any time if you need to sell your 1INCH. Note that these brokers have satisfied de facto industry-recognized criteria and are deemed reputable platforms for both newcomers and experienced investors. The brokers on the list above all operate in the same sector and enable thousands of investors to buy and sell crypto assets, as well as trade them for profit. They have marketplaces in a variety of locations across the globe. Furthermore, they comply with current restrictions in the countries where they operate, while also growing their services to allow customers in these nations to get more out of them. It’s critical to seek certain benchmarks before choosing a broker. When a broker fails to meet these criteria, his or her integrity is called into doubt. Premium customer service, a clear user interface, adherence to standards, several trading desks, security, and many more criteria are among them. The aforementioned exchanges are highly recommended by important players in the sector due to their ability to achieve the given criteria. These brokers also brag of additional fantastic benefits that they provide to their millions of consumers. Lending and borrowing, staking crypto assets, and allowing consumers to pay for services using their exchange accounts are just a few of the capabilities available. These brokers record billions of dollars in daily trading activity, implying that obtaining liquidity for the asset you’re holding, or 1INCH, is a breeze. Clients may sometimes participate in futures trading and have access to perks such as increased leverage. This list of brokers has become well-known among investors since they are dedicated to providing the finest crypto services to their customers. As a result, 1INCH’s faith and confidence in them indicate that you may always sell your 1INCH on their sites. It’s almost as easy to sell 1INCH as it is to buy it. In any event, whether you can trade the asset or any other crypto asset depends on whether it has liquidity. This decides whether or not the cryptocurrency asset is sold. Make sure there is a suitable withdrawal channel before trying to sell your 1INCH item. Although it is possible to sell 1INCH on the platforms of all of the brokers mentioned above, for this tutorial, we will concentrate on eToro, which is ranked top on our list. eToro has continually shown itself to be a reliable broker when it comes to buying or selling crypto assets. eToro is consistently ranked among the top ten cryptocurrency exchanges in the world. The eToro platform was created with both novice and experienced brokers in mind. Every element on the site is designed to make trading easier. As a result, novice investors will find it quite easy to use eToro to swap 1INCH or any other crypto asset without making any errors. The remainder of the post outlines five methods for selling 1INCH on eToro. Selling on the platform will be simple if these procedures are followed correctly. Because it’s ludicrous to expect to sell an asset that you don’t already own, buying 1INCH is the first step before any selling can take place. Clients of eToro may buy 1INCH, or you can buy it from another exchange. Then, after purchasing, you may sell it on eToro. Buy 1inch Only verified customers are allowed to purchase 1INCH on eToro. As a result, you’ll need to complete verification criteria after signing up. You may deposit money assets into your account after entering the essential data for verification. The great majority of cryptocurrency traders choose to fund their accounts using USDT. eToro offers a variety of ways for you to deposit funds into your account. Fiat may be sent to your eToro account by your local bank account, credit card, or third parties. Once the money supplied through any of the aforementioned methods has arrived in your eToro account, you may either buy 1INCH in a fiat currency of your choice or purchase USDT first and then 1INCH. The latter is preferred by most people since USDT is a stablecoin that is not susceptible to the same volatility as other cryptocurrencies. Depending on your choice, you may use one of the two methods. Investors buy a tradable asset with the intention of profiting. It’s crucial to know when to buy a crypto asset like 1INCH, but it’s also important to know when to sell. Even investors that buy crypto assets for the long term are aware of when they are profitable and may sell. If you know what you’re doing, you can prevent losing money on your investments. Furthermore, the value of digital assets might be volatile. As a result, you may be able to benefit from your investments today and in the next few days if the price of the asset you bought has fallen. Furthermore, no one has authority over the values of these assets. A selling aim for your 1INCH investment is appropriate. Failure to do so might mean disaster for your investments, resulting in a loss of money. To assist traders in making informed investment choices, eToro has incorporated charts for each crypto asset, including 1INCH. These graphs provide patterns that aid in the analysis of historical data for a variety of assets, including 1INCH. Similarly, you can use similar charts to figure out when it’s time to buy 1INCH or other cryptocurrencies. If you go to eToro and click on 1INCH, you’ll be sent to a page with further information about the asset, including the traded volume on the exchange. Aside from 1INCH, you may have other assets in your account since eToro provides a wide range of trading pairs and cryptocurrencies. As a result, knowing the total value of your portfolio will help you determine if the 1INCH you want to sell is worth the required amount. Because eToro has a minimum withdrawable amount of 1INCH, you must have that amount before selling. 1INCH chart To find out how much your portfolio is worth, go to the top left corner of the site and select ‘Portfolio.’ You’ll see all of your crypto assets and their values after pressing on the symbol. There, in addition to 1INCH, you may click on any other asset you want to sell. Before you sell the item, make sure you have the required amount of cash on hand. You’d have to close current positions to sell your 1INCH asset. Closing your active positions refers to selling the asset. Furthermore, you won’t be able to do so if the item is still in its original state. The highly volatile character of cryptocurrencies is a cause for caution. Leaving your 1INCH investment without selling it for your chosen currency—fiat or USDT—is a hazardous decision since you will almost certainly lose your money. Because of how unpredictable prices may be, if you don’t sell at your target price after it’s been reached or wait a bit thereafter, you can find that prices have retraced. You must act quickly to protect your revenues. Closing trade on eToro To close your open trades, you’ll need to exchange the 1INCH for other digital currencies. Following the closure of these investments, your portfolio will show the equivalent or less. Similarly, if you sell at a market price, the actual quantity of 1INCH sold may differ from the amount shown in USDT. When an asset settles at a price lower than the anticipated target price, this occurs. It may be seen from either a good or negative perspective. If you want to cancel an active position on 1INCH via your eToro account, you may do so by clicking on the portfolio symbol, which displays all of your assets. You may then choose 1INCH, which will take you to the trade section. You may choose the value of 1INCH you wish to sell in this section. Alternatively, you may use the search icon to find a 1INCH pair that you want. After you’ve found your favorite pair, click on it to be transported to the trading area, where you may sell. Your portfolio still indicates the quantity of 1INCH you sold. This money may also be withdrawn to a PayPal account, a local bank account, or a credit card associated with your account. Withdrawing assets from eToro is simple as long as all of the withdrawal requirements are met. On eToro, the withdrawal procedure has received largely good feedback. Withdrawals on the exchange are simple to understand, especially for newcomers. There are times when withdrawal symptoms may appear, although they are uncommon. It’s also possible that a customer is using an account from a nation that’s been banned. Errors while starting withdrawals, inadequate verification, and failure to activate withdrawal channels are only a few examples. eToro is focusing on making withdrawals as simple as possible on its platform. As a result, you as a user may easily sell your 1INCH without any hassles. eToro guarantees that any crypto asset held on its platform may be traded. Whenever you can convert your 1INCH to fiat currency. While other exchanges maintain a greater base withdrawable amount, eToro has lowered the threshold without sacrificing the quality of its services. This displays eToro’s thoughtfulness when it comes to withdrawal costs. Because cryptocurrency is decentralized, imposing tax duties on its owners may be difficult. The use of cryptocurrency for criminal purposes has long been a source of worry for US officials. As a result, they are attempting to develop legislation that would include and protect against such activities. Around the world, there are various controlled and decentralized exchanges. Crypto exchanges are often used to make cryptocurrencies available to investors and enthusiasts. They also offer platforms for crypto traders to trade such asset types. Despite having a single goal, these platforms may provide a variety of services. This implies that, in addition to buying and selling cryptocurrency, these exchanges may provide other services. As a result, your requirements will determine which exchange is best for you. Some crypto exchanges have managed to stand out and connect with thousands of individuals throughout the world, even though there are many. This is not because the services they provide are unique, but rather because they go above and beyond to ensure their consumers’ satisfaction. The finest crypto exchanges are distinguished by a set of distinct features. Security, a user-friendly interface, prompt customer service, a tutorial on how to use the exchange, and a developing community are among these criteria. In light of the above, several exchanges have been able to pass these characteristics on to their users to provide the best service possible. Other exchanges have fallen short of these benchmarks, with fewer signups and lower daily trading volume than the former. A few exchanges enable their consumers to employ copy trading or trading bots services, providing premium services to its users. Traders who aren’t cut out for manual trading might duplicate deals from other experts or use bot trading to automate the process. Digital wallets are where 1INCH and other cryptocurrencies are kept. Cryptocurrency investors and holders may store their digital assets in a variety of ways. Some people keep their money in hot and software wallets, while others put it in hardware wallets, also known as cold wallets. They may also leave their tokens on the market after they buy them. This is not recommended, since the tokens might be stolen. On centralized exchanges, investors’ crypto assets have been hacked and stolen on multiple occasions in the past. This isn’t to say that decentralized exchanges aren’t risky. Regardless, you may keep your 1INCH in whatever wallet you like as long as you take the required precautions to safeguard your assets. You must also be prepared to suffer the consequences if anything goes wrong. We’ve listed some of the finest crypto wallets for storing your 1INCH holdings in another article. If you’re going to invest and sit back, you’ll have to keep an eye on the price of 1INCH, particularly if you don’t have a target price in mind. It might be difficult to keep track of an asset’s price since you need to be aware of what’s going on in the crypto market to decide whether to sell or retain your 1INCH holdings. Essentially, the investment plan you choose determines your ability to sell your 1INCH holdings. If you choose a short-term plan, you must wait until the proper moment comes to exchange your 1INCH. As a result, there is no one-size-fits-all approach to selling. When your investing plan says so, it’s the proper moment. Given the volatile nature of the crypto market, a lot may happen in the time between when your investment reaches the objective you set. A piece of unfavorable news might have an impact on any open positions or holdings you have. This is why anytime you wish to invest, you should always do research. Even when the transaction is heading in the wrong direction, the analysis keeps you in check. You may have to wait longer than required to strike your target. The price of 1INCH has fluctuated a lot. The price fluctuates due to the unpredictability of the market. When the market shifts, it means that prices will rise in some instances, then fall at some moment after a negative 1INCHort or when investors start selling. The price changes of 1INCH may be seen on the charts using candlesticks and recognized patterns. You must close positions to sell 1INCH on eToro and other brokers’ platforms. You may exchange the asset for USDT or your home country’s fiat money, then withdraw to your local bank account. 1INCH, whether hardware or software, may be kept in a wallet. If you want to acquire a cryptocurrency, you should do it after doing your research and not because the asset seems to be lucrative. Invest just what you can afford to lose, as the saying goes. The crypto market is very volatile, and it cannot be traded based on hope or conjecture. This article may serve as a reference guide for you to refer to anytime you wish to invest in 1INCH. When you’ve made a profit, you may sell your 1INCH tokens. Before selling your 1INCH, keep the following points in mind. Remember to hold where you haven’t met your goal yet. When it comes to investing in cryptocurrency, patience is essential.On this Page:

Tutorial on How to Sell 1INCH

Step 1: Buy 1INCH

Step 2: Recognize when it’s time to sell

Overview on eToro

Step 3: Determine Your Portfolio’s Total Value

Step 4: Closing All Active Positions

Step 5: Exchange Rates And Withdrawal Requirements

Cryptocurrency Taxation In The United States

Best Crypto Exchanges

The Best Wallets For Storing 1INCH

When Should I sell My 1INCH?

1INCH Prices

Summary

Should I sell 1INCH?