Join Our Telegram channel to stay up to date on breaking news coverage

Zunami, a DeFi yield aggregator, was hit by a price manipulation hack that resulted in a loss of $2.1 million, security firm Peckshield tweeted.

Hi @ZunamiProtocol Today's hack leads to >$2.1m loss and there are two hack txs involved:

– tx1: https://t.co/jsOmPT62mk

– tx2: https://t.co/u7YOvoS0R9It is a price manipulation issue, which can be exploited by donation to incorrectly calculate the price as shown in the… https://t.co/yqwMVy0pCA pic.twitter.com/OfrDni7KtE

— PeckShield Inc. (@peckshield) August 14, 2023

Peckshield reported the loss via Twitter and warned users to take appropriate action to secure their funds.

Following Peckshield’s warning, Zunami tweeted, “It appears that zStables have encountered an attack.”

In a follow-up tweet, it warned its followers not to buy zETH and UZD since their emissions are under attack. It has also informed its user base that the collateral is still secure, and it has started investigating the hackt.

Zunami Exploit Was a Price Manipulation Issue – Peckshield

Peckshield also informed in the same tweet that the hack was due to a price manipulation issue. According to the security firm, this can be exploited by donations to calculate the price incorrectly.

The founder of SlowMist, Xian Yu, tweeted that his firm had identified the issue two months ago.

“This project was attacked by price manipulation and lost more than $2.1 million,” said the tweet, which was written in Chinese. “The key point is that our system detected their risk two months ago, and we informed them privately in advance. Unfortunately, it was an unpleasant communication.”

“It now appears that perhaps they were unavoidable,” he said.

Tokens Have Been Washed by Tornado Cash – Peckshield

Two hours after the tweet, Peckshield reported that the stolen tokens had been washed by Tornado Cash.

Here comes the flow of stolen funds, which have been washed via @TornadoCash pic.twitter.com/SHSajq4fBO

— PeckShieldAlert (@PeckShieldAlert) August 14, 2023

Tornado Cash is a decentralized crypto tumbler that was sanctioned by the US Department of the Treasury’s Office of Foreign Assets Control (OFAC) in August last year after it was alleged that the crypto tumbler allowed hackers to launder $7 billion in crypto since 2019.

DeFi Continues to Suffer in 2023

There have been a slew of attacks on DeFi since the beginning of this year.

ImmuneFi has reported that DeFi exploits have continued to generate losses for the ecosystem. Two major exploits in the first quarter of 2023 led to a loss of $317 million.

These exploits were Euler Finance, which suffered a loss of $197 million, and BonqDAO, which was on the receiving end of an oracle attack that led to it losing $120 million.

The report also suggested that 2023 continues to see DeFi as the main target of exploits. There have been 99.6% successful exploits in Q1 2023 as compared to CeFi.

In Q2, there was a cumulative loss of $265 million, led by Atomic Wallet, which got hacked and lost $100 million, followed by Fintoch, which lost $32 million.

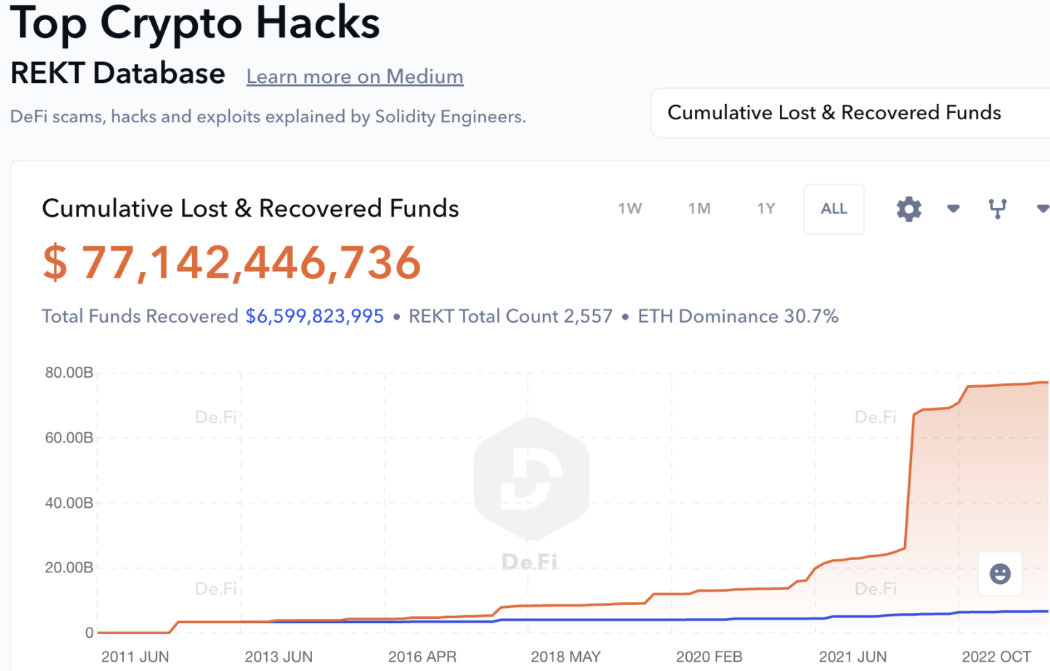

And on August 8th, Rekt Database reported that there was a loss of $389.82 million in DeFi Losses in July alone. Since 2011, a cumulative total value of more than $77 billion has been lost due to DeFi exploits.

Ethereum was the most targeted and lost $350 million due to 36 different incidents. The single biggest loss was suffered by Multichain, which lost $231 million due to an access control exploit.

Related

- Curve Stablecoin Exchange Hit by $50 Million Cyber Attack Due to Vyper Vulnerability

- Worldcoin (WLD) In Turmoil as Regulators and Privacy Advocates Raise Concerns

- CRV Price Soars as Hacker Returns Funds

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage