Join Our Telegram channel to stay up to date on breaking news coverage

Altcoins are showing patterns reminiscent of the explosive Q1 2021 rally, sparking speculation of a potential breakout. Despite facing significant losses in recent downturns, historical market cycles and key technical indicators suggest a strong recovery could be on the horizon.

Currently, the Altcoin Season Index, a key indicator tracking whether the market favors altcoins than Bitcoin, is at 26, well below the 75-point mark needed to confirm an “altcoin season.” This suggests Bitcoin remains the dominant force, though a shift could emerge if its momentum steadies or pulls back.

Interestingly, while the broader altcoin market lags, tokens in other asset classes — particularly cost-effective cryptocurrencies — have begun to rally. As investors seek high-potential opportunities, many are paying attention to the best cheap cryptos to buy now under 1 dollar, hoping to capture significant upside in the evolving market landscape.

5 Best Cheap Cryptos to Buy Now Under 1 Dollar

SEI, a modular layer-1 blockchain token, has recently shown encouraging signs of recovery following a prolonged period of decline. Meanwhile, the Curve DAO Token (CRV) holds the #98 spot in the market rankings. IOTA currently maintains a market capitalization of roughly $756.97 million.

Algorand has demonstrated its impressive scalability, processing 34,008 transactions within a single block in under three seconds. Additionally, Solaxy, a layer-2 solution built on the Solana blockchain, successfully raised $23 million through its initial coin offering (ICO), drawing strong interest from investors. In traditional finance, the Bank of America CEO has hinted at the possibility of launching a stablecoin.

1. Sei (SEI)

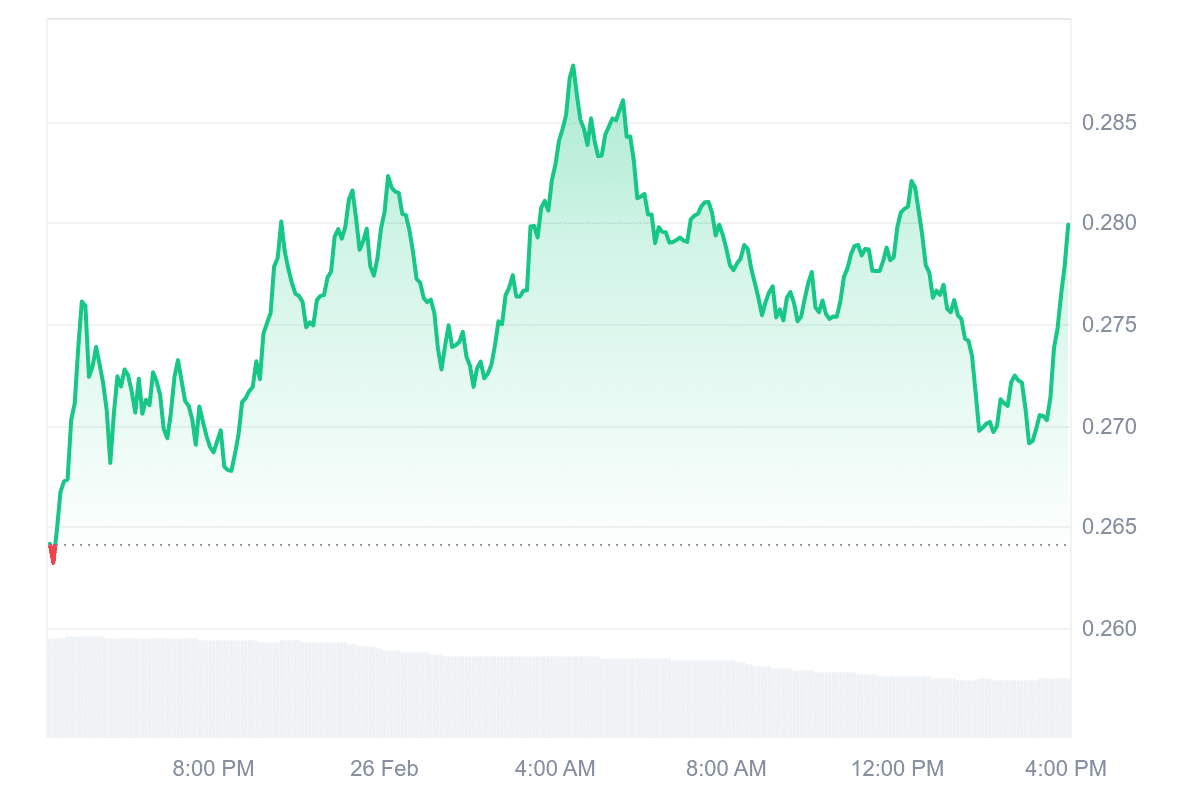

SEI, the layer-1 modular blockchain token, has recently shown signs of recovery after a prolonged downtrend. Over the past week, its price has surged by 20%, indicating renewed buying interest. Currently trading around $0.27, SEI remains significantly below its all-time high, but technical indicators suggest potential for further gains.

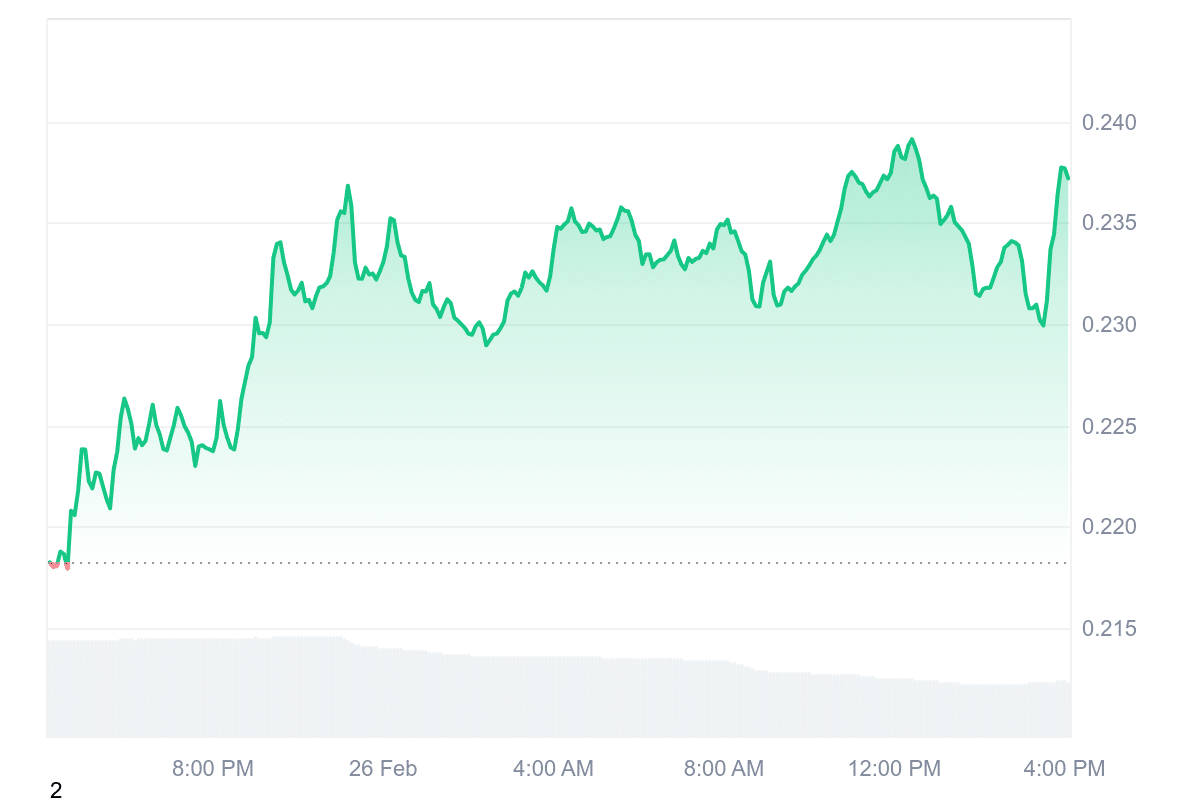

Since peaking at $0.70 in December, SEI has experienced a series of lower highs and lower lows, reaching a bottom of $0.22 earlier this month. This price movement formed a falling wedge pattern, a bullish signal suggesting an upward breakout. SEI’s recent price surge confirms this breakout, indicating a potential shift in trend.

The Relative Strength Index (RSI) has moved above the 50 neutral mark, reflecting a shift in momentum from bearish to bullish. The Moving Average Convergence Divergence (MACD) has also entered the positive zone, reinforcing the growing buying pressure.

All gas, no brakes.

New deployments, fresh integrations, and community events marked another massive week across the Sei ecosystem.

Here's what went down 👇

🔴 State of Sei – First-ever ecosystem leadership livestream covers vision, growth, and next steps – Catch the replay.… pic.twitter.com/aSLgJGn3rx

— Sei 🔴💨 (@SeiNetwork) February 21, 2025

SEI has broken above the 20-day Exponential Moving Average (EMA), a significant trend indicator. If the price is sustained above this level, the next resistance is around the 50-day EMA, which aligns with the 0.786 Fibonacci level at nearly $0.31. A successful breakout at this level could push SEI towards $0.40, with further upside potential reaching $0.53 if demand grows.

2. Curve DAO Token (CRV)

Curve is a decentralized finance (DeFi) ecosystem offering several key products. The Curve DEX is a decentralized exchange designed for stablecoins and pegged assets, using an automated market maker (AMM) model to optimize liquidity. The crvUSD decentralized stablecoin issuance app allows users to borrow stablecoins against secure assets such as ETH and BTC while incorporating collateral liquidation protection.

Curve Lend provides an isolated borrowing platform where users can take loans in crvUSD or lend the stablecoin for interest, utilizing the LLAMMA Lend engine. Additionally, savings crvUSD functions as a decentralized stablecoin with an embedded yield mechanism.

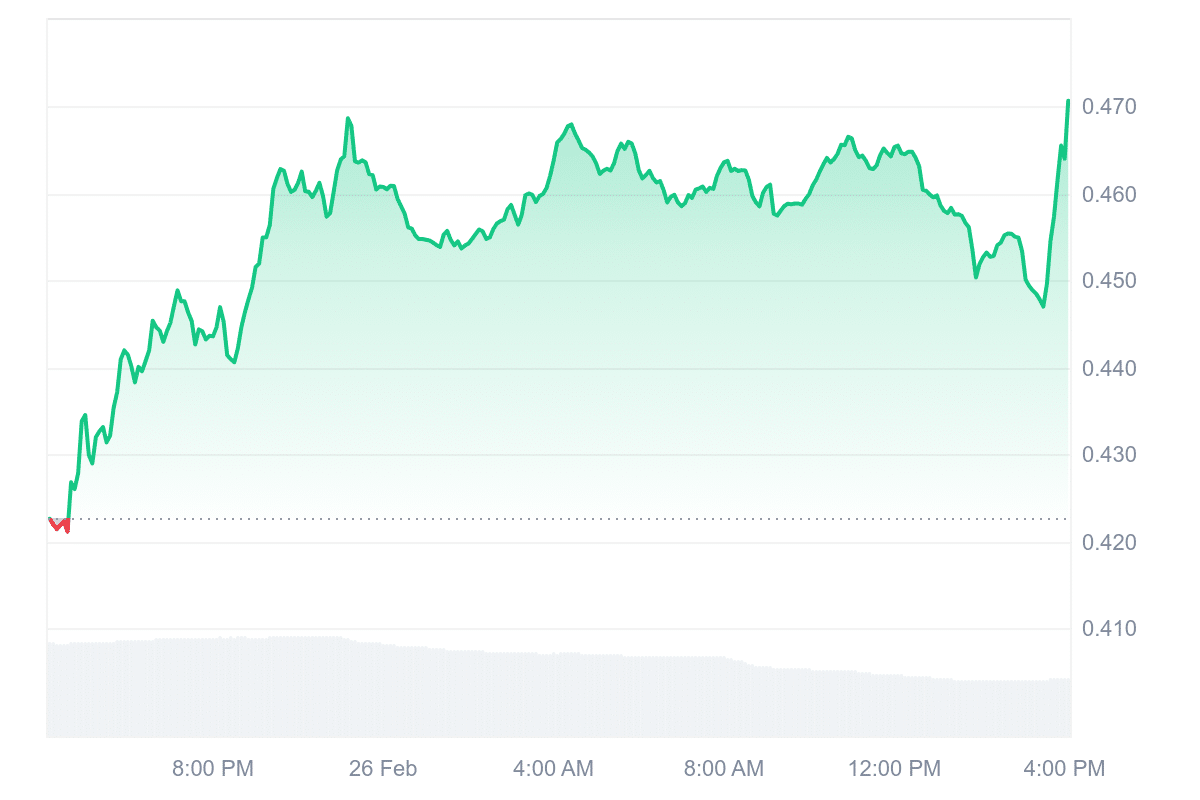

The Curve DAO Token (CRV) is ranked #98, with a total market capitalization of approximately $606.32 million. Currently priced at $0.4707, CRV has increased 11.46% in the past day, indicating strong liquidity relative to its market cap.

Market projections for February 2025 estimate a potential 3.25% growth, setting an average price of around $0.4809. The price is expected to fluctuate between $0.4531 and $0.5091, suggesting a possible return on investment (ROI) of 9.31% based on the current price. If these predictions hold, CRV may present an opportunity for investors looking for moderate gains in the short term.

3. IOTA (IOTA)

IOTA continues to enhance its decentralization efforts with new validators joining the IOTA Rebased test network. These additions strengthen security, scalability, and decentralization, reinforcing the network’s long-term stability. One notable validator is BlackNodesHQ, an India-based staking provider supporting over 60 blockchain networks. By diversifying node locations and resources, BlackNodesHQ increases redundancy, reducing risks associated with centralization and enhancing network resilience.

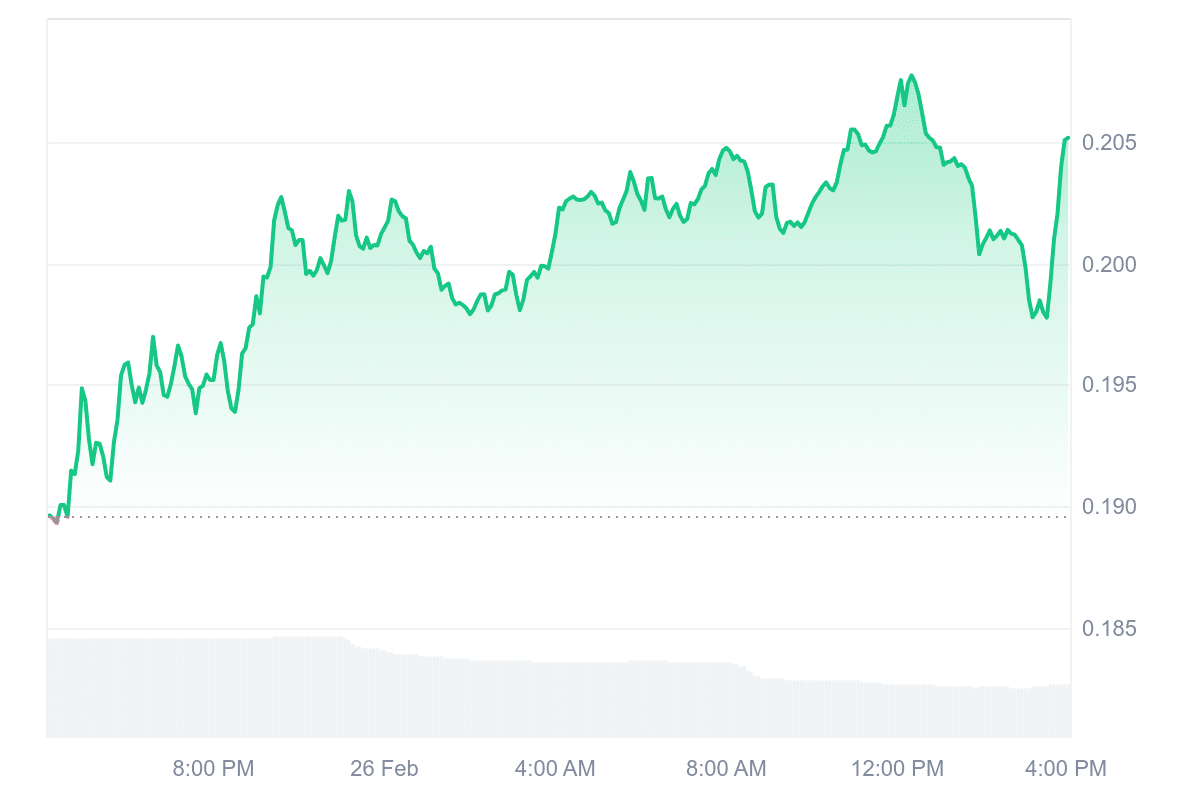

With a market ranking of #85, IOTA currently holds a market capitalization of approximately $756.97 million. The token is priced at $0.2073, reflecting a 9.44% increase over the past day. Additionally, IOTA is trading 7.63% above its 200-day simple moving average (SMA) of $0.1918, indicating strong momentum. This trend, combined with its high liquidity, suggests sustained investor confidence.

🌍 Decentralization in action.

New validators join the #IOTA Rebased test network! From institutional staking to cutting-edge blockchain services, they enhance security, decentralization & scalability

📖https://t.co/uz4nddUOKg🔽 Meet the new additions! 🔽 pic.twitter.com/NFh1KjeUHp

— IOTA (@iota) February 26, 2025

Looking ahead, market forecasts for February 2025 predict a potential price increase of 2.17%, with an average price projection of $0.2109. The anticipated trading range is between $0.1996 and $0.2268, offering a potential return on investment (ROI) of 9.88%. While these projections indicate growth, external factors such as market sentiment and macroeconomic conditions may influence performance. Investors should consider both technical indicators and broader trends before making decisions.

4. Algorand (ALGO)

Algorand demonstrated impressive scalability in early 2025 by processing 34,008 transactions within a single block in under three seconds. This achievement and a 100% success rate underscores the blockchain’s efficiency and reliability. Such performance highlights Algorand’s potential as a high-throughput network, making it a compelling choice for developers and investors seeking scalable blockchain solutions.

Currently ranked #47, Algorand has a market capitalization of approximately $2.02 billion and a token price of $0.2394. Over the past year, ALGO has recorded an 11% price increase and has outperformed 63% of the top 100 cryptocurrencies by market cap. The asset’s high liquidity further supports its strong market presence, indicating sustained investor interest.

Algorand is the blueprint📘

Major companies have referenced Algorand in US patents, including:@Visa @CBOE @VMware @HP @Microsoft @ATT @IBM @TDBank_US

When industry giants look to blockchain innovation, they look to Algorand.

— Algorand Foundation (@AlgoFoundation) February 26, 2025

Technical indicators suggest a potential breakout as bullish patterns emerge across multiple charts. Market sentiment appears to be strengthening, which could pave the way for further price appreciation. If this momentum continues, ALGO may soon experience a notable rally. However, investors should monitor broader market conditions and external factors that could influence price action.

5. Solaxy ($SOLX)

Solaxy, a layer-2 solution for the Solana blockchain, has raised $23 million in its initial coin offering (ICO), attracting strong interest from investors. Unlike many Solana-based assets currently under selling pressure, Solaxy has gained traction due to its potential to enhance the network’s scalability and efficiency. The Solana ecosystem has faced congestion issues, particularly during periods of high transaction volume, making a layer-2 solution increasingly relevant.

Solaxy’s architecture is designed to process transactions off-chain using roll-up technology and zero-knowledge proofs before settling them on Solana’s mainnet. This approach aims to reduce congestion and improve overall network performance. The project also integrates with Celestia for data availability and Hyperlane to enable cross-chain bridging between Solana and Ethereum.

Despite the broader market downturn, Solaxy continues to attract institutional and retail investors, with whales making large purchases during the presale. Analysts suggest that its valuation remains low compared to Ethereum layer-2 projects, implying room for significant growth. While some early investors anticipate returns of up to 100x, more conservative estimates suggest a 10x potential.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage